Permohonan Peranan MyTax: A Complete Guide for Employers in Malaysia

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowAs employers, we rely on MyTax to handle important filings such as Form E and CP204. However, the system only works smoothly if the correct roles are assigned inside the portal. Without it, HR or admin staff may find themselves locked out at the very moment deadlines approach. To avoid this, we must understand how permohonan peranan MyTax works and what steps are required.

What is MyTax?

MyTax is LHDN’s official online platform for taxpayers. I functions as the main channel for filing statutory forms, checking records, and managing tax submissions on behalf of the business.

Using MyTax ensures:

- Compliance with LHDN requirements.

- Faster, paperless filing for employer obligations.

- Clear assignment of who in the organisation is responsible for submissions.

What is Permohonan Peranan MyTax?

In MyTax, permohonan peranan means role application. Employers and representatives must apply for the appropriate role in the portal to gain permission to file on behalf of the company.

The purpose of assigning roles is to:

- Control access to sensitive tax data.

- Ensure accountability for submissions.

- Allow HR or authorised staff to act on the employer’s behalf when approved.

Types of roles relevant to employers:

- Employer: used to submit all employer filings.

- Employer Representative: appointed by an Employer role holder to act on behalf of the company.

- Director: for private companies, this is applied for first; once approved, the Employer role is automatically granted.

Why is Permohonan Peranan Important for Employers/Businesses?

From an employer’s point of view, applying for the right role is not just a technical requirement. It directly affects compliance.

- It ensures the correct staff can access and submit forms.

- It defines responsibility for employer submissions such as CP204, CP58, and Form E.

- It prevents delays, errors, or legal issues if the wrong person attempts to file without proper authorisation.

Who Needs to Apply for This Role?

Employers should apply in the following cases:

- Private companies / private entities (besides company): A Director must apply for the Director role. Once approved, Employer is automatically assigned.

- Sole proprietorships, Government or statutory bodies, Local authorities: Apply directly for the Employer role.

- HR or admin staff: Can act as Employer Representatives once appointed by an Employer role holder.

- Scenarios: New company registration, new HR representative joining, or migration to the MyTax system.

