Extended SST Rates (6%–8%) Effective 1 July: Why and What to Prepare

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowStarting 1 July 2025, Malaysia’s updated Sales and Service Tax (SST) rates came into effect. While essential goods like food and medicine remain tax-free, many business-related services are now taxed at 6% or 8%, such as construction, leasing, training, and healthcare.

It does not affect those who sell the things included in SST only, but also impacts those who buy them, especially for companies. Your HR, finance, and operations teams need to review contracts, adjust budgets, and update internal systems.

In this article, we will share more about the new SST rates and further details on what your company can do.

Quick Overview: What Changed?

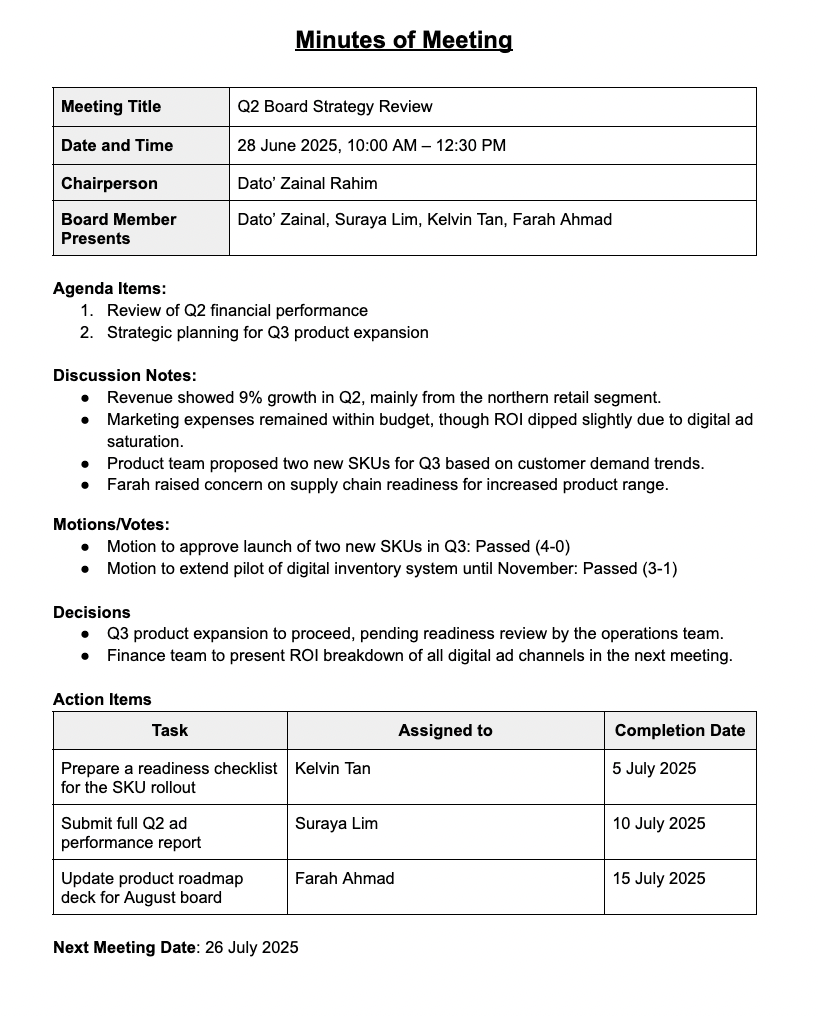

|

Category |

Old Rate/Status |

New Rate/Status (1 July 2025) |

|---|---|---|

|

Essential goods (e.g. rice, milk, meds) |

0% |

0% (unchanged) |

|

Imported fruits (e.g. apples, dates) |

Taxable |

Exempted |

|

Selected premium goods (e.g. salmon, oils) |

0% |

5% |

|

Luxury goods (e.g. antique art) |

0% or 5% |

10% |

|

Rental & leasing services |

8% (threshold RM500k) |

8% (threshold raised to RM1 million) |

|

Financial services (fee or commission) |

8% (threshold RM500k) |

8% (threshold raised to RM1 million) |

|

Construction services |

Not previously taxed |

6% SST, threshold RM1.5 million |

|

Private healthcare (for non-citizens) |

Not previously taxed |

6% SST, threshold RM1.5 million |

|

High-end education (private) |

Not previously taxed |

6% SST on tuition above RM60k/year |

|

Beauty services (e.g. facial, haircuts) |

Proposed 8% |

Cancelled, excluded from SST expansion |

Is your business ready for new SST rates?

