How to Use the PERKESO/SOCSO Calculator for Employee Contributions

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowIf you’re running a business in Malaysia, you’ve probably heard of SOCSO or PERKESO. It’s one of those things employers must handle every month without fail.

But between all the salary slips, invoices, and tax documents, figuring out exactly how much to contribute to SOCSO can get tricky.

That’s why many business owners and HR teams rely on the PERKESO/SOCSO calculator to get it right.

This article will help you understand how the calculator works and why it’s so useful for employers.

What is PERKESO / SOCSO Contribution?

SOCSO, officially termed PERKESO (Pertubuhan Keselamatan Sosial), provides social security protection to Malaysian employees through two primary schemes:

-

Employment Injury Scheme: Offers coverage for workplace accidents, occupational diseases, and commuting accidents.

-

Invalidity Scheme: Provides financial assistance for permanent disability or death due to any cause, irrespective of its relation to employment.

Employers are mandated to contribute to SOCSO on behalf of their employees.

Contribution rates are determined based on salary brackets and are specified in the official contribution schedule. Notably:

-

Local Employees: Both employer and employee contribute monthly. For employees under 60 years old, the employer's share is 1.75% of the employee's monthly wages, while the employee contributes 0.5%.

-

Foreign Workers: Only the employer contributes, covering the Employment Injury Scheme at a rate of 1.25% of the employee's monthly wages.

Rate of Contribution for Employees’ Social Security Act 1969 (Act 4)

