KWSP (Kumpulan Wang Simpanan Pekerja) Guide for Employers in Malaysia

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowKumpulan Wang Simpanan Pekerja (KWSP), or the Employees Provident Fund (EPF), is a mandatory retirement savings scheme for private-sector employees in Malaysia.

Employers play a crucial role in ensuring timely contributions, which provide employees with financial security upon retirement.

This guide covers key aspects of KWSP contributions, including employer obligations, contribution rates, exemptions, and digital submission processes.

What is KWSP?

KWSP (Kumpulan Wang Simpanan Pekerja) is a Malaysian government agency that manages mandatory savings and retirement planning for employees in the private and non-pensionable public sectors.

Both employees and employers contribute to the employee's savings, which KWSP invests to generate returns.

These savings can be withdrawn upon reaching retirement age or under specific conditions.

Advantages of KWSP

There are several benefits for both employers and employees in contributing to KWSP:

-

Retirement Security: Savings for their retirement years, reducing financial dependency.

-

Tax Benefits: Employer contributions are tax-deductible, and employees can claim tax relief on their personal contributions up to RM4,000 annually.

-

Competitive Dividends: KWSP guarantees a minimum dividend of 2.5%, with historical rates often exceeding this, ensuring employees' savings grow over time.

-

Investment Opportunities: Employees can invest a portion of their savings in approved investment schemes to increase returns.

-

Withdrawal Flexibility: Employees can partially withdraw at 50 and fully withdraw at 55 or under special circumstances like disability, housing purchases, or migration.

KWSP Contribution Rate

Employers and employees contribute a percentage of the employee’s salary to KWSP. The current contribution rates are:

-

Employees below 60 years old: Employer contributes 13% (for salaries below RM5,000) or 12% (for salaries above RM5,000), while employees contribute 11%.

-

Employees aged 60 and above: Employer contributes 4%, and employees are not required to contribute but can opt to do so voluntarily.

-

Voluntary Contributions: Employers or employees can opt to contribute additional amounts beyond the statutory rates to enhance retirement savings.

KWSP Exempt Payment

Certain payments are exempt from KWSP contributions, such as:

-

Overtime wages, unless specified in the employment contract

-

Bonuses (if not part of contractual salary)

-

Travel and food allowances

-

Gratuity and retrenchment benefits

-

Commission (if not specified in the contract as part of the salary)

Employers must review payroll structures to ensure compliance and proper categorization of exempt and non-exempt payments.

How to Increase KWSP Contributions for Employees and Employers

Employers and employees can contribute more than the statutory rates. To increase contributions:

1. For Employees:

-

Fill out KWSP Form 17A (AHL) and submit it to the employer.

-

Employers update the contribution rate through i-Akaun Majikan.

-

Additional voluntary contributions can be made directly through KWSP-approved channels.

2. For Employers:

-

Employers can voluntarily increase their contribution rate via i-Akaun Majikan under the Voluntary Excess (VE) section.

-

Higher employer contributions can serve as an employee benefit to attract and retain talent.

What Payments Are Subject to KWSP Contributions and Get Relief?

Mandatory KWSP contributions apply to:

-

Basic salary: The core salary stated in the employment contract.

-

Fixed allowances: Housing, transport, and meal allowances if stipulated in the employment agreement.

-

Commission: If it is part of the regular salary structure.

-

Service charges and contractual bonuses: These are subject to KWSP deductions.

Contributions qualify for tax relief up to RM4,000 per year for employees, while employer contributions are tax-deductible as business expenses.

