How to Check EPF Number: Easy Steps for Employers

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowEvery employee and employer in Malaysia needs an EPF number to manage monthly contributions to the Employees Provident Fund (EPF), also known as KWSP. It’s your unique identification number for savings, withdrawals, and employment verification. If you’ve misplaced or forgotten it, don’t worry! There are several quick ways to retrieve your EPF number online or offline.

Importance of Knowing Your EPF Number

Your EPF number acts as your personal reference ID within the Employees Provident Fund system. It is used for:

-

Tracking monthly contributions made by your employer.

-

Checking your savings and dividends through your i-Akaun.

-

Submitting withdrawal or retirement applications.

-

Updating your personal or employment details.

Employees usually receive their EPF number when they start their first job, as employers are required to register new employees with EPF. However, some may forget or lose access to it when changing jobs, losing payslips, or moving to a new address.

Methods to Check EPF Number

There are several ways to check your EPF number, depending on what’s most convenient for you:

1. Through Your Employer or HR Department

Your HR or payroll department keeps a record of your EPF number, as it’s used for monthly contributions. You can simply request it from them, especially if you’ve just started a new job or misplaced your payslip.

2. Through Your EPF Statement

You can find your EPF number printed on your monthly or annual EPF statement. These are usually available in physical form (if mailed to you) or digitally through your employer’s payroll portal.

3. Through i-Akaun (EPF Online Portal)

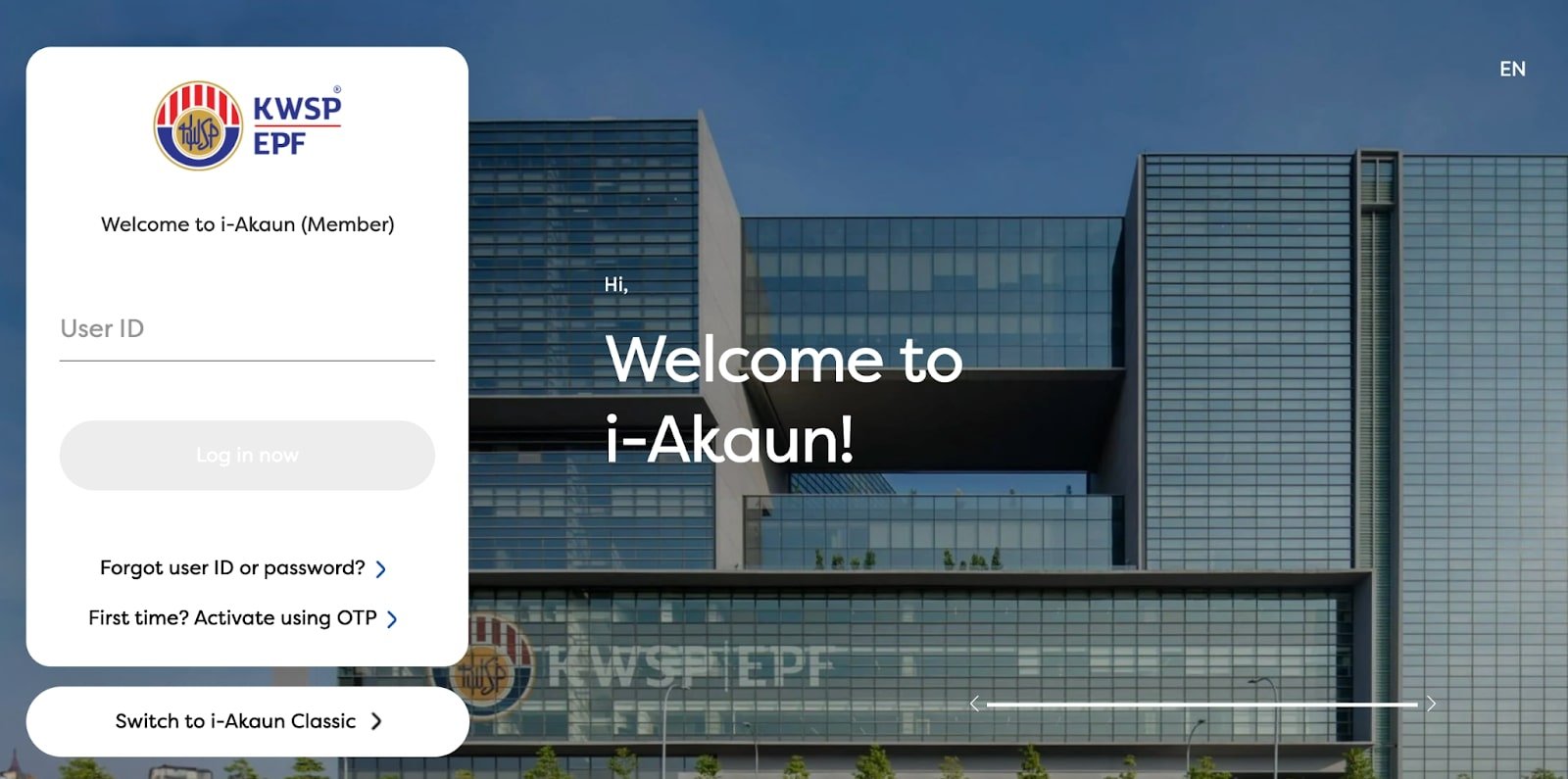

If you’ve registered for i-Akaun, you can easily find your EPF number online.