|

No |

Actual monthly wage of the month |

First Category (Employment Injury Scheme and Invalidity Scheme) |

Second Category (Employment Injury Scheme) |

||

|---|---|---|---|---|---|

|

Employer's |

Employee's |

Total Contribution |

Contribution By Employer Only |

||

|

1 |

Wages up to RM30 |

40 cents |

10 cents |

50 cents |

30 cents |

|

2 |

When wages exceed RM30 but not exceed RM50 |

70 cents |

20 cents |

90 cents |

50 cents |

|

3 |

When wages exceed RM50 but not exceed RM70 |

RM1.10 |

30 cents |

RM1.40 |

80 cents |

|

4 |

When wages exceed RM70 but not exceed RM100 |

RM1.50 |

40 cents |

RM1.90 |

RM1.10 |

|

5 |

When wages exceed RM100 but not exceed RM140 |

RM2.10 |

60 cents |

RM2.70 |

RM1.50 |

|

6 |

When wages exceed RM140 but not exceed RM200 |

RM2.95 |

85 cents |

RM3.80 |

RM2.10 |

|

7 |

When wages exceed RM200 but not exceed RM300 |

RM4.35 |

RM1.25 |

RM5.60 |

RM3.10 |

|

8 |

When wages exceed RM300 but not exceed RM400/td> |

RM6.15 |

RM1.75 |

RM7.90 |

RM4.40 |

|

9 |

When wages exceed RM400 but not exceed RM500 |

RM7.85 |

RM2.25 |

RM10.10 |

RM5.60 |

|

10 |

When wages exceed RM500 but not exceed RM600 |

RM9.65 |

RM2.75 |

RM12.40 |

RM6.90 |

|

11 |

When wages exceed RM600 but not exceed RM700 |

RM11.35 |

RM3.25 |

RM14.60 |

RM8.10 |

|

12 |

When wages exceed RM700 but not exceed RM800 |

RM13.15 |

RM3.75 |

RM16.90 |

RM9.40 |

|

13 |

When wages exceed RM800 but not exceed RM900 |

RM14.85 |

RM4.25 |

RM19.10 |

RM10.60 |

|

14 |

When wages exceed RM900 but not exceed RM1,000 |

RM16.65 |

RM4.75 |

RM21.40 |

RM11.90 |

|

15 |

When wages exceed RM1,000 but not exceed RM1,100 |

RM18.35 |

RM5.25 |

RM23.60 |

RM13.10 |

|

16 |

When wages exceed RM1,100 but not exceed RM1,200 |

RM20.15 |

RM5.75 |

RM25.90 |

RM14.40 |

|

17 |

When wages exceed RM1,200 but not exceed RM1,300 |

RM21.85 |

RM6.25 |

RM28.10 |

RM15.60 |

|

18 |

When wages exceed RM1,300 but not exceed RM1,400 |

RM23.65 |

RM6.75 |

RM30.40 |

RM16.90 |

|

19 |

When wages exceed RM1,400 but not exceed RM1,500 |

RM25.35 |

RM7.25 |

RM32.60 |

RM18.10 |

|

20 |

When wages exceed RM1,500 but not exceed RM1,600 |

RM27.15 |

RM7.75 |

RM34.90 |

RM19.40 |

|

21 |

When wages exceed RM1,600 but not exceed RM1,700 |

RM28.85 |

RM8.25 |

RM37.10 |

RM20.60 |

|

22 |

When wages exceed RM1,700 but not exceed RM1,800 |

RM30.65 |

RM8.75 |

RM39.40 |

RM21.90 |

|

23 |

When wages exceed RM1,800 but not exceed RM1,900 |

RM32.35 |

RM9.25 |

RM41.60 |

RM23.10 |

|

24 |

When wages exceed RM1,900 but not exceed RM2,000 |

RM34.15 |

RM9.75 |

RM43.90 |

RM24.40 |

|

25 |

When wages exceed RM2,000 but not exceed RM2,100 |

RM35.85 |

RM10.25 |

RM46.10 |

RM25.60 |

|

26 |

When wages exceed RM2,100 but not exceed RM2,200 |

RM37.65 |

RM10.75 |

RM48.40 |

RM26.90 |

|

27 |

When wages exceed RM2,200 but not exceed RM2,300 |

RM39.35 |

RM11.25 |

RM50.60 |

RM28.10 |

|

28 |

When wages exceed RM2,300 but not exceed RM2,400 |

RM41.15 |

RM11.75 |

RM52.90 |

RM29.40 |

|

29 |

When wages exceed RM2,400 but not exceed RM2,500 |

RM42.85 |

RM12.25 |

RM55.10 |

RM30.60 |

|

30 |

When wages exceed RM2,500 but not exceed RM2,600 |

RM44.65 |

RM12.75 |

RM57.40 |

RM31.90 |

|

31 |

When wages exceed RM2,600 but not exceed RM2,700 |

RM46.35 |

RM13.25 |

RM59.60 |

RM33.10 |

|

32 |

When wages exceed RM2,700 but not exceed RM2,800 |

RM48.15 |

RM13.75 |

RM61.90 |

RM34.40 |

|

33 |

When wages exceed RM2,800 but not exceed RM2,900 |

RM49.85 |

RM14.25 |

RM64.10 |

RM35.60 |

|

34 |

When wages exceed RM2,900 but not exceed RM3,000 |

RM51.65 |

RM14.75 |

RM66.40 |

RM36.90 |

|

35 |

When wages exceed RM3,000 but not exceed RM3,100 |

RM53.35 |

RM15.25 |

RM68.60 |

RM38.10 |

|

36 |

When wages exceed RM3,100 but not exceed RM3,200 |