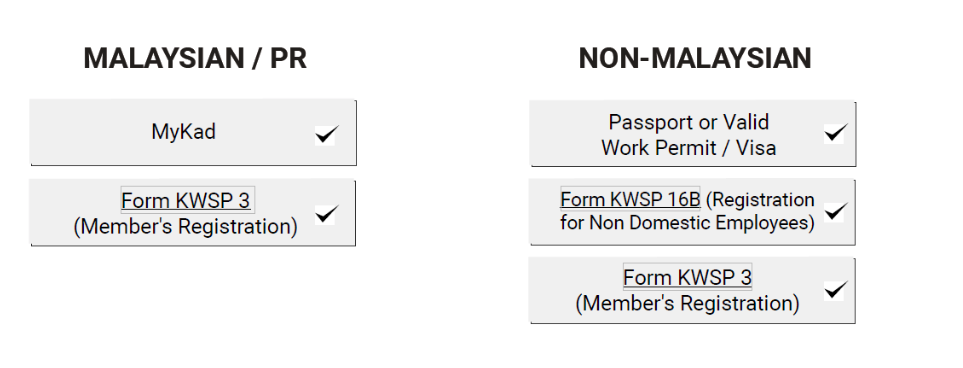

How to Register My Employees as KWSP Members?

Employers must register new employees with KWSP within seven days of hiring.

There are four different ways to register employees who have not been registered before:

1. Through i-Akaun (Employer)

This option is for Malaysian citizens and permanent residents with MyKad numbers of 7 or 12 digits.

Log in to your i-Akaun and click on "Register EPF Member."

2. Automatic Registration via Monthly Contribution Form (Form A)

Employees who are not yet registered will be automatically enrolled once they are included in Form A.

This option is only available for Malaysian citizens and permanent residents as MyKad details are required.

3. Using KWSP Form 3

You can register at the nearest EPF counter or by mail. Submit the required form and supporting documents.

4. Registration via MyKad at EPF Counter

The employee must visit an EPF counter in person. Registration will be done using the MyKad chip.

This option is only for Malaysian citizens and permanent residents.

What Happens If the Employer Overpays or Underpays the KWSP Contribution?

Overpayment:

You can request a refund or carry forward the balance for next month’s contribution.

To request a refund, prepare:

- Fill in Form 14.

- Write an explanation letter with details of the mistake.

- Submit the documents at any EPF counter near you.

Underpayment:

- Log in to i-Akaun (if you don’t have one, check here).

- Select ‘Contribution Payment’ and ‘Submit Contribution’.

- Choose the contribution month you want to adjust.

- Select ‘Blank Form A’ and click ‘Add New Employee’.

- Fill in Form A with the employee’s name, ID number, and payment adjustment amount.

- Scroll down and click ‘I confirm that’, then ‘Next’.

- Finally, choose a payment method and complete the payment.

How Do I Send the KWSP File (CSV) Through i-Akaun?

After your payroll is processed using payroll system, you can download the KWSP file (EPF_iAkaun.csv) and upload it to your i-Akaun to submit the contribution details (Form A) to KWSP.

Follow these steps:

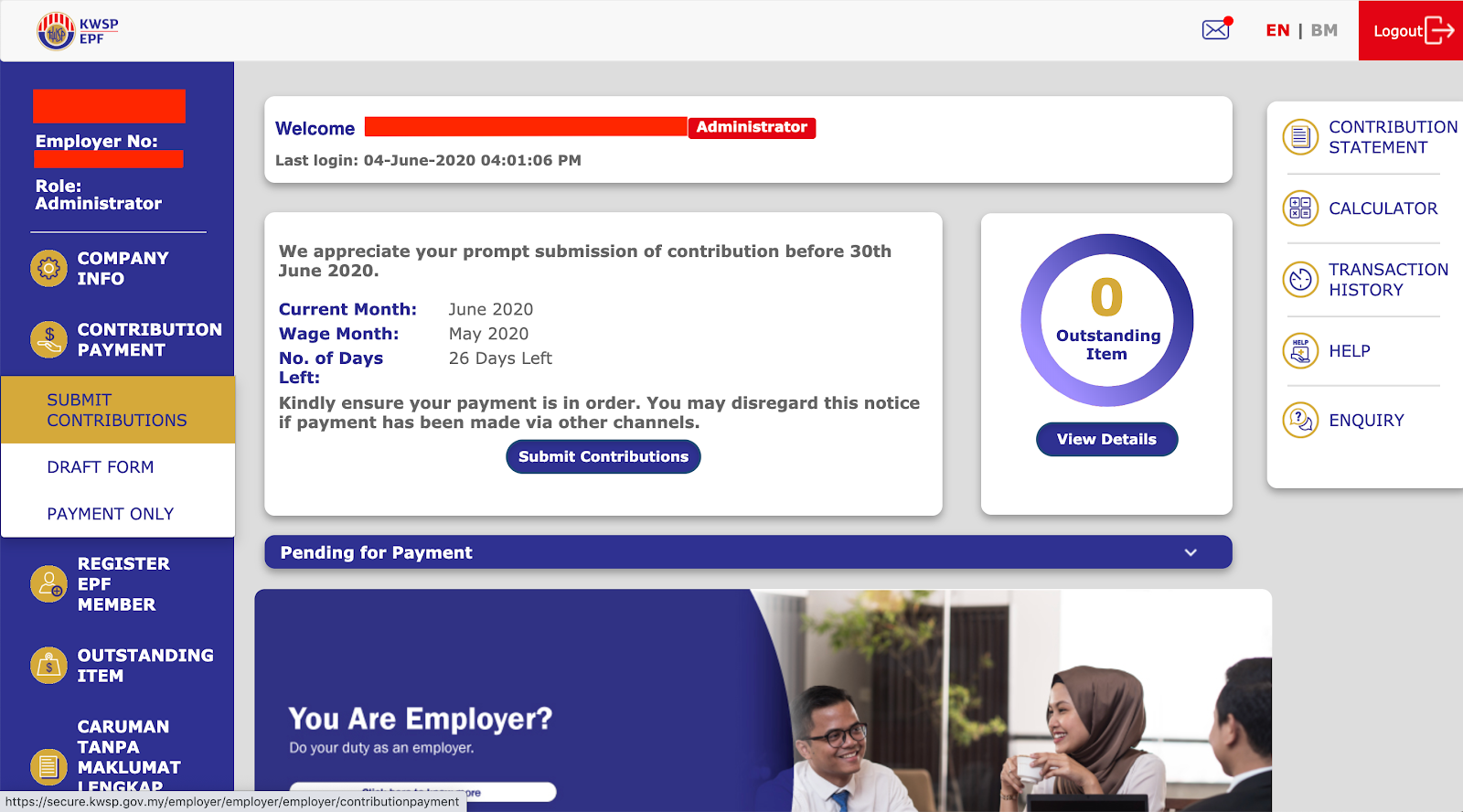

1. Log in to your employer i-Akaun portal.

Use your employer KWSP number as the User ID and enter your password to sign in.

.jpg)

