EA Form (C.P. 8A): Free Download Form, Deadline & How to for Employers

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowAs tax season approaches, many employees will ask their employers for their EA Form 2024.

Employers must prepare and distribute EA Forms accurately and on time, as it helps employees file their income tax returns with the Inland Revenue Board of Malaysia (LHDN).

Failure to provide the EA Form can lead to penalties, including fines or imprisonment under the Income Tax Act 1967.

To avoid these issues, employers need to understand what the EA Form is, who needs to receive it, and how to issue it correctly. Check the details below.

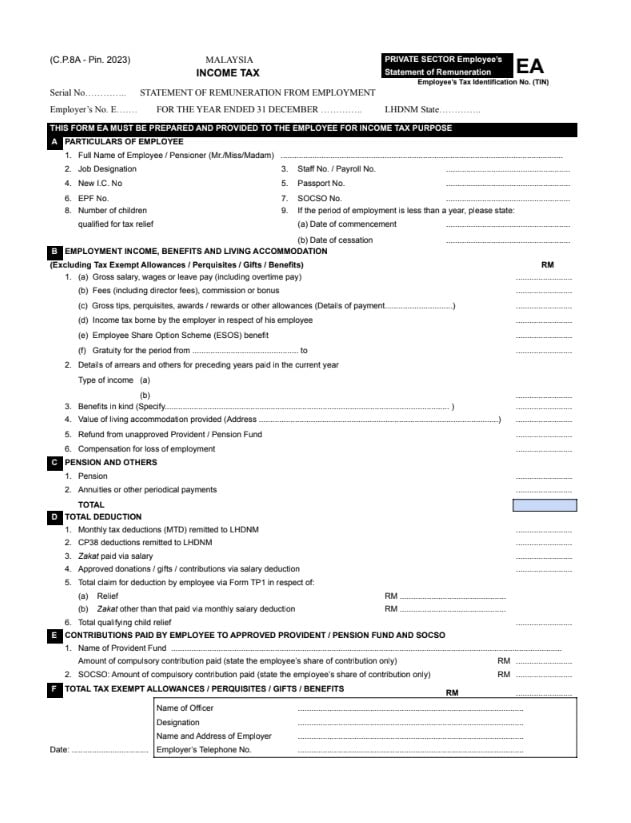

What is the EA Form (C.P. 8A)?

The EA Form (C.P. 8A), also known as Borang EA, is a yearly statement issued by employers to their employees.

It acts as a summary of an employee’s earnings for the previous year, helping them calculate their taxable income and file their income tax returns.

The EA Form includes all types of earnings received by the employee, such as:

-

Basic salary

-

Overtime pay

-

Bonuses

-

Commissions

-

Allowances

-

Benefits-in-kind (BIK)

-

EPF, SOCSO, and EIS contributions

Employees use this form when filing Form BE, which must be submitted to LHDN before 30th of April 2025.

Who Needs to Fill Up the EA Form?

Employers are responsible for preparing and issuing the EA Form to all employees who worked for them during the Year of Assessment (YA) 2024. This applies to both:

-

Current employees

-

Former employees (who worked during any part of 2024)

The EA Form must be issued to all full-time, part-time, and contract employees, as long as they are paid for their work.

Even employees who only worked for a short period must receive this form if they earned taxable income.

EA Form for foreign workers must be issued if they were employed under a contract of service.

However, if they were independent contractors, the employer may need to issue Form CP58 instead.

Directors of a company are also considered employees and must receive an EA Form.

When is the Deadline for EA Form Issuance?

Employers must submit the EA Form 2024 to employees no later than 28 February 2025.

This deadline is set under Section 83(1A) of the Income Tax Act 1967.

Even if an employee resigns before the end of the year, they must still receive their EA Form for any income earned in 2024.

Failing to issue the EA Form by this deadline can result in serious consequences. Employers may face:

-

Fines of up to RM20,000

-

Imprisonment for up to six months

-

Or both fines and imprisonment

Although employers do not need to submit the EA Form to LHDN, employees rely on it to file their income tax.

Delays or mistakes in issuing the EA Form can lead to complaints and unnecessary legal risks.

What to Put in the EA Form

The EA Form contains several sections, each requiring accurate information:

-

Employee details: Name, NRIC (or passport number), position, marital status, and number of children (if applicable).

-

Income details: Total salary, overtime, bonuses, commissions, and allowances.

