Skim Jaminan Kredit Perumahan (SJKP): How Malaysians Can Buy a Home Without a Payslip

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowBuying a home in Malaysia often starts with one big challenge: getting a housing loan approved. For many Malaysians who do not receive a fixed monthly pay slip, this step can feel almost impossible. Skim Jaminan Kredit Perumahan (SJKP) was introduced to bridge that gap by helping first-time home buyers access financing even without traditional income documents.

What Is Skim Jaminan Kredit Perumahan (SJKP)?

Skim Jaminan Kredit Perumahan (SJKP) is a Malaysian government housing financing scheme designed to help eligible individuals purchase their first home. The scheme focuses on Malaysians who have the ability to repay monthly instalments but face difficulties qualifying for housing loans due to the absence of a fixed payslip.

Under SJKP, the government provides a financing guarantee to participating banks. This guarantee allows banks to approve home financing for applicants with non-fixed or irregular income, as long as repayment capacity and other eligibility requirements are met.

SJKP financing is provided in collaboration with licensed financial institutions and applies strictly to residential properties intended for owner-occupation.

Why SJKP Was Introduced

A large segment of the Malaysian workforce earns income outside the traditional salaried structure. While many of them can afford monthly housing instalments, they are often excluded from standard housing loans because their income does not come with payslips or fixed employment contracts.

SJKP was introduced to address this structural gap by:

-

Recognising alternative income sources

-

Allowing flexible income assessment

-

Supporting home ownership among non-traditional workers

Through this approach, the scheme helps broaden access to home financing without lowering repayment discipline or financial responsibility.

Who Can Benefit From SJKP

SJKP is designed for Malaysians who earn income in non-conventional ways. This includes individuals whose income may be stable but not documented through monthly payslips.

Groups that commonly benefit from SJKP include:

-

Gig workers and platform workers

-

Freelancers and independent contractors

-

Small business owners

-

Hawkers and traders

-

Farmers and fishermen

-

Contract or commission-based workers

Salaried employees may also apply if they meet the eligibility requirements, particularly first-time home buyer status.

Types of SJKP Schemes

SJKP is offered through more than one scheme to cater to different financing needs. Each scheme comes with its own financing limit and coverage, while maintaining the same objective of supporting first-time home buyers.

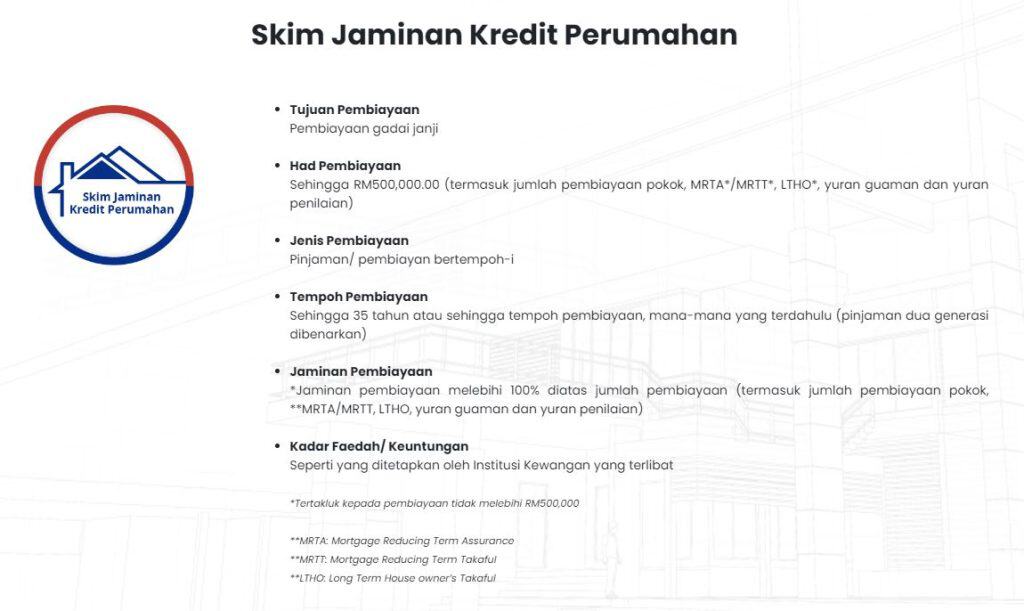

Skim Jaminan Kredit Perumahan (SJKP)

This is the standard SJKP scheme available to first-time home buyers. Key features include:

-

Financing of up to RM500,000

-

Financing of up to 100% or more (subject to bank assessment)

-

Maximum repayment tenure of up to 35 years

-

Applicable only for residential properties

The scheme focuses on enabling home purchase without requiring a down payment, subject to bank approval.

