How to Add a New Employee in SOCSO Malaysia

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowWhen hiring a new employee in Malaysia, one of the key responsibilities of an employer is registering them with the Social Security Organisation (SOCSO), also known as PERKESO.

This is mandatory under Malaysian law to ensure employees receive social security protection.

This guide will explain the process, requirements, and important details you need to know as an employer.

Who Needs to Be Registered?

All employees earning RM30 to RM5,000 per month must be registered under SOCSO. This applies to:

-

Full-time employees

-

Part-time employees

-

Temporary or contract workers

-

Malaysian citizens and permanent residents

Foreign workers are not covered under SOCSO but must be registered under the Foreign Workers Compensation Scheme (FWCS).

How to Add a New Employee in the Assist Perkeso Portal

Step 1: Prepare Required Documents

Before registering, ensure you have the following documents:

-

Employee’s Identification Card (IC) copy

-

Form 2 (Employee Registration Form)

-

Employer's SOCSO number

Step 2: Add a new employee through ASSIST Portal

The registration process is done online via the SOCSO ASSIST Portal. Follow these steps:

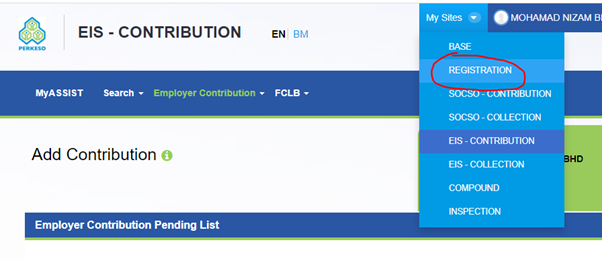

1. Visit https://assist.perkeso.gov.my/employer/login and log in. Navigate to "My Sites" and select "Registration

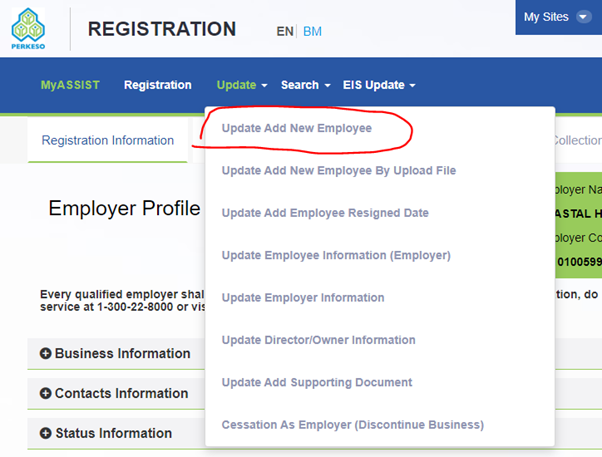

2. In the "Update" section, click "Update Add New Employee"

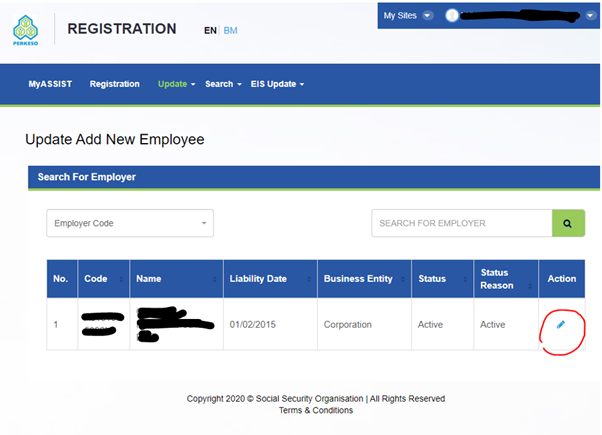

3. Click the Pen icon in the "Action" column

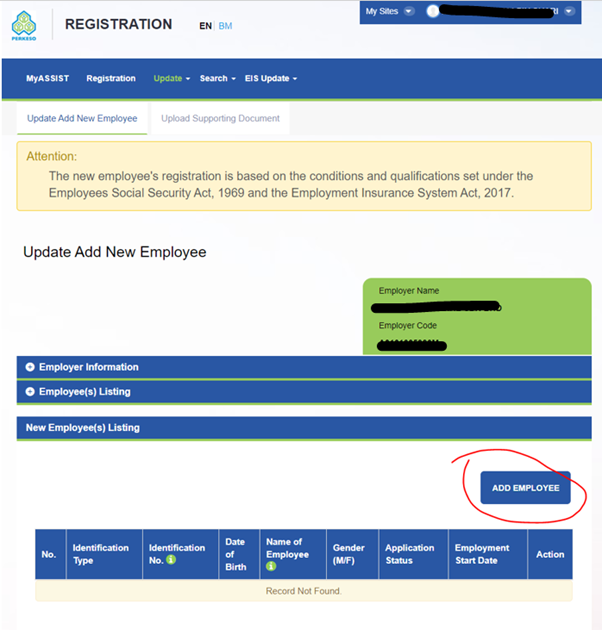

4. Choose "Add New Employee"

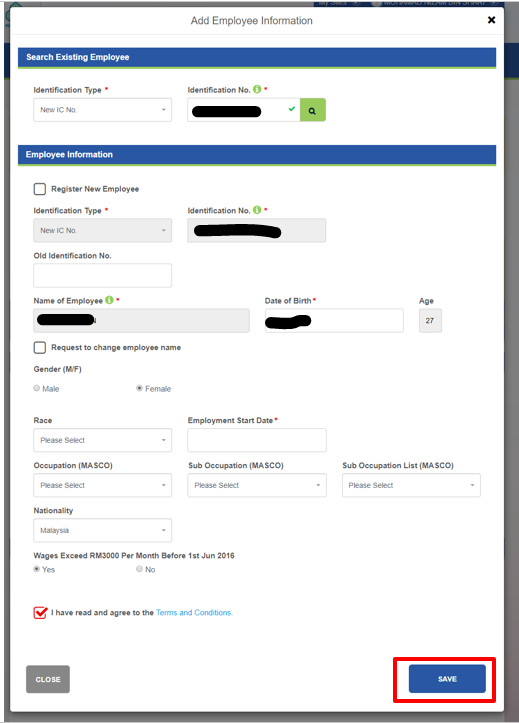

5. A form will appear to enter the new employee's details; after filling it out, click "Save"

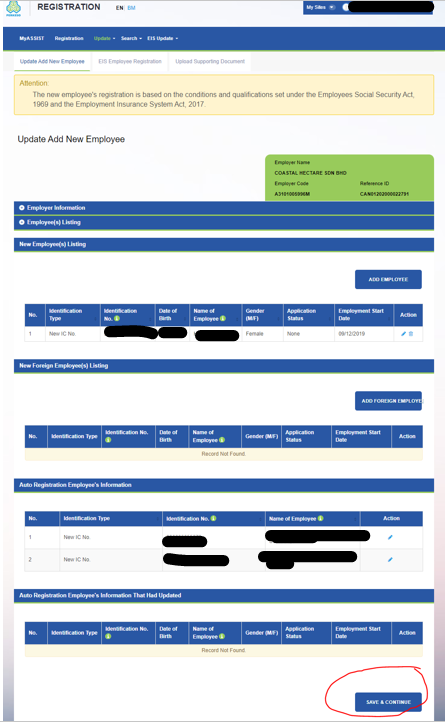

6. Scroll to the bottom and click "Save & Continue"

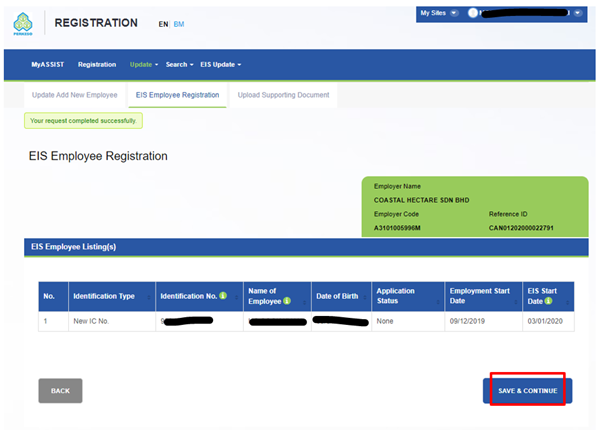

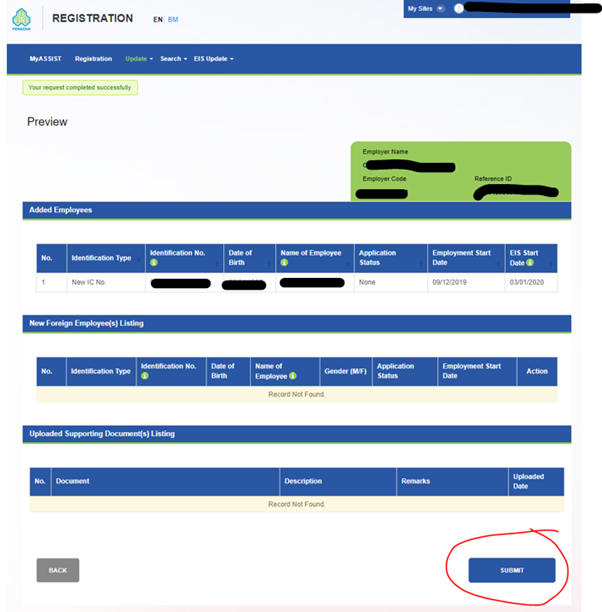