RM55.15 |

RM15.75 |

RM70.90 |

RM39.40 |

|

37 |

When wages exceed RM3,200 but not exceed RM3,300 |

RM56.85 |

RM16.25 |

RM73.10 |

RM40.60 |

|

38 |

When wages exceed RM3,300 but not exceed RM3,400 |

RM58.65 |

RM16.75 |

RM75.40 |

RM41.90 |

|

39 |

When wages exceed RM3,400 but not exceed RM3,500 |

RM60.35 |

RM17.25 |

RM77.60 |

RM43.10 |

|

40 |

When wages exceed RM3,500 but not exceed RM3,600 |

RM62.15 |

RM17.75 |

RM79.90 |

RM44.40 |

|

41 |

When wages exceed RM3,600 but not exceed RM3,700 |

RM63.85 |

RM18.25 |

RM82.10 |

RM45.60 |

|

42 |

When wages exceed RM3,700 but not exceed RM3,800 |

RM65.65 |

RM18.75 |

RM84.40 |

RM46.90 |

|

43 |

When wages exceed RM3,800 but not exceed RM3,900 |

RM67.35 |

RM19.25 |

RM86.60 |

RM48.10 |

|

44 |

When wages exceed RM3,900 but not exceed RM4,000 |

RM69.15 |

RM19.75 |

RM88.90 |

RM49.40 |

|

45 |

When wages exceed RM4,000 but not exceed RM4,100 |

RM70.85 |

RM20.25 |

RM91.10 |

RM50.60 |

|

46 |

When wages exceed RM4,100 but not exceed RM4,200 |

RM72.65 |

RM20.75 |

RM93.40 |

RM51.90 |

|

47 |

When wages exceed RM4,200 but not exceed RM4,300 |

RM74.35 |

RM21.25 |

RM95.60 |

RM53.10 |

|

48 |

When wages exceed RM4,300 but not exceed RM4,400 |

RM76.15 |

RM21.75 |

RM97.90 |

RM54.40 |

|

49 |

When wages exceed RM4,400 but not exceed RM4,500 |

RM77.85 |

RM22.25 |

RM100.10 |

RM55.60 |

|

50 |

When wages exceed RM4,500 but not exceed RM4,600 |

RM79.65 |

RM22.75 |

RM102.40 |

RM56.90 |

|

51 |

When wages exceed RM4,600 but not exceed RM4,700 |

RM81.35 |

RM23.25 |

RM104.60 |

RM58.10 |

|

52 |

When wages exceed RM4,700 but not exceed RM4,800 |

RM83.15 |

RM23.75 |

RM106.90 |

RM59.40 |

|

53 |

When wages exceed RM4,800 but not exceed RM4,900 |

RM84.85 |

RM24.25 |

RM109.10 |

RM60.60 |

|

54 |

When wages exceed RM4,900 but not exceed RM5,000 |

RM86.65 |

RM24.75 |

RM111.40 |

RM61.90 |

|

55 |

When wages exceed RM5,000 but not exceed RM5,100 |

RM88.35 |

RM25.25 |

RM113.60 |

RM63.10 |

|

56 |

When wages exceed RM5,100 but not exceed RM5,200 |

RM90.15 |

RM25.75 |

RM115.90 |

RM64.40 |

|

57 |

When wages exceed RM5,200 but not exceed RM5,300 |

RM91.85 |

RM26.25 |

RM118.10 |

RM65.60 |

|

58 |

When wages exceed RM5,300 but not exceed RM5,400 |

RM93.65 |

RM26.75 |

RM120.40 |

RM66.90 |

|

59 |

When wages exceed RM5,400 but not exceed RM5,500 |

RM95.35 |

RM27.25 |

RM122.60 |

RM68.10 |

|

60 |

When wages exceed RM5,500 but not exceed RM5,600 |

RM97.15 |

RM27.75 |

RM124.90 |

RM69.40 |

|

61 |

When wages exceed RM5,600 but not exceed RM5,700 |

RM98.85 |

RM28.25 |

RM127.10 |

RM70.60 |

|

62 |

When wages exceed RM5,700 but not exceed RM5,800 |

RM100.65 |

RM28.75 |

RM129.40 |

RM71.90 |

|

63 |

When wages exceed RM5,800 but not exceed RM5,900 |

RM102.35 |

RM29.25 |

RM131.60 |

RM73.10 |

|

64 |

When wages exceed RM5,900 but not exceed RM6,000 |

RM104.15 |

RM29.75 |

RM133.90 |

RM74.40 |

|

65 |

When wages exceed RM6,000 |

RM104.15 |

RM29.75 |

RM133.90 |

RM74.40 |

How to Calculate SOCSO Contribution?

Calculating SOCSO contributions involves determining the respective percentages for both the employer and the employee based on the employee's monthly salary.

Here's a step-by-step guide:

-

Determine the employee's gross monthly earnings, including basic salary, overtime, commissions, and other relevant payments.

-

Refer to the SOCSO contribution table. The table outlines the exact contribution amounts corresponding to various salary ranges. For instance:

-

For a monthly wage exceeding RM1,000 but not RM1,100:

-

Employer's contribution: RM18.35

-

Employee's contribution: RM5.25

-

Total contribution: RM23.60

-

-

-

Apply the rates from the contribution table to the employee's monthly salary to determine both the employer's and employee's contributions.

