![Full LHDN Stamp Duty Guide on Malaysia Employment Contract [2025]: Penalties, Exemptions, & More](/resources/blog/data/blog/images/2025/05/20250530055820-big.jpg)

Full LHDN Stamp Duty Guide on Malaysia Employment Contract [2025]: Penalties, Exemptions, & More

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

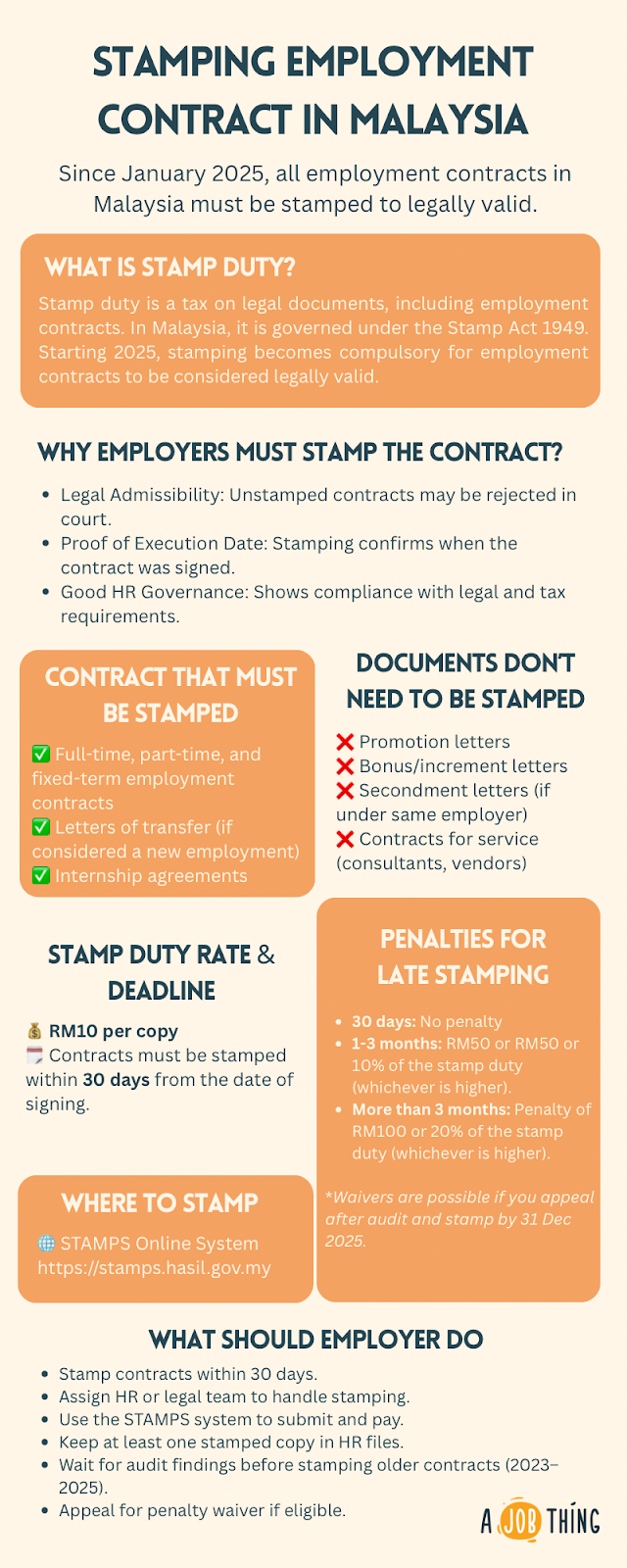

Hire NowSince January 2025, the Inland Revenue Board of Malaysia (LHDN) has begun actively enforcing the long-standing requirement under the Stamp Act 1949 for employment contracts to be stamped within 30 days of signing.

While the requirement isn’t new, LHDN has increased its focus on compliance by conducting audits on employment contracts signed from 2023 onwards.

This means employers may now be subject to stamp duty penalties of up to RM100 per contract if proper stamping is not completed within the 30-day timeframe.

If you're an employer in Malaysia, whether you're running an SME, managing HR in a larger company, or hiring contract staff, this update affects you.

Unstamped employment contracts may not only lead to financial penalties but could also be rejected as evidence in court during disputes.

This article breaks down everything you need to know about stamp duty on employment contracts in Malaysia, including who is responsible, how to stamp, the deadlines, the penalties, and what you can do next to stay compliant.

What Is Stamp Duty and Is Stamping of Employment Contracts Required by Law?

Stamp duty is a tax paid to the Inland Revenue Board of Malaysia (LHDN) to register legal documents, such as contracts and agreements, officially.

Once you pay the stamp duty, the contract gets an official stamp (physical or digital), showing that the government has recorded it.

Under the Stamp Act 1949, employment contracts are considered chargeable instruments.

Even though the term "employment contract" isn’t directly mentioned in the law, it falls under the broader category of documents that must be stamped.

