Employee Income Tax Number in Malaysia: How to Check and Register for It

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowEvery employee who earns income in Malaysia must have a tax number. The tax number is used for monthly PCB deductions and tax reporting. If the number is missing or incorrect, it can cause issues with LHDN. That’s why HR and payroll teams need to know how to check, register, and manage employee income tax numbers the right way.

We will share with you things you need to know about the employee income tax number and how to check if an employee already has the tax number.

What is an Employee Income Tax Number?

An employee income tax number is a unique identifier assigned to every individual registered as a taxpayer in Malaysia. This number is issued by LHDN (Lembaga Hasil Dalam Negeri), also known as the Inland Revenue Board of Malaysia.

The tax number is used to track and record an individual’s income, tax deductions, and payments throughout their working life. The number is needed to process monthly PCB deductions in a company.

Why Employers Must Ensure Employees Have a Tax Number

Every time you process payroll for an employee who qualifies for PCB, that deduction must be reported using the correct income tax number. Without it, the submission may be incomplete or invalid.

Having a valid tax number for each employee means:

-

You can carry out monthly PCB deductions as required by LHDN.

-

Your company is aligned with income tax regulations.

-

You reduce the risk of penalties due to incorrect or missing tax submissions.

-

Your employees won’t face tax reporting issues later on.

This is why collecting and verifying an employee's tax number should be part of the onboarding process, especially before the first salary payment.

How to Check an Employee’s Tax Number

If you’re not sure whether an employee already has a tax number, there are a few ways to check:

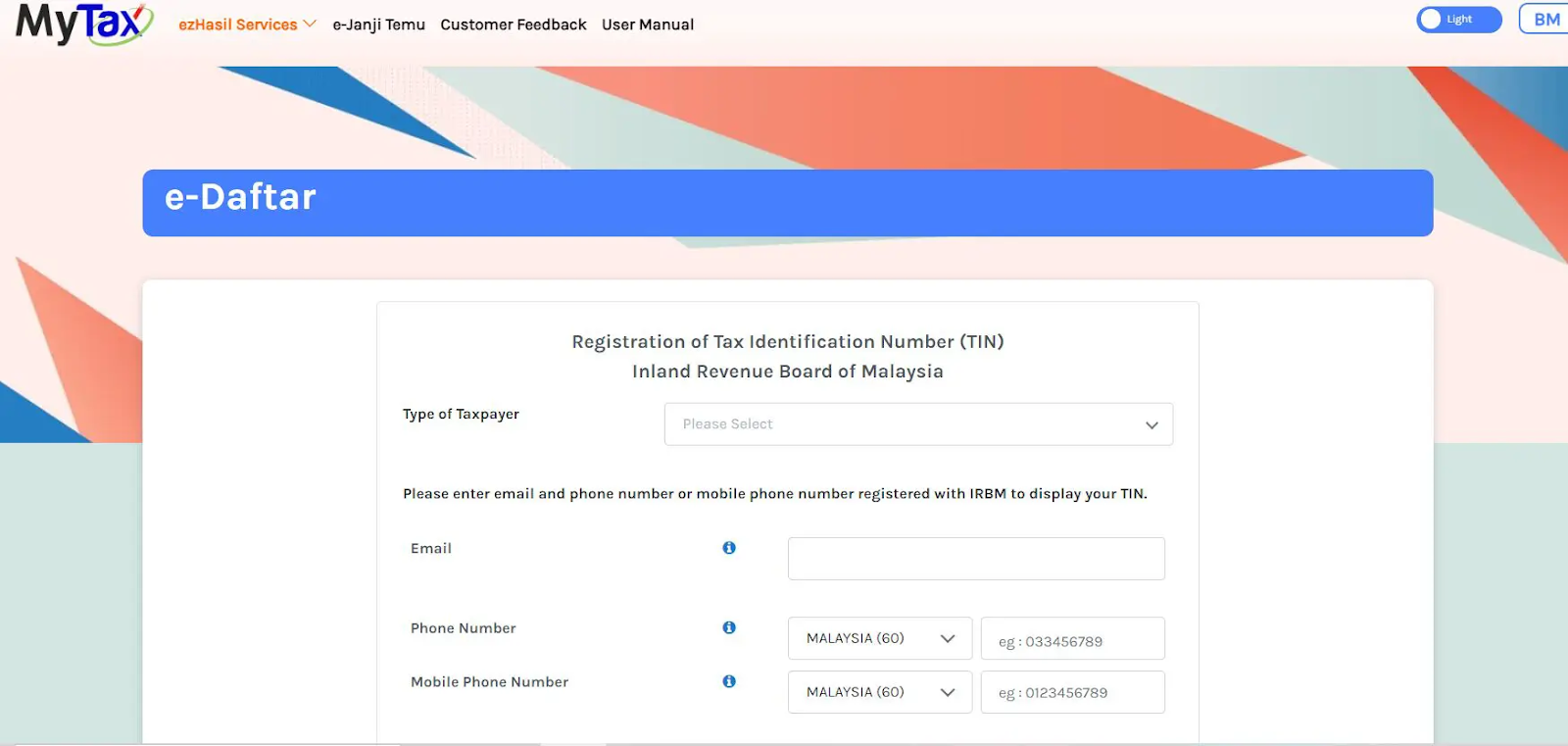

1. Use the MyTax Portal

.png)