Example calculation: An employee earning RM4,200 per month.

-

Employer's Contribution: RM4,200 × 1.75% = RM73.50

-

Employee's Contribution: RM4,200 × 0.5% = RM21.00

-

Total SOCSO Contribution: RM94.50

How to Use SOCSO Contribution Calculator

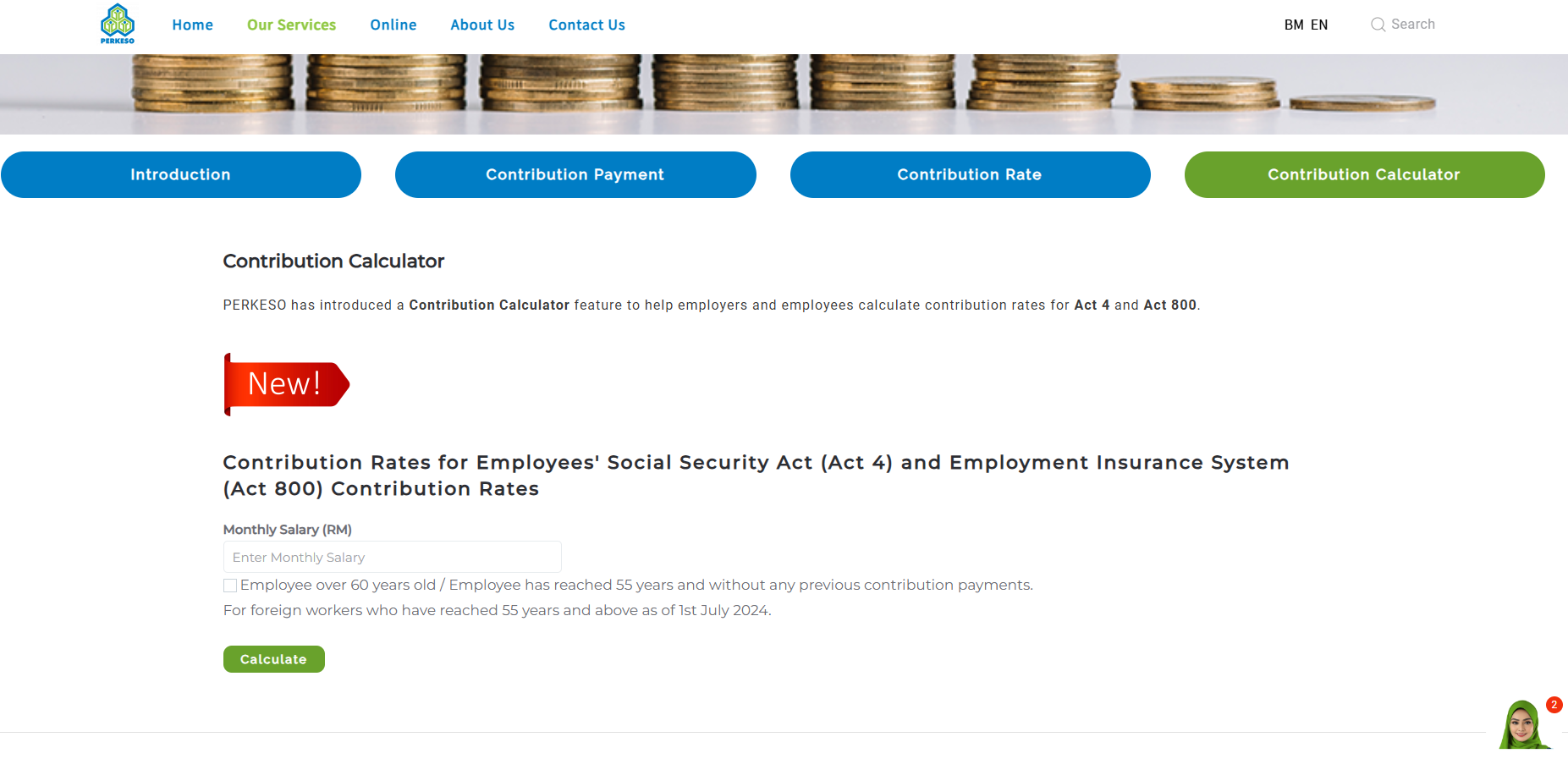

To streamline the calculation process, PERKESO offers an online Contribution Calculator. Here's how to use it:

-

Visit the official PERKESO website and navigate to the Contribution Calculator section. Or you can just click this link.

