Malaysia Form E 2026: Submission Guide, Deadline, and Penalties

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowNow that it’s 2026, Malaysian employers are getting ready for another tax season.

One important task they need to handle is submitting Form E, a key document in Malaysia’s tax system.

Let’s break down everything you need to know about submitting Form E for 2025 and help you stay prepared to meet your responsibilities.

What is Form E?

Form E, also known as Borang E in Malay, is an annual report that employers in Malaysia must submit to the Inland Revenue Board of Malaysia (LHDN).

This form provides a comprehensive summary of employment information, including employee salaries, bonuses, and deductions for the previous year.

It's essentially a snapshot of your company's payroll activities, allowing the LHDN to cross-check individual tax returns and ensure compliance.

Employers must also distribute Form EA to employees for their individual income tax filings.

The purpose of Form E goes beyond mere record-keeping. It plays a crucial role in Malaysia's tax ecosystem by:

-

Providing the LHDN with an overview of your company's workforce and compensation structure

-

Helping to verify the accuracy of individual employee tax returns

-

Ensuring that proper tax deductions have been made throughout the year

-

Facilitating the calculation of the company's tax obligations

Deadline for Submitting Form E in 2026

For the 2026 tax year, which covers income earned in 2025, the Form E submission deadline is set for March 31, 2026, applicable to all employers.

This includes public and private companies, partnerships, sole proprietorships, and non-profit organizations.

Submissions must be completed either online via the e-Filing platform or manually if necessary. Employers should mark their calendars and plan accordingly to avoid last-minute stress.

How to Submit Form E

Online Submission

The most efficient method is through LHDN’s e-Filing system, accessible via the MyTax portal.

Employers can log in, input employee details, and submit the form electronically. This platform also allows employers to verify data accuracy before submission.

Manual Submission

For companies unable to submit online, a manual submission is permitted.

Employers must ensure the physical form is completed accurately and delivered to the nearest LHDN branch by the deadline.

Late Submission Penalties

Failure to meet the deadline can result in severe consequences, including:

-

Fines up to RM200 to RM20,000 under Section 120 of the Income Tax Act 1967.

-

Possible legal action for repeated non-compliance.

If the deadline is missed, employers should immediately contact LHDN to mitigate penalties and submit the form as soon as possible.

If possible, provide a written explanation, detailing the reasons for the delay. While this does not guarantee waiver of penalties, it may be taken into consideration.

Preparation for Form E Submission

To ensure a smooth submission process, gather the following information:

-

Complete employee details (name, identification number, address)

-

Total remuneration for each employee

-

Breakdown of salaries, bonuses, and other benefits

-

Details of deductions (EPF, SOCSO, income tax)

-

Any benefits-in-kind provided to employees

Accuracy is paramount when preparing Form E. Double-check all figures and ensure they match your payroll records.

Consider using payroll software that can generate Form E reports automatically, reducing the risk of human error.

How to submit Form E via e-Filing for Employers

1. Access the MyTax Portal

Visit the MyTax portal and log in by selecting your ID type, entering your ID number, and providing your password.

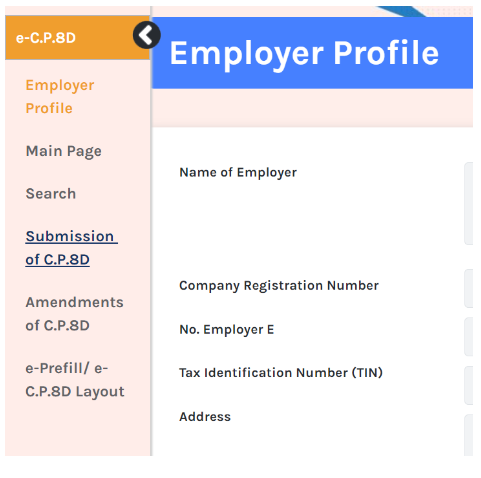

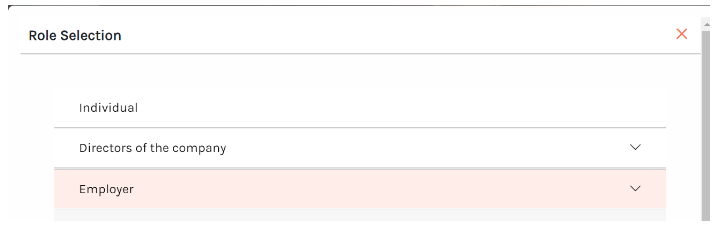

2. Select Your Role and Business

After logging in, choose "Employer" or "Employer Representative" from the Role Selection dropdown.

Then, select the business or company for which you are submitting Form E. If you cannot see the role, refer to a guide on applying for access.

3. Submit CP8D via EzHasil

Navigate to the EzHasil Services menu and select "e-Data Praisi/e-CP8D" to submit the CP8D form. You can fill in employee details manually through the online form.

4. File Form E

Return to the EzHasil Services menu and select "e-Filing."

- Choose "e-Form" and the appropriate year of assessment (e.g., 2023).

- Complete any missing company information and click "Next."

- Enter details such as the number of employees, new hires, employees who left, and those subject to PCB. Use PayrollPanda's E form PDF for easy reference.

