EPF Dividend 2024: Latest Rate, Impacts, & How to Calculate

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowEvery year, the Employees Provident Fund (EPF) dividend announcement is a moment many Malaysian workers and employers look forward to.

The EPF dividend reflects the health of the country's retirement fund and signals how confident employees might feel about their financial future.

In 2024, EPF declared its highest dividend since 2017.

What does this mean for employers? And how can you use this update to boost employee engagement and build trust? Let's break it down.

What is the EPF Dividend?

The EPF dividend is the annual return paid to members based on the performance of EPF’s investments.

It’s like a profit-sharing reward that gets credited into each member’s EPF account. The dividend is not fixed every year.

It depends on how well the fund’s investments perform.

Over the past five years, the EPF dividend for Simpanan Konvensional has ranged between 5.2% and 6.1%, with a dip during the pandemic years.

Simpanan Shariah, which is managed under Shariah-compliant investments, typically offers slightly lower or comparable rates.

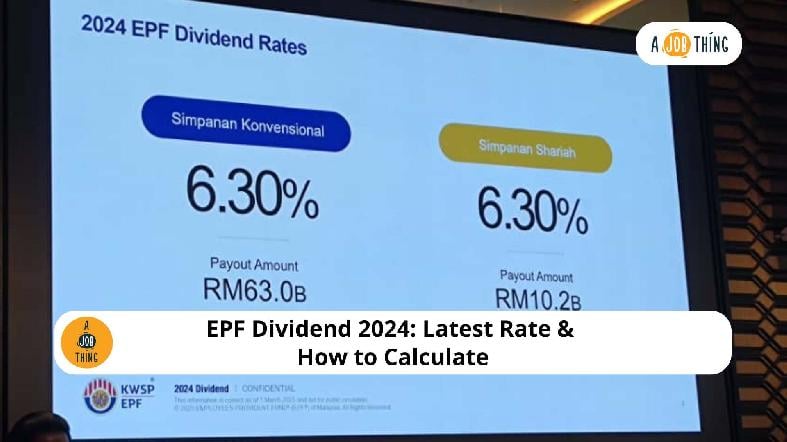

The good news for this year? Both Simpanan Konvensional and Simpanan Shariah have hit 6.30%, a strong bounce back that beats many market expectations.

Latest EPF Dividend 2024 Rate Announcement

On 1 March 2025, EPF officially announced that both Simpanan Konvensional and Simpanan Shariah received 6.30% dividends for the financial year 2024.

This translates to a total payout of RM73.24 billion, with RM63.05 billion going to conventional savings and RM10.19 billion to shariah savings.

This is the highest dividend declared since 2017, and a big jump from the 5.50% declared for conventional savings in 2023.

Behind this strong result was a total investment income of RM74.46 billion in 2024, up 11% from the previous year.

EPF credited the recovery of global and local markets, a strong labour market, and stable inflation for the positive performance.

Impacts of EPF Dividend on Employers and HR

A high dividend means more growth in your employees' savings, and this can have a positive ripple effect in your organisation.

First, it boosts employee morale. When employees see their retirement savings growing, they feel more secure about their future.

This sense of security contributes to higher satisfaction and loyalty at work.

Second, it strengthens your image as an employer who cares about long-term employee welfare.

Even though employers have no control over dividend rates, sharing this news with your team shows that you’re keeping them informed and helping them understand how their contributions are growing.

It’s also a useful talking point in recruitment and retention strategies.

Highlighting EPF performance, especially during onboarding or career talks, can give you an edge when candidates compare job offers with similar salaries.

Employer’s Contribution to EPF

As of now, employers contribute between 12% to 13% of an employee’s monthly salary to EPF, depending on how much the employee earns:

-

If the monthly salary is RM5,000 and below, the employer contributes 13%.

-

If it’s more than RM5,000, the employer contributes 12%.

-

Employees under 60 contribute 11%, while those aged 60 and above are exempted from personal deductions, though employers still contribute a smaller percentage.

Some employers even go beyond the statutory requirement by offering voluntary top-ups.

These extra contributions are sometimes used as retention strategies, especially for senior-level employees or long-serving staff.

How to Calculate EPF Dividend

The EPF dividend is calculated based on the monthly average balance of your EPF savings, not the total year-end balance.

