How to Set Up ERP for Accounting Software on MyInvois Portal

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowAs LHDN begins enforcing e-invoicing, companies in Malaysia must make sure their invoice systems are ready. If you're using ERP software to manage accounting, syncing it with the MyInvois portal can automate your submission process and keep your business aligned with tax regulations.

Confused on how to do it? Check this article to know how to set up ERP Accounting Software on MyInvois Portal.

What is the MyInvois Portal?

The MyInvois portal is the official platform by LHDN (Lembaga Hasil Dalam Negeri) for handling e-invoice submissions. All businesses that fall under the SST/e-invoice implementation roadmap must register and start using the portal according to the phased rollout.

It is used to generate, submit, and manage electronic invoices either manually or through system integration.

What is ERP Integration with MyInvois?

ERP stands for Enterprise Resource Planning. It integrates software platforms like SAP, Oracle, AutoCount, or SQL that help manage business operations, including accounting and invoicing.

When your ERP system is integrated with MyInvois, it means your software can directly send e-invoices to LHDN’s system. There are three main ways to do this:

-

API-based integration for real-time data transfer

-

Manual XML file uploads for companies without advanced ERP

-

Using a third-party connector or intermediary

Prerequisites Before Integration

Before you can start integrating, a few things must be ready:

-

Your business must be registered on the MyInvois portal

-

Your ERP software must be compatible with LHDN’s API or XML format

-

You need to apply for API credentials and a Digital Certificate (DC) from LHDN for secure data exchange

Step-by-Step Guide to Set Up ERP Integration

-

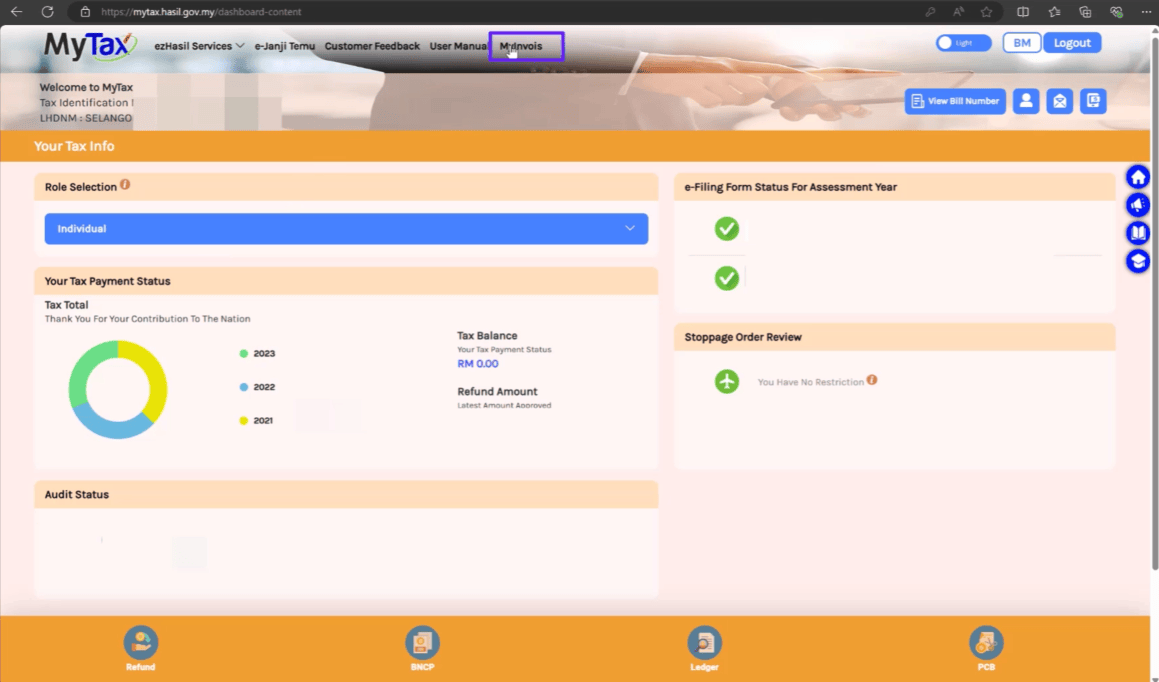

Log in to MyInvois using your business profile.