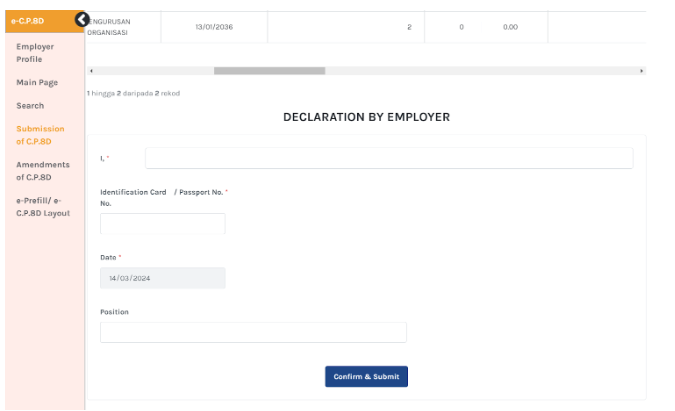

5. Submit the Form

After reviewing, input your designation, sign using your ID number and password, and click "Sign & Send."

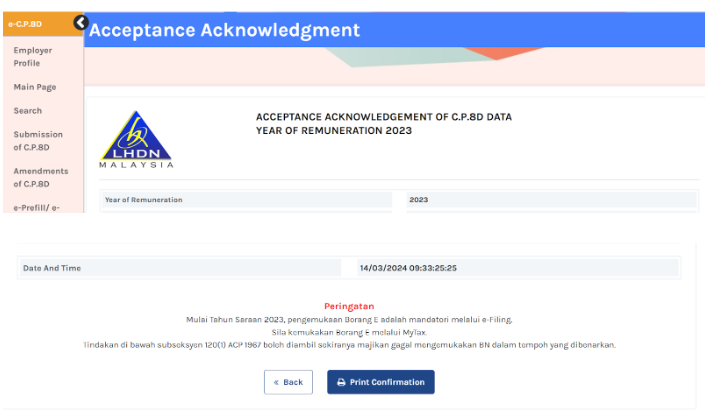

6. Receive Acknowledgment

You'll receive confirmation of the Form E submission, which you can download along with the completed form.

Tips for Meeting the Form E Deadline

To ensure you meet the Form E submission deadline:

1. Start Early

Begin gathering the required data months before the deadline.

This includes employee salaries, bonuses, and deductions, ensuring no critical information is overlooked.

2. Leverage Payroll Software

Invest in reliable payroll software to automate data collection and form preparation.

This reduces the risk of manual errors and saves valuable time.

3. Assign a Dedicated Overseer

Designate a specific team member to manage the entire Form E submission process. This ensures accountability and streamlines the workflow.

4. Set Internal Deadlines

Establish internal deadlines earlier than the official due date. This buffer period allows time to address unforeseen issues or delays.

5. Provide Regular Training

Conduct periodic training sessions for your HR and finance teams. Keeping them updated on the latest tax regulations minimizes compliance risks.

6. Conduct a Final Review

Before submission, carefully review all data to identify and correct any inaccuracies. A last-minute check can prevent errors that might lead to penalties.

Common FAQs About Form E Submission

Q: What if I find an error after submitting Form E?

A: Contact LHDN immediately and submit an amended form. Depending on the nature of the error, you may need to provide additional documentation.

Q: Can Form E be amended after the deadline?

A: Yes, but you may still be subject to late submission penalties. It's best to submit an accurate form before the deadline.

Q: What are the consequences of not submitting Form E at all?

A: Failure to submit Form E can result in hefty fines, potential imprisonment, and damage to your company's reputation. It may also trigger a tax audit.

As we approach the 2025 tax season, staying informed and prepared is key to a smooth Form E submission process.

By understanding the requirements, deadlines, and best practices, you can ensure your company remains compliant with Malaysian tax regulations.

Remember, early preparation and attention to detail are your best allies in navigating the complexities of tax compliance.

Form E Deadline Stress? Let Us Help You Hire the Right Talent!

Stressed about submitting Form E by March 31, 2025? Many employers struggle with last-minute filing, risking costly penalties!

Why stress? Hire an experienced finance/accounting professional NOW! Our AI writes job descriptions for you! Get the right finance/accounting candidates fast!

- FREE Account Payable Specialist Job Ad Description! Get Hired FAST!

- FREE Tax Manager Job Ad Description for You! Just Copy & Paste to Your Job Ads!

- FREE Accounting Assistant Job Description to Copy! Help you to get an accountant ASAP!

PCB (Monthly Tax Deduction) Calculator for Employers in Malaysia

Calculating employee tax manually can take a lot of time and may cause mistakes. This PCB calculator helps HR and employers calculate Monthly Tax Deduction (PCB) accurately, quickly, and without hassle.

With just a few inputs, you can get the correct PCB amount based on employee salary — no manual calculation needed.

Are you hiring in 2026?

Start your hiring journey with Ajobthing today! Post your job ads, connect with top talents, and streamline your recruitment process with our easy-to-use platform.

Read More:

- PCB (Potongan Cukai Bulanan) in Malaysia: A Complete Guide for Employers

- Tax Reliefs in Malaysia 2026 for Employers: Types and How to Apply

- New EPF Retirement Savings: Helping Employers Support Financial Well-Being for Employees

- Can we retain staff over the age of 60 in Malaysia?

- Malaysian Employment Act 1955: Key Provisions Every Employer Must Know

- Malaysia National Registration Identity Card (NRIC): A Guide for Employers

- What is the TIN Number in Malaysia?

- Long Weekend 2025 List in Malaysia

- Public Holidays in Malaysia for 2025: Complete List and Dates