10 Free Invoice Template Download Malaysia

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowRunning a business today means handling invoices regularly. If you’ve ever spent too much time formatting one from scratch or worried whether your invoice includes the right tax details, you're not alone.

To help you reduce your time in developing an invoice, we give you ready-to-use e-invoice templates in this article. Plus, we’ll explain what makes up a proper Malaysian e-invoice and how to use it effectively.

What is an e-invoice?

An e-invoice, or electronic invoice, is a digital version of a traditional invoice. It contains the same core information, like billing details, payment terms, and tax, but is created and issued electronically. LHDN has started implementing e-invoicing through the MyInvois platform to streamline tax reporting and reduce fraud.

The key difference between a traditional invoice and an e-invoice lies in how it's processed. Traditional invoices may be created in Word or Excel and sent manually. E-invoices, however, are submitted through a system like MyInvois or via API, with automatic validation by LHDN.

Benefits of Using an E-Invoice Template

A good invoice template saves time and helps maintain professionalism. You won’t need to redesign the format every time you issue a new invoice. You can also avoid errors such as wrong tax calculations or inconsistent client details.

Templates also standardise the structure of your invoices. Accountants and auditors are able to understand your documentation clearly during tax season.

What Should Be Included in a Malaysian E-Invoice?

Regardless of format, a proper invoice in Malaysia should include the following elements:

-

Unique Invoice Number

-

Business Name, Address, and Tax Identification Number (TIN)

-

Buyer’s Name and TIN (if available)

-

Description of Goods or Services

-

Quantity, Unit Price, and Discount (if applicable)

-

Subtotal and Tax Breakdown (e.g. SST at 6%)

-

Total Invoice Amount

-

Payment Terms (due date, bank details, or payment method)

10 Free Downloadable E-Invoice Templates

We’ve prepared ten ready-to-use invoice templates in various formats that suit different industries and business sizes:

-

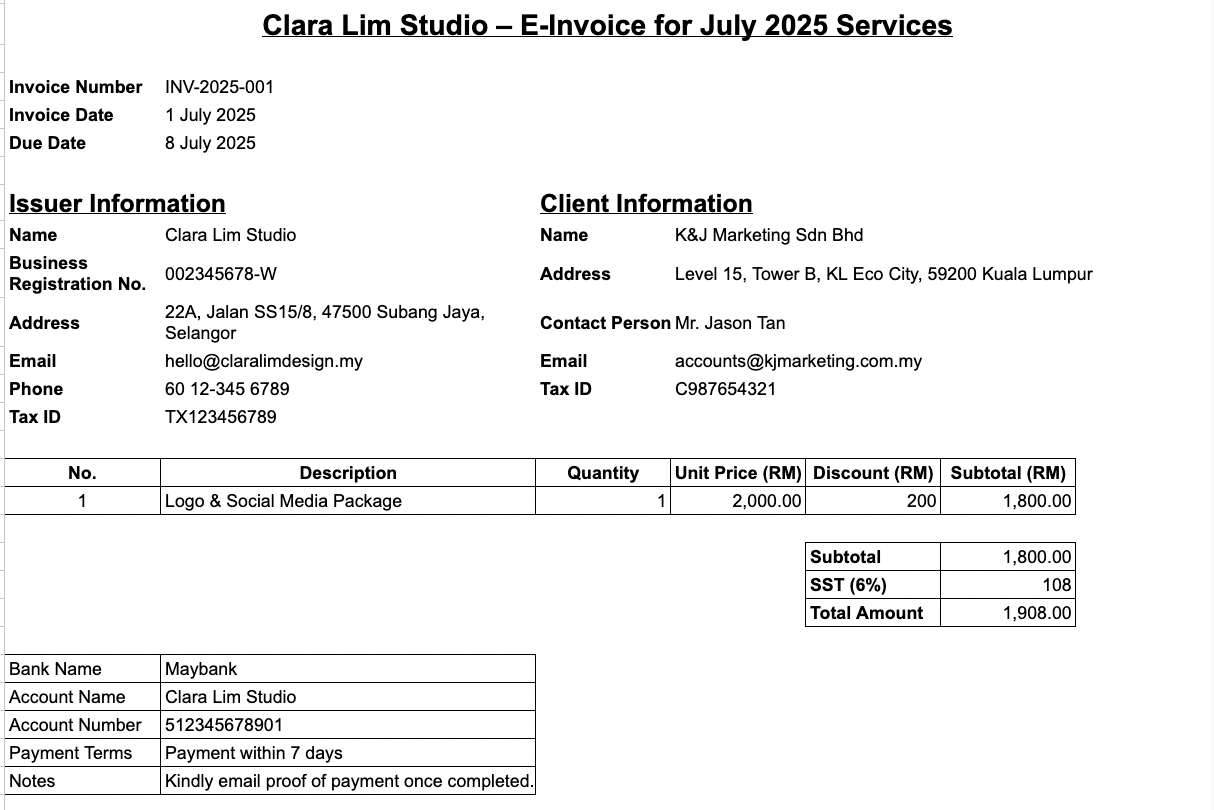

Freelance Graphic Design Services

Free download template:

-

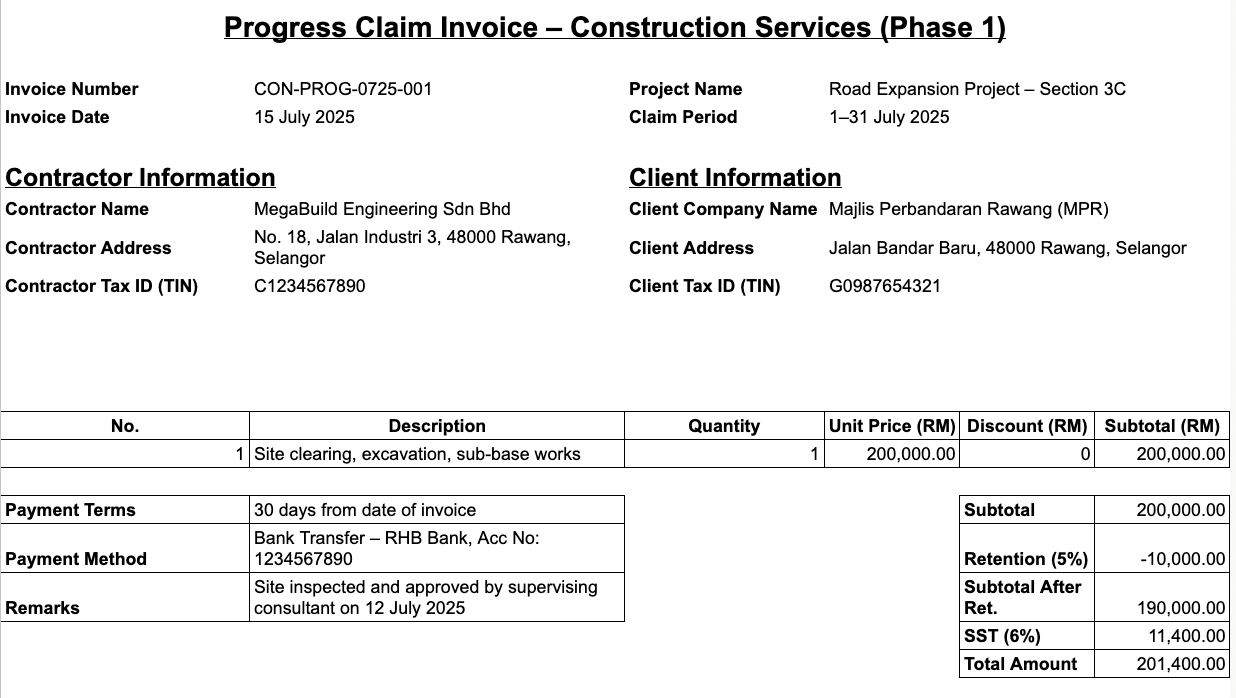

Construction Progress Claim Invoice (Contractor/Project Work)

Free download template:

-

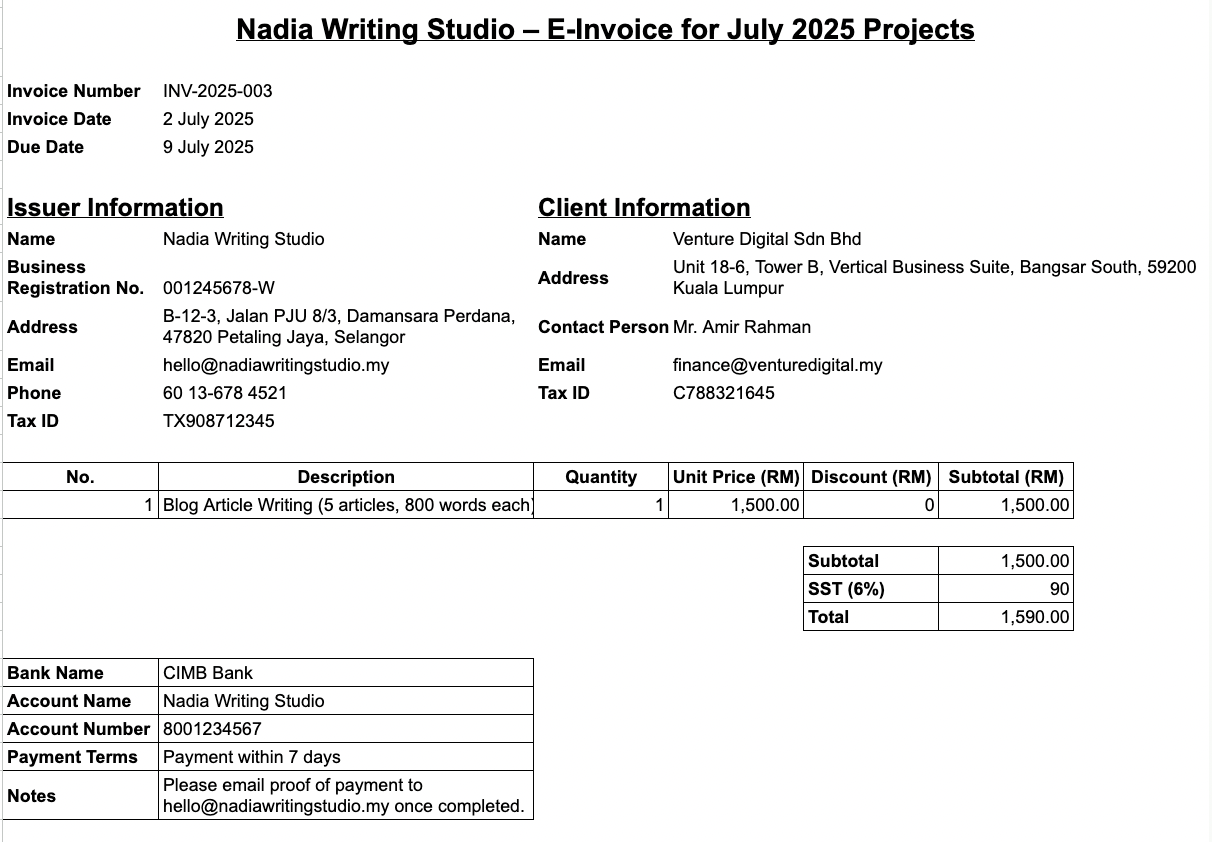

Freelance Writing Services

Free download template:

-

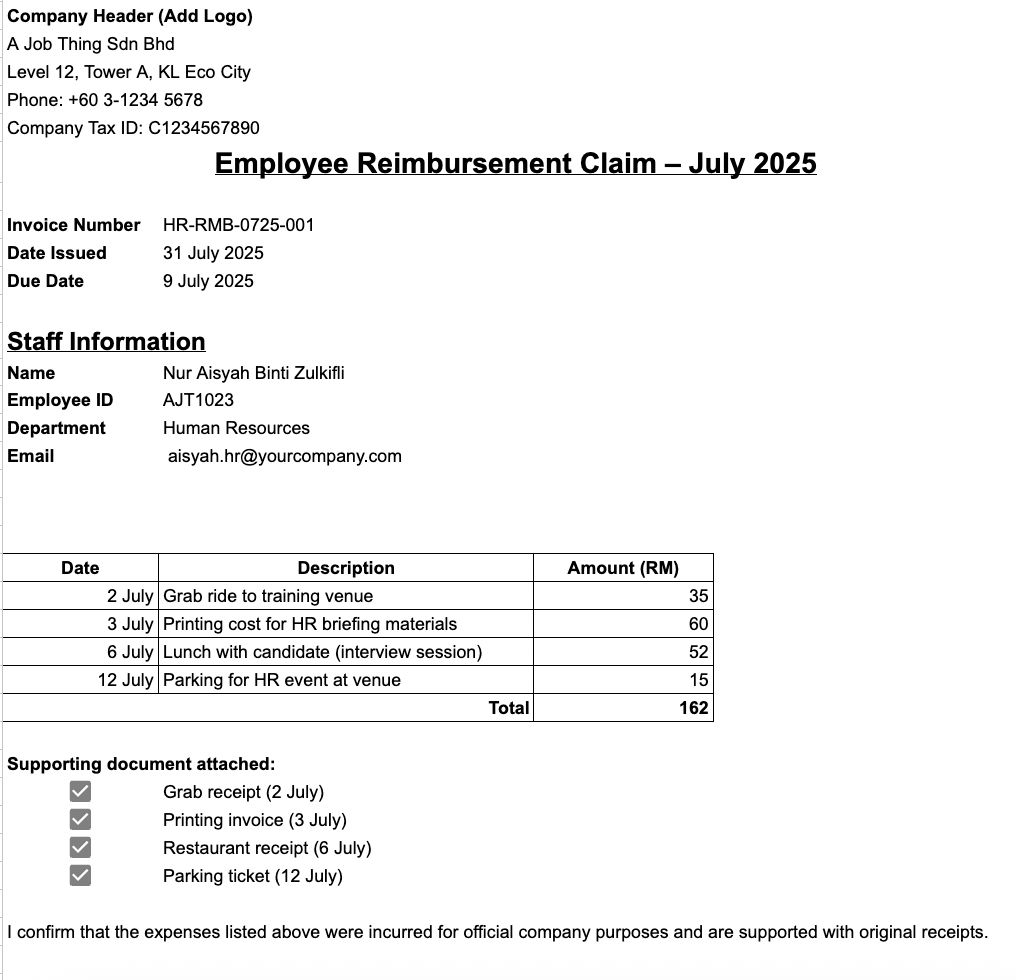

HR Reimbursement Claim Template

Free download template:

-

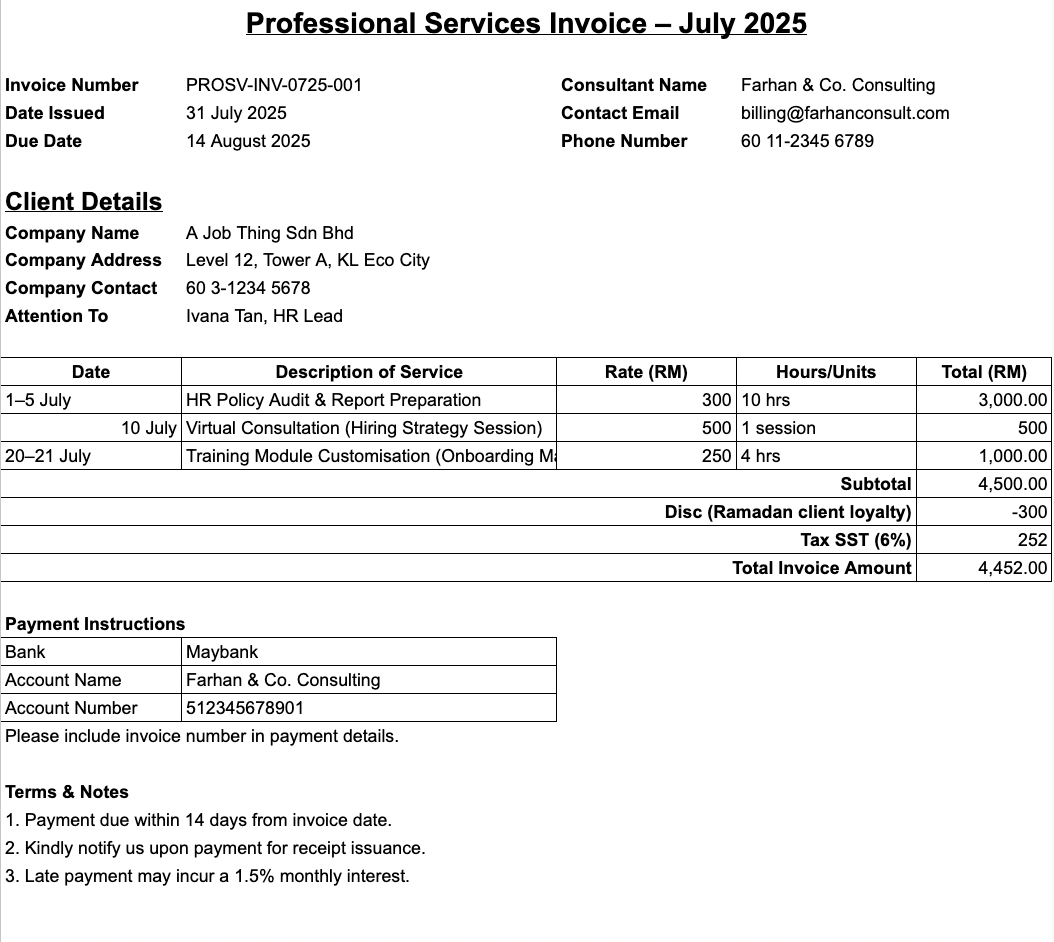

Consultancy/Professional Services Invoice Template

Free download template:

-

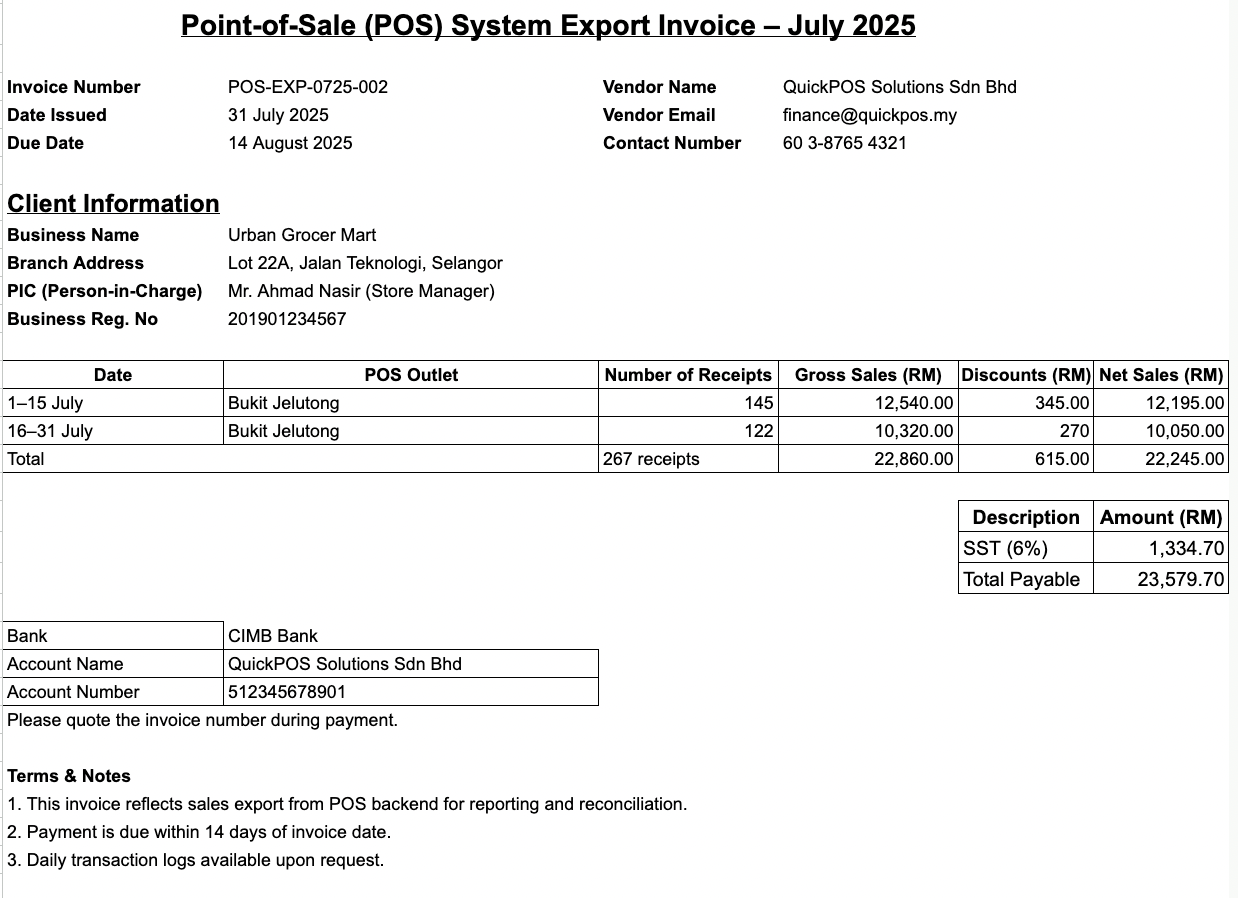

POS System Invoice Export Template

Free download template:

-

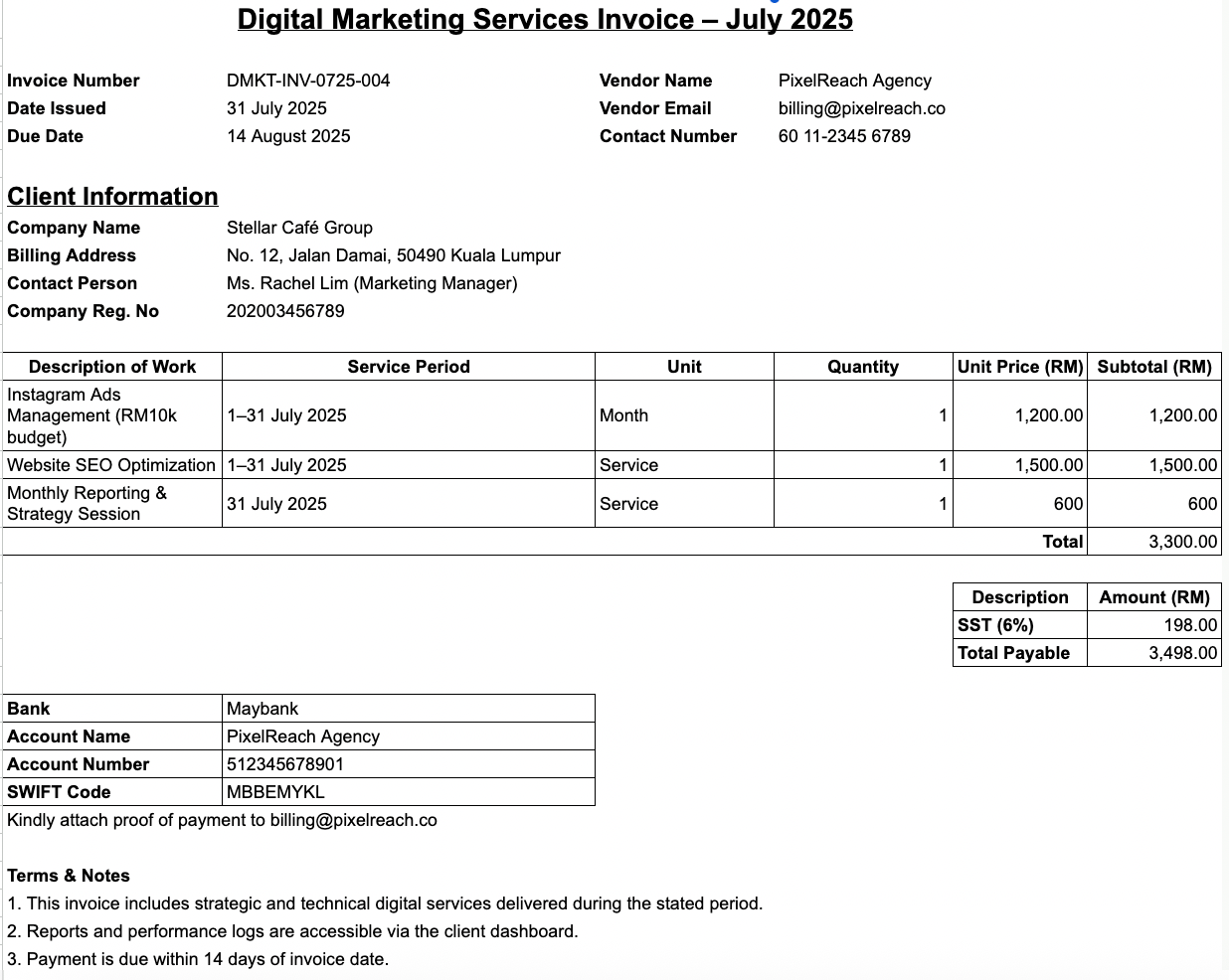

Digital Services Invoice Template

Free download template:

-

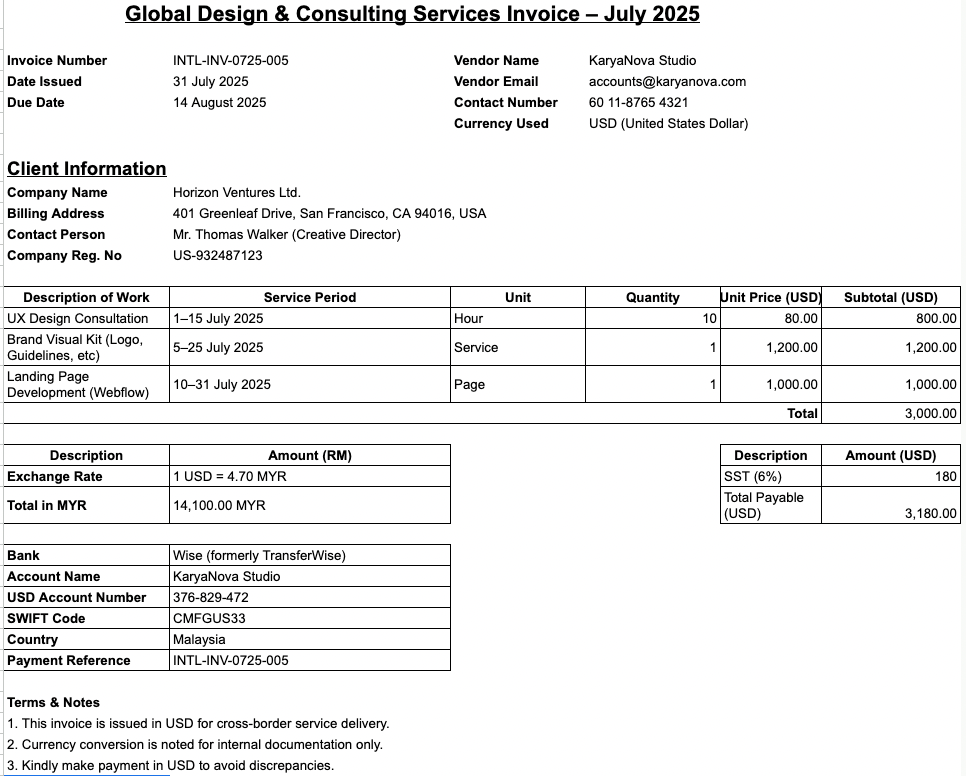

Multi-Currency International Invoice

Free download template:

-

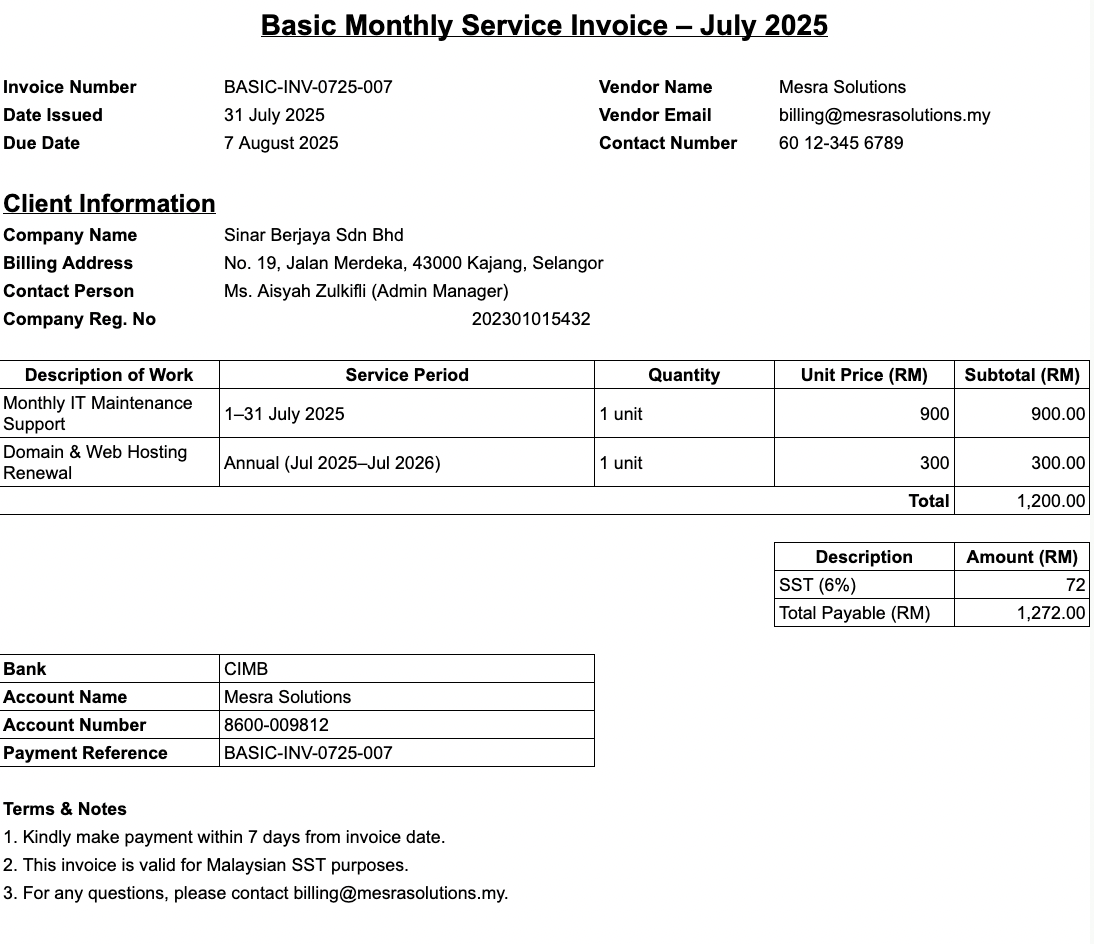

Basic Service Invoice

Free download template:

-

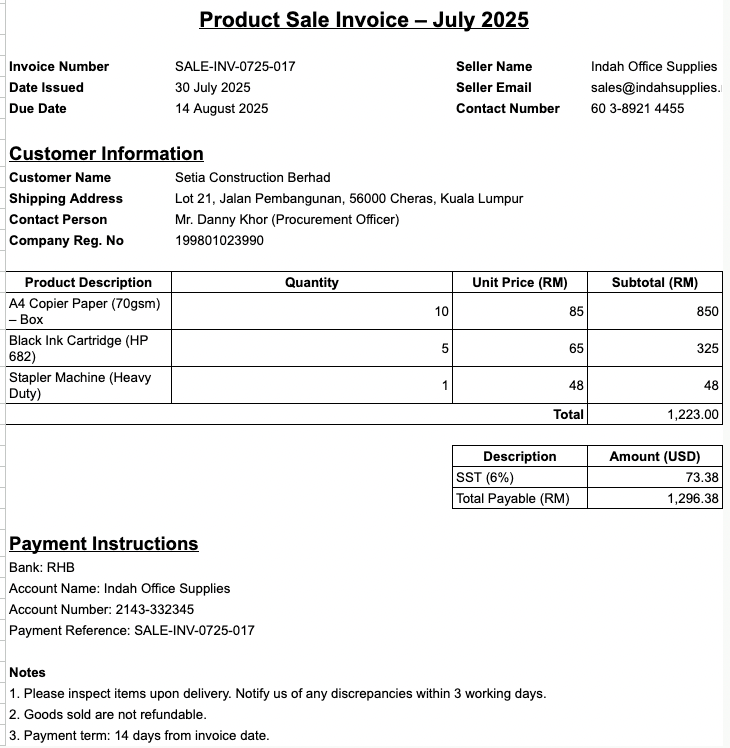

Product Sale Invoice Template

Free download template:

[Click here to download all templates in one folder]

How to Use the E-Invoice Template

Start by choosing the template that fits your business type. Replace the placeholder fields (such as [Your Company Name] or [Client TIN]) with actual details. In Excel or Sheets templates, the total and tax fields are already pre-set to auto-calculate.

Upload your company logo to make the invoice more personalised. To do this, just insert your image file in the designated logo area.

For businesses that regularly issue invoices, you may want to save a copy as your default template and duplicate it every time you need to bill a new client.

Tips for Managing Invoices Efficiently

Good invoicing habits keep your cash flow stable and reduce headaches during tax reporting:

-

Use a consistent numbering system (e.g., INV-2025-001)

-

Keep a digital record of all sent and received invoices

-

Schedule reminders for upcoming or overdue payments

-

Reconcile your invoice data with accounting software regularly

If you’re using platforms like SQL, AutoCount, or cloud HR systems, check if they offer e-invoice generation or integration with LHDN’s MyInvois platform.

FAQs

Q: Is this e-invoice template SST-compliant?

A: Yes. Some templates come with SST fields that you can edit according to the latest SST rate (e.g., 6%).

Q: Do I need LHDN approval to use these e-invoices?

A: If you're not yet required to use MyInvois, you can still use these templates for record-keeping. Once LHDN mandates e-invoicing for your company, you’ll need to issue through the approved system.

Q: Can I send these invoices via email or WhatsApp?

A: Yes. Convert to PDF and send them through your preferred messaging or email platform.

Q: Can freelancers and small businesses use these?

A: Definitely. These templates are made to suit solo business owners, SMEs, and corporate teams.

Q: Can I link this invoice to my accounting system?

A: If your system accepts Excel or CSV uploads, you can import the invoice data easily.

Q: Can I use this invoice format for overseas clients?

A: Yes. Just switch to the appropriate currency and add international payment instructions.

Looking to Build a Stronger Team?

Let AJobThing help you find the right people who will grow with your company.

Post your job ads and connect with top talent across platforms like Maukerja, Ricebowl, and Epicareer today.

Read More:

- How to Write Effective Minutes of Meeting (with Free Templates)

- Onboarding Checklist for New Hires (Free Downloadable Template)

- What is e-Invoice Malaysia? (Free Download Template)

- Employment Induction Checklist to Improve New Hire Experience

- Employment Verification Letter: Importance, How To, Free Downloadable Templates

- How to Write an Employment Letter (With Examples & Tips)

- How to Use a Letter of Indemnity in HR and Employee Requests

- Leave Management System for Malaysian Employers – Track Leave Easily (Free Template)

- How to Create and Use an Appraisal Form in Malaysia (With Templates)

- How to Write a Professional Surat Kenaikan Gaji (with Samples)

- 13 Free HR Templates for Various Activities in the Company

- How to Write an Employer Confirmation Letter (+ Free Samples)

- Salary Calculator for Employers in Malaysia [+FREE Template]

- Free KWSP/EPF Calculator Excel Template for Malaysian Employers

- How to Prepare a Monthly Salary Report in Malaysia (+ Free Templates)