i-Simpan EPF (KWSP): How It Works & How Employees Can Contribute

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire Nowi-Simpan is a voluntary EPF (KWSP) contribution option that allows members to add extra retirement savings anytime, based on their own financial ability.

From 1 January 2026, EPF officially uses the name i-Simpan (previously known as Self-Contribution / Caruman Pilihan Sendiri) to make retirement planning easier to understand.

This article explains what i-Simpan is, who can contribute, and how HR and employers can guide employees on using this option.

For official details, employers may also refer to the Kumpulan Wang Simpanan Pekerja (KWSP) website: https://www.kwsp.gov.my/

What is i-Simpan EPF (KWSP)?

i-Simpan is a voluntary EPF contribution option.

In simple terms:

-

Employees or individuals can top up their EPF savings on their own

-

No employer involvement is required

-

Contributions can be made anytime, with no fixed schedule

i-Simpan is suitable for:

-

Employees who want to save more for retirement

-

Self-employed individuals

-

Freelancers and gig workers

-

Housewives

-

Anyone without a regular employer

Even employees with a full-time job can still use i-Simpan to boost their EPF savings.

Why EPF Introduced i-Simpan (2026 Update)

Starting January 2026, EPF rebranded Caruman Pilihan Sendiri as i-Simpan to:

-

Make EPF products easier to understand

-

Encourage proactive retirement savings

-

Align with other EPF products like i-Saraan and i-Lindung

For HR teams, this is mainly a name and clarity update — not a payroll change.

Key Benefits of i-Simpan

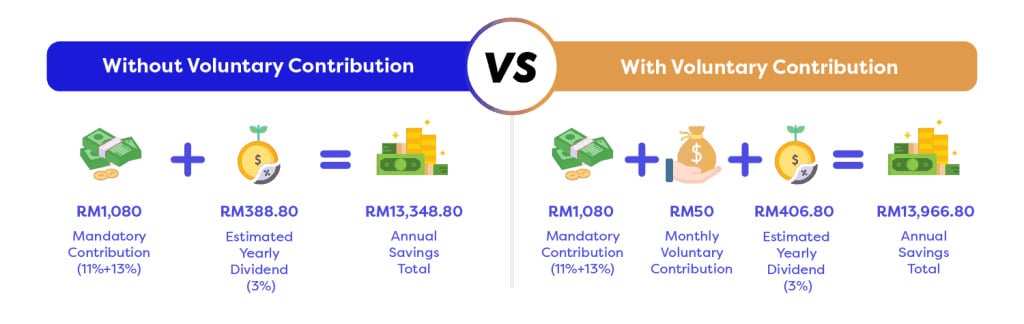

1. Same EPF Dividend as Normal Contributions

Money saved under i-Simpan:

-

Earns the same annual EPF dividend

-

Benefits from compound growth over time

The earlier and more consistently employees save, the more their retirement fund grows.

Helping Employees Plan Voluntary EPF Savings?

Our EPF Calculator helps estimate contributions before reaching annual EPF limits. Calculate EPF contributions now.

2. Eligible for Income Tax Relief

i-Simpan contributions are eligible for income tax relief, subject to LHDN limits.

This means employees can:

-

Reduce taxable income

-

Save for retirement at the same time

(Actual tax relief depends on individual tax limits.)

3. Very Flexible Contributions

-

Minimum contribution: RM1

-

No fixed monthly amount

-

Can contribute:

-

Monthly

-

Occasionally

-

Once a year

-

Maximum combined voluntary contribution limit:

-

RM100,000 per year

-

Includes i-Simpan, i-Saraan, and i-Suri

4. Death Benefit Protection

If a member passes away before age 60, the nominee may receive:

-

RM2,500 Death Benefit (subject to EPF terms)

This provides additional support for the family.

5. Auto Contribution Option (Auto Simpan)

Members can set up automatic deductions using:

-

DuitNow AutoDebit

This helps employees save consistently without manual payments.

6. Safe & Government-Backed Savings

EPF savings are:

-

Guaranteed by the Malaysian government

-

EPF is required to declare a minimum dividend (2.5%) for Conventional Savings

This makes i-Simpan a low-risk, long-term savings option.

