How to Register SOCSO for Foreign Workers

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowImagine a scenario where a foreign worker in your company suffers a serious workplace injury, and because they are not registered with SOCSO, they cannot access medical treatment or compensation.

This could lead to unexpected costs, legal consequences, and business disruptions.

SOCSO registration is essential to protect foreign workers from workplace risks and provide them with financial security.

Read this article to learn everything about how to register foreign workers with SOCSO and why it is important for both employers and workers.

What is SOCSO and Why is It Important for Foreign Workers?

SOCSO (also known as PERKESO) is a government agency that provides social security protection for all workers including foreigners in Malaysia. It manages two main schemes:

-

Employment Injury Scheme (EIS): Covers medical treatment, temporary disablement, permanent disability, and dependents' benefits if a worker suffers an accident or illness due to work.

-

Invalidity Scheme: Provides financial assistance if a worker is unable to work due to a permanent disability, regardless of whether it is job-related.

Foreign workers must be registered by their employers under these schemes, depending on their age and employment status.

Without SOCSO coverage, workers may not receive financial support for injuries, and employers could face penalties.

Who Needs to Register with SOCSO?

Employers must register all foreign workers under SOCSO, including:

-

Workers on a Temporary Employment Pass (VP(TE))

-

Foreign domestic helpers on a VP(SS)

-

Skilled and unskilled foreign workers in construction, manufacturing, plantation, agriculture, and services sectors

However, some foreign employees do not need SOCSO registration, such as:

-

Expatriates holding a Professional Visit Pass

-

Foreigners on short-term business visas

-

Foreign students in internship programs

Why is SOCSO Registration Important for Foreign Workers?

Foreign workers face the same risks as Malaysian employees, such as workplace accidents and long-term illnesses.

SOCSO registration ensures that they have financial protection, which includes:

-

Medical Benefits: Hospital bills for work-related injuries.

-

Temporary and Permanent Disablement Benefits: Financial aid if a worker cannot work due to an accident.

-

Survivor’s Pension: Financial support to the worker’s family if they pass away due to work-related reasons.

Without SOCSO, foreign workers might not get the medical care they need, and employers may be legally responsible for paying their expenses.

Documents Needed for Registration

Before registering a foreign worker with SOCSO, employers must prepare the following documents:

-

Worker’s passport copy

-

Valid work pass (Employment Pass or Temporary Employment Pass)

-

Worker’s personal details (Full name, nationality, etc.)

-

Employer’s business registration number

Employers should also check that all documents are valid and updated to avoid processing delays.

Steps to Register with SOCSO for Foreign Workers

The process of registering foreign workers for SOCSO is straightforward but requires proper documentation and timely submission. Follow the steps below.

Step 1: Access the SOCSO Employer Portal (eSP) or Visit a SOCSO Office

Log in to the SOCSO Assist Portal or visit an appointed SOCSO office.

The Assist Portal is the main platform where employers can handle SOCSO-related matters, including registration and contributions.