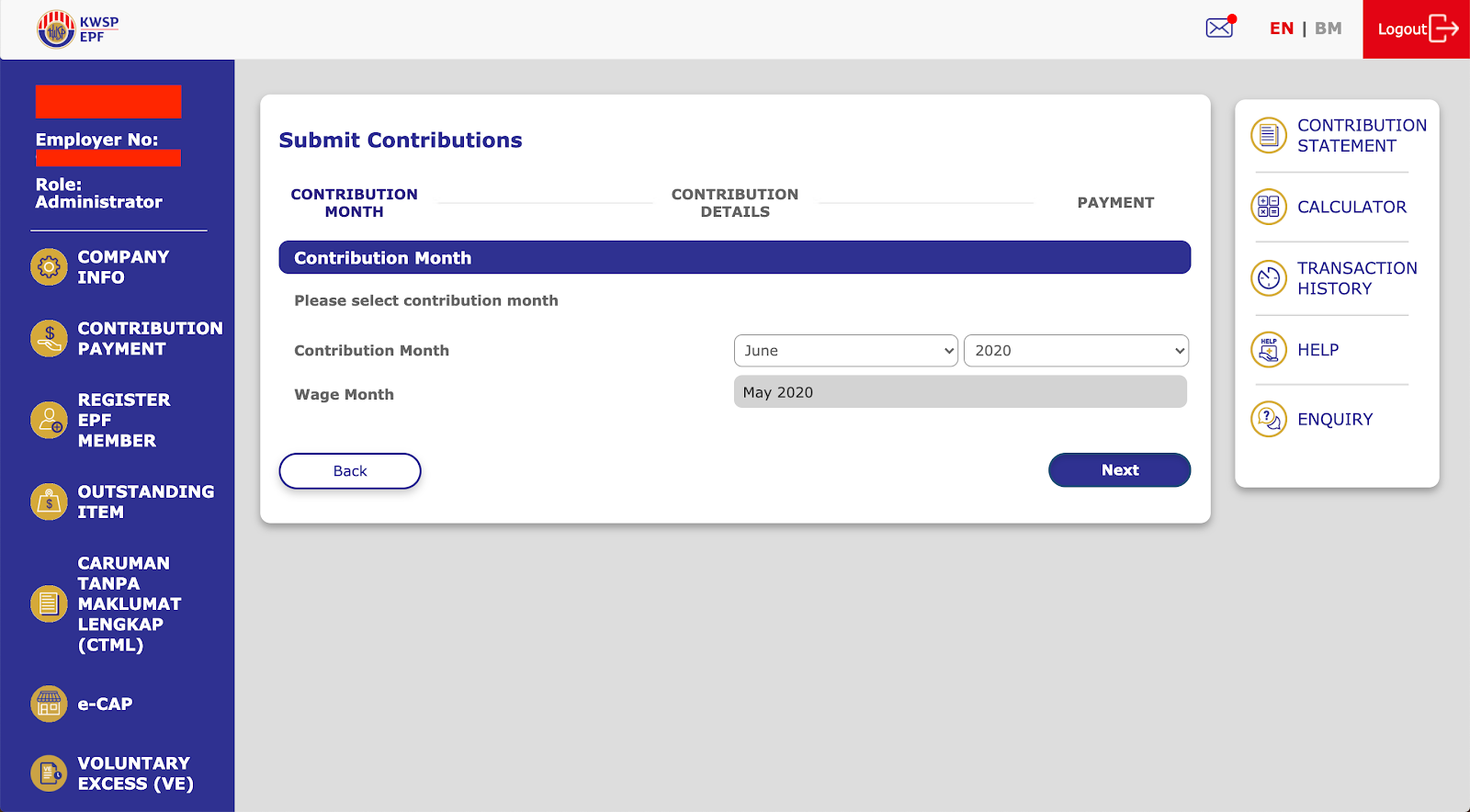

2. On the left side of the page, select Contribution Payment and then Submit Contributions.

3. Choose the correct contribution month.

IMPORTANT: KWSP contributions are always for the previous month. For example, if you process payroll for January 2025, the contribution month should be February 2025.