-

EPF, SOCSO, and EIS contributions: Monthly deductions for statutory contributions.

-

Benefits-in-kind (BIK): Non-cash benefits provided by the employer, such as a company car or housing.

-

Tax deductions: Monthly tax deductions (MTD/PCB) made throughout the year.

All income earned within the year must be declared, including late payments of bonuses from previous years.

Employers cannot report only basic salary while excluding commissions or other benefits.

LHDN cross-checks these amounts with company records and employee tax filings.

Download Your 2 FREE EA Form Templates (2023, 2024)!

To help employers with EA Form preparation, here are two free downloadable templates from Official Sites:

These templates make it easier to organize and distribute EA Forms efficiently.

Step-by-Step Guide on Submitting and Printing EA Form for Employers

Employers can generate the EA Form 2024 using payroll software or manual templates. The process involves several steps:

Step 1: Gather Employee Income Data

Before issuing EA Forms, collect all salary, bonus, and allowance records for each employee from 1 January 2024 to 31 December 2024.

Step 2: Download EA Form Templates

Many employers use payroll software to automatically generate EA Forms.

Alternatively, employers can download LHDN’s official EA Form template and manually fill in employee details.

Step 3: Log in to MyTax Portal

Once you have the PDF, you must log in to the MyTax portal to submit it.

- Go to MyTax portal: https://mytax.hasil.gov.my/

- Click on Login and enter your username & password.

- If you forgot your password, click “Forgot Password” to reset it.

Step 4: Access e-Filing Section

.jpg)

After logging in, click on “Services”. Select “e-Filing” from the menu. Click on “e-Form” to proceed.