Step-by-Step Guide: How to Apply for an Employer Role in MyTax

A. For Private Companies / Private Entities

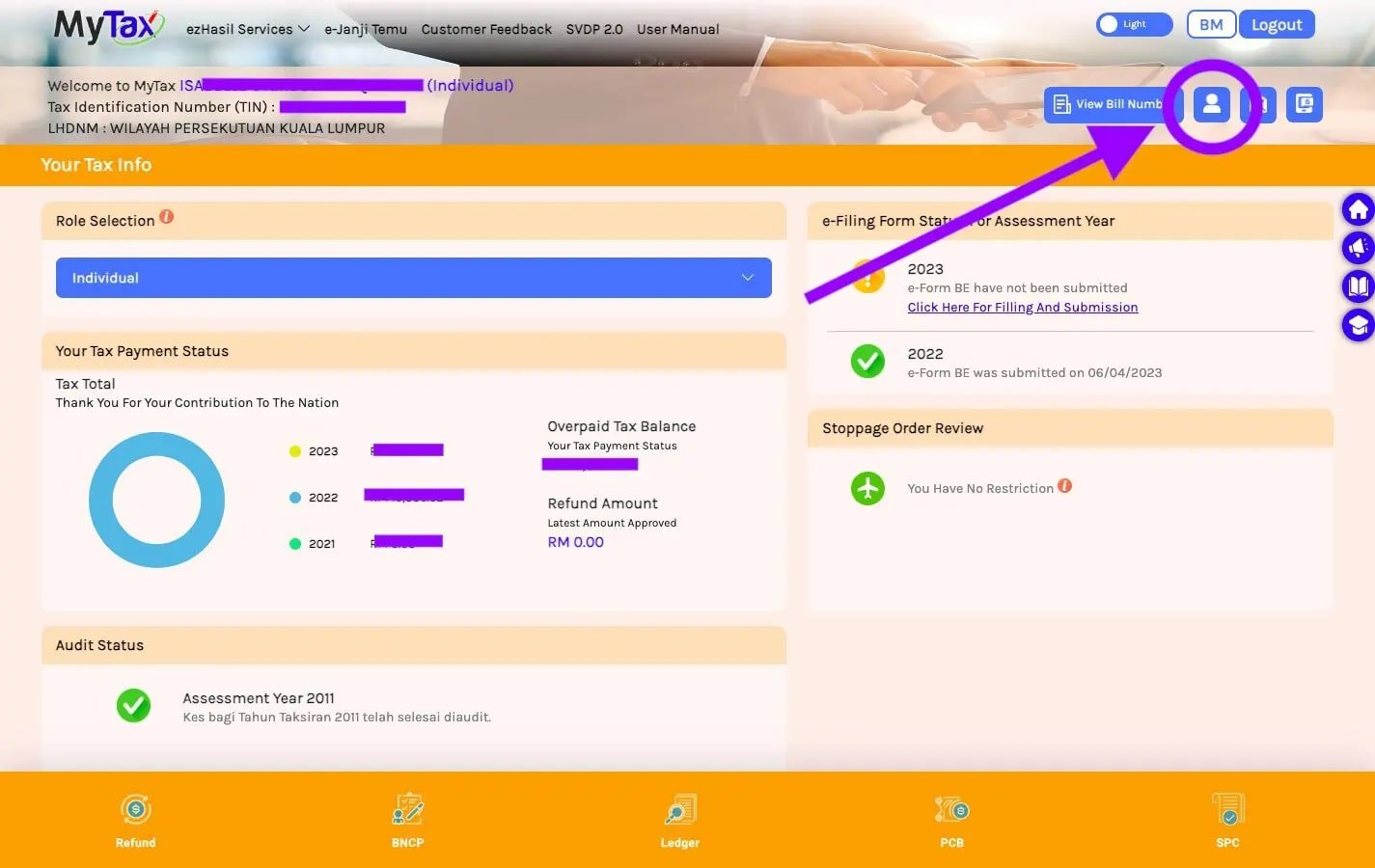

