i-Topup KWSP: Contribution Rules & Guide for Employers in Malaysia

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

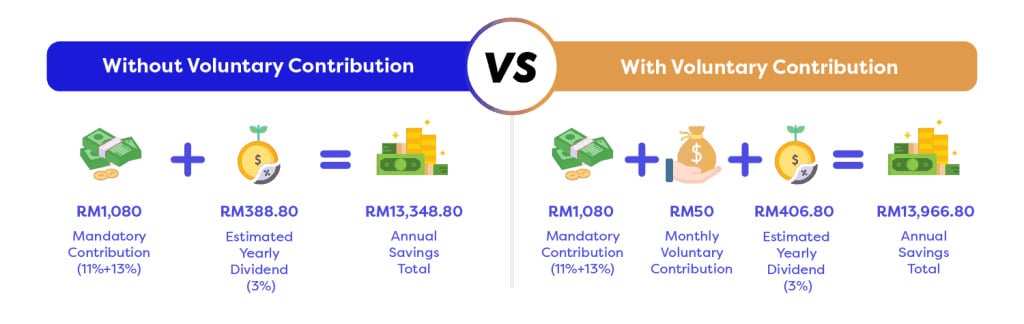

Hire NowManaging EPF contributions is a core responsibility for HR and payroll teams in Malaysia. From time to time, employees may request to contribute more than the standard EPF rate, or employers may want to offer higher EPF contributions as part of their employee benefits package. This is where i-Topup KWSP becomes relevant.

This article explains i-Topup KWSP for HR teams and employers in Malaysia, covering what it is, how it works, contribution calculations, HR processes, and compliance considerations.

What is i-Topup KWSP?

i-Topup KWSP (previously known as Voluntary Excess / VE) is a voluntary EPF contribution option under Kumpulan Wang Simpanan Pekerja (KWSP).

It allows:

-

Employees to contribute more than the statutory employee EPF rate through salary deduction, and/or

-

Employers to contribute more than the statutory employer rate as an additional employee benefit

In simple terms, i-Topup allows EPF contributions to go above the standard rates set by law.

Official reference: www.kwsp.gov.my

Simple Explanation for HR & Employers

Under normal rules, an employee below 60 years old contributes 11% of their monthly salary to EPF.

With i-Topup, either:

-

The employee chooses to increase their own contribution (for example, from 11% to 16%), or

-

The employer chooses to add extra EPF on top of the normal employer share

All additional contributions are processed through monthly payroll, not manual or ad-hoc payments.

Why i-Topup Matters for Employers

From an employer and HR perspective, i-Topup:

-

Supports long-term employee financial wellbeing

-

Acts as a meaningful, non-cash employee benefit

-

Helps with employee retention and employer branding

-

Uses existing payroll and EPF systems

-

Requires minimal administrative changes

Key Benefits of i-Topup

Benefits for Employees

-

Automatic EPF savings through salary deduction

-

Same EPF dividend rate for additional contributions

-

Long-term growth through compounding

-

Eligible for income tax relief, subject to EPF limits

-

Flexible contribution rate that can be changed or cancelled

Benefits for Employers

-

Can be offered as an additional employee benefit

-

No special employer registration required

-

Managed through i-Akaun (Majikan)

Who Can Use i-Topup?

Employees

Any employee with an employer may request to increase their EPF contribution rate.

HR requirement:

-

Employee completes KWSP Form 17A/18A

-

Form is submitted to HR or Payroll for processing

Employers

Employers may choose to:

-

Pay EPF contributions above the statutory employer rate

-

Use higher EPF contributions as an incentive or retention tool

HR note:

-

No submission at the KWSP counter is required

-

HR must update payroll and i-Akaun (Majikan) records

i-Topup Contribution Calculation (HR & Payroll Reference)

The tables below show illustrative calculations based on Jadual Ketiga, EPF Act 1991.

Actual contribution amounts may vary depending on employee age, salary, and selected contribution rates.

Employer Adds 5% i-Topup (Employer Share)

|

Employee Category |

Salary |

Employee Statutory Rate |

Employer Statutory Rate |

i-Topup Employer |

Total Employer Contribution |

Total EPF Contribution |

|

Below 60, salary below RM5,000 |

RM1,000 |

11% = RM110 |

13% |

5% |

18% = RM180 |

RM290 |

|

Below 60, salary above RM5,000 |

RM6,250 |

11% = RM693 |

12% |

5% |

RM1,062.50 |

RM1,756* |

|

60 & above, salary below RM5,000 |

RM1,000 |

0% |

4% |

5% |

RM90 |

RM90 |

|

60 & above, salary above RM5,000 |

RM6,250 |

0% |

4% |

5% |

RM562.50 |

RM563* |

* Rounded to the nearest ringgit.

