Penjawat Awam 2026: Official Monthly Salary Payment Dates

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowThe Jabatan Akauntan Negara Malaysia (JANM) has issued Surat Pekeliling Akauntan Negara Malaysia (SPANM) Bilangan 5 Tahun 2025, which sets the official Salary 2026 payment schedule for all Penjawat Awam under the Federal Government.

This circular confirms the fixed monthly salary payment dates for 2026, along with the procedures that must be followed to ensure salaries are processed accurately and on time.

Latest Update: Phase 2 SSPA Salary Adjustment

The Phase 2 SSPA salary adjustment will be paid on 22 January 2026.

Penjawat awam who have opted for the Sistem Saraan Perkhidmatan Awam (SSPA) will receive the Phase 2 salary adjustment together with the January 2026 salary payment. The increase will be calculated based on the final salary as at 31 December 2025.

According to the Deputy Director of Salary Policy, Salary and Allowances Division, Jabatan Perkhidmatan Awam (JPA), Mohd Shahir Shaari, although the new salary structure takes effect from 1 January 2026, payment will be made on 22 January 2026, which is the official salary date for that month.

Source: BERNAMA

Purpose of SPANM Bil. 5 Tahun 2025

The main objectives of this circular are:

-

To inform all ministries and departments of the official monthly salary payment dates for 2026; and

-

To establish salary payment management procedures so that emoluments are paid accurately and according to the schedule set by JANM.

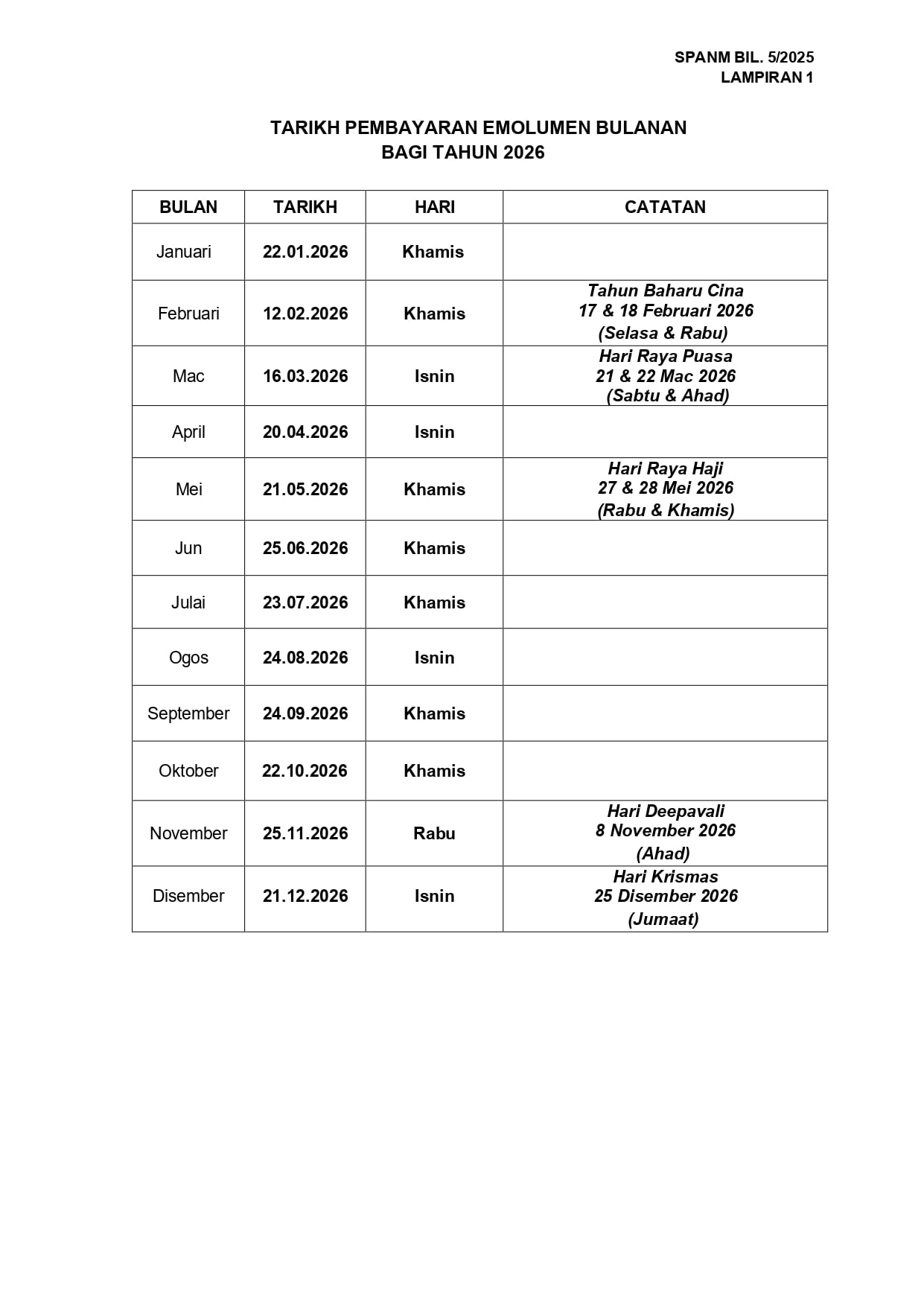

Official Salary Payment Schedule 2026 for Penjawat Awam

Based on Appendix 1 of SPANM Bil. 5/2025, the official Salary 2026 dates are as follows:

|

Month |

Salary Payment Date |

|

January |

22 January 2026 (Thursday) |

|

February |

12 February 2026 (Thursday) |

|

March |

16 March 2026 (Monday) |

|

April |

20 April 2026 (Monday) |

|

May |

21 May 2026 (Thursday) |

|

June |

25 June 2026 (Thursday) |

|

July |

23 July 2026 (Thursday) |

|

August |

24 August 2026 (Monday) |

|

September |

24 September 2026 (Thursday) |

|

October |

22 October 2026 (Thursday) |

|

November |

25 November 2026 (Wednesday) |

|

December |

21 December 2026 (Monday) |

Public Holidays Near Salary Dates

-

Chinese New Year: 17–18 February 2026

-

Hari Raya Aidilfitri: 21–22 March 2026

-

Hari Raya Haji: 27–28 May 2026

-

Deepavali: 8 November 2026

-

Christmas: 25 December 2026

Important note: Salary payments are usually brought forward when they fall close to major festive seasons to help Penjawat Awam manage their expenses.

Bantuan Khas Aidilfitri Penjawat Awam 2026

The Prime Minister announced Bantuan Khas Kewangan Aidilfitri during the Budget 2026 Speech.

This initiative reflects the government’s appreciation for the contribution of public servants, despite the Phase 2 salary adjustment involving an estimated financial implication of RM18 billion.

The assistance aims to ease financial commitments ahead of the festive season while boosting morale among civil servants.

Payment month: February 2026.

Salary 2026 for Daily-Paid Workers and MySTEP

In addition to permanent Penjawat Awam, the circular also clarifies that:

Daily-Paid Workers

-

Salary must be paid no later than the 7th working day of the following month.

-

Payments may be made earlier if they fall close to major festive seasons.

MySTEP Personnel

Personnel under the MySTEP (Short Term Employment Programme) will be paid according to the MySTEP Procurement Guidelines currently in force.

Salary Payment Rules & Procedures for 2026

The Salary 2026 circular took effect on 21 October 2025 and applies to:

-

All Federal Ministries and Departments

-

Federal and State Statutory Bodies

-

Local Authorities (subject to acceptance)

Guidelines to Ensure Smooth Salary Payment

1. Responsibilities of Pusat Tanggungjawab (PTJ)

-

Submit salary amendment forms (Kew.320 Pin.1/2019) within the stipulated timeline

-

Verify employee details in the Master Salary File and ePenyata Gaji

-

Ensure salary payments are processed through the Sistem Emolumen Berkomputer (SEB)

2. Responsibilities of Accounting Offices

-

Set monthly salary processing dates

-

Ensure all transactions follow the approved schedule

-

Obtain approval from the Chief Accountant or State JANM Director for special cases

3. Responsibilities of Penjawat Awam

-

Regularly check bank account status

-

Ensure there are no payment blocks due to existing loans or financial commitments

Official Reference

Official information and downloadable documents are available at the JANM website: https://www.anm.gov.my

Frequently Asked Questions (FAQ)

What is Salary 2026?

Salary 2026 refers to the official monthly emolument payment schedule for Penjawat Awam, as determined by JANM under SPANM Bil. 5 Tahun 2025.

Who determines the Salary 2026 schedule?

The schedule is issued by the Jabatan Akauntan Negara Malaysia (JANM).

When does the circular take effect?

The circular is effective from 21 October 2025 and applies to salary payments beginning January 2026.

Will salary be paid earlier during festive seasons?

Yes. Salary payments are usually brought forward when they fall near major public holidays.

Does Salary 2026 apply to all government agencies?

Yes, including federal ministries, statutory bodies, and local authorities, subject to acceptance.

When will the SSPA Phase 2 salary adjustment be paid?

The adjustment will be paid on 22 January 2026, together with the January salary.

Your Next Hire Could be Just a Click Away!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best.

Post your job ads today & simplify your hiring process!

Read More:

-

Malaysia Income Tax Exemption 2025 Guide for Employers & HR | e-Filling 2026

-

LHDN Stamp Duty Requirements for Business and Employment Documents in Malaysia

-

What Employers Must Submit Through LHDN e-Filing in Malaysia

-

i-Topup KWSP: Contribution Rules & Guide for Employers in Malaysia

-

i-Simpan EPF (KWSP): How It Works & How Employees Can Contribute

-

EPF (KWSP) New Updates in January 2026 for Employers & HR in Malaysia

-

Penamaan KWSP in Malaysia: Legal Implications, Process, and HR’s Role

-

i-Sayang KWSP Guide: Requirements, Benefits & How to Register

-

EPF, SOCSO, EIS, and LHDN Employer Registration Guide for Malaysian Companies

- Cara Kira Potongan KWSP dan SOCSO | How to Calculate EPF and SOCSO Deductions in Malaysia

-

Deadlines & Penalties for SOCSO, EPF, PCB/Form E, and HRD Levy in Malaysia

-

PCB for Foreign Workers in Malaysia: Employer’s Complete Guide

-

EPF Withdrawal for Education: Employer’s Guide to Supporting Staff

-

Akaun Fleksibel (EPF’s New Account Structure): Key Info for Employers

-

KWSP Call Centre for Employers: Contact Numbers, Services, and Support Channels