- Go to https://mytax.hasil.gov.my/ and log in to your account.

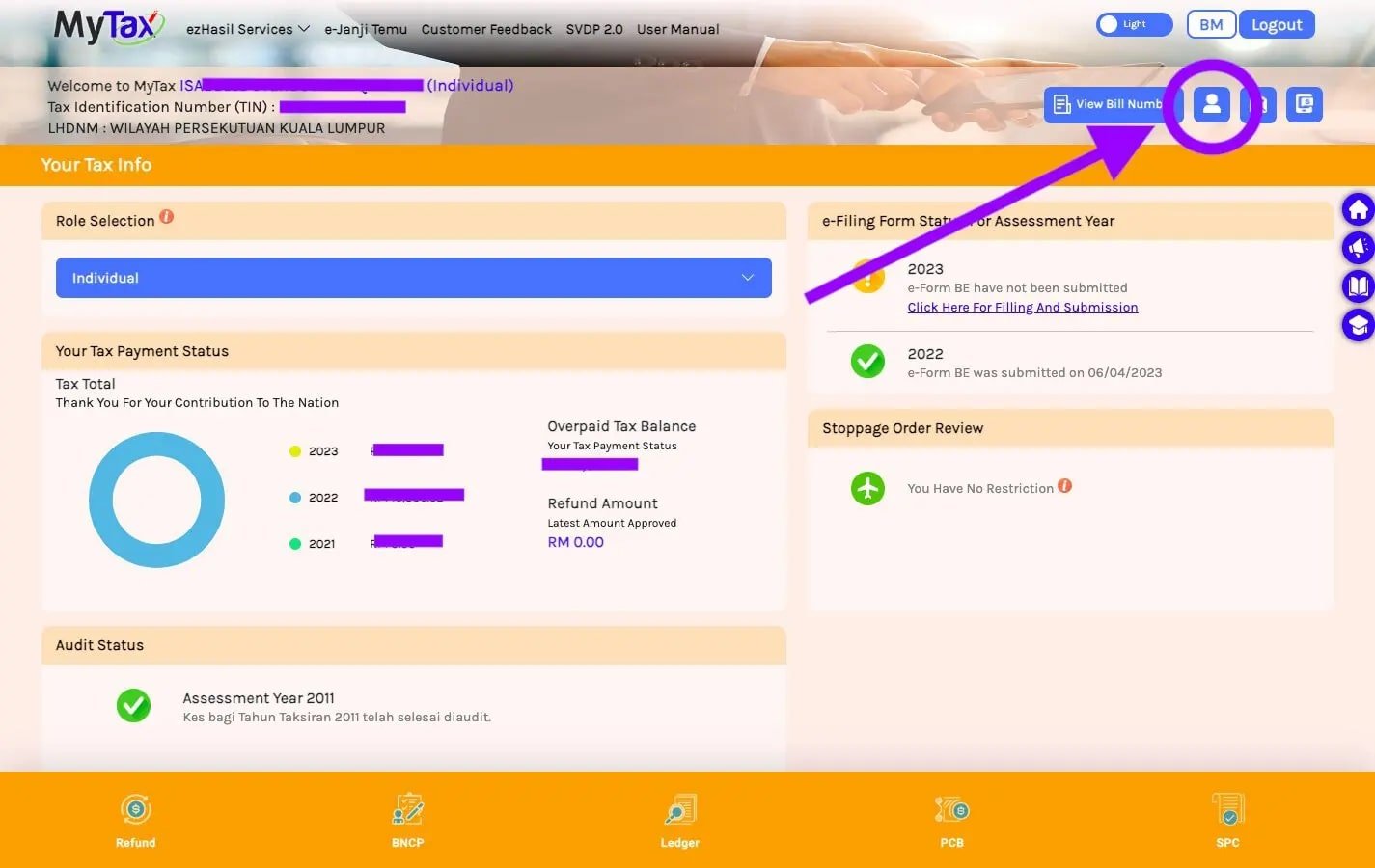

- Click on the profile icon at the top right corner of the page.

