MySIP: Get Double Tax Deductions When Hiring Interns

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowHiring interns can be more than just a short-term solution for extra help.

In Malaysia, the Malaysia Structured Internship Programme (MySIP) offers a structured way for employers to bring in interns while enjoying financial incentives.

What is MySIP, and what benefits does it offer your business?

Learn how to maximize these advantages below!

What is MySIP (Malaysia Structured Internship Programme)?

MySIP, short for Malaysia Structured Internship Programme, is a national initiative introduced by TalentCorp in collaboration with the Ministry of Higher Education (MOE).

The programme encourages companies to provide structured, paid internships to students from recognised universities, colleges, and TVET institutions.

The main idea behind MySIP is to help students gain real working experience and develop career-ready skills.

At the same time, it gives companies a way to train potential future employees while benefiting from a tax incentive.

If your business hires interns often or plans to, joining MySIP could help you do it better, and with extra support from the government.

Benefits of Hiring Interns Under MySIP for Employers

Hiring interns through MySIP (Malaysian Structured Internship Programme) gives your business real advantages while helping to grow local talent.

1. Build a Future Talent Pipeline

Interns who join your company through MySIP get hands-on training and real work experience.

Many of them return as full-time employees after graduation.

This makes your hiring process faster and easier in the future because they already understand your company and how it works.

2. Lower Recruitment Costs

When you train interns on the job, you spend less on advertising, interviewing, and onboarding new staff later.

MySIP helps you save money by turning interns into ready-to-work employees.

3. Enjoy Double Tax Deduction

If you're a company that hires Malaysian full-time students from local public or private universities (IPTA or IPTS), overseas institutions, or TVET colleges for a structured internship programme approved by TalentCorp, you can claim a double tax deduction for the expenses related to the internship.

This includes allowances, training costs, and other expenses for MySIP-approved internships. It’s a great way to reduce your tax bill while growing your talent pool.

4. Support CSR and ESG Goals

Many companies now focus on corporate social responsibility (CSR) and environmental, social, and governance (ESG) goals.

By joining MySIP, you show that your business supports education, skill-building, and local employment. This helps improve your brand image with stakeholders and customers.

5. Invest in Human Capital

Hiring and training interns through MySIP means you are investing in the future of your company and the country. It helps build a skilled, local workforce that benefits everyone.

Who Can Be a MySIP-Approved Company?

To qualify for the MySIP incentive, your company must meet these requirements:

1. Internship Duration

Offer internships for at least 10 weeks to Malaysian students.

2. Intern Allowance

- Pay at least RM600 per month for interns who are doing a Master’s degree, Bachelor’s degree, Malaysian Advanced Skills Diploma (DLKM), Professional Certificate, or equivalent.

- Pay at least RM500 per month for interns who are doing a Diploma, Malaysian Skills Diploma (DKM), Malaysian Skills Certificate (SKM) Level 1–3, Certificate, or equivalent.

3. Structured Internship Programme

Provide a proper internship plan with clear learning goals. You must declare the internship module and job descriptions, which must be approved by TalentCorp.

4. Company Registration

Your business must be registered with the Companies Commission of Malaysia (SSM), other relevant authorities, local councils in Sabah/Sarawak, or statutory bodies if you provide professional services.

5. MySIP Registration

Apply for MySIP and complete the endorsement process on the MyNext platform by TalentCorp.

For more information or assistance, email the MySIP team at: sip@talentcorp.com.my

How to Declare MySIP Internship

Companies in Malaysia can declare their internships under the MySIP programme through two options provided by MyNext. Here’s how each option works:

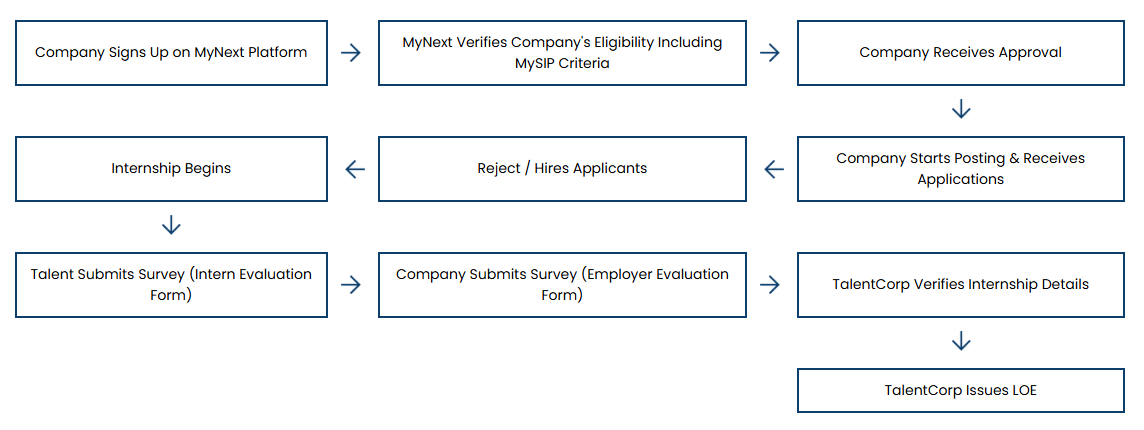

Option 1 – Advertised Internship on MyNext

In this option, companies post their internship openings on the MyNext platform. Interns can then apply directly through the site.

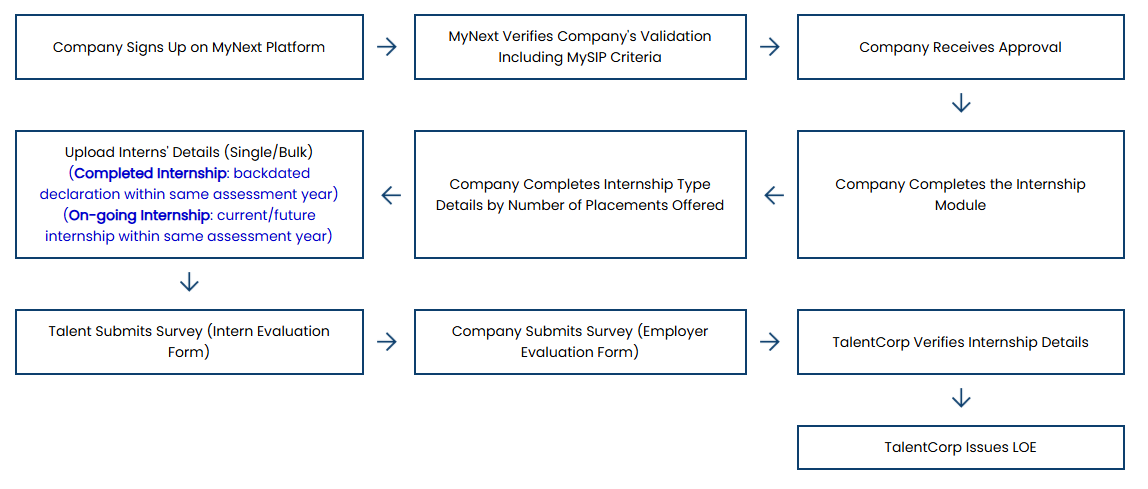

Option 2 – Direct Hiring Internship

In this option, companies can recruit interns on their own (not through MyNext) but still declare the internship under MySIP.

Are There Any Fees to Register as a MySIP Company?

No, there are no charges to apply or register as a MySIP company.

TalentCorp has been officially appointed by the Ministry of Finance to manage the registration and endorsement process for MySIP companies.

You will only need to pay if you choose to advertise your internship opportunities on the mynext platform. For more details, please visit www.mynext.my.

Double Tax Deduction Incentive by LHDN

Here’s where it gets even more attractive for employers. Companies registered under MySIP can claim double tax deduction for internship-related costs.

This means the amount you spend on interns can be claimed twice when filing your corporate taxes.

But there are a few conditions you need to meet:

-

You must hire at least three interns at a time.

-

These interns must be from approved higher learning institutions in Malaysia or abroad.

-

The internship must last at least minimum of 10 weeks.

-

You must pay a minimum allowance of RM600 for degree-level interns and RM500 for diploma or certificate-level interns.

This incentive is offered through LHDN (Lembaga Hasil Dalam Negeri) and has been a key reason many Malaysian businesses are joining the MySIP programme today.

How to Qualify for Double Tax Deduction

To enjoy the tax benefits under MySIP, your company must first be officially recognised as a MySIP-endorsed company by TalentCorp.

You can qualify in one of two ways:

-

You want to hire new interns through the MySIP platform and are open to advertising your internship openings on MDEC’s mynext portal.

-

You already have interns in your company and you’re looking for support to become a registered MySIP company.

In both cases, you’ll need to submit your internship structure to TalentCorp for review.