-

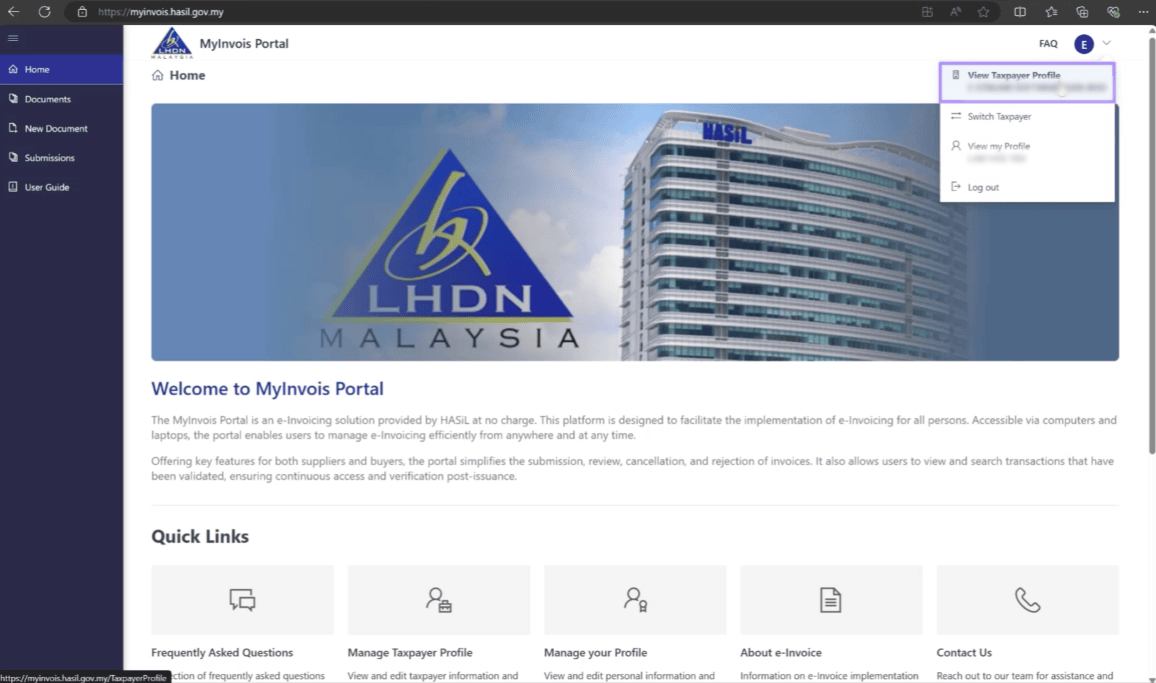

Go to "View Taxpayer Profile"

-

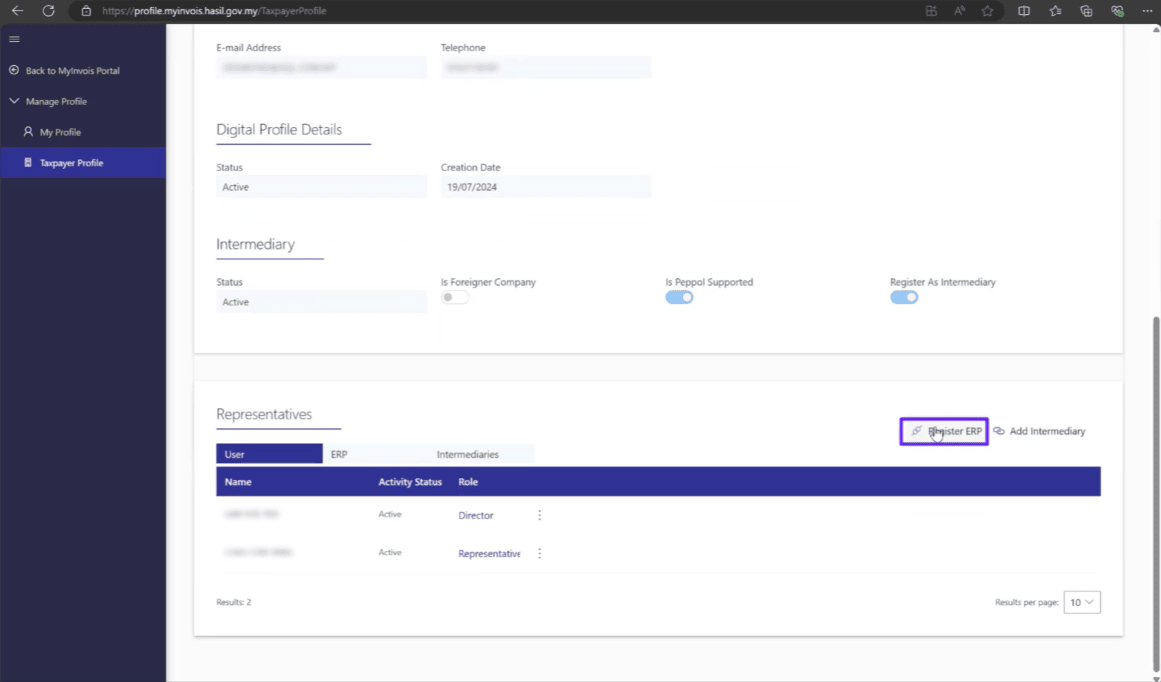

Scroll down to "Representatives" section, click on "Register ERP."