-

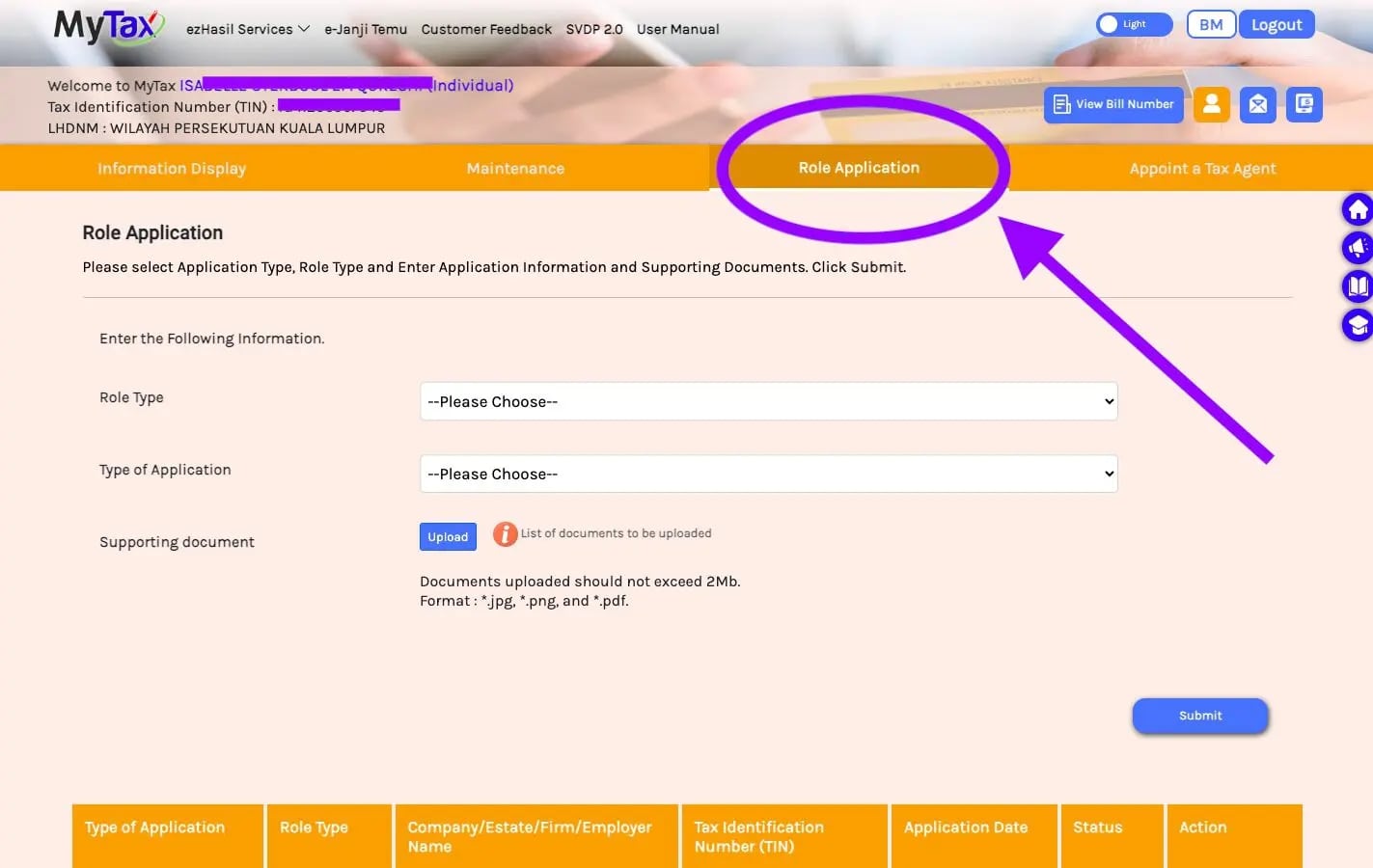

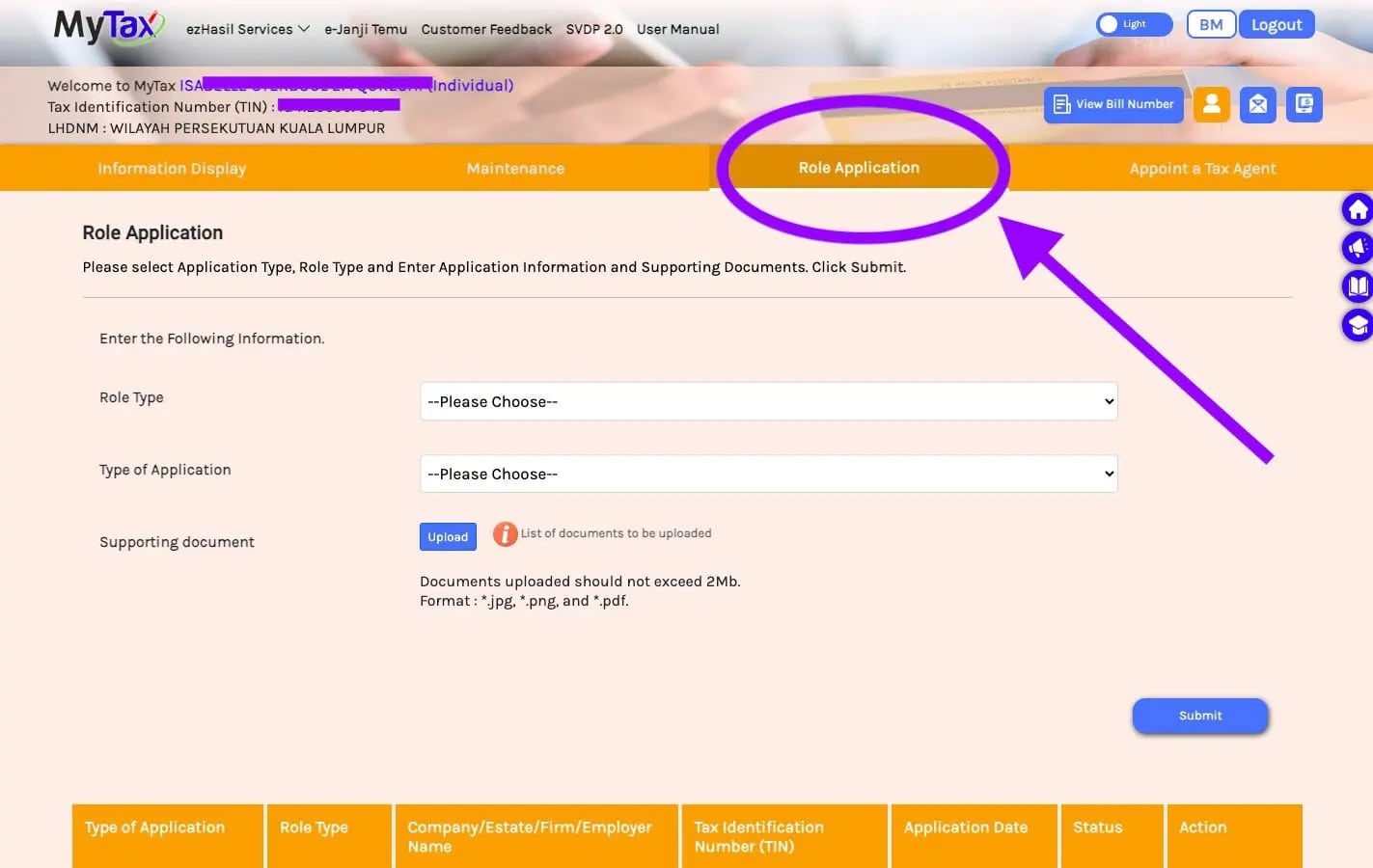

Select the “Role Application” tab.