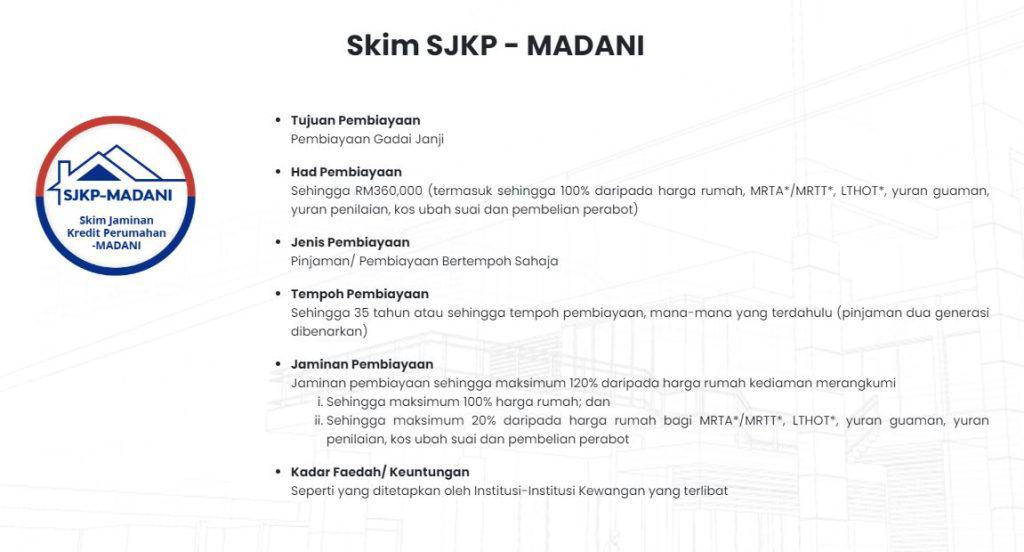

Skim Jaminan Kredit Perumahan - MADANI

SJKP-MADANI is a targeted enhancement under the MADANI framework. Under this scheme:

-

Financing is available up to RM360,000

-

Financing may cover additional costs such as:

-

MRTA or MRTT

-

Legal fees

-

Valuation fees

-

Renovation or basic furniture (within approved limits)

-

-

Government financing guarantee may reach up to 120%

This option is intended to reduce upfront financial barriers for eligible buyers.

Key Benefits of SJKP

SJKP offers several advantages that make home ownership more accessible:

-

No payslip required

-

No deposit required in most cases

-

Flexible income assessment

-

Government-backed financing guarantee

-

Available through multiple participating banks

-

Designed specifically for first-time home buyers

These benefits help shift the focus from fixed documentation to actual repayment capability.

Eligibility Criteria

To apply for SJKP, applicants must meet the following general requirements:

-

Malaysian citizen

-

Aged 18 years and above

-

First-time home buyer

-

Fixed or non-fixed income accepted

-

Debt Service Ratio (DSR) generally not exceeding 65%

-

Acceptable CCRIS credit record

-

Property must be purchased for own stay, not investment

Final eligibility is subject to assessment by the participating bank.

Types of Properties Allowed

SJKP financing is limited to residential properties, including:

-

New residential houses

-

Completed residential units

-

Subsale properties

-

Auction properties

-

Low- and medium-cost homes

The scheme does not apply to refinancing or commercial properties.

How to Check SJKP Eligibility

Before applying, individuals are encouraged to conduct a simple self-assessment:

-

Are you a Malaysian citizen?

-

Is this your first home purchase?

-

Can you afford the estimated monthly instalment?

Eligibility can also be checked through official SJKP channels or during consultation with participating banks.

Documents Required

Although SJKP does not require a payslip, applicants still need to prepare supporting documents to demonstrate income consistency and property details during the financing assessment process.

Property Documents

-

Booking receipt

-

Draft Sale and Purchase Agreement

Income Documents

-

Six months of bank statements

-

EPF statement (if available)

-

Income tax records (if available)

Supporting Documents

-

Copy of MyKad

-

Employer confirmation letter (if applicable)

-

Business licence or permit (if applicable)

-

Income declaration letter certified by authorised officers

Banks may request additional documents depending on individual circumstances.

Repayment Period

SJKP financing offers:

-

Repayment tenure of up to 35 years

-

Or until the borrower reaches 65 years of age

Approval remains subject to bank assessment and risk evaluation.

How to Apply for SJKP 2026

Applications are made through participating financial institutions, not directly to SJKP. The general process includes:

-

Choose a suitable residential property

-

Prepare required documents

-

Obtain income confirmation if needed

-

Apply through a participating bank

-

Bank submits the application under the SJKP framework

Approval timelines and conditions may vary between banks.