The internship must be more than just an administrative task list.

It should include a clear framework of learning and work exposure that helps students build real-world skills.

Once approved, your company will be listed as a MySIP partner and will become eligible for the tax deduction.

How to Claim the Double Tax Deduction (Step-by-Step Guide)

The process of claiming your double tax deduction under MySIP is quite straightforward. Here’s how it works:

-

Register your company on the MySIP platform or contact TalentCorp to initiate the endorsement process.

-

Once registered, you’ll be asked to submit your internship details, including job scope, duration, intern background, and allowance offered.

-

Gather all supporting documents, such as:

-

Internship contracts

-

Proof of monthly allowance payments

-

Internship reports or evaluations (if available)

-

Submit your claim to LHDN when filing corporate taxes. The tax deduction will only be processed once your claim is reviewed and approved.

What Can Be Claimed?

Many employers are surprised to learn that the tax deduction goes beyond the intern’s monthly allowance. You can also claim for:

-

Training costs are directly related to the intern’s development

-

Logistics or tools used specifically during the internship

-

Data, communication, or internet costs if they are necessary for the intern’s role

-

Any other approved costs that were clearly documented

Keep all receipts and records during the internship period to support your claims. Having clear documentation is important during tax filing or in case of an audit.

Common Mistakes to Avoid When Claiming

Some companies miss out on MySIP benefits because of simple errors that can be avoided with the right preparation.

-

Hiring fewer than three interns. The double tax deduction is only available if you hire at least three qualified interns during the same period.

-

Failing to register for the internship through the MySIP platform. Just hiring interns and calling them MySIP doesn’t qualify. Official registration and approval by TalentCorp is needed.

-

Many claims get rejected due to missing documents, late submissions, or unclear internship scopes. Take the time to prepare your documents properly before submitting them to LHDN.

Tips for Maximising Internship Benefits

To make the most of the MySIP programme, don’t just treat internships as short-term support.

With the right planning, you can turn interns into long-term team members.

One way is to partner with local universities or TVET colleges.

This creates a steady flow of candidates and improves your visibility among students looking for meaningful placements.

Invest time in onboarding and mentoring. When interns feel guided and supported, they contribute more and are more likely to return as full-time staff.

Don't forget to evaluate your interns properly. Give them feedback, monitor their progress, and keep a lookout for potential full-time hires.

Many companies use internships as a “trial run” for new talent, and that’s exactly what MySIP encourages.

FAQ

Is MySIP registration mandatory for all interns?

No. Only if you want to claim the double tax deduction or be listed as a MySIP company. If you’re offering unpaid or informal internships, MySIP is not required, but you won’t enjoy the benefits either.

What happens if interns quit early?

If an intern leaves before completing two months, the internship no longer meets MySIP’s criteria. You won’t be able to claim the tax deduction for that intern.

Is the incentive available to SMEs?

Yes. SMEs and even startups can register as MySIP companies. In fact, TalentCorp offers special support through LiKES, a version of MySIP made specifically for small businesses and startups.

Can remote internships qualify?

Yes, but only if the internship still includes a clear learning structure, meets the minimum duration, and the intern receives a proper allowance. You must also be able to document and track the intern’s work and progress.

Your next hire could be just a click away!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best while staying compliant with LHDN regulations.

Post your job ads today & simplify your hiring process!

Read More:

- How to Check Malaysia Visa Status Online & Offline

- What is Unstructured Interview & When to Use It?

- Why a Clear Signing Off From Work Policy Matters

- What is Work Life Balance? Benefits, Factors, and How to

- 75 Company Gift Ideas for Employee Resignation

- 150+ Nama Nama Company Yang Best to Inspire Your Business Name

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- EPF Voluntary Contribution in Malaysia: How It Works & Benefits

- STR 2025 (Sumbangan Tunai Rahmah): Eligibility, Payment Dates & How to Apply

- CP22 Form: Deadline, Free Download Form, How to Fill

- CP204: Deadline, Calculation, & Free Download Form

- How to Use ByrHASiL for Online Tax Payments in Malaysia

- PCB Deduction in Malaysia: Calculation, Rates & Employer Guide

- What is the 182 Days Rule in Malaysia? Tax Residency Explained

- Labour Law Malaysia Salary Payment For Employers

- Best Answers for 'Why Should We Hire You' – A Guide for Employers

- 12 Employment Types You Need to Know: A Guide for Employers

- What is Precarious Employment? Risks, Challenges, and Solution