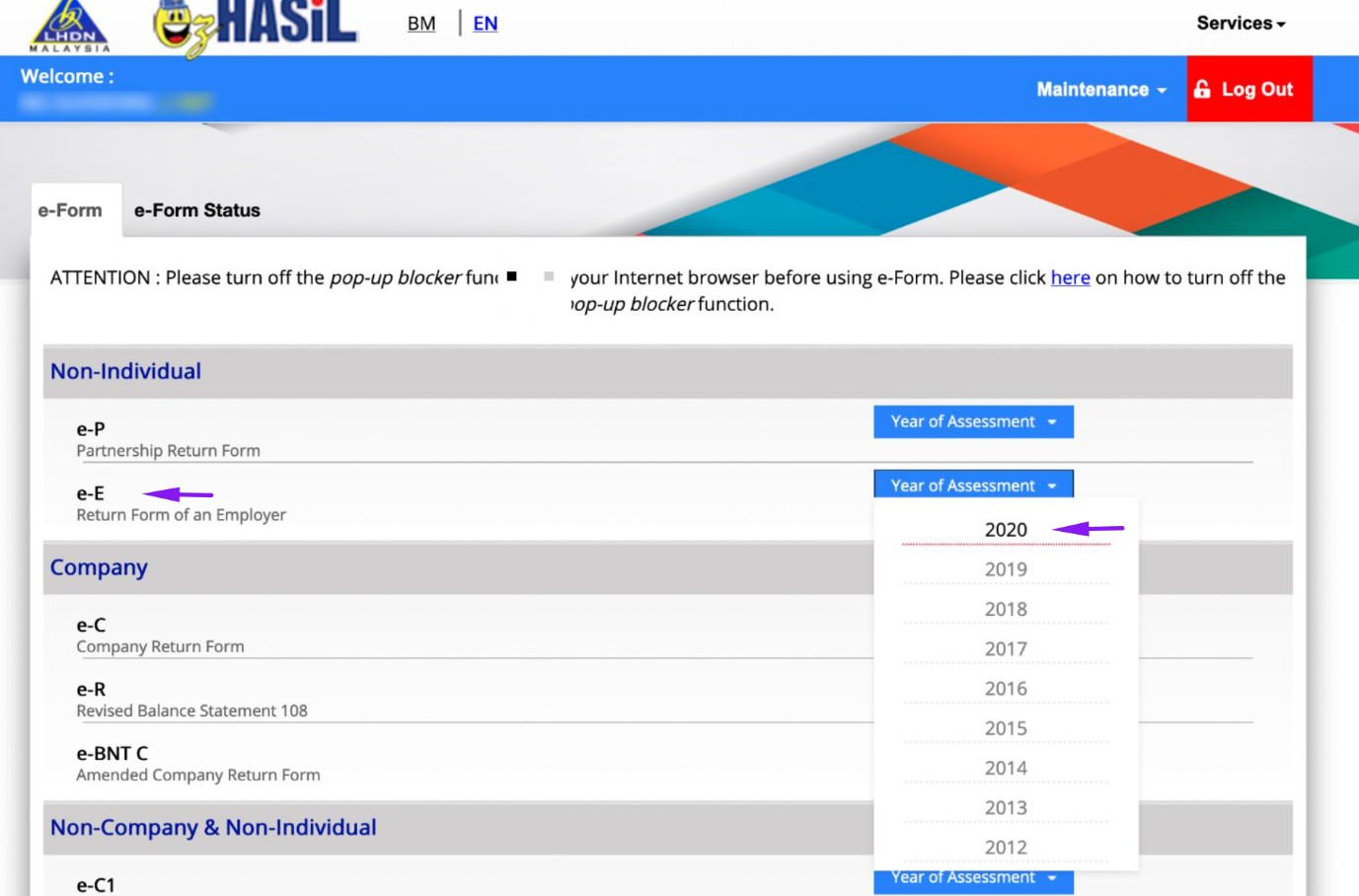

Step 5: Select the Correct e-Form

Under the e-Form tab, select Non-Individual. Click on e-E Section (this is the section for Form E submission).

Choose the correct Year of Assessment.

For example: If submitting for 2024, select Year of Assessment 2024.