7. A confirmation message will appear showing your request was successful; click "Save & Continue"

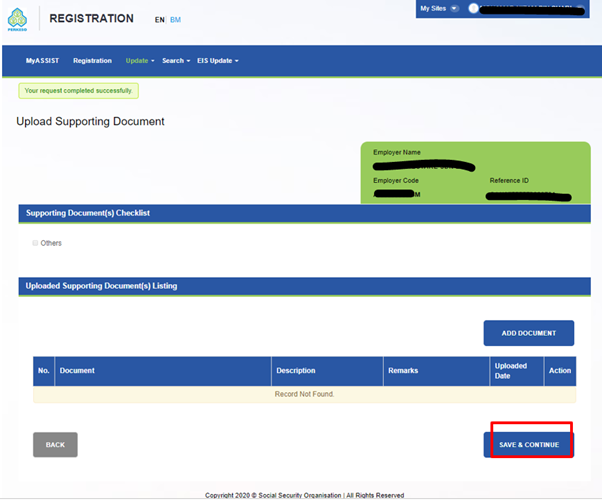

8. Click "Save & Continue" once more

9. Finally, click "Submit"

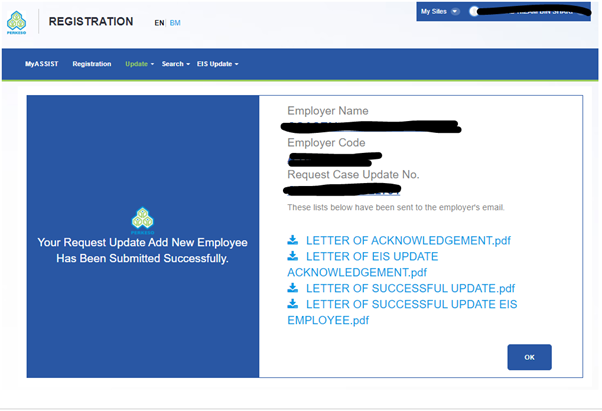

10. Finally, this is the screen to show new employee has been submitted successfully

Source: kakitangan.com

Step 3: Make SOCSO Contributions

Once registered, employers must start contributing to SOCSO monthly. The contribution rate depends on the employee’s salary:

-

Below RM5,000/month: Both employer and employee contribute.

-

Above RM5,000/month: Only the employer contributes.

Employers must make payments via Perkeso ASSIST Portal, Internet banking, or over the counter at appointed banks.

When Should You Register?

Employers are required to register a new employee with SOCSO within 30 days from their start date.

It’s important to meet this deadline to ensure compliance with the law.

Delaying the registration can result in fines, penalties, or even legal action against the employer.