Step-by-Step Calculation:

-

Obtain monthly closing balances from your EPF statement (Jan to Dec).

-

Sum the 12 monthly balances.

-

Divide by 12 to get the average monthly balance.

-

Multiply by the declared dividend rate (%).

Formula:

EPF Dividend = (Total of Monthly Balances ÷ 12) × Dividend Rate Example (Conventional Account):

-

Total of monthly balances: RM60,000

-

Average monthly balance: RM60,000 ÷ 12 = RM5,000

-

Dividend rate: 6.30%

Dividend = RM5,000 × 6.30% = RM315

When Are EPF Dividends Credited?

EPF typically credits dividends in March of the following year. For example, dividends for 2024 will be credited in March 2025.

You can check your credited dividends via:

-

KWSP i-Akaun (online/mobile)

-

EPF kiosks or counters

How Employers Can Support Financial Literacy Among Employees

The 6.30% dividend is great news, but not all employees may fully understand what it means. This is where HR teams can play a bigger role.

Start by sharing the dividend announcement internally through email or the company portal. A short note explaining the impact in simple language can go a long way.

Next, consider hosting financial wellness sessions. These can include guest speakers from EPF or certified financial planners.

Topics can include retirement planning, voluntary top-ups, or how to manage EPF nominations.

You can also encourage employees to check their EPF accounts using i-Akaun, the online portal provided by KWSP.

Many employees don’t check their balances regularly, so a simple reminder can help them stay engaged with their savings.

What to Expect Going Forward

EPF’s 2024 performance benefited from strong equity markets, smart investment diversification, and steady domestic economic recovery.

But like any investment institution, EPF still faces future challenges, from geopolitical tensions to changing global trade patterns and interest rates.

EPF’s Chairman has emphasised that the fund will continue focusing on long-term sustainability through its Strategic Asset Allocation (SAA) approach.

This means members can expect steady, fair returns over time, even if short-term results fluctuate.

This signals a continued opportunity to build trust by keeping employees updated and informed on retirement savings.

FAQ

What was the EPF dividend for 2024?

The dividend for both Simpanan Konvensional and Simpanan Shariah in 2024 was 6.30%. This is the highest payout since 2017 and reflects strong investment performance by the EPF.

Does the EPF dividend affect employer contributions?

No, the dividend rate does not change how much employers need to contribute each month. Employers still contribute based on statutory rates (12% or 13%), regardless of how much dividend the EPF announces.

How can employers explain the EPF dividend to employees?

Use simple terms. You can say: “Every year, EPF invests the money you and the company contribute. The 6.30% dividend means your savings grew more this year, which helps you build a better retirement fund.”

Sharing a quick internal memo or organising a financial wellness session can also help.

Are Shariah and Conventional dividends different?

Usually, yes. In some years, the rates are slightly different because they depend on separate investment portfolios. But in 2024, both Simpanan Konvensional and Simpanan Shariah received the same dividend rate of 6.30%.

Are you looking for new staffs?

Start your hiring journey with AJobThing today! Post your job ads, connect with top talents on multiple platform like Maukerja, Ricebowl, and Epicareer with our easy-to-use platform.

Read More:

- How Foreign-Owned Businesses Can Operate in Malaysia

- What is Akta Buruh Waktu Bekerja Seminggu in Malaysia?

- What Is Ad Hoc Work? Meaning, Examples & Benefits

- How Domino’s Pizza Hired 3,600 Staffs with Maukerja by AJobThing

- How to Register and Use MyCOID for Your Business

- How to Handle Abscondment in the Workplace Professionally

- What is Dividend ASB and How Can Employers Promote It?

- 50 Simple & Deep Labor Day Wishes & Greetings for Staffs

- GST vs SST in Malaysia: Key Differences Every Employer Should Know

- Employment Pass (EP) Malaysia: Application, Renewal, and Employer Duties

- Professional Visit Pass (PVP) Malaysia: Process, Rules, and Tips for Hiring Short-Term Foreign Workers

- Is Your Staff Leaving Early Without Telling You? Here's What to Do

- What is Visit Pass Temporary Employment (Temporary Employment Pass)?

- What is Work Remotely Meaning? Definition, Types, and Tips

- What Does Legally Authorized to Work Mean?