What is Payslip: Definition, How To, Example, and Free Templates

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowEmployees receive their salary every month, but there are always deductions.

To maintain transparency, employers need to provide a payslip that details the salary breakdown for each employee.

A payslip helps prevent confusion and avoids conflicts between employers and employees.

It also gives employees peace of mind, knowing exactly how their earnings are calculated.

This article will explain the purpose of a payslip and how to create one. Keep reading to learn more.

What is a Payslip?

A payslip is a document that shows an employee’s earnings and deductions for a specific period.

It is given by the employer to help employees understand their salary details.

In Malaysia, providing payslips is required by law under the Employment Act 1955.

Payslips ensure that employees get clear information about their wages, allowances, and deductions.

Why are Payslips Important for Employees and Employers?

There are several important payslips existence both for employers and employees:

-

For legal requirements, employers must give payslips to employees, showing a breakdown of their salary, allowances, and deductions.

-

Payslips can give transparency, so employees can track their income, taxes, and other deductions, which helps them manage their finances better.

-

Payslips are often required for tax filing, loan applications, or renting a house.

-

Employers can keep organized payroll records, which is useful for audits and resolving disputes.

What to Include in a Payslip

A good payslip should contain important details, including:

-

Employee details: Name, job title, department, and employee ID.

-

Pay period: The start and end dates for the salary period.

-

Gross salary: Total earnings before any deductions.

-

Allowances and bonuses: Extra payments such as travel allowances, performance bonuses, or overtime pay.

-

Deductions: Contributions to EPF, SOCSO, EIS, taxes, and other deductions like loan repayments.

-

Net salary: The final amount paid after deductions.

-

Employer contributions: The employer’s share of EPF, SOCSO, EIS, and other benefits.

-

Leave balances: Leave entitlements and any unused leave.

-

Other benefits: Medical benefits, meal allowances, or other perks.

How to Customize a Payslip Template for Your Organization

A payslip should be clear, easy to read, and include all important salary details.

Employers need to customize their payslip templates to meet both legal requirements and their company’s payroll structure.

Below are key steps to create a well-structured payslip for employees.

Understanding your company’s payroll policies and legal obligations

Before making changes to a payslip template, employers must follow Malaysia’s payroll laws and company policies.

A payslip must include important details like gross salary, deductions (EPF, SOCSO, EIS, and taxes), net salary, and employer contributions.

If any required information is missing, it could lead to legal issues or payroll disputes.

Each company also has its own payroll policies, such as how bonuses, overtime, and allowances are handled.

Employers should make sure their payslip template matches these rules so that employees receive accurate salary details.

Customizing the payslip format to suit your business needs

Every business is different, so a standard payslip format may not work for everyone.

Employers should include all necessary salary details based on how their company operates.

For example, companies that offer performance-based pay should include a section for commissions and bonuses.

Businesses that have overtime pay should add a clear breakdown of overtime hours and rates.

If employees receive allowances for travel, meals, or remote work, these should be listed separately.

By customizing the payslip to reflect the company’s salary structure, employers can help employees understand how their pay is calculated and avoid misunderstandings.

Creating a professional and user-friendly layout

A payslip should be structured in a way that employees can quickly understand.

Employers should divide the payslip into sections that have been mentioned in What to Include in a Payslip Template section.

A clean and organized layout makes it easier for employees to check their salary details.

Employers should use a simple format with clear headings, spacing, and alignment to improve readability.

Customizing for specific pay cycles (weekly, monthly, bi-weekly)

Companies follow different payroll schedules, such as weekly, bi-weekly, or monthly payments.

The payslip template should match the company’s pay cycle to avoid confusion.

For example, companies that pay weekly wages should include a breakdown of hours worked and hourly rates.

Employers that pay monthly salaries may focus more on deductions and employer contributions.

If a company hires contract or freelance workers, they may need a separate payslip template with different payment terms.

5 Payslip Template Examples

Below are some templates that you can use from Payroll Panda and Paysliper:

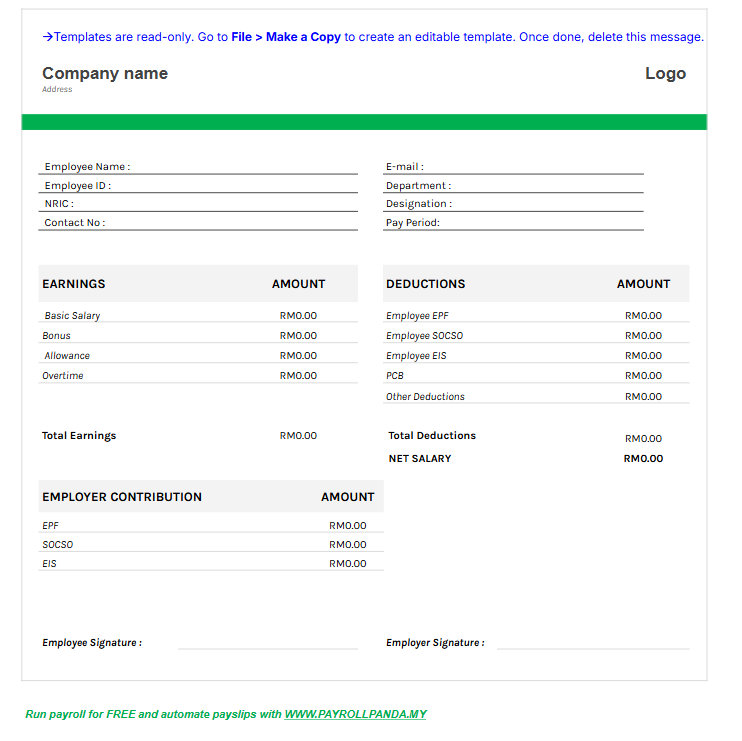

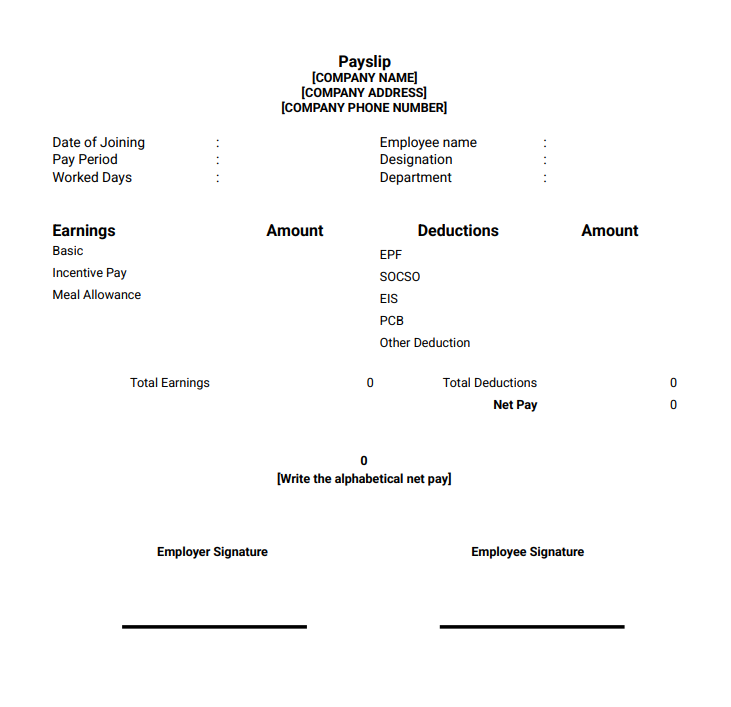

Simple Payslip Template 1

Download Spreadsheet Here: Template 1

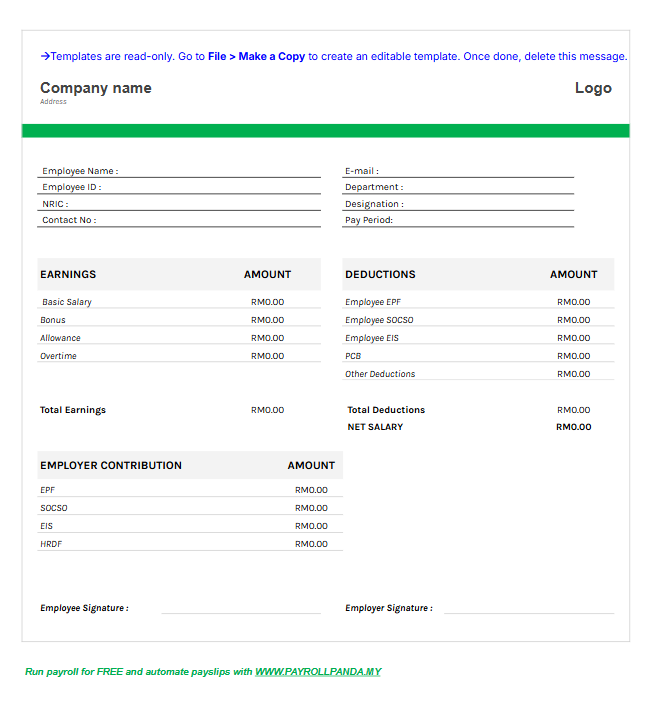

Payslip Template 2 with HRDF

Download Spreadsheet Here: Template 2 with HRDF

Payslip Template 3 with Signature

Download Spreadsheet Here: Template 3

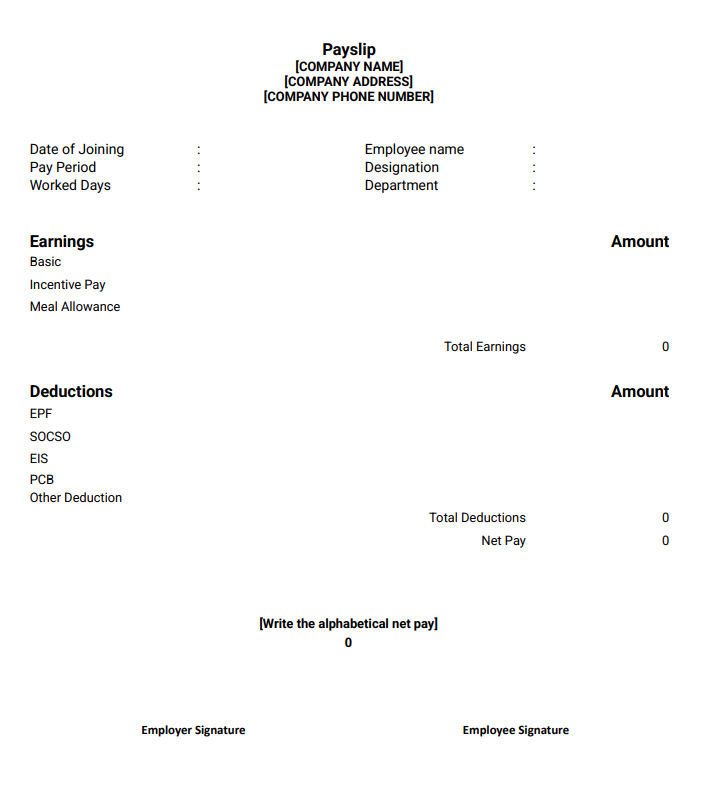

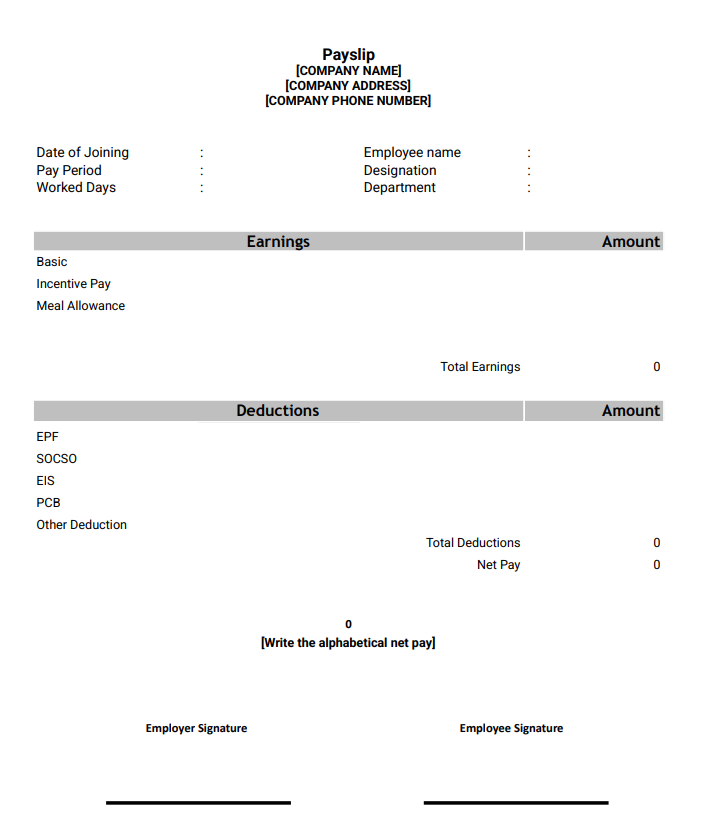

Different Layout Payslip Template 4 with Signature

Download Spreadsheet Here: Template 4

Simple Payslip Template 5 with Signature

Download Spreadsheet Here: Template 5

How to Use a Payslip Template Effectively

1. Generate and Distribute Payslips on Time

Employees expect to receive their payslips on or before payday.

Late payslips can cause confusion and delay financial planning for employees.

To avoid issues, employers should have a fixed schedule for distributing payslips.

Businesses using payroll software can automate payslip generation, making sure employees get their payslips without delay.

2. Communicate with Employees About Their Payslips

Employees should know how to read their payslips and check if all salary details are correct.

Employers should encourage them to review their payslips for any errors, such as incorrect deductions or missing allowances.

If employees find mistakes, they should have a clear process to report issues and get them corrected.