This applies to all types of employment arrangements, including full-time, part-time, fixed-term, and internship contracts.

The law applies across Malaysia, including Sabah and Sarawak.

The LHDN has made it clear that stamping is required, no matter the nationality of the employee or employer.

It doesn’t matter if both parties are non-Malaysians. If the work takes place in Malaysia, the contract must be stamped.

Why Is It Important to Stamp Employment Contracts?

An unstamped contract might not be accepted as evidence in court if a dispute arises.

This could create serious legal risks, especially when dealing with employee claims or termination issues.

Stamping confirms the contract’s execution date, which is important in proving when the agreement began.

Also, stamping supports good HR practices by showing that your company is following legal requirements.

Even though the stamp duty itself is small, which is RM10 per copy, the impact of not doing it can be costly.

What Happens If Employers Don’t Stamp the Contract?

Starting 1 January 2025, new penalties apply:

-

Within 30 days of signing: No penalty, just pay the RM10 stamp duty.

-

From 31 days to 3 months: Penalty of RM50 or 10% of the stamp duty (whichever is higher).

-

More than 3 months: Penalty of RM100 or 20% of the stamp duty (whichever is higher).

If the LHDN audits your company and finds unstamped contracts, penalties will be applied automatically.

Worse, the contract may not be accepted in court until all duties and penalties are paid.

Penalties for Late Stamping (Effective 1 January 2025)

These penalties are based on Section 47A of the Stamp Act 1949.

The later you stamp the contract, the higher the penalty. However, there is one exception.

LHDN has agreed to offer a temporary penalty waiver: if your company stamps any employment contracts signed on or before 31 December 2025 by that same date, you can request to waive the penalties.

But you must submit an appeal for the waiver after receiving the audit results, not before.

If you stamp the contract before the audit, the system may still impose a penalty that cannot be refunded later.

So if you’re dealing with older contracts, it’s best to wait for the audit and follow the steps given.

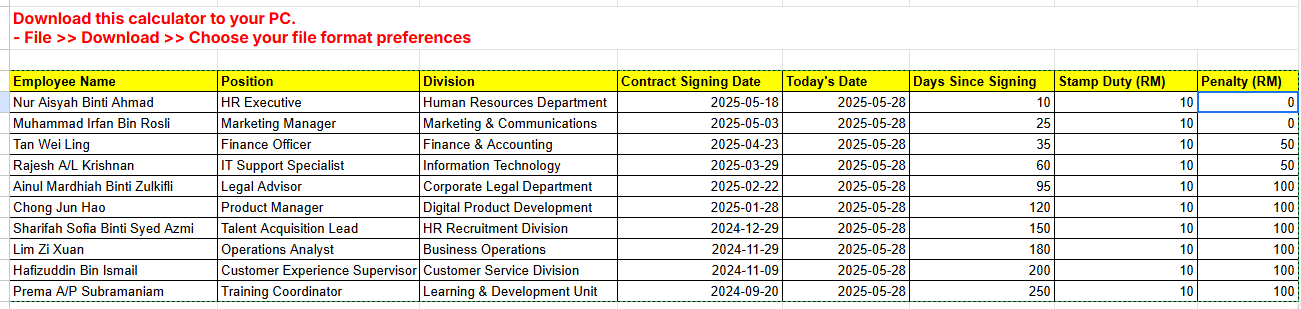

Free Download Penalty Simulation

To make it easier for you to calculate how many penalties you have to pay, you can use the penalty calculator below.

Free Penalty Simulation Download

Keep in mind that this is only simulation. To check for the penalty, please make sure you read LHDN Guide Here.

What Should Employers Do? 2 Things You Must Act On

First, always stamp employment contracts within 30 days after signing. Do not wait.

Even if you plan to revise or renew the contract later, stamping must be done based on the original date.

Second, assign a person or team responsible for this. For most companies, this would fall under the HR department or legal team.

Stamping should become part of the onboarding process.

Some SMEs overlook it because they’re unfamiliar with the rules, but ignorance is no longer an excuse now that enforcement has begun.

When and Where to Stamp the Contract

You must stamp the contract within 30 days of the date it was signed.

If you miss this window, penalties will apply as mentioned earlier.

Contracts should be stamped through LHDN’s online STAMPS system at stamps.hasil.gov.my.

This platform lets employers submit documents, calculate duties, and make payments digitally. The online platform is simple to use.

Employers can upload the contract, pay the stamp duty, and download a digital copy with the stamp included. No physical visits needed.

Stamp Duty Rate for Employment Contracts

Most employment contracts are charged a flat RM10 stamp duty for one copy, which is typically kept by the employer.

If the employee requests a stamped copy, a second one can be prepared, but this is optional.

Who Is Responsible for Stamping and Paying?

The employer is responsible. LHDN considers the employer as the party who first executes the contract, so it is the employer’s job to stamp it and cover the cost.

If a penalty is involved, the employer also has to pay it. Employees are not expected to bear this cost.