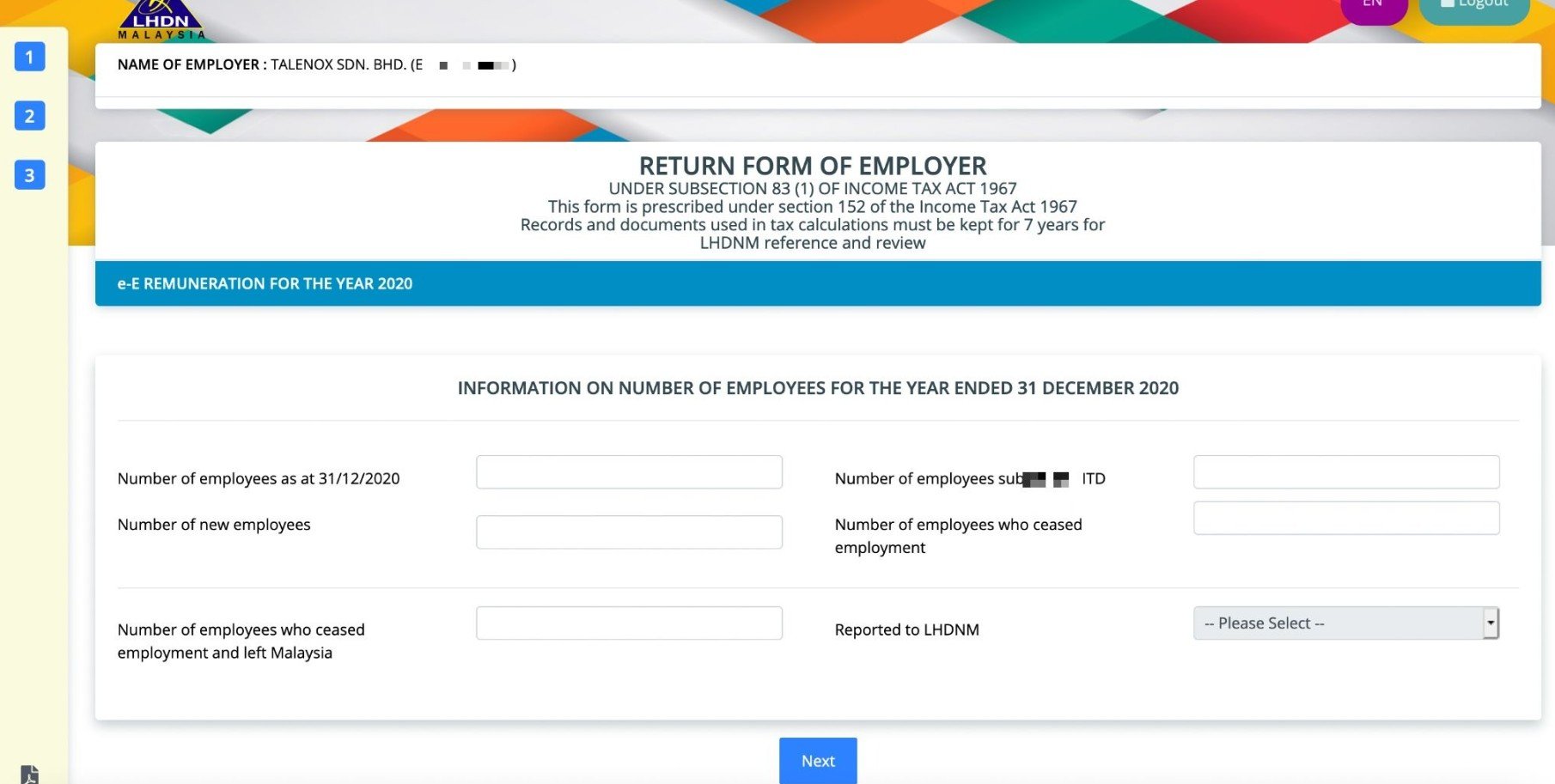

Step 6: Fill in the Required Details

Once inside the e-Form E section, enter the following details:

Company/Employer Information

- Employer’s name, registration number, and tax file number.

- Business type and nature of operations.

- Employer’s contact details (address, phone, email, etc.).

Employee Details

- Total number of employees for the year.

- Number of employees who received remuneration.

- Number of new hires and resignations.

Salary & Tax Deduction Information

- Total salary/wages paid to employees.

- Tax deductions (PCB, EPF, SOCSO, EIS, Zakat, etc.).

- Bonus and other benefits.

Additional Details (if required)

Any other relevant financial or payroll information.