Step 2: Complete the Required Forms

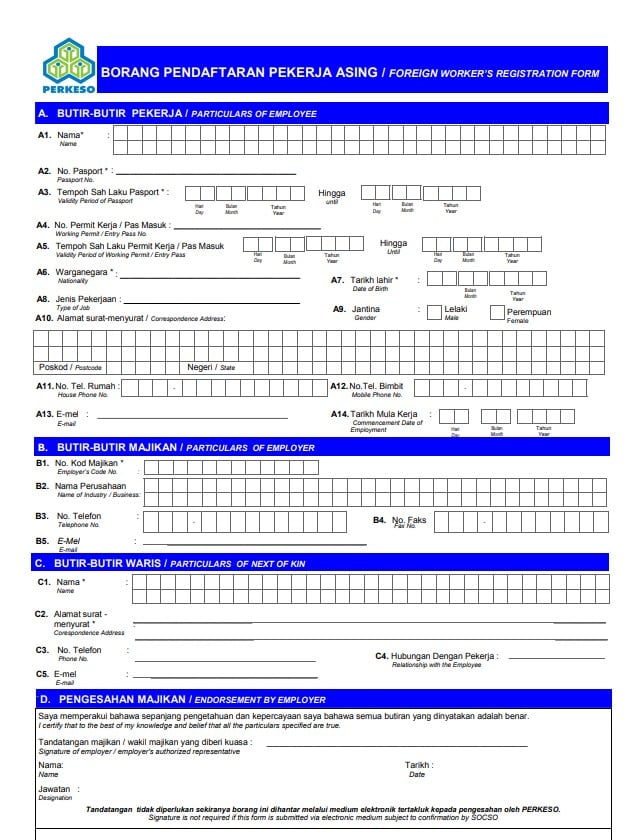

To register a foreign worker, employers need to download and fill in the necessary forms, including:

-

Borang Pendaftaran Pekerja Asing (Foreign Worker Registration Form)

-

Borang Pengisytiharaan Orang Tanggungan Pekerja Asing (Declaration of Worker’s Dependents)

These forms must be filled out accurately and scanned for submission.

Step 3: Prepare and Upload Required Documents

Employers must submit the following documents along with the registration forms:

-

A copy of the worker’s passport (with at least 12 months of validity)

-

A valid work pass (Employment Pass or Temporary Employment Pass)

-

Worker’s personal details (full name, nationality, and employment information)

-

The employer’s business registration number

All documents should be uploaded through the Assist Portal or submitted in person at a SOCSO office.

Step 4: Submit the Registration

After completing the forms and attaching the necessary documents, submit the application via the SOCSO Assist Portal or manually at a SOCSO office.

Employers will receive a confirmation email once the application is successfully submitted.

Step 5: Wait for SOCSO’s Approval

SOCSO will process the registration and verify the documents.

If everything is in order, SOCSO will issue a Social Security Foreign Worker (SSFW) number for the registered worker. Regularly check the Assist Portal for updates.

SOCSO Online Registration Process

If employers prefer online registration, use the eSOCSO Employer Portal. Here’s how:

-

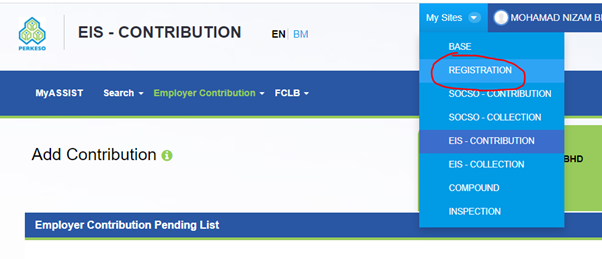

Log in to the eSOCSO Portal. Go to My Sites in the portal dashboard.

-

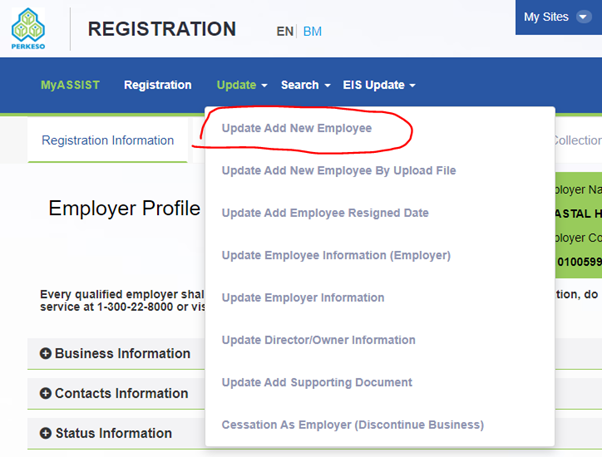

Click on Registration, select Update, and click Update Add New Employee.