-

Enter the employee's monthly salary and select the appropriate category (e.g., age group, local or foreign worker).

-

The calculator will display the exact contribution amounts for both employer and employee.

Other than PERKESO’s, you can also use Payroll Panda’s SOCSO Contribution Calculator in this link. The steps are the same as PERKESO’s.

After you calculate it, utilize the SOCSO Contribution Table to cross-reference and compute contributions based on salary brackets.

When should SOCSO contributions be paid?

SOCSO contributions must be remitted by the 15th of the following month. For example, contributions for September should be paid by October 15th.

Timely payments are crucial to avoid penalties and maintain compliance with Malaysian labor laws.

What is the easiest way to calculate SOCSO contributions?

The most straightforward method is to use the PERKESO Contribution Calculator available on their official website.

This tool provides accurate calculations and reduces the likelihood of errors.

Additionally, payroll software solutions often integrate SOCSO calculation features, further simplifying the process.

Who is covered by SOCSO?

SOCSO coverage extends to:

-

Malaysian Citizens and Permanent Residents: All employees under 60 years old, earning wages, are required to contribute.

-

Foreign Workers: Covered under the Employment Injury Scheme, with contributions made solely by the employer.

Do part-time employees need to contribute to SOCSO?

Yes, part-time employees are subject to SOCSO contributions if they earn a monthly wage of RM30 or more. The contribution rates are applied based on their earnings, similar to full-time employees.

Can I opt out of SOCSO coverage in Malaysia?

No, SOCSO contributions are mandatory for eligible employees. There is no provision for opting out, as these contributions provide essential social security benefits.

FAQ

How do I check my SOCSO contribution online?

Employers and employees can check contribution records through the PERKESO Assist Portal by registering and logging into their accounts.

What is the employer’s SOCSO contribution percentage?

For employees under 60 years old, the employer contributes 1.75% of the employee's monthly wages. For employees aged 60 and above, the employer's contribution is 1.25%.

Are SOCSO contributions tax-deductible?

Yes, SOCSO contributions made by employers are deductible expenses under Malaysian tax laws.

What happens if I miss my SOCSO payment?

Late payments may result in penalties and interest charges. It's essential to remit contributions by the 15th of the following month to avoid such issues.

How do foreign workers contribute to SOCSO?

Foreign workers are covered under the Employment Injury Scheme, with contributions made solely by the employer at a rate of 1.25% of the employee's monthly wages.

Need to hire the right talent?

If you’re hiring, post your jobs on Maukerja or Ricebowl—with over 6 million jobseekers in Malaysia, your next top talent is waiting!

Read More:

- 13 Free HR Templates for Various Activities in the Company

- Foreigner vs Non-Resident in Malaysia: Key Differences to Know for Payroll & Tax

- Average Salary in Malaysia 2025: Industry & Job Role Insights

- What is Sistem Insurans Pekerjaan (SIP)? A Complete Guide

- How to Handle a Retirement Letter to Employer

- How to Handle Resignation Letter for Employers

- 10 Exit Interview Questions to Ask Employees

- Tips for Interviewer: How to Prepare and Conduct a Virtual Interview

- Key Performance Indicator (KPI): Definition, Types, Dashboard, Criteria and Examples

- How to Handle Quiet Quitting in Malaysia

- How to Check Income Tax for Employers in Malaysia

- What Are Statutory Deductions? Definition, Types, Example

- Calculate Take-Home Salary in Malaysia (With Examples)

- Tax Borne by Employers: What is it and How to Calculate

- How to Check Income Tax for Employers in Malaysia