Who Can Contribute to i-Simpan?

i-Simpan is open to:

-

EPF members

-

Malaysian citizens or Permanent Residents

-

Individuals below 75 years old

How to Make i-Simpan Contributions

Employees can contribute online or physically.

Funds are usually credited within:

-

3 working days (electronic payments)

-

7 working days (physical channels)

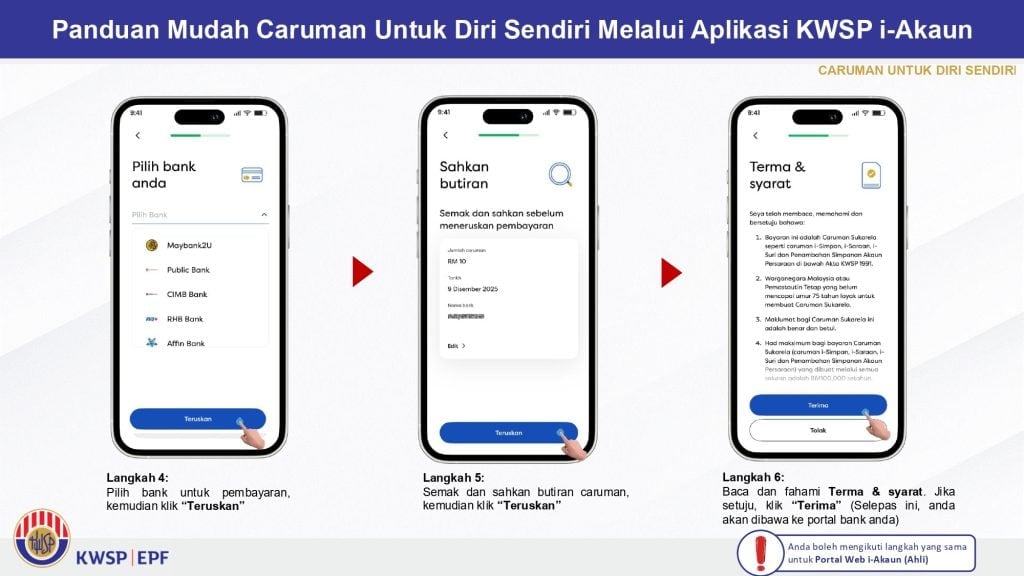

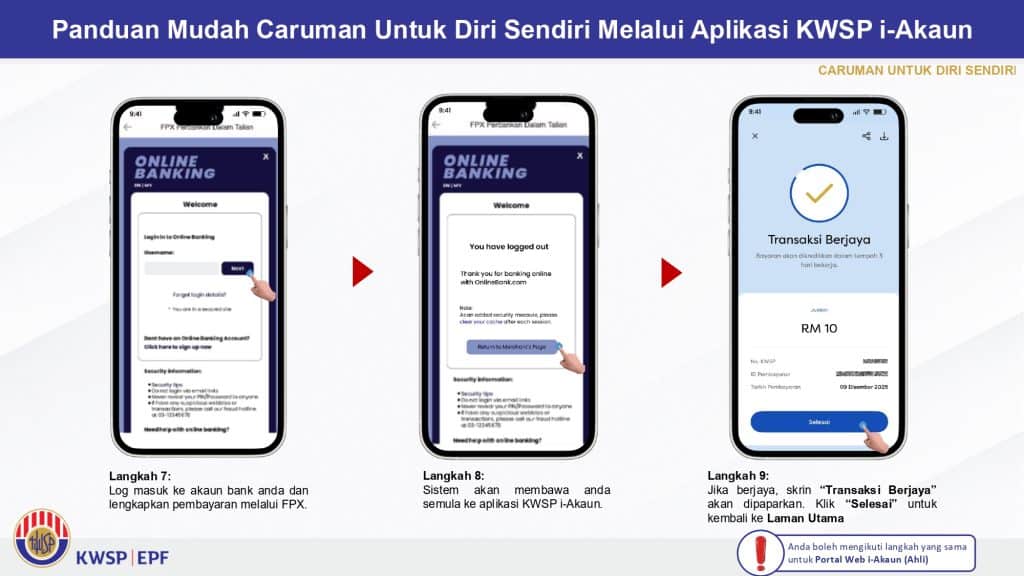

1. Via EPF i-Akaun (Recommended)

Steps:

-

Log in to EPF i-Akaun (App or Web)

-

Click “Tambah Simpanan”

-

Select “Diri Sendiri”

-

Follow instructions and confirm

-

Download receipt for records

2. Via Internet Banking

Employees can contribute through most major banks under:

-

“Bill Payment” or “Investment” section

Supported banks include:

Maybank, CIMB, Public Bank, RHB, Bank Islam, Hong Leong Bank, BSN, AmBank, and others.

3. Bank Counters & ATMs

Employees may visit appointed bank counters or use ATMs.

-

IC required

-

Minimum amount may vary by bank

4. EPF Self-Service Terminals (SST)

Available at EPF branches nationwide.

-

Debit card payments accepted

Note for HR:

-

EPF Muar & Kangar counters no longer accept voluntary payments from 1 January 2026

-

Online and banking channels are encouraged

Contribution Limits (Important for HR Reference)

|

Item |

Amount |

|

Minimum contribution |

RM1 |

|

Maximum combined voluntary contribution |

RM100,000 per year |

|

Includes |

i-Simpan, i-Saraan, i-Suri |

Difference Between i-Simpan and i-Topup

|

Feature |

i-Simpan |

i-Topup |

|

Old name |

Self-Contribution |

Voluntary Excess |

|

How payment is made |

Self-paid |

Salary deduction |

|

Employer involvement |

No |

Yes |

|

Flexibility |

Very flexible |

Monthly |

|

Minimum amount |

RM1 |

Based on salary |

|

Annual limit |

RM100,000 (combined) |

RM100,000 (combined) |

HR Summary: What Employers Should Know

-

i-Simpan does not change payroll deductions

-

No employer action is required

-

Useful for employee financial education

-

Helps employees plan retirement voluntarily

-

HR can share this as an optional savings option

Frequently Asked Questions (For HR & Employees)

What is i-Simpan?

A voluntary EPF contribution option to increase retirement savings.

What is the minimum contribution?

RM1. No fixed monthly amount.

Is i-Simpan eligible for tax relief?

Yes, subject to LHDN limits.

What is the maximum yearly contribution?

RM100,000 (combined with other voluntary EPF schemes).

Do employees need to re-register if they used Self-Contribution before?

No. Existing settings continue automatically under i-Simpan.

Can money in i-Simpan be withdrawn anytime?

No. EPF withdrawal rules still apply.

Can parents contribute for children or spouses?

Yes. Third-party contributions are allowed.

Does dividend start from payment date?

Yes. EPF dividend is calculated based on daily balance.

Can full-time employees use i-Simpan?

Yes. i-Simpan is open to all EPF members.

Ready to Build Your Future Team?

With AJobThing, finding the right talent is simple and fast.

Post your job ads today and reach candidates on Maukerja, Ricebowl, and Epicareer!

Read More:

-

EPF (KWSP) New Updates in January 2026 for Employers & HR in Malaysia

-

Penamaan KWSP in Malaysia: Legal Implications, Process, and HR’s Role

-

i-Sayang KWSP Guide: Requirements, Benefits & How to Register

-

EPF, SOCSO, EIS, and LHDN Employer Registration Guide for Malaysian Companies

- Cara Kira Potongan KWSP dan SOCSO | How to Calculate EPF and SOCSO Deductions in Malaysia

-

Deadlines & Penalties for SOCSO, EPF, PCB/Form E, and HRD Levy in Malaysia

-

PCB for Foreign Workers in Malaysia: Employer’s Complete Guide

-

EPF Withdrawal for Education: Employer’s Guide to Supporting Staff

-

Akaun Fleksibel (EPF’s New Account Structure): Key Info for Employers

-

KWSP Call Centre for Employers: Contact Numbers, Services, and Support Channels

-

How to Check KWSP/EPF Balance: Online, SMS, Call Center, and More (2025)