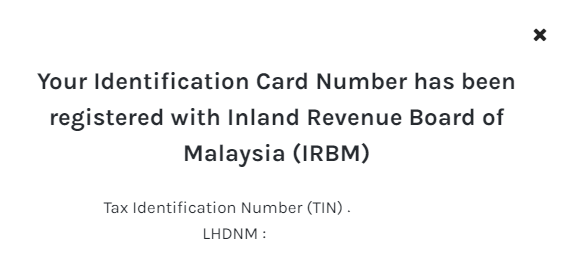

Visit https://mytax.hasil.gov.my and go to the e-Daftar section. You’ll need to enter the employee’s personal details (e.g. full name, IC number). If the person is already registered, their tax number will appear.

2. HASiL Live Chat

Through the LHDN website, use the live chat service. You’ll need to verify your identity and provide employee information to the officer.

3. Call the LHDN Contact Centre

You can call the Hasil Care Line at 03-8911 1000 (or 603-8911 1100 for overseas). Be ready with employee details for verification.

4. Visit a Nearby LHDN Branch

If needed, you or the employee can go to the nearest LHDN office for direct help.

How to Register for an Income Tax Number (If Employee Doesn’t Have One)

Some employees, especially fresh graduates or foreign workers, may not yet have a tax number. In that case, employers should assist or guide them to register one.

Online Registration via e-Daftar

-

Go to MyTax

-

Select e-Daftar

-

Choose Individual as the type of taxpayer

-

Fill in the form and upload supporting documents

Required documents include:

-

NRIC or passport copy

-

Employment offer letter or employer’s confirmation letter

-

Basic employment details (position, salary, start date)

Alternatively, registration can be done at any LHDN branch by submitting the same documents.

Employer’s Role in Reporting Employee Tax Information

Once the employee has a tax number, employers must:

-

Submit the CP22 form to LHDN for new employees as an official notice that the person has started working.

-

Start deducting PCB using the employee’s correct income tax number.

-

Update the company’s payroll system with the tax number to avoid errors.

Late or missing CP22 submissions may result in delays in tax record updates, and that can impact the employee’s tax filing later on.

Integrating Tax Numbers with Payroll Systems

After the tax number is confirmed or registered, make sure your payroll system is updated. Payroll software or PCB files submitted to LHDN should reflect the accurate tax number for each employee.

Failing to update this information can cause:

-

Rejection of monthly PCB files

-

Tax mismatches in the employee’s personal tax record

-

Manual correction tasks later during the audit or EA form preparation

To avoid repeated issues, HR and payroll staff should double-check that the tax number is present before every PCB submission.

What Happens If There’s No Tax Number?

If you process payroll for an employee without a valid tax number, several problems may arise:

-

LHDN may reject the monthly PCB submission

-

Your company may be flagged for incorrect tax reporting

-

The employee may face complications during yearly tax filing

-

In some cases, there may be penalties or notices issued by LHDN

Data Privacy and Handling of Tax Numbers

Because income tax numbers are personal and linked to sensitive data, they must be stored and handled carefully.

Employers should:

-

Store tax numbers in secure, password-protected systems

-

Restrict access to only authorised HR or payroll personnel

-

Avoid sharing tax information via email or unsecured channels

By doing this, your company stays compliant with the Personal Data Protection Act (PDPA) and protects employees from identity risks.

FAQ

How do I check if an employee already has a tax number?

Visit https://mytax.hasil.gov.my, go to e-Daftar, and search using the employee’s IC or passport number.

Can I register a tax number on behalf of the employee?

You can assist, but the registration must use the employee’s personal details. The employee may need to confirm the submission, especially if done online.

What’s the difference between a tax number and a PCB number?

The income tax number is a unique reference from LHDN. PCB (Potongan Cukai Bulanan) refers to the monthly tax deduction process. The tax number is required to process PCB.

Do foreign workers need a tax number in Malaysia?

Yes. Any employee earning taxable income in Malaysia, including foreign workers, must register for a tax number and be included in PCB submissions.

Where can I get the CP22 form?

It is available for download on the LHDN website. HR teams must submit this form when hiring new employees.

What if the tax number is incorrect in the PCB file?

PCB submissions may be rejected. You’ll need to correct the information and resubmit. This may cause delays in tax processing or EA form generation.

Your Next Hire Could be Just a Click Away!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best while staying compliant with LHDN regulations.

Post your job ads today & simplify your hiring process!

Read More:

- How to Get Ready for LHDN e-Invoicing in Your Company

- GST vs SST in Malaysia: Key Differences Every Employer Should Know

- Employment Pass (EP) Malaysia: Application, Renewal, and Employer Duties

- Professional Visit Pass (PVP) Malaysia: Process, Rules, and Tips for Hiring Short-Term Foreign Workers

- Is Your Staff Leaving Early Without Telling You? Here's What to Do

- What is Visit Pass Temporary Employment (Temporary Employment Pass)?

- What is SST 8%? Types, How to Charge, and SST Filling

- Pelepasan Cukai 2024/2025: Tax Reliefs Guide for Employers

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- How to Submit CP22 for New Employees in Malaysia in LHDN MyTax Portal