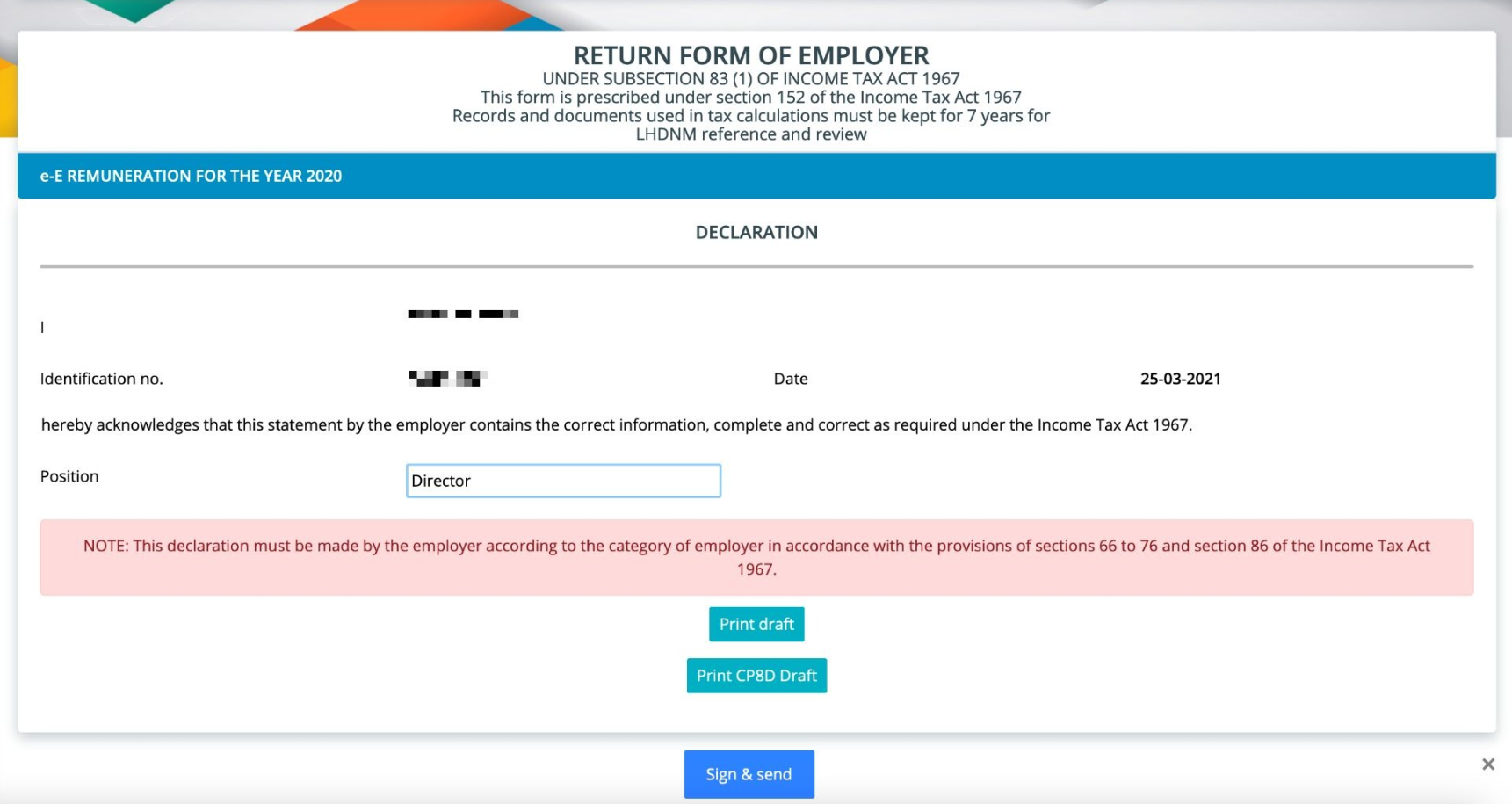

Step 7: Sign the Declaration Form

Before submitting, you need to sign off the Declaration Form. Review all the details you entered to make sure they are accurate.

Click on "Sign & send" to confirm that the information is correct.

Step 8: Print and Distribute Securely

After signing, click the “Submit” button. You will see a confirmation message.Save or print the confirmation receipt for your records.

Once verified, employers can:

-

Print physical copies for employees.

-

Send soft copies via email to employees for convenience.

Employers should store copies of all EA Forms for at least seven years in case of audits or disputes.

Step 9: Check Submission Status

After submission, you can check the status of your Form E:

Go to MyTax Dashboard. Click on "e-Filing History".

Look for Form E Submission Status to confirm it has been received.

PCB (Monthly Tax Deduction) Calculator for Employers in Malaysia

Calculating employee tax manually can take a lot of time and may cause mistakes. This PCB calculator helps HR and employers calculate Monthly Tax Deduction (PCB) accurately, quickly, and without hassle.

With just a few inputs, you can get the correct PCB amount based on employee salary — no manual calculation needed.

FAQs

Where should employers submit the EA form?

Employers do not need to submit the EA Form to LHDN. The form is for employees to use when filing their personal income tax (Form BE).

How often should employers provide the EA form?

Employers must issue the EA Form annually, no later than 28 February each year, for the previous year’s income.

How can Payroll System help with EA form compliance?

Payroll System simplifies EA Form preparation by:

-

Automatically generating EA Forms with accurate calculations.

-

Reducing errors in statutory deductions like PCB, EPF, and SOCSO.

-

Keeping records updated with the latest tax requirements.

Using payroll software helps businesses save time and avoid costly mistakes in tax reporting.

EA form giving you a headache? We get it—it’s tedious and time-consuming. Maybe it’s time to hire a finance expert or accountant. Not sure how to write a job description? We’ve got you covered! Grab our free accounting job description template and hire with ease.

- Accounting Assistant Job Description Template (FREE)

- Tax Manager Job Description Template (FREE)

- Accounts Administrator Job Description Template (FREE)

- Accounting Clerk Job Description Template (FREE)

Are you hiring in 2026?

Start your hiring journey with Ajobthing today! Post your job ads, connect with top talents, and streamline your recruitment process with our easy-to-use platform.

Read More:

- How to Submit CP22 for New Employees in Malaysia in LHDN MyTax Portal

- Malaysia Tax Bracket 2025: Income Tax Rates for Employers

- Malaysia Form E 2025: Submission Guide, Deadline, and Penalties

- Offer Letter: Definition, How To, and Free Templates

- PCB (Potongan Cukai Bulanan) in Malaysia: A Complete Guide for Employers

- Tax Reliefs in Malaysia 2025 for Employers: Types and How to Apply

- New EPF Retirement Savings: Helping Employers Support Financial Well-Being for Employees

- Can we retain staff over the age of 60 in Malaysia?

- Malaysian Employment Act 1955: Key Provisions Every Employer Must Know

- Malaysia National Registration Identity Card (NRIC): A Guide for Employers

- What is the TIN Number in Malaysia?

- Long Weekend 2025 List in Malaysia

- Public Holidays in Malaysia for 2025: Complete List and Dates