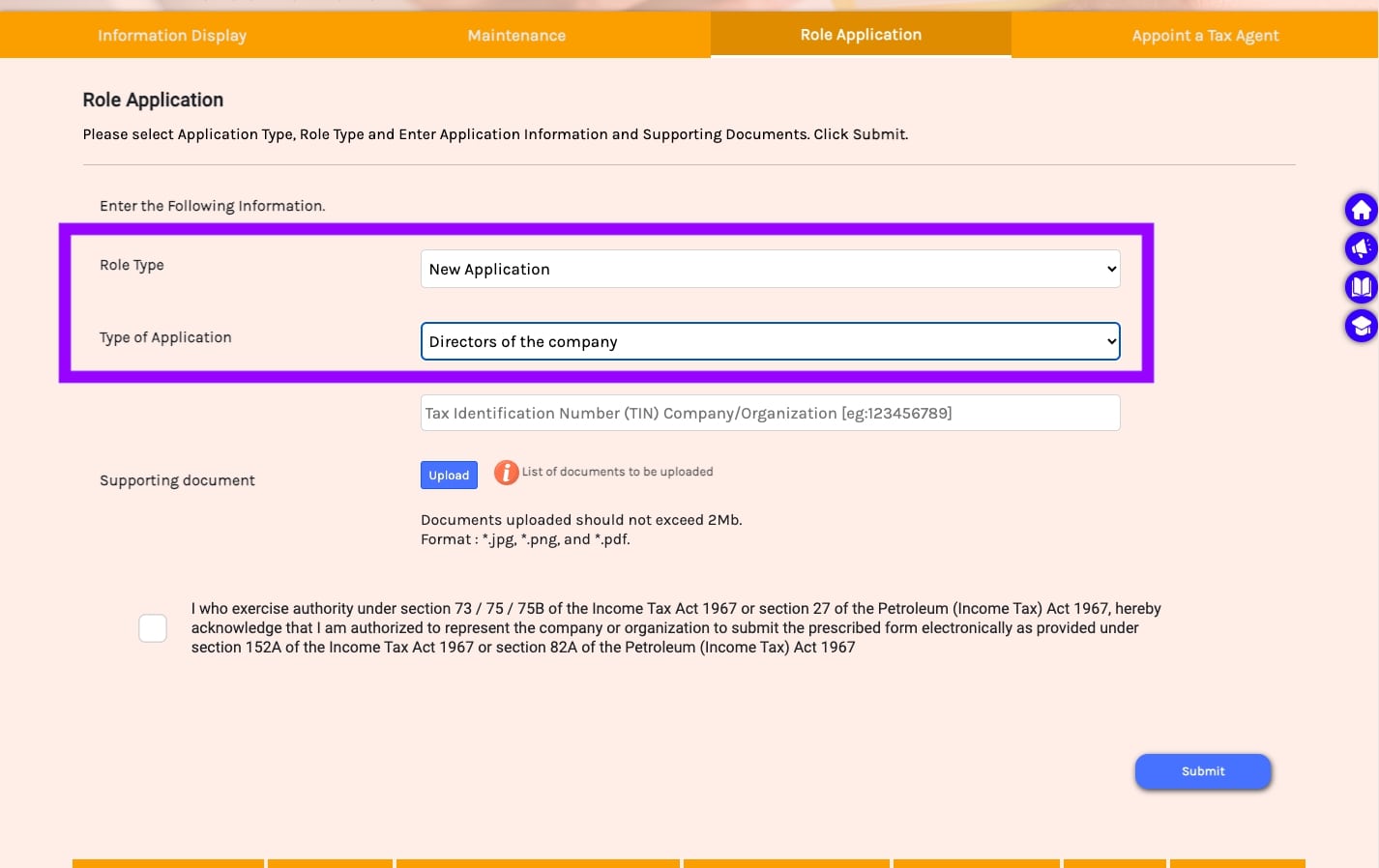

- Under Role Type, choose “New Application.”

- For Type of Application, select “Directors of The Company.”

- Enter your organisation’s Tax Identification Number (TIN).

- Upload the required documents:

- Certificate of Registration (Form 9 / Section 17)

- List of Directors (Form 49 / Section 14).

- Tick the confirmation box and click “Submit”.

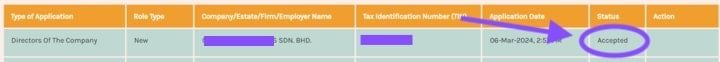

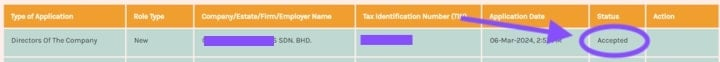

- Wait for the application to be processed. It usually takes up to 5 working days. Once approved, the status will change from “New” to “Accepted.”

B. For Sole Proprietors, Government, Local Authorities

- Go to https://mytax.hasil.gov.my/ and log in with your account.

- Click on the profile icon at the top right corner of the page.

-

Select the “Role Application” tab.

