STR 2025: Payment Schedule, Benefits, and Other Important Things

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowSTR 2025 has already begun rolling out, but not everyone is clear on when the next phase will arrive or how to check their application status. If you're an employer or HR manager, check this guide to help you keep track of STR updates so you can assist your staff, especially those depending on it for household budgeting.

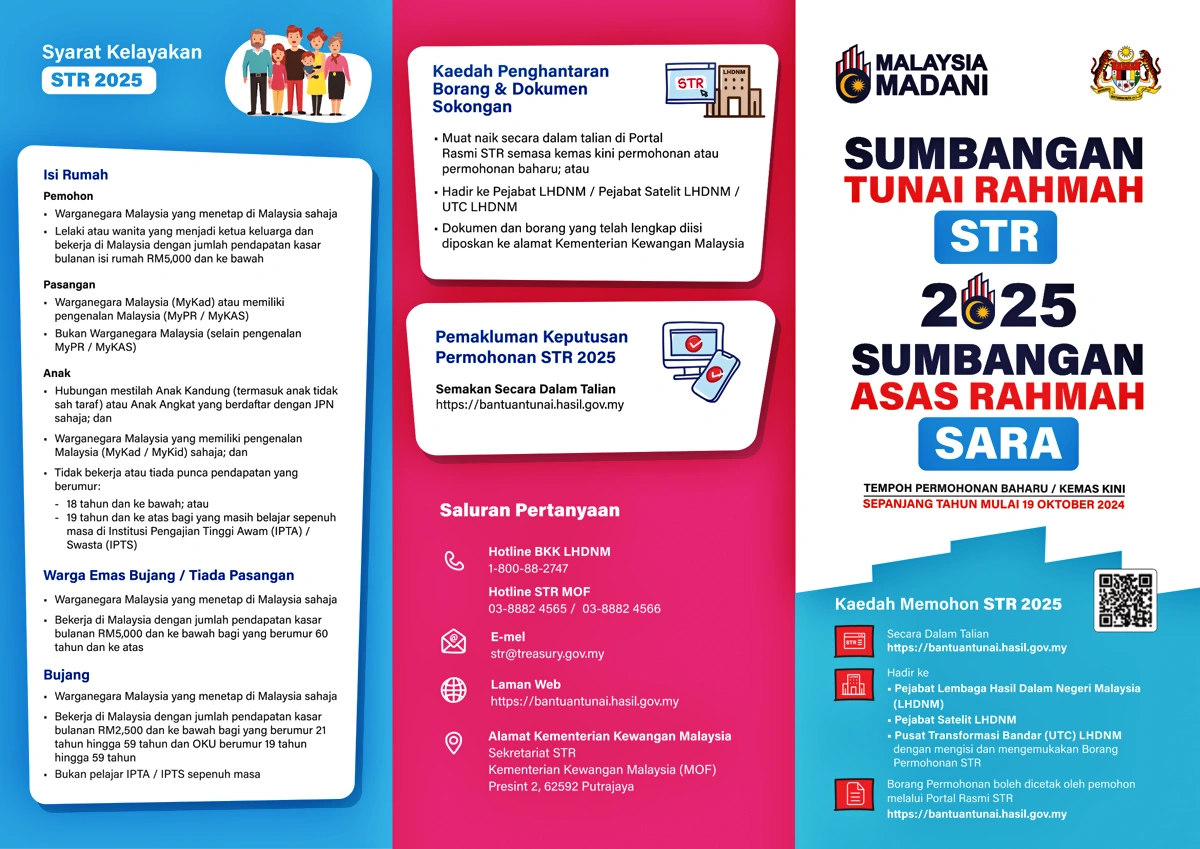

What is STR 2025?

STR stands for Sumbangan Tunai Rahmah, a government cash aid programme introduced under Budget 2025. It aims to help eligible B40 and M40 households manage their living expenses. The support is distributed in multiple phases and varies based on income and household size.

This initiative replaces previous schemes like BPR and BKC, and it continues to be managed by the Lembaga Hasil Dalam Negeri (LHDN) via the official portal: https://bantuantunai.hasil.gov.my.

STR 2025 Payment Schedule

STR is released in four payment phases throughout the year:

-

Phase 1: 22 January 2025 (already completed)

-

Phase 2: 24 March 2025 (released before Hari Raya)

-

Phase 3: Expected late July or early August 2025

-

Phase 4: Expected November 2025

Each phase is automatically credited based on eligibility status. If your employees ask when the next payment is due, these are the reference dates to share.

