Cara Buka Akaun LHDN for Employees & Employers in Malaysia

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowOpening an LHDN account is the first step for anyone starting work or running a business in Malaysia. Through the MyTax portal, you can file returns, pay taxes, and update your information online. Here’s a complete guide on how to register an LHDN account for the first time, what you need to prepare, and how to activate it successfully.

What Is an LHDN Account and Why Do You Need It

The LHDN account, managed by the Inland Revenue Board of Malaysia (Lembaga Hasil Dalam Negeri, or LHDN), is a personal tax account that allows individuals and businesses to manage all their tax-related matters online.

Having an LHDN account is essential because it enables you to:

-

Check your tax reference number (No. Cukai Pendapatan).

-

Access and submit e-Filing forms.

-

Pay income tax online through the MyTax portal.

-

Receive official notifications and statements.

Anyone earning an income in Malaysia, whether a full-time employee, freelancer, business owner, or employee, needs an LHDN account. Employees require it for Monthly Tax Deductions (PCB), while self-employed individuals use it to declare business income annually.

What You Need Before Registering

Before registering for an LHDN account, make sure you have these ready:

-

MyKad / NRIC (for Malaysians) or passport (for non-residents).

-

Active email address and mobile phone number for verification.

-

Basic personal details such as name, address, and date of birth.

-

Employment or income details, such as your EA Form (for employees) or business registration (for self-employed).

If you already have a tax file number from your employer but haven’t activated your MyTax account yet, you can link your existing number during the registration process.

How to Register for an LHDN Account

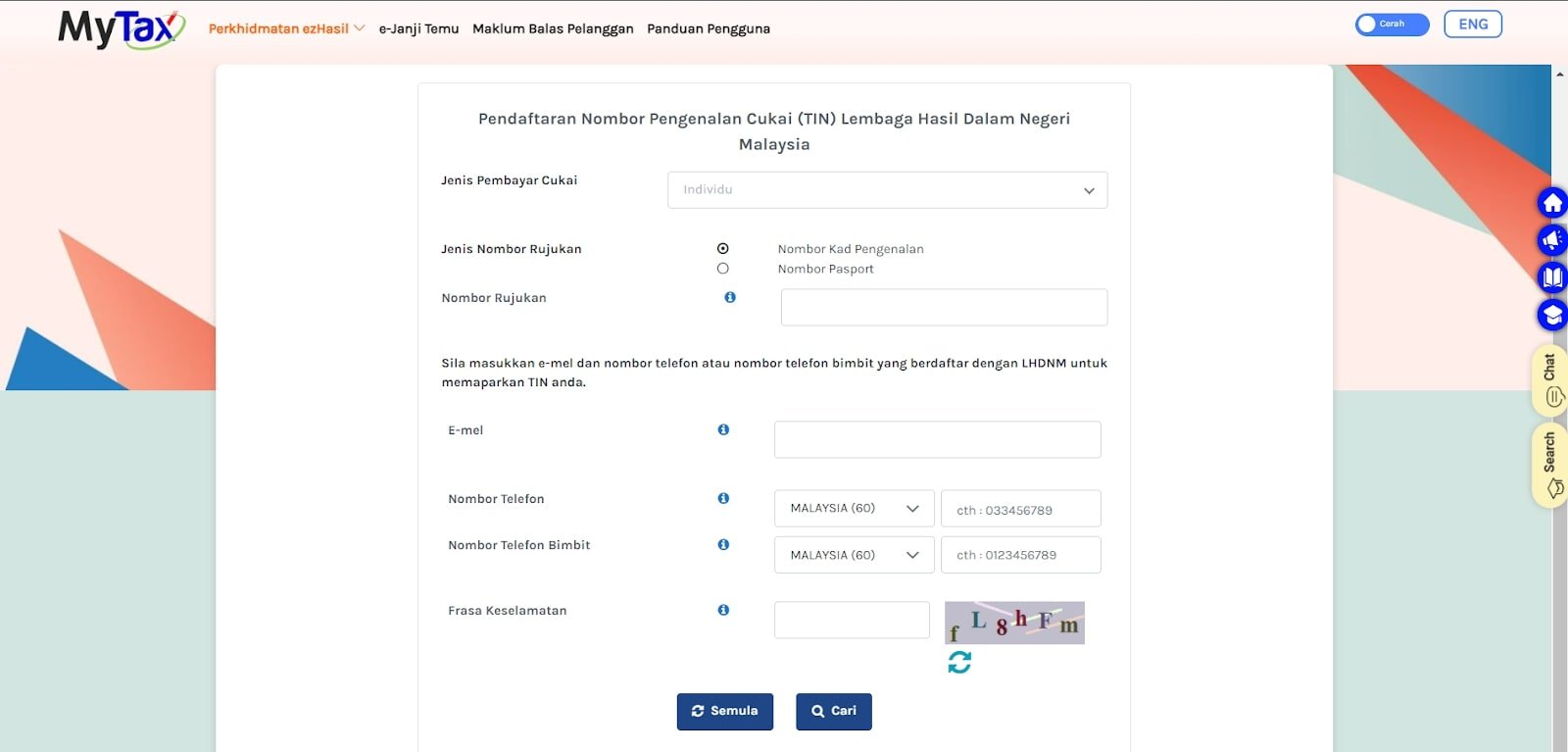

You can register for an LHDN account completely online through the MyTax portal. Follow these steps:

-

Go to https://mytax.hasil.gov.my and click “e-Daftar”

-

Click on “Jenis Pembayar Cukai” and select “Individual”. Next, in the “Reference Number” field, enter your IC number (MyKad number).