Malaysia’s updated Sales and Service Tax (SST) system officially took effect. This update was announced in Belanjawan 2024 and now affects a wider range of goods and services.

For Sales Tax:

-

Essential goods remain at 0%, including items like basic food, baby formula, and medicines. These are not taxed to protect everyday consumers.

-

Some goods are now taxed at 5%. This applies to certain non-essential or mid-range items, like processed foods or household electronics.

-

Luxury items continue to be taxed at 10%, including high-end imported goods such as expensive watches, jewellery, and designer products.

For Service Tax:

-

The service tax rate is now between 6% and 8%, depending on the type of service.

-

The scope of services has also expanded to include:

-

Leasing and rental

-

Construction services

-

Financial services

-

Private healthcare

-

Education services

-

Beauty and personal care

-

-

Some services still have exemptions or lower rates, especially when used by Malaysian citizens or small businesses, depending on the service type and provider.

These new rates are already in effect from 1 July 2025. All businesses offering taxable goods or services must begin charging and reporting under the new structure.

However, the government has given businesses until 31 December 2025 to fully comply without facing penalties. This gives employers some time to adjust contracts, systems, and budgeting

What is SST (Sales and Service Tax)?

With the new SST Malaysia 2025 rates starting on 1 July, it’s important to understand what cukai SST means.

Sales and Service Tax (SST) is a tax you pay when buying certain goods or services. It replaced GST in 2018 and has two parts:

-

Sales Tax is charged on some goods when they are made in Malaysia or brought in from other countries. Only the manufacturer or importer pays this tax. It is not charged again after that.

-

Service Tax is charged on certain services. These include food and drinks, hotels, transport, and consulting. From 2025, it now also covers construction, leasing, and private healthcare.

SST is simpler than the old GST because it is not charged at every step. But businesses cannot claim back the tax they pay, so it can increase costs.

With the new rates now active, many services are taxed at 6% to 8%. Employers and HR teams should check if their spending — like training, software, or HR services — is affected. If not planned properly, these new cukai SST costs may impact your budget.

Objective of New SST Rates (Cukai SST)

With the new cukai SST rates starting on 1 July 2025, many businesses will see higher costs. Services like construction, equipment rental, office space, staff training, and private healthcare may now include 6% or 8% service tax.

Even if your company doesn’t provide these services, you might pay for them through vendors. This means the extra cost can affect many parts of your business.

Some vendors may increase their prices to cover the new tax. So, it’s important to review your budget, plan your spending, and update contracts if needed.

HR and finance teams should also check costs for staff benefits, training, and outsourced services. These may now be taxed under SST Malaysia 2025, even if they weren’t before.

Also, update your systems like invoices, accounting software, and forms to use the correct SST rates. The government allows changes to be made without penalty until 31 December 2025 — so this is a good time to get ready.

When is the Effective Date of the New SST Rates?

The new Sales and Service Tax (SST) structure officially started on 1 July 2025.

From this date onward, all businesses involved in taxable goods or services must follow the updated SST rates and expanded service categories that has mentioned above.

While the new rates are already in effect, the government has provided a transition period until 31 December 2025. During this time, companies can update their systems and processes without facing penalties for late compliance.

Latest Press Release by the Ministry of Finance Malaysia

Press Release 9 June 2025: “Revised SST Rates & Service Scope Effective 1 July 2025”

The press release confirms the government’s decision to proceed with targeted SST adjustments:

-

Sales Tax remains 0% for essential items (food, medicine, school books, etc.).

-

Selected premium goods (e.g. king crab, salmon, imported fruits, essential oils, truffle) now taxed at 5% (previously 0%).

-

Luxury goods (e.g. racing bicycles, antique art) now taxed at 10%.

-

Service Tax scope expanded to include six new sectors:

-

Leasing or rental services

-

Construction services

-

Financial services

-

Private healthcare

-

Education (private, high-end)

-

Beauty & wellness (initially included, but later excluded based on June 27 release)

-

.png)

Press Release 27 June 2025: “MOF Adjusts SST Scope After Industry Feedback”

The government reviewed feedback from the public and industry stakeholders on the expanded scope of SST.

Effective 1 July 2025:

-

Selected imported fruits (apples, oranges, mandarin oranges, dates) are exempt from Sales Tax.

-

Everyday essentials (e.g. rice, poultry, eggs, fresh fish, and vegetables) remain exempt from SST.