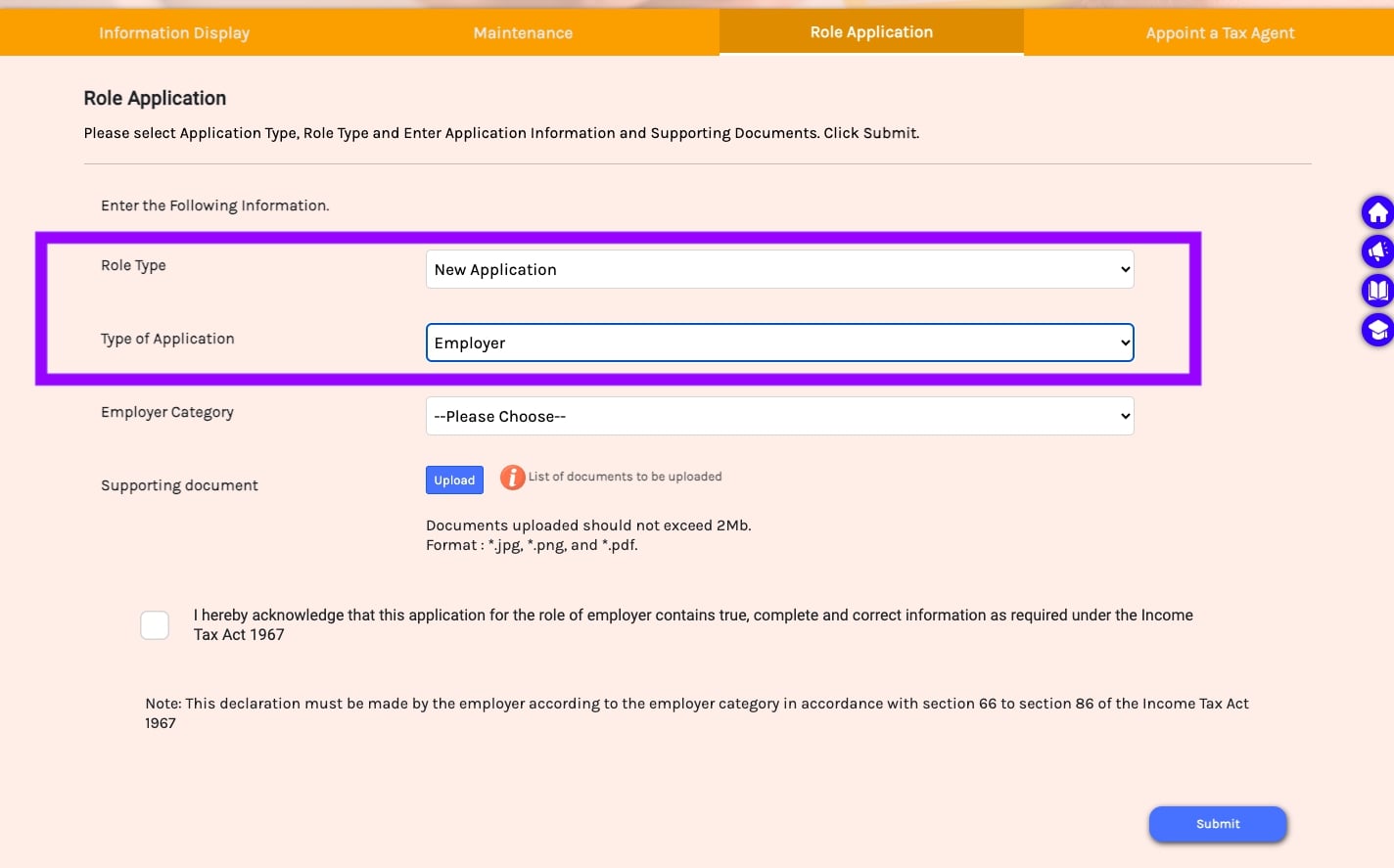

- Under Role Type, choose “New Application.”

- For Type of Application, select “Employer.”