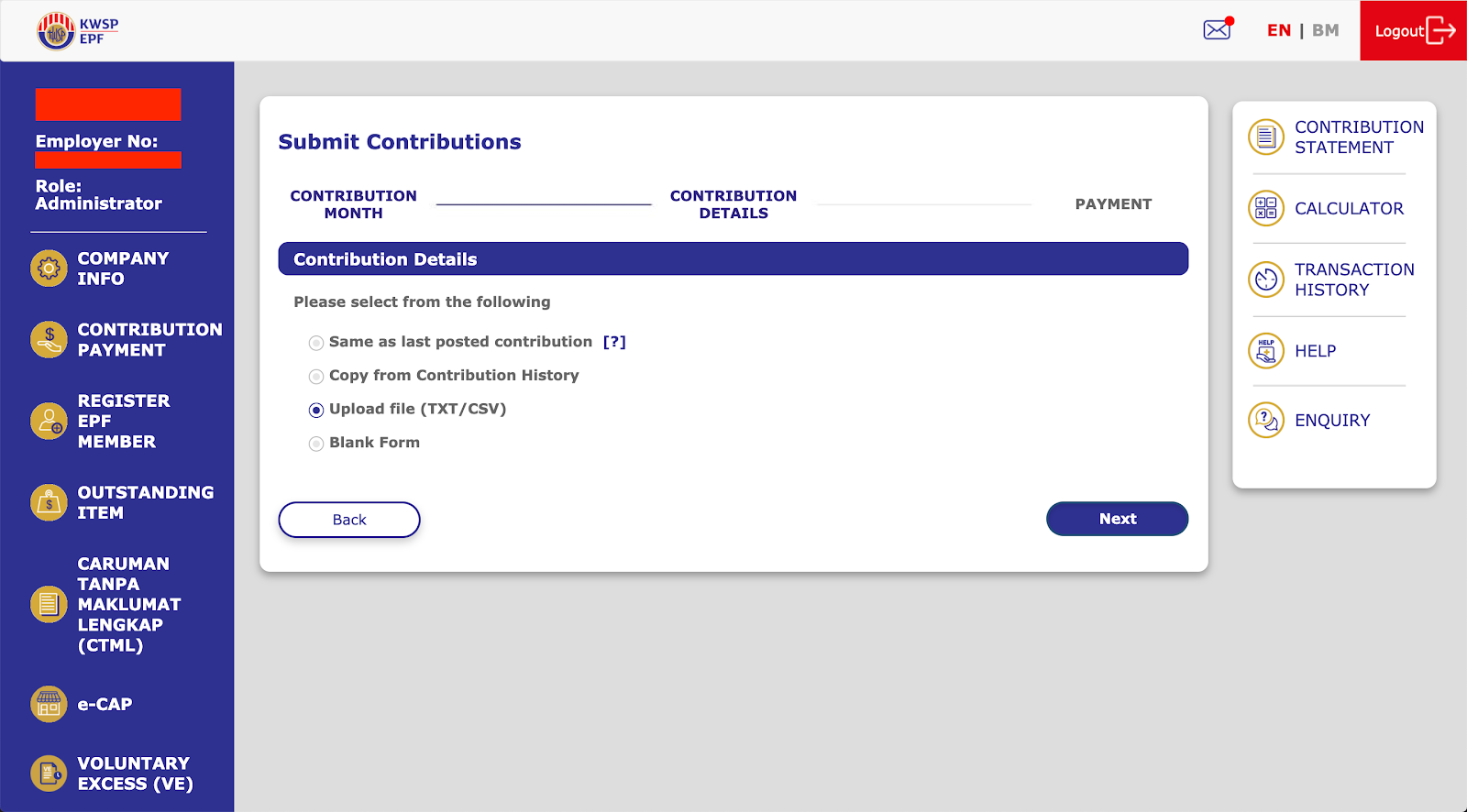

4. Click Upload file (TXT/CSV) and upload the EPF.csv file to the KWSP portal. After uploading, click Upload and then Next.