How to Stamp an Employment Contract

The process is straightforward:

-

Complete and sign the contract.

-

Go to the STAMPS portal

-

Upload the contract and pay RM10 per copy.

-

Download the stamped version and store it in your company files.

Only one stamped copy needs to be kept by the employer.

Existing and Fixed-Term Contracts

What if your employees have been working for years and never had their contracts stamped?

You still need to take action, especially now that LHDN is auditing contracts signed between 2023 to 2025.

If the contracts are still valid, prepare them for audit and wait for the waiver guidance from LHDN. For new contracts, always stamp within 30 days.

If you use fixed-term contracts (e.g., for one year or two years), each new contract must be stamped.

Do not label it as a “renewal,” because that may be misunderstood as a permanent employment status, which can complicate things legally.

Exemptions and Future Proposals

Currently, only contracts for employees earning below RM300 are exempt. However, this limit is outdated.

The Malaysian Employers Federation (MEF) has proposed raising the exemption threshold to match current wages, somewhere between RM7,000 to RM20,000.

They’ve also suggested extending the penalty waiver deadline to 30 June 2026 to give employers more time for compliance.

No decision has been finalised yet, but employers are advised to keep an eye out for updates from LHDN.

Find out more about the stamp duty on employment contracts in Malaysia in this video.

Source:

- https://stamps.hasil.gov.my

- Stamp Duty in Malaysia: Rates, Exemptions and Penalties

- https://www.hasil.gov.my/en/stamp-duty/

- Method of Payment for Stamp Duty by LHDN

- Penalty (Stamp Duty)

- Stamp Duty and Amount by PHL Hasil Gov MY

- 2025 Malaysia Stamp Duty Guide for Employment Contracts

- Employment Contract Stamping in Malaysia

- Stamp Act 1949

FAQ

Is stamping compulsory for all employment contracts?

Yes. Any formal employment contract must be stamped, regardless of the employment type or the nationality of the parties.

Can I stamp a contract signed more than 3 months ago?

Yes. But a penalty will apply, which is RM100 or 20% of the stamp duty, whichever is higher. You can also apply for a waiver if the contract was signed before 31 December 2025.

How much is the stamp duty?

RM10 per copy for most employment contracts. If the contract involves salary clauses or bonus payments, this amount may still remain the same, but check with LHDN if you’re unsure.

Can I use the STAMPS online portal for stamping?

Yes. Visit stamps.hasil.gov.my. Upload the contract, pay the fee, and download the stamped version.

Who should pay for stamping?

The employer should. Since the employer prepares the contract, they are considered responsible by law.

What if I forgot to stamp within 30 days?

A penalty will apply. The longer the delay, the higher the fine.

Is digital signing okay for stamped contracts?

Yes. As long as the contract is complete and validly signed, digital signatures are acceptable.

Are you Looking for New Staffs?

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best while staying compliant with LHDN regulations.

Post your job ads, connect with top talents on multiple platform like Maukerja, Ricebowl, and Epicareer with our easy-to-use platform.

Read More:

- How Employers Can Embrace National Work From Home Day in 2025

- How to Handle Employees Who Abscond from Work in Malaysia

- Dependant Pass Malaysia 2025: Eligibility, Process, and HR Tips

- Who Can Look at Employee Personnel Files?

- Why a Clear Signing Off From Work Policy Matters

- What is Work Life Balance? Benefits, Factors, and How to

- 75 Company Gift Ideas for Employee Resignation

- 150+ Nama Nama Company Yang Best to Inspire Your Business Name

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- EPF Voluntary Contribution in Malaysia: How It Works & Benefits

- STR 2025 (Sumbangan Tunai Rahmah): Eligibility, Payment Dates & How to Apply

- CP22 Form: Deadline, Free Download Form, How to Fill

- CP204: Deadline, Calculation, & Free Download Form

- How to Use ByrHASiL for Online Tax Payments in Malaysia

- PCB Deduction in Malaysia: Calculation, Rates & Employer Guide

- What is the 182 Days Rule in Malaysia? Tax Residency Explained

- Labour Law Malaysia Salary Payment For Employers

- Best Answers for 'Why Should We Hire You' – A Guide for Employers

- 12 Employment Types You Need to Know: A Guide for Employers

- What is Precarious Employment? Risks, Challenges, and Solution

- New EPF Retirement Savings: Helping Employers Support Financial Well-Being for Employees

- Higher Pensioners in 2024, Government Set to Finalize Pension Rates

- Lack of Diversity in Candidate Pool: Why It Matters and How to Improve It

PCB (Monthly Tax Deduction) Calculator for Employers in Malaysia

Calculating employee tax manually can take a lot of time and may cause mistakes. This PCB calculator helps HR and employers calculate Monthly Tax Deduction (PCB) accurately, quickly, and without hassle.

With just a few inputs, you can get the correct PCB amount based on employee salary — no manual calculation needed.