(1).jpg)

List of Participating Banks

SJKP is available through selected financial institutions, including:

-

Maybank / Maybank Islamic

-

Bank Islam

-

Bank Rakyat

-

BSN

-

RHB Islamic

-

MBSB Bank

-

Agrobank

-

Hong Leong Bank / Islamic

-

Alliance Bank / Islamic

-

AmBank Islamic

Applicants are encouraged to compare offers and terms across banks.

Important Reminders

Before applying for SJKP, it helps to be clear about how the scheme works so you can avoid unnecessary costs, delays, or scams.

SJKP Does Not Appoint Agents or Representatives

If someone claims they can “help you secure approval” on behalf of SJKP, treat it as a red flag.

SJKP Does Not Charge Any Processing Fees to Borrowers

You should not be asked to pay a “registration fee” or “SJKP processing fee” directly to SJKP.

Applications Must Be Made Through Participating Banks Only

You do not apply directly to SJKP. The participating financial institution will process and submit it under the SJKP framework.

Approval is Still Based on a Bank Assessment

SJKP provides a guarantee mechanism, but the bank still evaluates repayment ability, credit record, and documentation.

Use Official Channels for Verification

If you are unsure about eligibility, documents, or procedures, check via official SJKP references or speak directly with a participating bank branch.

Stay Alert for Scams

Avoid sharing personal details or making payments to individuals who promise guaranteed approval, faster processing, or “special access” to SJKP.

Official Reference & Contact

For the latest and official information:

-

Official hotline and email channels

-

Tel: 03-2096 5000

-

Fax: 03-2096 5090

-

Emaill: enquiry@sjkp.com.my

-

-

Physical office addresses listed by the programme: Tingkat 12, Bangunan Setia 1, 15 Lorong Dungun,Bukit Damansara, 50490 Kuala Lumpur.

FAQs

What is Skim Jaminan Kredit Perumahan (SJKP)?

It is a government-backed housing financing scheme for first-time home buyers, especially those without fixed pay slips.

Can I buy a house without a payslip under SJKP?

Yes. SJKP allows flexible income assessment without requiring a monthly payslip.

Who is eligible to apply for SJKP in Malaysia?

Malaysian citizens who are first-time home buyers and meet repayment capacity requirements.

Is SJKP only for self-employed or gig workers?

No. Salaried employees may also apply if they meet the eligibility criteria.

What is the maximum house price allowed under SJKP?

Up to RM500,000 under SJKP, and up to RM360,000 under SJKP-MADANI.

Do I need to pay a deposit under SJKP?

In most cases, no deposit is required, subject to bank approval.

Is SJKP only for first-time home buyers?

Yes. The scheme is strictly for first-time residential property purchases.

Your Next Hire Could be Just a Click Away!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best.

Post your job ads today & simplify your hiring process!

Read More:

-

Penyata KWSP: How to Check, Download & Understand Your EPF Statement

-

SST 2026 Malaysia: Key Changes, Tax Rates and Employer Compliance Guide

-

EIS Contribution Table 2026 Malaysia – Rates, Salary Ceiling and Calculation Guide

-

Semakan SARA 2026: Recipient Categories, Payment Dates and How to Use MyKad

-

SARA 2026 Malaysia: Eligibility, Payment Dates, Amount & MyKad Usage

-

Malaysia Employment Pass Salary Increase 2026 Takes Effect on 1 June

-

Malaysia Income Tax Exemption 2025 Guide for Employers & HR | e-Filling 2026

-

LHDN Stamp Duty Requirements for Business and Employment Documents in Malaysia

-

What Employers Must Submit Through LHDN e-Filing in Malaysia

-

i-Topup KWSP: Contribution Rules & Guide for Employers in Malaysia

-

i-Simpan EPF (KWSP): How It Works & How Employees Can Contribute

-

EPF (KWSP) New Updates in January 2026 for Employers & HR in Malaysia

-

Penamaan KWSP in Malaysia: Legal Implications, Process, and HR’s Role

-

i-Sayang KWSP Guide: Requirements, Benefits & How to Register

-

EPF, SOCSO, EIS, and LHDN Employer Registration Guide for Malaysian Companies

- Cara Kira Potongan KWSP dan SOCSO | How to Calculate EPF and SOCSO Deductions in Malaysia

-

Deadlines & Penalties for SOCSO, EPF, PCB/Form E, and HRD Levy in Malaysia

-

EPF Withdrawal for Education: Employer’s Guide to Supporting Staff

-

Akaun Fleksibel (EPF’s New Account Structure): Key Info for Employers

-

KWSP Call Centre for Employers: Contact Numbers, Services, and Support Channels