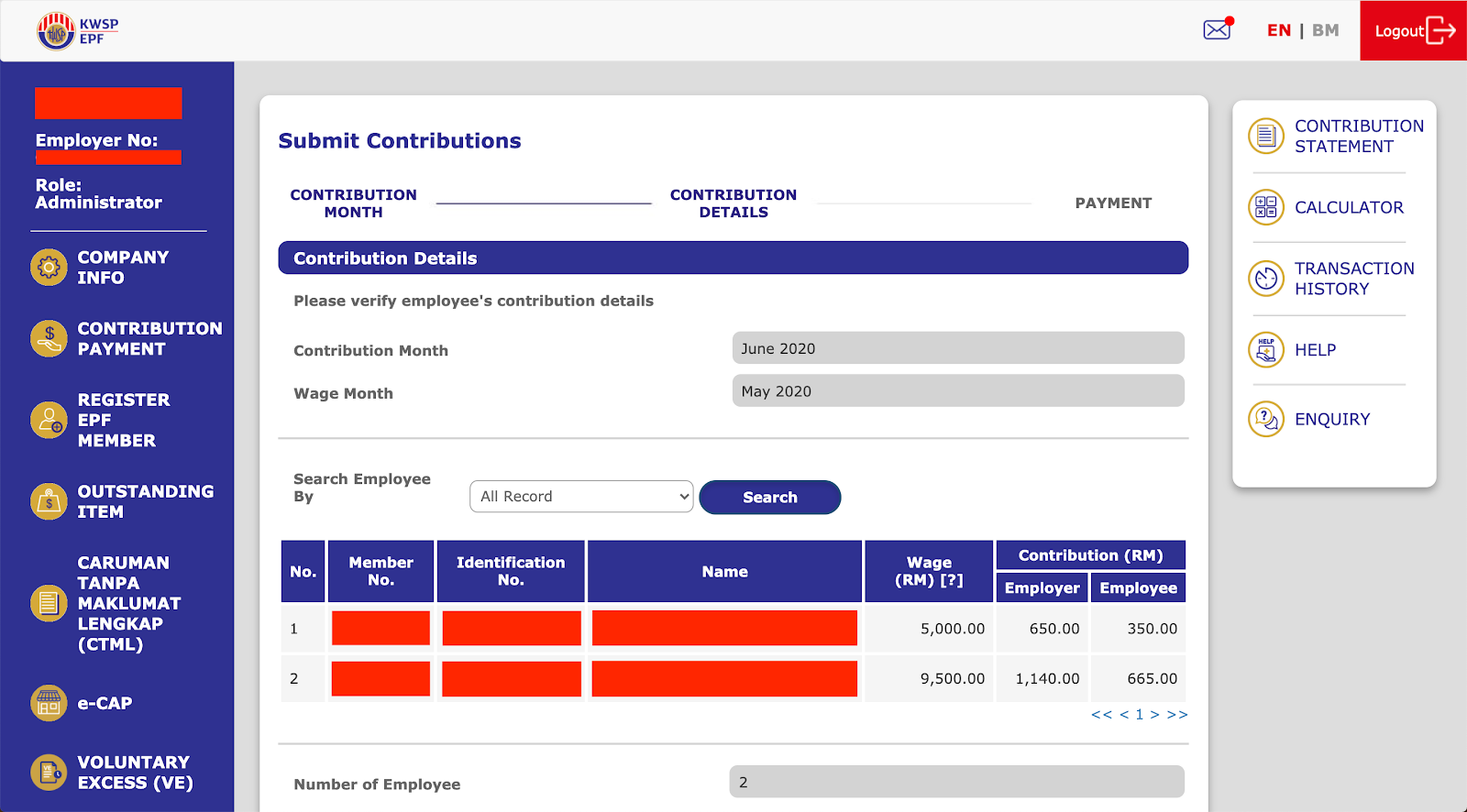

5. A list of employees and their contribution amounts will be displayed. Scroll down and check I confirm that: then click Next.