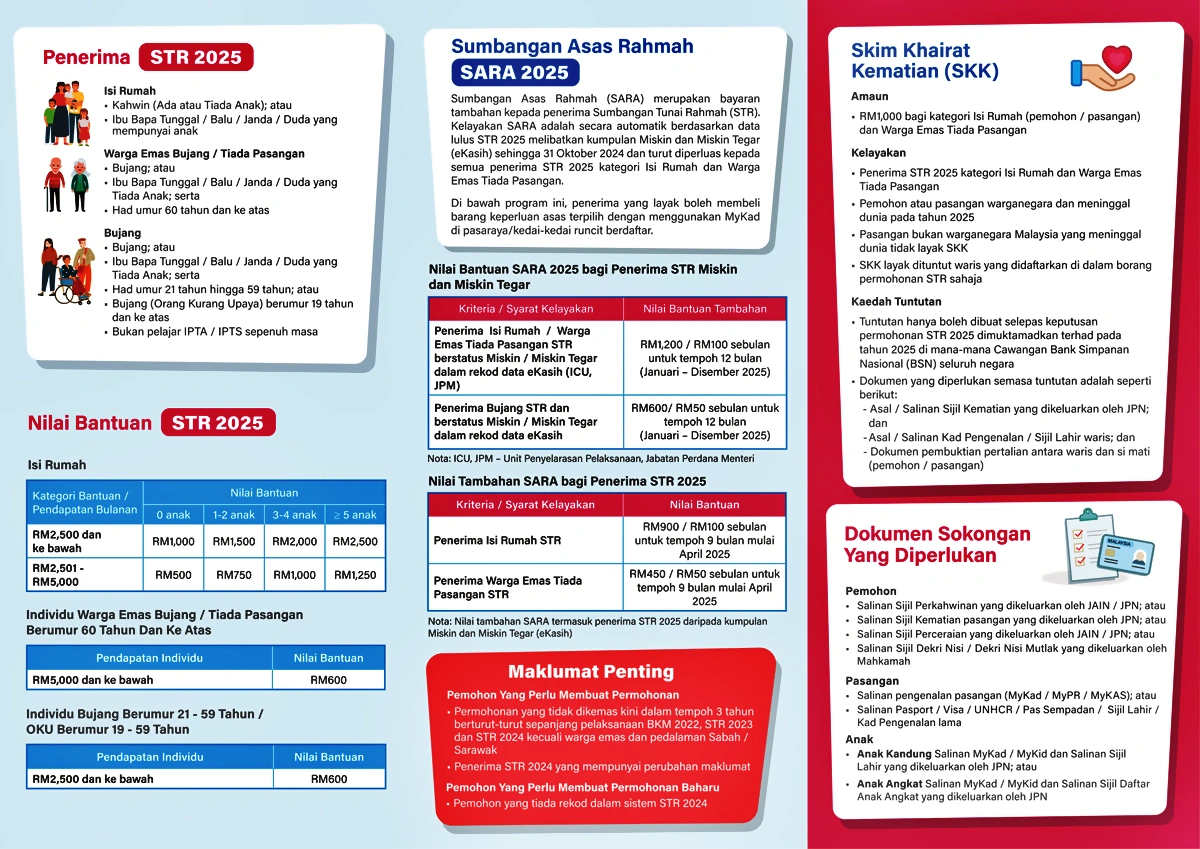

How Much Will Be Received?

The amount depends on household income, marital status, and dependents:

B40 households (Income ≤ RM2,500)

|

Number of Children |

Phase 1 |

Phase 2 |

Phase 3 |

Phase 4 |

Total |

|

0 (No children) |

RM500 |

RM150 |

RM150 |

RM200 |

RM1,000 |

|

1–2 children |

RM500 |

RM300 |

RM350 |

RM350 |

RM1,500 |

|

3–4 children |

RM500 |

RM500 |

RM500 |

RM500 |

RM2,000 |

|

5+ children |

RM500 |

RM650 |

RM650 |

RM700 |

RM2,500 |

M40 households (Income RM2,501–5,000)