-

Log in to your account at https://www.kwsp.gov.my.

-

Click on “My Account” or “Account Details.”

-

Your EPF number will be displayed at the top of your profile page.

If you haven’t registered for i-Akaun yet, you can do so at any EPF branch or kiosk (see below).

4. At an EPF Kiosk or Counter

Visit any EPF kiosk or branch with your MyKad (IC). You can check your EPF number by scanning your IC or by speaking to an officer at the counter. Most kiosks allow you to print a mini statement that includes your EPF number.

5. Through the EPF Customer Care Line

If you’re unable to visit a branch, call the EPF Customer Care Line at 03-8922 6000. You’ll be asked to verify your identity by providing your IC number and a few personal details before the officer can share your EPF number.

Step-by-Step Guide: Checking Through i-Akaun

Here’s how to check your EPF number online through i-Akaun:

-

Visit the official EPF website at https://www.kwsp.gov.my. Click on “Member Login”

-

Enter your User ID and Password.

-

Once logged in, go to “Account Details” or “Personal Information.”

-

Your EPF number will be listed at the top of your account summary.

If you haven’t activated i-Akaun yet, you can:

-

Visit the nearest EPF kiosk or branch to obtain an Activation Code (Kod Pengaktifan).

-

Use the activation code to register online within 30 days.

What to Do If You Lost Your EPF Number

If you’ve lost or never received your EPF number, here’s what you can do:

-

Visit the nearest EPF branch with your MyKad (IC) and a copy of your salary slip or EA form. The officer will help you retrieve or reissue your EPF number.

-

Call EPF Customer Service at 03-8922 6000 and verify your identity.

-

Ensure your contact information is updated. Your phone number, email, and address should be current so EPF can contact you if needed.

If you’re a foreign employee, bring your passport and work permit when visiting the EPF branch.

Tips for Employers & Employees

Both employers and employees play an important role in keeping EPF records correct and up to date. Here are some best practices to help maintain compliance and prevent common issues.

Keep Your EPF Number Safely Recorded

Store it in a secure place such as your HR file or personal finance tracker.

Employers Should Verify EPF Details during Onboarding

This ensures accurate contribution reporting and avoids mismatched accounts.

Cross-check EPF Contributions Regularly

Employees can use i-Akaun to ensure that their employer’s monthly contributions are being received correctly.

Update Your Details After Job Changes

Always inform EPF if you change employers, addresses, or phone numbers.

FAQs

Can I have more than one EPF number?

No. Each member is only allowed one EPF number linked to their NRIC or passport number. Multiple accounts can cause contribution mismatches.

How can foreigners working in Malaysia get an EPF number?

Foreign employees can apply for an EPF number through their employer or at any EPF branch by presenting their passport, work permit, and employment details.

What should I do if my EPF contributions don’t appear under my number?

Check with your employer first to confirm payment details. If contributions are missing, contact EPF directly with proof of employment and payslips.

Is the EPF number the same as the IC number?

No. Although your EPF number is linked to your IC number, they are not the same. The EPF number is a unique reference assigned to your account.

Hire Smarter, Faster — Your Next Star Employee Awaits!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best.

Post your job ads today & simplify your hiring process!

Read More:

- Deadlines & Penalties for SOCSO, EPF, PCB/Form E, and HRD Levy in Malaysia

- PCB for Foreign Workers in Malaysia: Employer’s Complete Guide

- How to Pay PCB For Employees: A Guide For Employers

- Pengeluaran KWSP 2025: Complete Guide for Employers

- EPF Withdrawal for Education: Employer’s Guide to Supporting Staff

- Akaun Fleksibel (EPF’s New Account Structure): Key Info for Employers

- i-Saraan KWSP 2025: Benefits and How To Register

- KWSP Call Centre for Employers: Contact Numbers, Services, and Support Channels

- KWSP Application Deadline 2025 for Employers in Malaysia

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- What is the CP8D Form? Definition, Deadline, and FAQ

- How to Schedule an EPF Appointment via Janji Temu Online