-

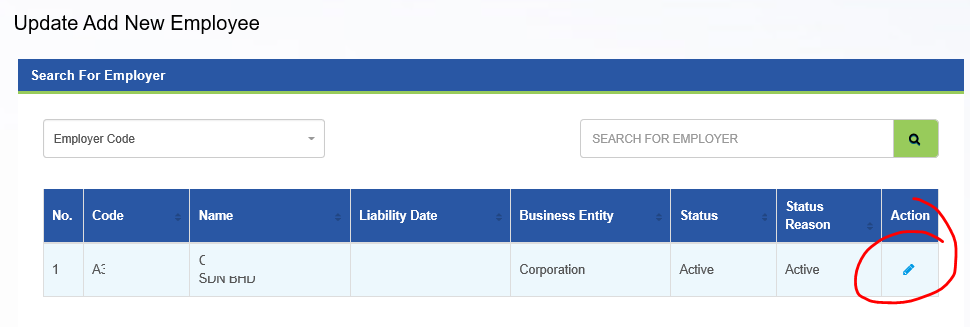

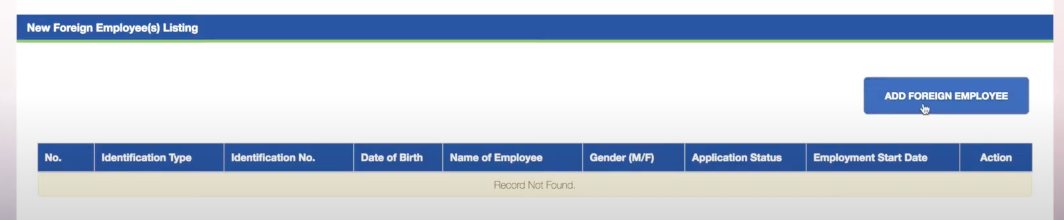

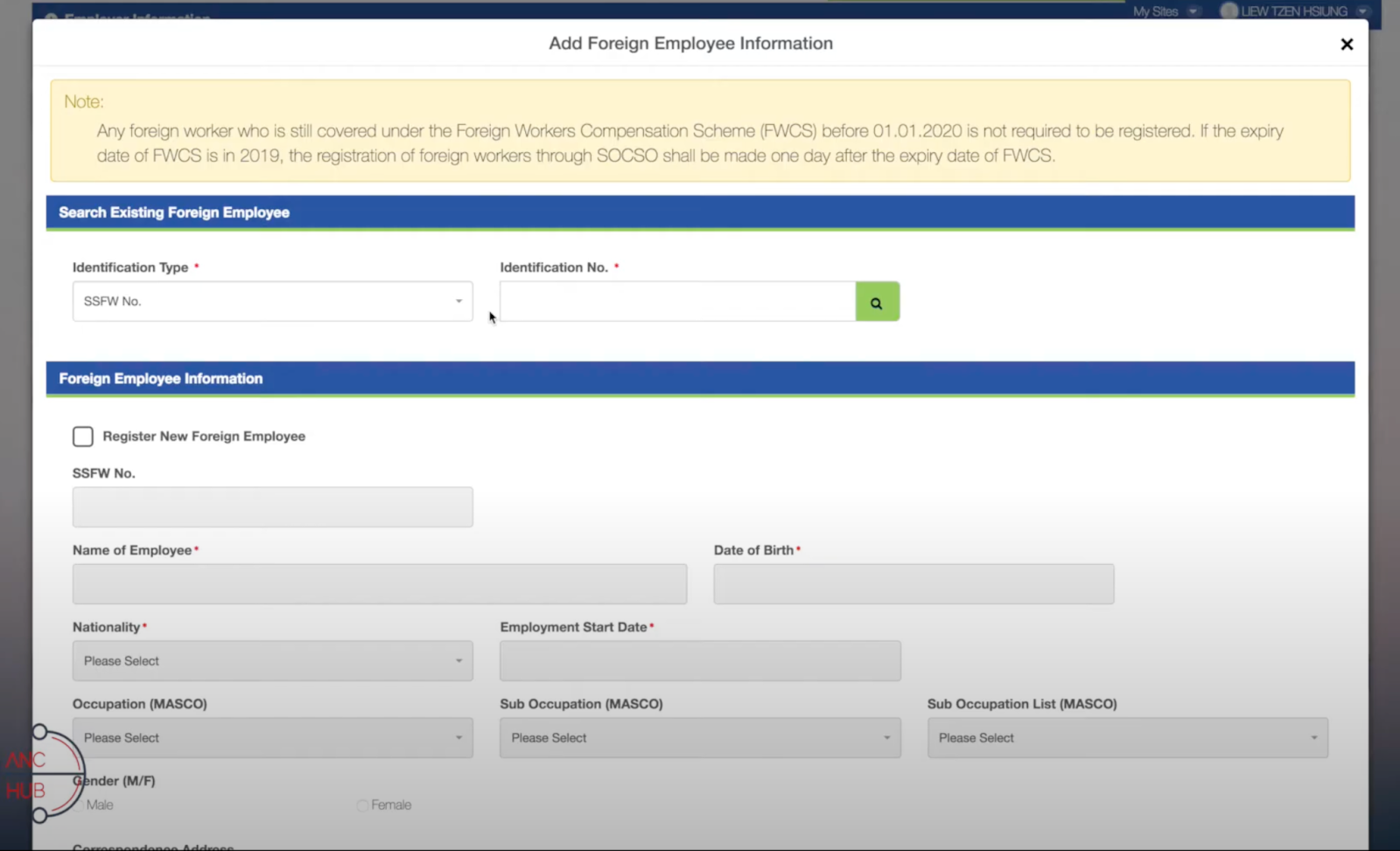

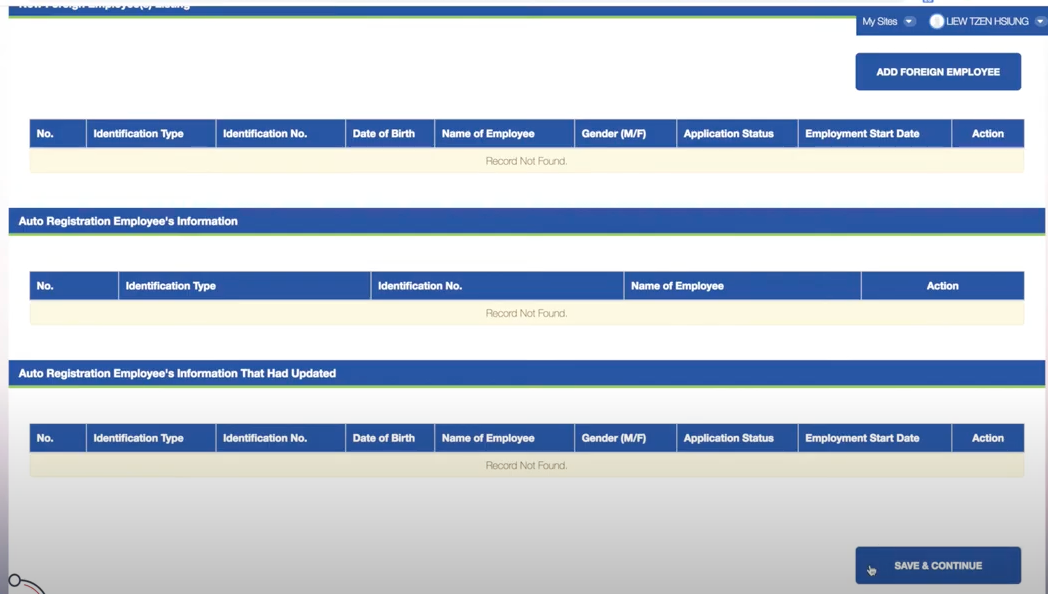

Click the Action (pencil icon) on the right side of your company name. Scroll down a bit to New Foreign Employee(s) Listing, then click Add Foreign Employee.

-

Fill in the foreign worker’s details such as passport number, nationality, and work permit. Upload a copy of the worker’s passport and valid work permit. Click Save.

-

Click Save and Continue twice to proceed to the document section.

-

Clicking Add Document and upload Borang Pendaftaran Pekerja Asing (Foreign Worker Registration Form). Click Save and Continue.

-

End the process by clicking Submit, then click Confirm to finalize the registration.

Once submitted, SOCSO will process the application, and the worker will be assigned an SSFW number.