Having an HR or payroll contact available to explain salary details can help employees feel more confident about their earnings.

3. Use Payslips as a Tool for Record-Keeping

Payslips serve as official proof of salary payments and deductions. Employers should store all payslips properly for:

-

Audits and financial reports

-

Fixing payroll mistakes or disputes

-

Employee use in loan applications, tax filings, or EPF contributions

Businesses using digital payroll systems can store payslips electronically, making it easier to access past records when needed.

Are you hiring in 2025?

Start your hiring journey with Ajobthing today! Post your job ads, connect with top talents, and streamline your recruitment process with our easy-to-use platform.

Read More:

- Salary Slip Malaysia: Format, Sample, and Free Download

- 16 Employee Self-Evaluation Sample Questions & Answers for Employers

- 120 Performance Appraisal Employee Final Comments & Reviews

- How to Calculate Pay for Working on Christmas Day in Malaysia

- 10 Simple Christmas Office Decoration Ideas for Employers

- 20 Quick Ideas to Celebrate Christmas and New Year in Office

- Long Weekend 2025 List in Malaysia

- Public Holidays in Malaysia for 2025: Complete List and Dates

- Work Anniversary Wishes and Messages to Employee

- 50 Farewell Messages for Your Employees

- Guide to Leave Entitlements in Malaysia under Employment Act