-

New SST registration threshold for rental and financial services increased from RM500,000 to RM1 million to reduce the burden on small businesses.

-

Beauty services like manicure, facial, and hairdressing are excluded from the expanded Service Tax scope.

.png)

.png)

.png)

.png)

.png)

.png)

Expansion of Service Tax Scope 2025 (Effective 1 July 2025)

More types of services are now subject to tax, even if they weren’t taxed before. Here are the key sectors now included under Service Tax:

1. Rental or Leasing Services

If your company rents office space, equipment, or vehicles, these transactions may now come with an extra 8% service tax, unless they fall under a specific exemption. Check the leasing contracts and see how costs will change.

2. Construction Work Services

This applies to construction, renovation, and maintenance work. If your company owns property, renovates office spaces, or hires contractors, these costs may now include service tax and affect facilities budgets and vendor pricing.

3. Financial Services

Some financial services are now taxable, such as processing fees, investment advisory, or loan-related charges. These matters if your business deals with financing, accounting, or employee benefits through financial institutions.

4. Healthcare Services

Private medical services may now be taxed, depending on the type of service and whether it's provided to Malaysian citizens. If your HR teams are managing health benefits or wellness claims for employees, it can affect the costs of coverage and insurance options.

5. Educational Services

Training programmes, certification courses, or corporate upskilling services may now carry service tax, especially if offered by private or for-profit providers, which affects L&D budgets and external training agreements.

6. Beauty and Personal Care Services

Services like corporate grooming, wellness retreats, or employee wellness programmes may now include tax if provided by certain vendors. Companies that offer these perks should check whether service tax is included in vendor pricing.

New Sales Tax Rates 2025 in Malaysia

Sales tax is now divided into three main rates depending on the type of goods:

0% Sales Tax: Essential Goods

Items that people rely on every day are not taxed, such as basic food, baby formula, and common medicines. The government keeps these goods at a 0% rate to avoid raising the cost of living, especially for lower-income households.

5% Sales Tax: Non-Essential, Selected Goods

Some items that are considered optional or moderately priced now have a 5% sales tax, including things like certain processed foods, household appliances, or mid-range electronics. These goods are not luxury items, but also not daily necessities.

10% Sales Tax: Luxury and High-End Goods

Goods that are more expensive or seen as luxury items continue to be taxed at 10%, including high-end watches, designer handbags, imported cosmetics, and other premium products.

Who Will Be Affected?

The updated SST not only affects companies that sell taxable goods or services only. It also impacts businesses that buy them. If your company works with vendors, suppliers, or service providers in the newly taxed sectors, you’ll likely see changes in your cost structure.

So, here are the groups that are affected by the change:

Businesses Offering Taxable Goods and Services

If your company sells products that fall under the 5% or 10% sales tax categories or provides services now included under the expanded SST list you’ll need to register (or update your registration) with the Royal Malaysian Customs Department and start charging the correct tax rate to your clients.

Employers in Service based Industries

Companies in recruitment, logistics, warehousing, delivery, hospitality, professional consulting, healthcare, or HR outsourcing are especially affected. Many of these services now fall under the 6% or 8% service tax bracket, which means both providers and clients in these industries will need to update contracts, invoicing, and pricing.

HR and Finance Teams Managing Outsourced Services

Even if you’re not a service provider, if you buy services like employee wellness packages, learning platforms, payroll software, or business leasing, you may start seeing SST included in your bills. These teams will need to monitor charges, review agreements, and check whether vendors are now SST-registered.

SMEs Working with Third-Party Vendors

Small and medium-sized enterprises that rely on external suppliers for training, equipment, marketing, or project work should also take note. Even if your own business is not taxable, you may still be paying for taxable services, and that affects your bottom line.

Action Steps for Employers and HR Teams

With the new SST structure in place, HR and business leaders need to act quickly to reduce confusion and avoid unexpected costs. Even if your company isn’t directly selling taxable goods or services, you might still be affected through vendor relationships or service subscriptions.

Check out the action steps for you below:

Audit All Contracts and Supplier Services

Start by reviewing your current list of vendors, especially those related to training, leasing, outsourcing, and healthcare. Check which services now fall under the SST scope and whether the vendor is charging service tax. Flag any contracts that need updates or discussion.

Update Your Financial Systems and Tools

Your accounting and procurement systems should reflect the correct SST codes and new tax rates to avoid reporting issues later and make it easier to track tax-related expenses across departments.