-

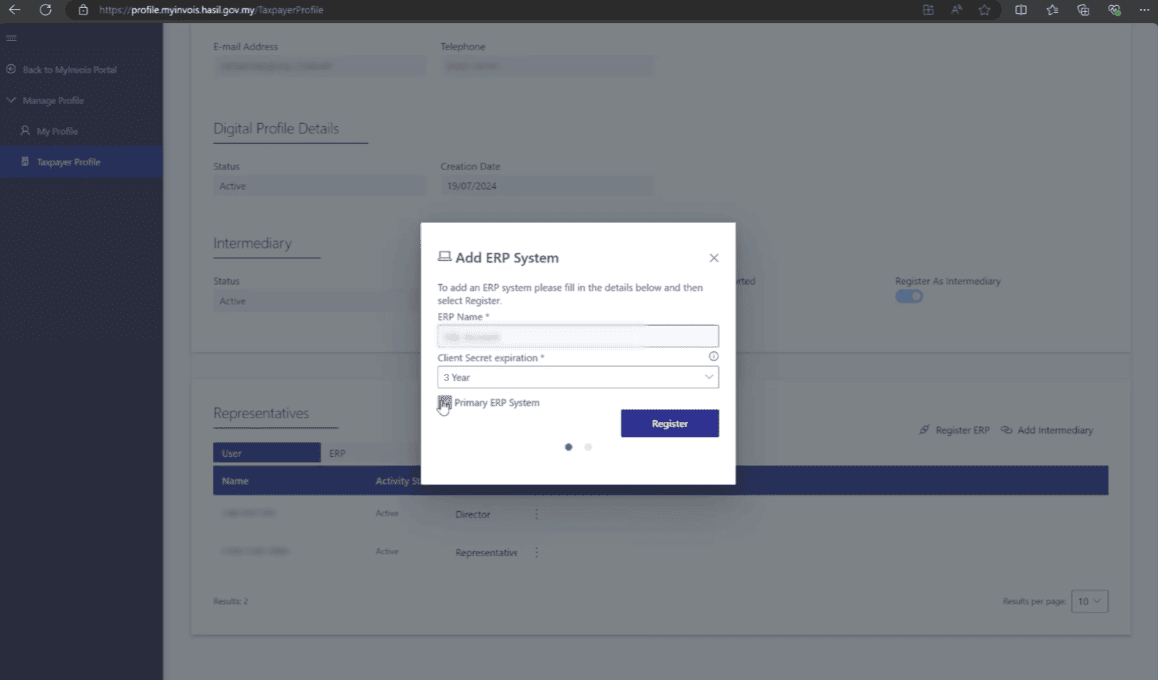

Enter the name of your ERP software and Client Secret Expiration Date. Tick the box if this is your main ERP system. Click "Register".