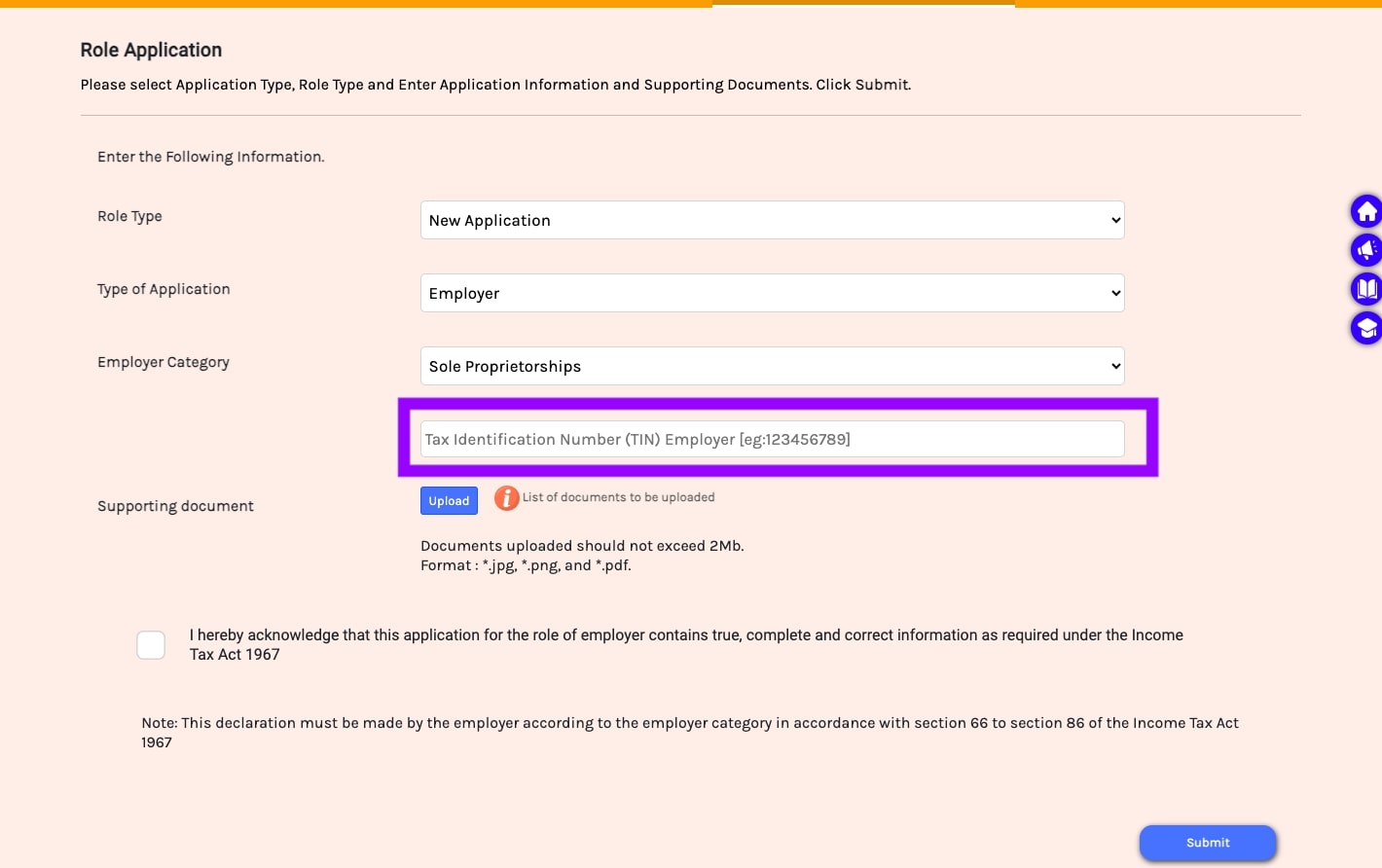

- Pick the correct Employer Category for your organisation. If you are a partnership, LHDN has confirmed that you should select Sole Proprietorships.

- Enter your organisation’s Tax Identification Number (TIN).

- Upload the required supporting documents (based on your entity type).

- Tick the confirmation box and click “Submit.”

- Wait for the processing. Approval usually takes up to five working days. Once approved, the status will change from “New” to “Accepted.”

Documents Needed for MyTax Employer Role Application

Employers should prepare all required documents before starting the application to avoid delays or rejections. Keep them in digital format (PDF or clear image) for upload.

Company Registration Details (SSM)

- For private companies: Certificate of Incorporation (Form 9 / Section 17).

- For partnerships or sole proprietorships: the latest SSM Business Registration certificate.

- For other entities (e.g., statutory bodies, local authorities): relevant registration papers as recognised by LHDN.

Employer Tax Number (E Number / Organisation TIN)

This number identifies the business as an employer in LHDN’s system. Ensure it matches exactly with LHDN’s records even small errors can cause rejection.

List of Directors (Form 49 / Section 14)

Required if applying via the Director route (for private companies). Make sure the version submitted is the latest filed with SSM.

Authorisation Letter (for HR/Admin Representatives)

Required when HR or admin staff apply as Employer Representatives. Must be on company letterhead, signed by the Employer/Director, and state the representative’s full name, IC/passport number, and role.

Identity Document (IC/Passport of Representative)

For Employer Representatives, a clear copy of their NRIC (Malaysian) or passport (foreign staff) is required. This verifies the representative’s identity for LHDN’s approval.

How Long Does Approval Take?

LHDN usually processes applications within five working days. Employers can check the application status in the portal: once approved, it moves from New to Accepted.

Is There Any Fee Required?

As per latest update, applying for Employer or Employer Representative roles in MyTax does not require any fee.

Common Issues & Troubleshooting

Even with the clear steps provided by LHDN, many employers run into difficulties when applying for roles. Below are the most common issues, why they happen, and what employers or HR staff can do to fix them quickly.

Application Rejected Due to Documents

Problem: LHDN rejects the request because uploaded documents are incomplete, expired, or don’t match the company records.

Solution:

- For private companies, always submit both Form 9 / Section 17 (registration certificate) and Form 49 / Section 14 (list of directors).

- Check that the documents are the latest versions filed with SSM. Old versions often cause rejection.

- Upload files in the format accepted by the portal (PDF or image, clear and readable).

Status Stuck at “New” for More Than 5 Working Days

Problem: Employers expect approval but the application remains in “New” status.

Solution:

- Normally, approval takes up to five working days.

- If it takes longer, employers should contact LHDN’s customer service with the application reference number.

- Keeping a screenshot or record of the submission date helps when following up.

Cannot Log In or Access Role Application Tab

Problem: Employer or representative cannot enter the portal or see the “Role Application” menu.

Solution:

- Make sure the user is registered with MyTax and has an active account.

- If login fails, reset the password via the official portal.

- Sometimes, access is blocked if NRIC/Company TIN doesn’t match LHDN records. Double-check company registration details.

Employer Representative Not Appearing After Appointment

Problem: After appointing a representative, their name doesn’t show in the list.

Solution:

- The Employer must first switch to the Employer role under “Role Selection” before making the appointment.