Employee Adds 5% i-Topup (Employee Share)

|

Employee Category |

Salary |

Employee Statutory Rate |

i-Topup Employee |

Total Employee Contribution |

Employer Contribution |

Total EPF Contribution |

|

Below 60, salary below RM5,000 |

RM1,000 |

11% |

5% |

RM160 |

RM130 |

RM290 |

|

Below 60, salary above RM5,000 |

RM6,250 |

11% |

5% |

RM1,000 |

RM750 |

RM1,750 |

|

60 & above, salary below RM5,000 |

RM1,000 |

0% |

5% |

RM50 |

RM40 |

RM90 |

|

60 & above, salary above RM5,000 |

RM6,250 |

0% |

5% |

RM312.50 |

RM252 |

RM563* |

* Rounded to the nearest ringgit.

Not Sure How Much EPF Contribution Applies with i-Topup?

Use our EPF Calculator to estimate employee and employer EPF contributions based on salary and contribution rate. Calculate EPF contributions now.

How i-Topup Works (HR Process)

When an Employee Requests i-Topup

-

Employee completes KWSP Form 17A/18A

-

Employee submits the form to HR or Payroll

-

HR updates the payroll system

-

New deduction starts from the next salary cycle

-

Employer submits EPF contributions as usual

When Employer Increases Employer Contribution

-

HR decides the new employer contribution rate

-

Update payroll settings

-

Submit contributions through i-Akaun (Majikan)

-

Keep records for audit and compliance

i-Topup vs i-Simpan (Quick Comparison)

|

Item |

i-Topup |

i-Simpan |

|

Payment method |

Salary deduction |

Self-payment (online) |

|

Who contributes |

Employee, employer, or both |

Individual only |

|

Contribution style |

Fixed monthly percentage |

Flexible, anytime |

|

HR involvement |

Required |

Not required |

|

Form needed |

KWSP Form 17A/18A |

None |

Cancelling or Changing i-Topup

Employees may:

-

Reduce the additional contribution percentage, or

-

Return to the original statutory contribution rate

Process:

-

Complete KWSP Form 17A/18A again

-

Submit to HR

-

HR updates payroll and i-Akaun (Majikan)

Tax Relief and Contribution Limits

-

Employees are eligible for EPF income tax relief, subject to current limits

-

Total voluntary EPF contributions (including i-Saraan and i-Sayang) are capped at RM100,000 per year

-

i-Topup contribution amount depends on monthly salary

Where to Get Official Information

For official forms, updates, and guidelines:

-

KWSP Contact Centre or nearest KWSP office

Compliance Disclaimer

EPF contribution rules and rates may change from time to time. Employers should always refer to the latest guidelines issued by Kumpulan Wang Simpanan Pekerja (KWSP) and ensure payroll settings are updated accordingly.

Frequently Asked Questions (FAQ)

What is i-Topup KWSP?

A voluntary option to increase EPF contributions through salary deduction.

Who can contribute using i-Topup?

Employees, employers, or both.

Is tax relief available?

Yes, subject to EPF tax relief limits.

Does HR approval matter?

Yes, because payroll and system updates are required.

Can employees change or cancel i-Topup later?

Yes. Employees can submit the same form again to update or cancel the contribution.

Need Staff Urgently? We’ve Got You Covered!

Start your hiring journey with AJobThing today!

Post your job ads, connect with top talents on multiple platform like Maukerja, Ricebowl, and Epicareer with our easy-to-use platform.

Read More:

-

i-Simpan EPF (KWSP): How It Works & How Employees Can Contribute

-

EPF (KWSP) New Updates in January 2026 for Employers & HR in Malaysia

-

Penamaan KWSP in Malaysia: Legal Implications, Process, and HR’s Role

-

i-Sayang KWSP Guide: Requirements, Benefits & How to Register

-

EPF, SOCSO, EIS, and LHDN Employer Registration Guide for Malaysian Companies

- Cara Kira Potongan KWSP dan SOCSO | How to Calculate EPF and SOCSO Deductions in Malaysia

-

Deadlines & Penalties for SOCSO, EPF, PCB/Form E, and HRD Levy in Malaysia

-

PCB for Foreign Workers in Malaysia: Employer’s Complete Guide

-

EPF Withdrawal for Education: Employer’s Guide to Supporting Staff

-

Akaun Fleksibel (EPF’s New Account Structure): Key Info for Employers

-

KWSP Call Centre for Employers: Contact Numbers, Services, and Support Channels

-

How to Check KWSP/EPF Balance: Online, SMS, Call Center, and More (2025)