Employers should keep a record of the SSFW number for payroll and SOCSO contributions.

Payment of Contributions After Registration

After registration, employers must pay monthly contributions to SOCSO. The contribution rates are as follows:

|

Contribution Type |

Employer’s Share |

Foreign Worker’s Share |

Total Contribution |

|---|---|---|---|

|

Employment Injury Scheme |

1.25% |

0% |

1.25% |

|

Invalidity Scheme |

0.5% |

0.5% |

1.0% |

Employers must make payments through the SOCSO Assist Portal or designated banks before the due date to avoid penalties.

What Happens After SOCSO Registration?

Once the foreign worker is successfully registered:

-

They receive an SSFW number, which links them to their SOCSO benefits.

-

Employers should record the SSFW number in payroll systems for future SOCSO payments.

-

Workers can track their registration status through logging in on SOCSO using ID and password.

-

If needed, they can apply for an SSFW card, which is used for medical claims.

Employer Responsibilities After Registration

SOCSO registration is not a one-time process. Employers must:

-

Make monthly SOCSO contributions for all registered foreign workers.

-

Report workplace injuries within 48 hours to SOCSO.

-

Update worker details if their employment status changes (e.g., renewal of work pass).

Failure to follow these responsibilities can lead to penalties.

What Happens If You Fail to Register Foreign Workers with SOCSO?

Employers who fail to register foreign workers may face:

-

Fines up to RM10,000 under the Employees’ Social Security Act 1969.

-

Imprisonment for up to 2 years if convicted.

-

Legal liability for all medical costs if a worker is injured.

-

Blacklist from hiring foreign workers in the future.

Frequently Asked Questions (FAQs)

How can I check if my foreign worker is registered with SOCSO?

Employers can check through the SOCSO Assist Portal using the worker’s passport number or SSFW number. Monthly contribution records also confirm registration. If unsure, contact SOCSO for assistance.

Can I register multiple foreign workers at once?

Yes, the SOCSO Assist Portal allows bulk registration. Employers must prepare the necessary documents and submit them in one batch for faster processing.

Do I need to register foreign workers on Temporary Employment Pass?

Yes, all workers with a VP(TE) must be registered under SOCSO for legal protection. Failing to do so can result in penalties.

What if a foreign worker loses their SSFW card?

Employers must report the loss to SOCSO via the Assist Portal or a SOCSO office. A replacement can be requested using the worker’s passport and SSFW details.

Is it necessary to register foreign workers with SOCSO if they are covered under other insurance?

Yes, SOCSO registration is mandatory even if the worker has private insurance. It provides legal protection for workplace injuries and disabilities.

Urgently seeking candidates to hire?

Look no further! AJobThing offers an effective hiring solution with our instant job ad feature. Hire in just 72 hours! Try Now!

Read More on AJobThing:

- What is SOCSO? A Simple Guide for Employers

- How to Claim SOCSO for Accidents in Malaysia

- SOCSO vs. EPF: Differences and Why EIS Matters Too

- Foreign Worker Permit Renewal in Malaysia: Employer Guide 2025

- Social Security Foreign Worker Number (SSFW): Definition, How to Get, Consequences

- Requirements to Hire Foreign Workers in Malaysia: Documents, Fees & How-To (2025)

- Recruiting the Future Talent: Generation Z (Gen Z)

- Tips for Interviewer: Job Interview Dos and Don'ts

- Reasons to Hire Working Moms (and How to Hire and Retain)

- HR Practice: New Employee Onboarding Process and Checklist

- Finding the Perfect Fit: 5 Personality Tests for Hiring Process

- Career Fair Recruitment Strategy: Benefits and Employer Planning Guide

- Tips for Interviewer: How to Prepare and Conduct a Virtual Interview

- Key Performance Indicator (KPI): Definition, Types, Dashboard, Criteria and Examples

- EPF Account 3 (Akaun Fleksibel): A Quick Guide to EPF Account Restructuring

- E-Invoicing Malaysia: A Comprehensive Guideline for Business