- Confirm that the representative already has a registered MyTax account. Without it, the system cannot link them.

- If the name still doesn’t appear, cancel the process and re-enter the ID number carefully.

Duplicate or Wrong Role Applied

Problem: HR staff mistakenly apply for the wrong role (e.g., applying for Employer instead of Employer Representative) or submit multiple applications.

Employer Tip:

- Only the Director should apply for Director/Employer roles in private companies.

- HR or admin should only be appointed via Appointment of Representative, not through Role Application.

- If a wrong application is submitted, cancel it and reapply correctly.

Issues After Staff Resignation or Role Change

Problem: Former HR staff or representatives still have access after leaving the company.

Solution:

- Employers must remove ex-staff immediately via Appointment of Representative → Cancel.

- Update records whenever staff changes occur.

- Keep at least two Employer Representatives at all times, so business continuity isn’t disrupted.

Delay in Submissions Due to Role Issues

Problem: Employer role not approved in time, and submission deadlines (e.g., Form E) are approaching.

Solution:

- Anticipate the role application process. Apply at least two weeks before filing deadlines.

- If approval is delayed, contact LHDN for manual assistance. Keep email or phone confirmation as proof in case of compliance audits.

Employer Tips for Smooth MyTax Role Application

Below are key tips to make the process efficient and reduce risks:

Prepare Documents in Advance

Don’t wait until the last minute. Employers should keep digital copies (PDF or scanned images) of the company registration certificate, list of directors, and authorisation letters ready. Preparing these early prevents rejections caused by incomplete uploads.

Match Records With LHDN

One of the most common causes of rejection is mismatched information. Make sure that the employer number (E Number), business registration details, and director names match exactly with what is registered with SSM and recognised in LHDN’s system. Even small errors in spelling or outdated director lists can cause issues.

Apply Early. Don’t Wait Until Filing Season

Since LHDN may take up to five working days to approve, employers should apply at least two weeks before filing deadlines. This avoids last-minute stress, especially before big deadlines like Form E (31 March) or year-end reporting.

Appoint a Backup Representative

To ensure business continuity, always appoint at least one Employer Representative in addition to the Employer role holder. This is crucial if the main person is on leave, resigns, or faces login issues. Companies that rely only on one person risk missing critical submission deadlines.

Keep Access Updated After Staff Changes

Whenever HR staff or admin representatives resign, employers must immediately revoke their access in the portal. Leaving access active for ex-staff not only creates compliance risks but also potential data security issues.

Secure Login Details

The Employer and Employer Representative roles give access to sensitive company tax information. Employers should:

- Keep login details confidential.

- Change passwords regularly.

- Limit access to authorised personnel only.

Document Internal Processes

Employers should create a simple internal SOP (standard operating procedure) on MyTax role management:

- Who is responsible for applying or updating roles.

- How to track application status.

- What steps to take in case of delays or rejections.

Having a clear SOP avoids confusion and ensures smooth role management even if staff turnover happens.

FAQs

What is MyTax used for?

Employers use MyTax to file mandatory forms like Form E, CP8D, and CP22 online.

Who can apply for roles in MyTax?

Directors of private companies apply first for the Director role; sole proprietors and public bodies apply directly for Employer. HR staff can be appointed as Employer Representatives.

How long does approval take?

Up to five working days. Status will change from “New” to “Accepted” once processed.

Can multiple roles be assigned to one user?

Yes. A user may hold Employer for one entity and also act as an Employer Representative elsewhere.

How do we remove a role if an employee resigns?

Employers can log in and cancel a representative’s access in the Appointment of Representative tab.

Do foreign companies in Malaysia need to apply?

Yes, if they are registered as employers with LHDN. The same role application process applies.

Need Staff Urgently? We’ve Got You Covered!

With AJobThing, access a massive pool of jobseekers and hire the right talent faster than ever.

Get started today and fill your vacancies with ease!

Read More:

- MyKasih Programme Malaysia: Employer’s Guide to Supporting Employees

- Duit dalam MyKad Explained: Myths, Truth & Safety Tips

- Sumbangan Asas Rahmah (SARA) 2025: Eligibility, Payment Date, & How to Check

- EPF Withdrawal for Education: Employer’s Guide to Supporting Staff

- Akaun Fleksibel (EPF’s New Account Structure): Key Info for Employers

- i-Saraan KWSP 2025: Benefits and How To Register

- LHDN e-Invoice Guideline for Malaysian Employers and What They Must Know

- STR 2025: Payment Schedule, Benefits, and Other Important Things

- KWSP Call Centre for Employers: Contact Numbers, Services, and Support Channels

- KWSP Application Deadline 2025 for Employers in Malaysia

- 10 Types of SOCSO Claims in Malaysia (Jenis-jenis Tuntutan PERKESO)

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- What is SST 8%? Types, How to Charge, and SST Filling

- Pelepasan Cukai 2024/2025: Tax Reliefs Guide for Employers