Communicate Across Departments

Let your finance, procurement, and HR teams know about the SST updates, especially if they’re handling payments or contracts. Clear communication helps reduce mistakes when dealing with invoices, pricing, and approval workflows.

Review Your Budgets and Forecasts

If services or goods you regularly use are now more expensive due to SST, you may need to adjust your department’s budget. Forecasting for Q3 and Q4 should take these cost increases into account.

Use the Grace Period to Get Everything in Order

The government has provided a transition window until 31 December 2025. During this period, businesses can make changes without facing penalties. Update internal processes, train your team, and reach out to vendors for clarification.

What to Monitor Next

The SST update is still evolving, and businesses need to stay informed to avoid falling behind. You need to pay attention to these things:

Official Updates from the Ministry of Finance and Royal Malaysian Customs

Regularly check the MySST portal and official press releases for any new guidelines, tax rulings, or changes to scope.

Sector-Specific Guidance

Industry groups like FMM (Federation of Malaysian Manufacturers) or advisory firms like KPMG may release transition guides. These resources often provide detailed checklists or examples tailored to specific industries.

Threshold Rules for Small Businesses and Individual Providers

Not all services are taxed the same way. Some small businesses or individual service providers may be exempted from charging SST if they don’t reach a certain income threshold.

In other cases, services like education, healthcare, or personal care may be taxed at a lower rate, especially when provided to Malaysian citizens.

Employers should stay updated on any new rules or exemptions that apply to SMEs, expat services, or sectors like healthcare and education, as these may affect how much SST you’re charged.

Any Changes in Government Tax Plans

Keep an eye out for any adjustments from Bank Negara Malaysia or announcements in upcoming national budgets. These may include SST rate changes, new exemptions, or policy shifts affecting future tax planning.

- Updates on thresholds or exemptions for SMEs, expatriates, and healthcare/education.

Source:

-

Guidelines for the Transition of Sales Tax Rate Changes (PDF)

-

Sales Tax Rate Revision & Service Tax Scope Expansion (MoF press citation)

FAQs

Is SST applicable to recruitment services now?

Yes. If you are using a third-party recruitment agency or hiring platform, their services may now fall under the expanded service tax list. Check if they’re charging 6% or 8% SST.

How do I check if my business is affected by the new SST scope?

Refer to the MySST portal or consult a licensed tax agent. You can also compare your service categories with the updated list of taxable services released by the Royal Malaysian Customs.

Are HR outsourcing services subject to the new 8% SST?

They could be. If you use vendors for payroll, training, or benefits administration, these services may now be taxed depending on the provider and scope. Review your contracts to confirm.

What if my business wasn’t previously registered for SST?

If your services now fall under the expanded list and meet the registration threshold, you must register with the Royal Malaysian Customs. Use the grace period (until 31 Dec 2025) to complete this without penalty.

Where can I download the full list of taxable services and goods?

You can get the full list from the official MySST website or through the latest press release by the Ministry of Finance Malaysia. Look for documents titled "Perkhidmatan Bercukai Tambahan 2025" or “Senarai Barang Cukai Jualan.”

Looking to Build a Stronger Team?

Let AJobThing help you find the right people who will grow with your company.

Post your job ads and connect with top talent across platforms like Maukerja, Ricebowl, and Epicareer today.

Read More:

- Ringgit Malaysia Climbs as U.S. Dollar Weakens, Why It Matters for HR Planning

- GST vs SST in Malaysia: Key Differences Every Employer Should Know

- Employment Pass (EP) Malaysia: Application, Renewal, and Employer Duties

- Professional Visit Pass (PVP) Malaysia: Process, Rules, and Tips for Hiring Short-Term Foreign Workers

- Is Your Staff Leaving Early Without Telling You? Here's What to Do

- What is Visit Pass Temporary Employment (Temporary Employment Pass)?

- What is Work Remotely Meaning? Definition, Types, and Tips

- What Does Legally Authorized to Work Mean?

- How to Register a Business in Malaysia: Step-by-Step Guide (2025)

- What is SST 8%? Types, How to Charge, and SST Filling

- Pelepasan Cukai 2024/2025: Tax Reliefs Guide for Employers

- What is Work Life Balance? Benefits, Factors, and How to

- 75 Company Gift Ideas for Employee Resignation

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- 10 Exit Interview Questions to Ask Employees

- How to Submit CP22 for New Employees in Malaysia in LHDN MyTax Portal