EPF (KWSP) New Updates in January 2026 for Employers & HR in Malaysia

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowThe Kumpulan Wang Simpanan Pekerja (KWSP), also known as EPF, has announced several new initiatives starting January 2026.

These changes are meant to:

-

Help members save better for retirement

-

Adjust EPF policies to today’s cost of living

-

Extend protection to gig workers, housewives, and older members

This article explains the EPF 2026 updates, focusing on what HR and employers should understand and communicate to employees.

For the latest official updates, employers can also refer to the EPF website: https://www.kwsp.gov.my/

What is EPF (KWSP)?

EPF is Malaysia’s mandatory retirement savings scheme for:

-

Private sector employees

-

Non-pensionable public sector employees

In simple terms:

-

Employees contribute a portion of their monthly salary

-

Employers contribute an additional portion

-

The money is saved, invested by EPF, and earns annual dividends

-

Employees can use the savings at retirement (usually age 55), or for approved withdrawals

For HR, EPF is a core statutory contribution that must be managed correctly through payroll.

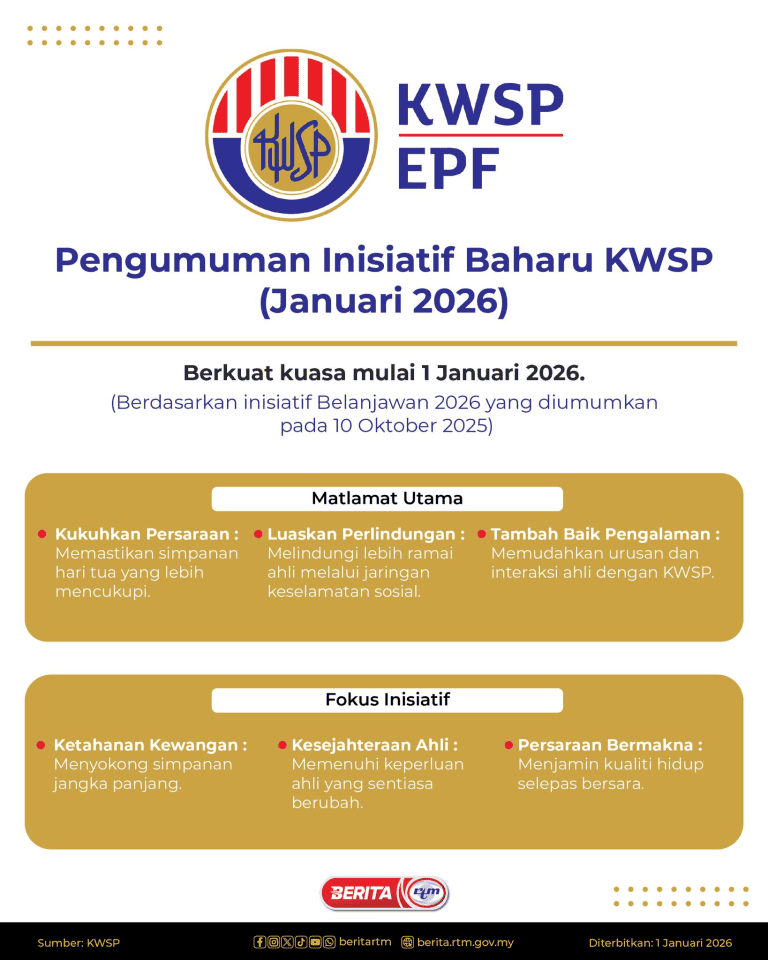

New EPF Initiatives Effective January 2026

Below are the key EPF changes in 2026 that HR and employers should be aware of.

1. Higher EPF Withdrawal Limit for Hajj

Starting 1 January 2026, EPF has increased the Hajj withdrawal limit:

-

Old limit: RM3,000

-

New limit: Up to RM10,000

The amount allowed is the lower of:

-

RM10,000, or

-

The available balance in the member’s Akaun Sejahtera

Why This Matters

Hajj costs have increased, and this change allows members to use their EPF savings more flexibly.

Eligibility (Important for HR to know)

-

Malaysian citizen

-

Muslim

-

Below 55 years old

-

Has an official “DIPILIH” (Selected) Hajj offer letter from Tabung Haji

-

Withdrawal allowed once in a lifetime only

Members who already withdrew for Hajj before 2026 cannot apply again under the new limit.

Application Process (simplified)

-

Go to EPF branch

-

Bring MyKad + original Tabung Haji offer letter

-

Thumbprint only (no complicated forms)

Important Reminder

If the Hajj trip is cancelled or postponed, the withdrawn amount must be returned to EPF.

2. Introduction of i-Saraan Plus (For Gig Workers)

From January 2026, EPF introduces i-Saraan Plus, an improved version of the existing i-Saraan scheme.

What’s New?

-

Government matching incentive: 20%

-

Maximum incentive: Up to RM600 per year

-

Lifetime incentive cap: RM6,000 or until age 60

This is higher than the old i-Saraan incentive (RM500 per year).

Who is Eligible?