|

Number of Children |

Phase 1 |

Phase 2 |

Phase 3 |

Phase 4 |

Total |

|

0 (No children) |

RM150 |

RM150 |

RM100 |

RM100 |

RM500 |

|

1–2 children |

RM150 |

RM200 |

RM200 |

RM200 |

RM750 |

|

3–4 children |

RM250 |

RM250 |

RM250 |

RM250 |

RM1,000 |

|

5+ children |

RM300 |

RM300 |

RM300 |

RM350 |

RM1,250 |

Singles and OKU (Income ≤ RM2,500)

|

Phase 1 |

Phase 2 |

Phase 3 |

Phase 4 |

Total |

|

RM150 |

RM150 |

RM150 |

RM150 |

RM600 |

Elderly without spouse (60 years and above, income ≤ RM5,000)

|

Phase 1 |

Phase 2 |

Phase 3 |

Phase 4 |

Total |

|

RM150 |

RM150 |

RM150 |

RM150 |

RM600 |

How STR Is Paid

Most recipients will receive the money through direct credit to their bank account.

For those without a bank account or if the crediting fails, payment will be made via cash collection at Bank Simpanan Nasional (BSN) branches. These cases are automatically flagged by LHDN, and beneficiaries can check their payment method on the MySTR portal.

How to Check Your STR Status

Employees can check their STR application and payment status on the MySTR portal. Here’s what to do:

-

Log in using their MyKad number and password (or MyDigital ID).

-

Check if their application was approved and when each payment phase is scheduled.

-

Reset passwords via security questions if forgotten.

Important Deadlines

To qualify for Phase 3 payments, employees must submit or update their STR application by 30 June 2025.

Employers can support their employees by reminding them to update their household or banking details before this date. This is especially helpful for new parents, those who recently got married, or anyone with a change in income.

What to Do If STR Is Not Credited

Some employees might say they haven’t received their STR even though their application was approved. In such cases, advise them to:

-

Check if their bank details were updated and accurate.

-

Confirm if their application was approved before the relevant phase began. Late applications may only start receiving aid from Phase 3 onwards.

-

Submit a correction or appeal via the MySTR portal.

Why It’s Important for HR & Employers

You might wonder why employers should care about government cash aid. Below are the reasons:

-

Employees plan their expenses around STR dates. Sharing accurate information reduces stress and absenteeism.

-

HR teams can support by spreading awareness, for example, reminding them of key dates and where to log in.

-

When a company cares about financial well-being, it creates trust and loyalty among workers, especially in the B40 category.

-

Employees who receive STR may request leave to collect cash at BSN. It’s useful to plan manpower around these periods.

FAQ

Q1: When will Phase 3 & 4 STR payments be made?

Estimated for late July–early August, and November 2025. LHDN will confirm the exact dates.

Q2: Do employees need to reapply for each phase?

No. If their application was approved early in the year, payments continue automatically across all phases. New applicants will start receiving aid from the phase after approval.

Q3: What if an employee has no bank account?

They will receive STR in cash at BSN, but must bring their IC and supporting documents. If a family member is collecting on their behalf (as a registered waris), additional proof is required.

Q4: Can STR recipients check payment status without logging in?

No. All details are shown in the MySTR portal, which requires login using MyKad and password or MyDigital ID.

Q5: Is there a hotline for STR questions?

Yes. LHDN has provided public guidance via the STR portal and FAQs. Encourage employees to use official sources only.

Your Next Hire Could be Just a Click Away!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best while staying compliant with LHDN regulations.

Post your job ads today & simplify your hiring process!

Read More:

- KWSP Call Centre for Employers: Contact Numbers, Services, and Support Channels

- KWSP Application Deadline 2025 for Employers in Malaysia

- 10 Types of SOCSO Claims in Malaysia (Jenis-jenis Tuntutan PERKESO)

- Extended SST Rates (6%–8%) Effective 1 July: Why and What to Prepare

- Kenapa SOCSO Ditolak dalam Gaji? | Why is SOCSO Deducted from Salary?

- Full LHDN Stamp Duty Guide on Malaysia Employment Contract [2025]: Penalties, Exemptions, & More

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- What is SST 8%? Types, How to Charge, and SST Filling

- Pelepasan Cukai 2024/2025: Tax Reliefs Guide for Employers

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- How to Submit CP22 for New Employees in Malaysia in LHDN MyTax Portal