By registering within the 30-day window, you avoid these risks and ensure your employees are properly covered under the Employees' Social Security Act 1969.

Make sure to complete the registration on time to protect both your organization and your employees.

What Happens After Adding a New Employee?

Once registered, the employee is covered under SOCSO. In case of a work-related injury or illness, they can claim benefits from SOCSO.

Employers should educate employees about their SOCSO rights and benefits.

Registering a new employee in SOCSO is a simple but essential process.

By following the correct steps, you ensure compliance with Malaysian labour laws and provide social security protection for your employees.

For more information, visit the official SOCSO website.

Why HR Needs to Add New Employees to SOCSO

Before diving into the steps, it’s important to understand for HR why adding new employees to SOCSO is essential:

1. Legal Compliance

Under the Employees' Social Security Act 1969, employers are legally required to register their employees with SOCSO.

This registration is not optional. Failing to comply with this law can result in serious legal consequences, including fines and penalties.

2. Employee Protection

SOCSO plays a crucial role in protecting employees.

By registering employees, you ensure they are eligible for important benefits such as financial support and medical coverage in case of work-related injuries, illnesses, or disabilities.

This protection helps employees feel secure and valued at the workplace.

3. Employer Liability

If an employer fails to register their employees with SOCSO, it can lead to significant legal repercussions.

Employers could face heavy fines, penalties, or even legal action.

This makes it vital for HR to stay on top of SOCSO registrations to avoid costly consequences.

4. Employee Trust

Properly registering employees with SOCSO shows that the employer is committed to the welfare of its workers.

It signals that the organization takes its responsibility seriously, creating an environment of trust and security.

Employees are more likely to feel valued and motivated when they see that their employer cares about their health and well-being.

Common Mistakes to Avoid

Late Registration

Make sure to complete the registration within 30 days of hiring a new employee.

Failing to do so can result in penalties and complications for both the employer and the employee.

Incorrect Employee Details

Always double-check the employee’s personal information, such as their identification card (IC) number and full name.

Errors in these details can cause delays or issues when processing claims or benefits. Accuracy is key.

Missing Documents

Ensure that all required documents are uploaded during the registration process.

Missing documents, such as a copy of the employee’s IC or other supporting documents, can cause delays in the registration process or result in the registration being rejected.

Not Updating Salary Changes

It is important to update SOCSO with any salary changes that occur during the employment period.

Failing to update salary details can lead to incorrect contributions and may affect the employee’s benefits later on.

Regular updates are necessary to ensure proper contributions are made.

FAQ: Adding a New Employee to SOCSO Malaysia

What is SOCSO, and why is it important?

SOCSO (PERKESO) provides social security for employees. Employers must register to comply with the law and avoid penalties.

Who must register for SOCSO?

All Malaysian employees earning RM30–RM5,000/month, including full-time, part-time, and contract workers. Foreign workers are under FWCS.

How to register employees with SOCSO?

Register via the SOCSO ASSIST Portal by filling in details, uploading documents, and submitting the application.

What documents are needed?

Employee’s IC copy, offer letter, Form 2, and employer’s SOCSO number.

What are the SOCSO contribution rates?

Below RM5,000/month: Employer + employee contribute. Above RM5,000/month: Only employer contributes. Payments via ASSIST Portal, banks, or online.

Are You Hiring in 2025?

Start hiring smarter with AJobThing today! Post your job ads, reach the best candidates, and simplify your hiring process using our user-friendly platform.

Read More:

- What is SOCSO? A Simple Guide for Employers

- How to Pay SOCSO Online

- Malaysia Form E 2025: Submission Guide, Deadline, and Penalties

- PCB (Potongan Cukai Bulanan) in Malaysia: A Complete Guide for Employers

- Tax Reliefs in Malaysia 2025 for Employers: Types and How to Apply

- New EPF Retirement Savings: Helping Employers Support Financial Well-Being for Employees

- Malaysian Employment Act 1955: Key Provisions Every Employer Must Know

- Malaysia National Registration Identity Card (NRIC): A Guide for Employer