-

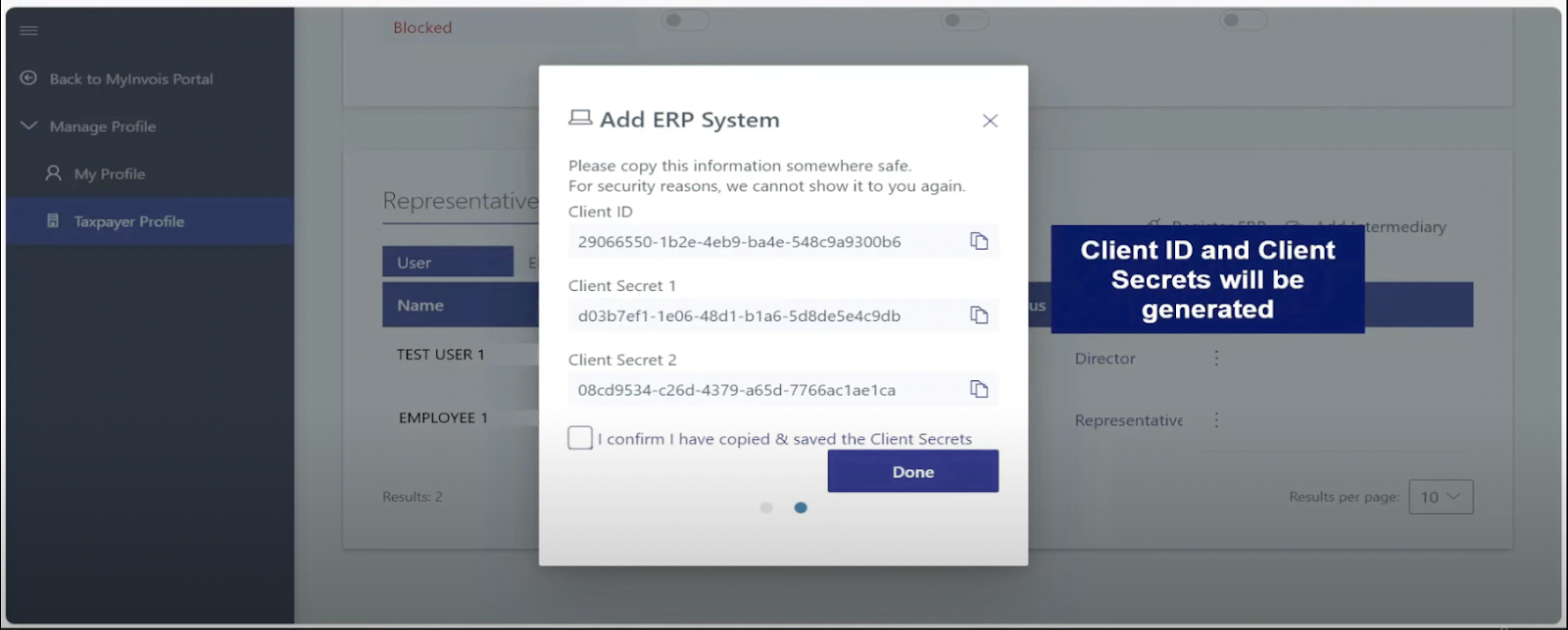

Once registered, the system will generate Client ID, Client Secret 1, and Client Secret 2. Copy them and save in a secure place. Tick the “I confirm I have copied & saved the Client Secrets”.