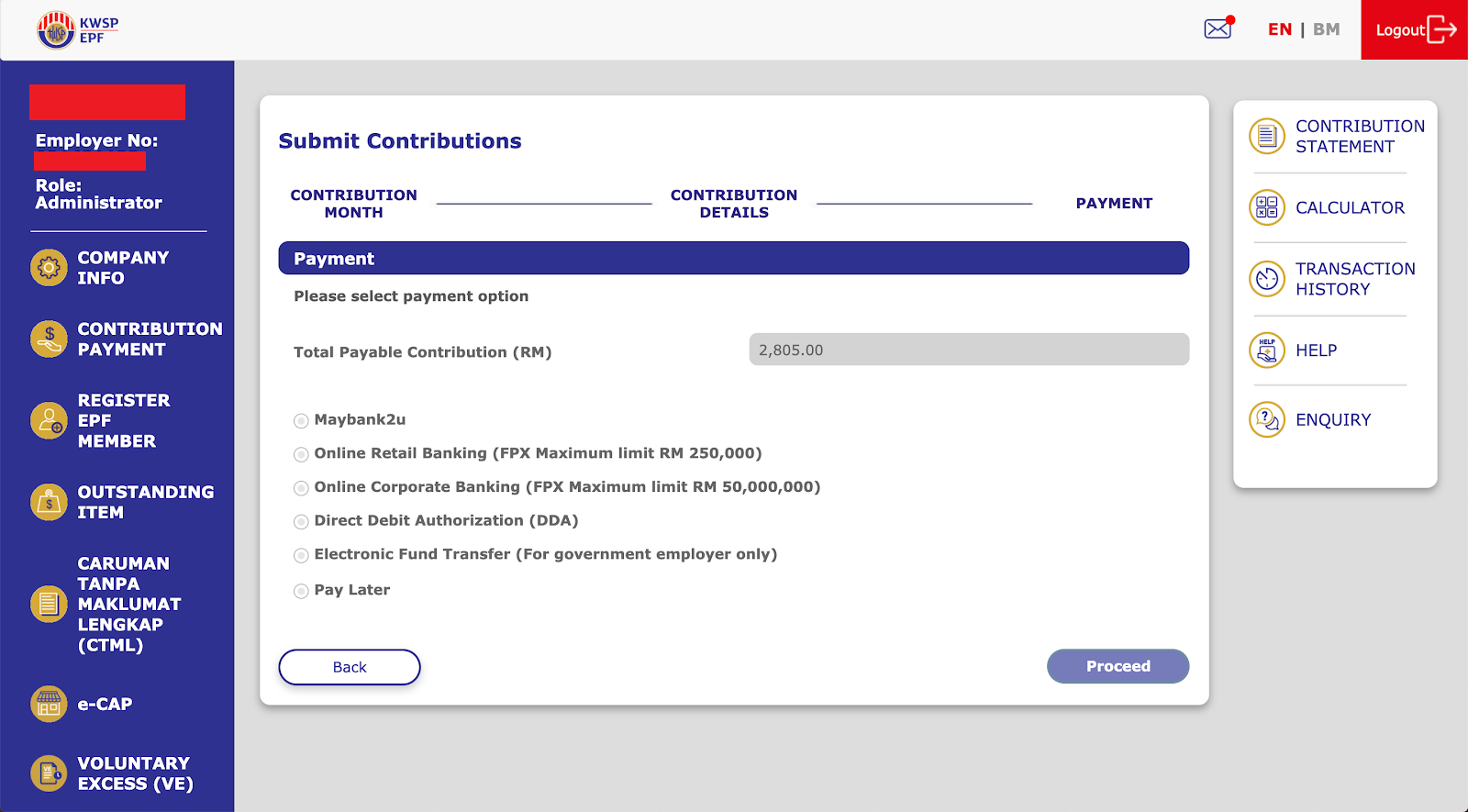

6. Choose a payment method:

- Pay directly via online banking (available for Maybank users).

- Pay via FPX.

- Pay through direct debit (for employers registered with DDA).

- Pay at KWSP or bank counters.

Source: Payrollpanda

How Do I Open an i-Akaun with KWSP?

Employers must open an i-Akaun Majikan for online transactions. Here's the steps:

-

Visit the KWSP website and select Employer Registration.

-

Provide the company’s business registration number (BRN) and employer reference number.

-

Submit the registration form online or at a KWSP office.

-

Activate the account using the activation link sent via email.

-

Log in and start managing contributions online, including submission and tracking.

As an employer, understanding your obligations and how to efficiently manage contributions helps ensure compliance and benefits your workforce.

By maximizing contributions and utilizing KWSP’s digital tools like i-Akaun, businesses can streamline processes and enhance employee financial well-being.

Employers should stay updated with KWSP regulations to avoid penalties and optimize retirement savings for their employees.

Are you hiring in 2025?

Start your hiring journey with AJobThing today! Post your job ads, connect with top talents, and streamline your recruitment process with our easy-to-use platform.

Read More:

- Where to Get and Download the Latest EPF Statement in Malaysia

- How to Check KWSP Balance: Online, SMS, Call Center, and More (2025)

- Complete Information about EPF in Malaysia

- Can we retain staff over the age of 60 in Malaysia?

- Malaysian Employment Act 1955: Key Provisions Every Employer Must Know

- 12 Employment Types You Need to Know: A Guide for Employers

- Pre-Employment Background Checks: A Guide for Malaysian Employers

- Finding Qualified Candidates: A Comprehensive Guide for Employers in Malaysia

- Screening Interviews: A Complete Guide for Employers

- Employment Verification: Importance, Process, and Best Practices

- Candidate Screening: Methods, Tools, and Best Practices for Employers