Fill in all required fields, including email, telephone number, mobile number, and security phrase. Then, click the “Search” button.

-

Depending on the message you receive, follow the appropriate next steps:

-

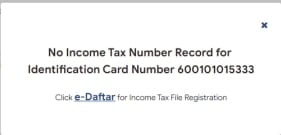

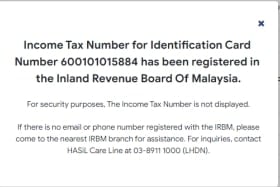

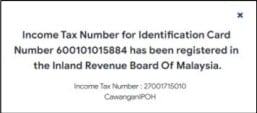

If you receive this message:

Click on the “e-Daftar” link shown and fill in the required information.

-

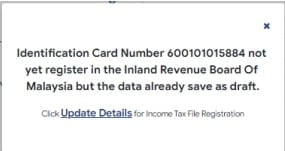

If you receive this message:

Click on “Update Details” and complete the necessary fields.

-

If you receive this message:

Or this one:

Follow the steps provided on-screen.

-

Once your registration is successful, you will receive an SMS or you need to visit to the nearest LHDN branch to obtain your PIN number.

Documents to bring to the LHDN office:

-

A copy of your MyKad (Identification Card)

-

A copy of your salary slip or EA Form

-

A copy of your marriage certificate (if you are married)

How to Activate Your Account

Once LHDN verifies your information, you will receive a PIN (usually via email or post) to activate your MyTax account.

To Activate:

-

Go back to https://mytax.hasil.gov.my.

-

Click “First Time Login.”

-

Enter your PIN number and NRIC/passport number.

-

Create your password and complete your profile setup.

After activation, you can log in anytime using your NRIC number and password.

If Activation Fails

-

Check that your IC number and email match your registration details.

-

If the system shows an error or mismatch, you may need to visit the nearest LHDN branch or contact Hasil Care Line (03-8911 1000) for assistance.

Common Problems and Solutions

Sometimes, new users face issues during registration or activation, especially if certain details don’t match LHDN records. Most problems, however, are easy to fix once you know what caused them.

Below are some of the most common registration errors and what you can do to resolve them quickly.

|

Issue |

Possible Cause |

Solution |

|

Registration rejected |

Incorrect or incomplete information |

Recheck your details and resubmit via e-Daftar |

|

Didn’t receive email verification |

Spam/junk filter or wrong email address |

Check the spam folder or update the email in the system |

|

Forgot password |

Account inactive for too long |

Use the “Forgot Password” option or contact LHDN support |

|

Incorrect IC or tax number |

Typing error during registration |

Visit the nearest LHDN office with your IC for manual correction |

What You Can Do After Registration

Once your LHDN account is active, you can:

-

Access and submit your annual e-Filing tax form (Form BE, B, or C).

-

Pay income tax online using FPX or a credit card.

-

View and print tax statements and receipts.

-

Update personal details such as address or contact information.

-

Check refund status and correspondence from LHDN.

Tips for Employers and Employees

Registering an LHDN account may seem like a small task, but it plays a major role in ensuring smooth payroll operations and tax compliance for both employers and employees. Here are some practical tips to make the process easier:

Register Early

Don’t wait until the tax filing period to create your account. Early registration helps avoid last-minute technical issues and ensures you receive your tax number in time for payroll reporting or e-Filing.

Keep Your Login Credentials Secure

Store your MyTax PIN, password, and security questions safely. Avoid sharing them with others, even colleagues or HR personnel, to protect your personal tax information.

Update Your Contact Details Regularly

Make sure your email address, phone number, and residential address in the MyTax portal are always up to date. This ensures you don’t miss important notices or reminders from LHDN.

Check Your Account Periodically

Log in every few months to review your tax status, confirm payments, and download statements. Staying proactive prevents issues such as missed filings or incorrect deductions.

For Employers: Verify Employee Tax Numbers

When onboarding new hires, confirm that each employee has a valid tax reference number. This helps you process Monthly Tax Deductions (PCB) correctly and stay compliant with payroll regulations.

Seek Help When Needed

If you encounter registration or e-Filing problems, contact Hasil Care Line (03-8911 1000) or visit the nearest LHDN branch. Getting quick clarification can save time and prevent future tax complications.

FAQs

1. Can foreigners open an LHDN account?

Yes. Foreign individuals working in Malaysia can register using their passport number and a valid work permit.

2. How long does it take for registration to be approved?

Normally, approval takes one to five working days, depending on the completeness of the information submitted.

3. Can I have more than one LHDN account?

No. Each individual is assigned a unique income tax number (No. Cukai Pendapatan) that is tied to their NRIC or passport number.

Your Next Hire Could be Just a Click Away!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best while staying compliant with LHDN regulations.

Post your job ads today & simplify your hiring process!

Read More:

- What is Inland Revenue Board of Malaysia (LDHN)?

- How Employers Should Handle Income Tax Reporting to LHDN

- LHDN e-Invoice Guideline for Malaysian Employers and What They Must Know

- Full LHDN Stamp Duty Guide on Malaysia Employment Contract [2025]: Penalties, Exemptions, & More

- Permohonan Peranan MyTax: A Complete Guide for Employers in Malaysia