-

Malaysian citizen

-

Below 60 years old

-

Gig workers (e-hailing & p-hailing drivers, delivery riders)

-

Registered under i-Saraan

-

Contributions must be made through the platform/provider

To receive the full RM600 incentive:

-

Member must contribute at least RM3,000 per year

HR Takeaway

This initiative is useful information for companies working with gig workers, riders, or contract-based platforms.

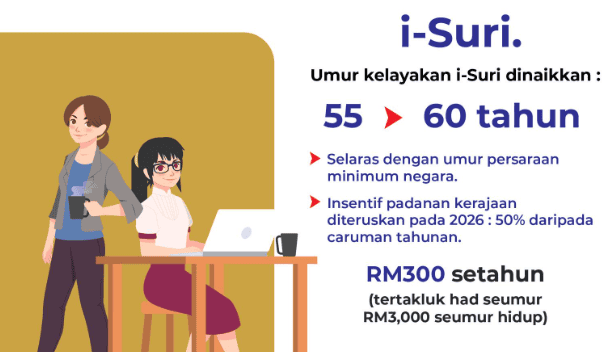

3. i-Suri Age Limit Increased to 60

Previously, i-Suri incentives were only available until age 55. From January 2026, the age limit is extended to 60.

What This Means

Housewives can now:

-

Continue contributing for 5 more years

-

Continue receiving government incentives

Eligibility

-

Malaysian citizen

-

Below 60 years old

-

Minimum contribution: RM5 per month or RM60 per year

-

Registered under eKasih as:

-

Head of household (KIR), or

-

Wife of head of household (low-income category)

-

Why This Matters

This helps reduce the retirement savings gap for women and ensures housewives are not left out of social protection.

4. Retirement Income Adequacy (RIA) Framework

EPF has introduced clearer retirement savings benchmarks to guide members.

New Savings Targets:

-

Basic: RM390,000

-

Adequate: RM650,000

-

Enhanced: RM1.3 million

Purpose

To help members understand:

-

How much they may need after retirement

-

Whether their current savings are enough

HR Use

This is helpful for:

-

Financial education sessions

-

Retirement planning talks

-

Internal HR awareness campaigns

5. Rebranding of Voluntary Contributions

EPF has simplified voluntary contribution options:

-

i-Simpan → Self-contribution

-

i-Topup → Contribution above the statutory 11% employee rate

Goal

-

Encourage employees to top up savings easily

-

Make EPF options easier to understand and use

.jpg)

Main Goals of EPF 2026 Initiatives

EPF’s 2026 updates focus on three key areas:

Stronger Retirement Savings

Help members build more meaningful savings for old age.

Wider Social Protection

Cover more groups, including gig workers and housewives.

Better Member Experience

Simpler processes, clearer rules, and easier access.

HR & Employer Summary

For employers and HR teams, the EPF 2026 updates mean:

-

No change to basic EPF payroll contribution rules

-

More employee questions about withdrawals & incentives

-

Opportunity to educate staff on retirement planning

-

Important updates for gig workers and low-income groups

As HR teams review these EPF updates, it may also help to double-check contribution amounts based on current salaries and policies.

FAQs

How much can employees withdraw for Hajj in 2026?

Up to RM10,000 from Akaun Sejahtera.

Do employees still need Tabung Haji balance proof?

No. This requirement has been removed.

Can foreign workers contribute to EPF?

Yes. Foreign workers must contribute at a fixed 2% rate.

What’s the difference between i-Saraan and i-Saraan Plus?

i-Saraan Plus offers:

-

Higher government incentive (up to RM600/year)

-

Higher lifetime incentive cap (RM6,000)

Can someone aged 56 still receive i-Suri incentives?

Yes. From 2026, eligibility is extended up to age 60.

Do these EPF 2026 changes affect normal employee payroll contributions?

No. There is no change to standard EPF contribution rates for employees and employers. Payroll deductions remain the same.

Should employers take any action for these EPF 2026 initiatives?

No system changes are required. However, HR is encouraged to inform employees about these updates, especially those related to Hajj withdrawals, gig workers (i-Saraan Plus), and i-Suri eligibility.

Build Your Team with the Right Talent

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best.

Post your job ads today & simplify your hiring process!

Read More:

-

Penamaan KWSP in Malaysia: Legal Implications, Process, and HR’s Role

-

i-Sayang KWSP Guide: Requirements, Benefits & How to Register

-

EPF, SOCSO, EIS, and LHDN Employer Registration Guide for Malaysian Companies

- Cara Kira Potongan KWSP dan SOCSO | How to Calculate EPF and SOCSO Deductions in Malaysia

-

Deadlines & Penalties for SOCSO, EPF, PCB/Form E, and HRD Levy in Malaysia

-

PCB for Foreign Workers in Malaysia: Employer’s Complete Guide

-

EPF Withdrawal for Education: Employer’s Guide to Supporting Staff

-

Akaun Fleksibel (EPF’s New Account Structure): Key Info for Employers

-

KWSP Call Centre for Employers: Contact Numbers, Services, and Support Channels

-

How to Check KWSP/EPF Balance: Online, SMS, Call Center, and More (2025)