-

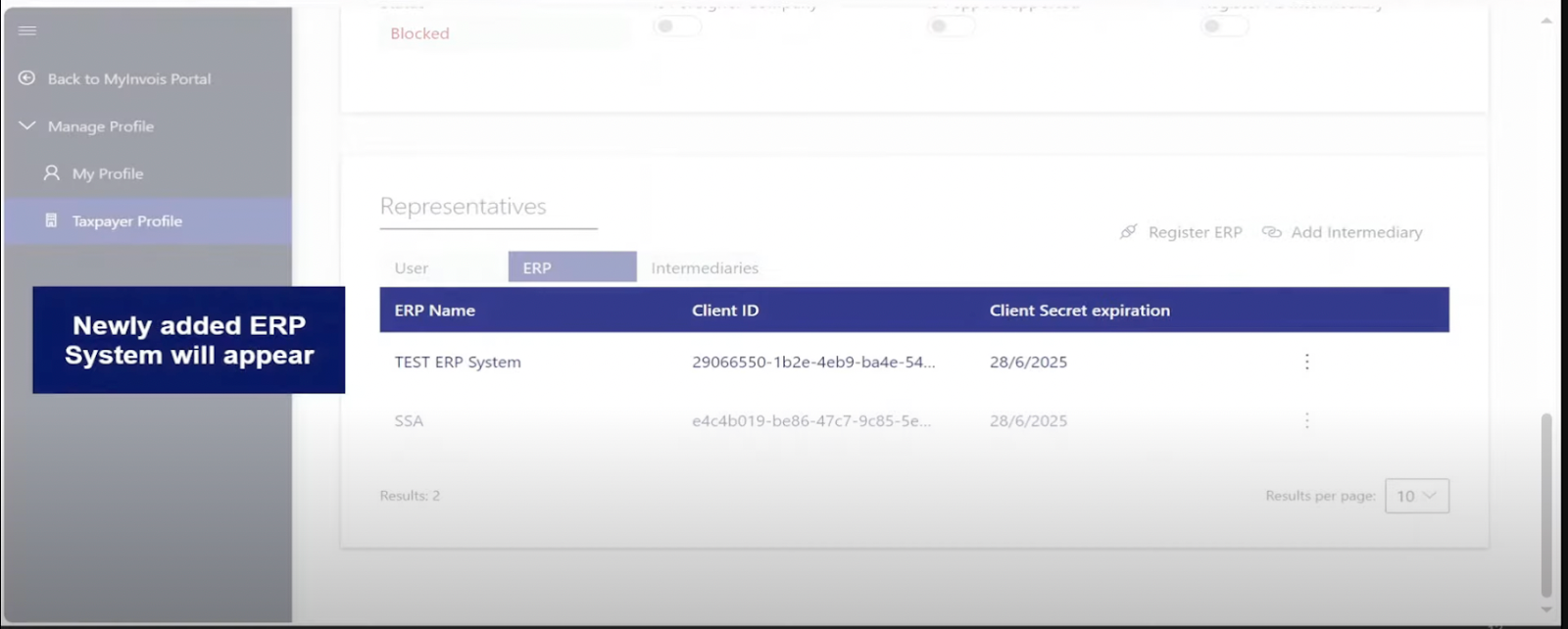

The newly registered ERP will appear in the ERP tab.

Best Practices for ERP Integration

Once your ERP is successfully connected to MyInvois, keeping it running smoothly is just as important as setting it up. It needs regular attention to avoid disruptions in your e-invoice submissions. Keep your integration reliable by doing these:

-

Assign a dedicated IT person or vendor to handle the technical setup and ongoing maintenance

-

Schedule regular health checks to make sure the API connection and digital certificate are still valid

-

Monitor the invoice status dashboard frequently and check rejection logs for issues

-

Always keep backups of all e-invoice data and enable audit trails within your ERP system

Common Mistakes to Avoid

Even with a clear integration plan, small oversights can cause big problems during e-invoicing. Mistakes can stop invoice submissions without warning, and you might only realise it when your reports don’t match or LHDN raises a red flag.

Some common mistakes that you need to avoid:

-

Registering unsupported ERP software

-

Skipping sandbox testing and going live too early

-

Forgetting to renew API keys or Digital Certificates before expiry

Compliance & Penalties

LHDN actively monitors submission records and expects invoice data to be accurate, timely, and in line with the official format. If your ERP connection fails silently, or if invoices are submitted late or with incorrect details, it could cause delays in tax reporting or trigger further investigation.

Failure to comply may result in:

-

Rejection of submitted invoices

-

Fines for late or missing e-invoice reporting

-

Tax audit or legal consequence.

Download Guide from LHDN

For the official e-Invoice setup materials, use the links below:

-

e-Invoice Guideline Version 4.5 (published on 7 July 2025)

-

e-Invoice Specific Guideline Version 4.3 (published on 7 July 2025)

FAQs

What ERP systems are supported by MyInvois?

Systems like SAP, Oracle, AutoCount, SQL, and others that support API or XML file formats.

Is ERP integration mandatory for all businesses?

No, but it’s highly recommended for medium to large companies with high invoice volumes.

How is manual submission different from ERP integration?

Manual submission requires entering data invoice by invoice. ERP integration automates this process.

How long does ERP setup take?

It varies by system, but with the right vendor, setup, and testing can be completed in a few days to a couple of weeks.

Who should manage ERP setup?

Your internal IT team or a trusted ERP vendor with experience in API configuration and certificate setup.

Can SMEs without ERP still use MyInvois?

Yes. They can submit e-invoices manually via the MyInvois web portal.

Is there a cost for ERP integration?

This depends on your ERP vendor and whether any software updates are needed. There may also be implementation or consulting fees.

How do I apply for the API Key and Digital Certificate?

You can apply through the MyInvois portal after registering your ERP system. The steps are provided under the API management section.

What’s the difference between sandbox and production environments?

The sandbox is for testing, while the production environment handles live invoice data.

What if my invoice is rejected during submission?

Check the error logs, correct the data, and resubmit. Always test similar scenarios in a sandbox to reduce future errors.

Looking to Hire the Best Candidates?

Let AJobThing help you find the right people who will grow with your company.

Post your job ads and connect with top talent across platforms like Maukerja, Ricebowl, and Epicareer today.

Read More:

- What is the Purpose of EIS in Malaysia?

- How Businesses Register LDHN MyInvois Portal for E-Invoice

- 10 Types of SOCSO Claims in Malaysia (Jenis-jenis Tuntutan PERKESO)

- Extended SST Rates (6%–8%) Effective 1 July: Why and What to Prepare

- Kenapa SOCSO Ditolak dalam Gaji? | Why is SOCSO Deducted from Salary?

- Full LHDN Stamp Duty Guide on Malaysia Employment Contract [2025]: Penalties, Exemptions, & More

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- What is SST 8%? Types, How to Charge, and SST Filling

- Pelepasan Cukai 2024/2025: Tax Reliefs Guide for Employers

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- How to Submit CP22 for New Employees in Malaysia in LHDN MyTax Portal