How to Appoint an Intermediary for E-Invoice Submission via MyInvois

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowAs e-Invoicing becomes mandatory for more businesses in Malaysia, many employers are choosing to work with third-party intermediaries to handle submission tasks. These intermediaries, such as accounting firms, ERP vendors, or payroll providers, can help companies submit e-Invoices directly through the MyInvois portal on behalf of the business.

But to do this legally and correctly, you must go through the official process of appointing them via the MyInvois system. Check out this article to find out more about what intermediaries are, how to appoint them, and what responsibilities you still hold as an employer.

What is an Intermediary for E-Invoice Submission?

In the e-Invoice system, an intermediary refers to a third party legally appointed to submit e-Invoices to LHDN on behalf of your company. These are often service providers already handling financial or HR tasks for your business, such as:

-

Accounting and tax consultants

-

ERP or accounting software vendors

-

Payroll outsourcing companies

Businesses may appoint intermediaries for convenience, to save time, or because they do not have the in-house expertise to manage e-Invoicing themselves.

Who Can Be Appointed as an Intermediary?

According to LHDN guidelines, any party appointed as an intermediary must:

-

Have a valid Tax Identification Number (TIN)

-

Be officially registered with the LHDN system

-

Be capable of submitting e-Invoices on your behalf using the MyInvois portal or approved API connection

Even if you outsource the task, your business is still responsible for the accuracy of the e-Invoice content and recordkeeping.

Steps to Add an Intermediary via MyInvois Portal

Follow these steps below to add an intermediary through the official MyInvois system:

-

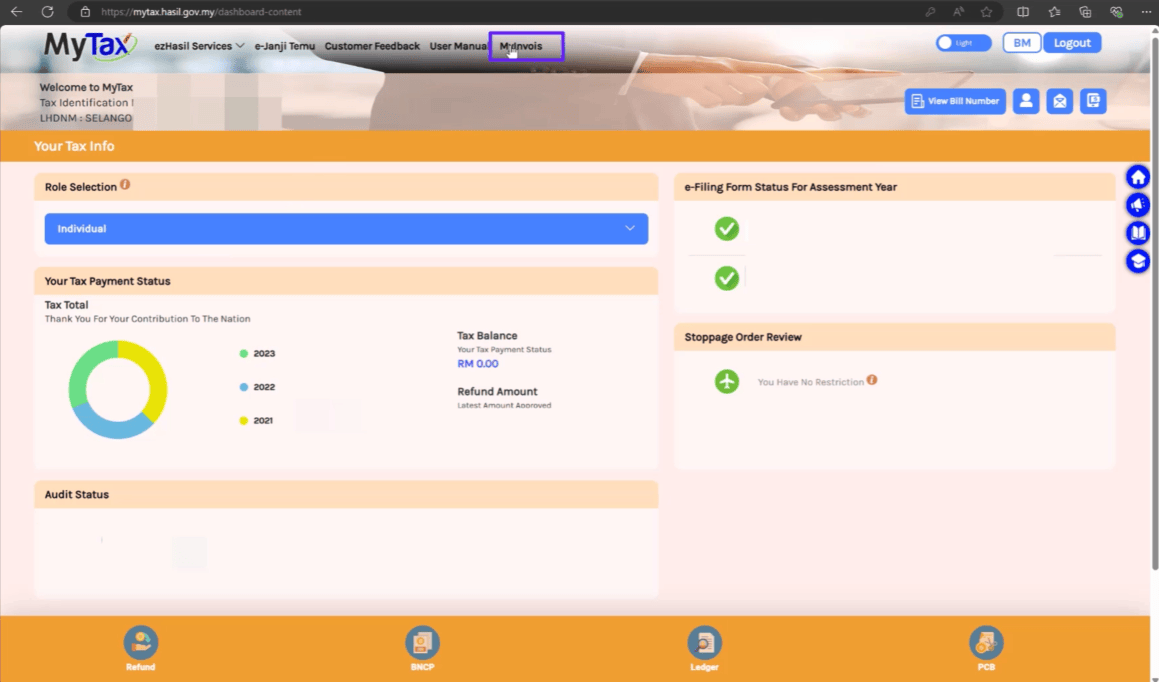

Visit https://mytax.hasil.gov.my/, click “MyInvois”.

-

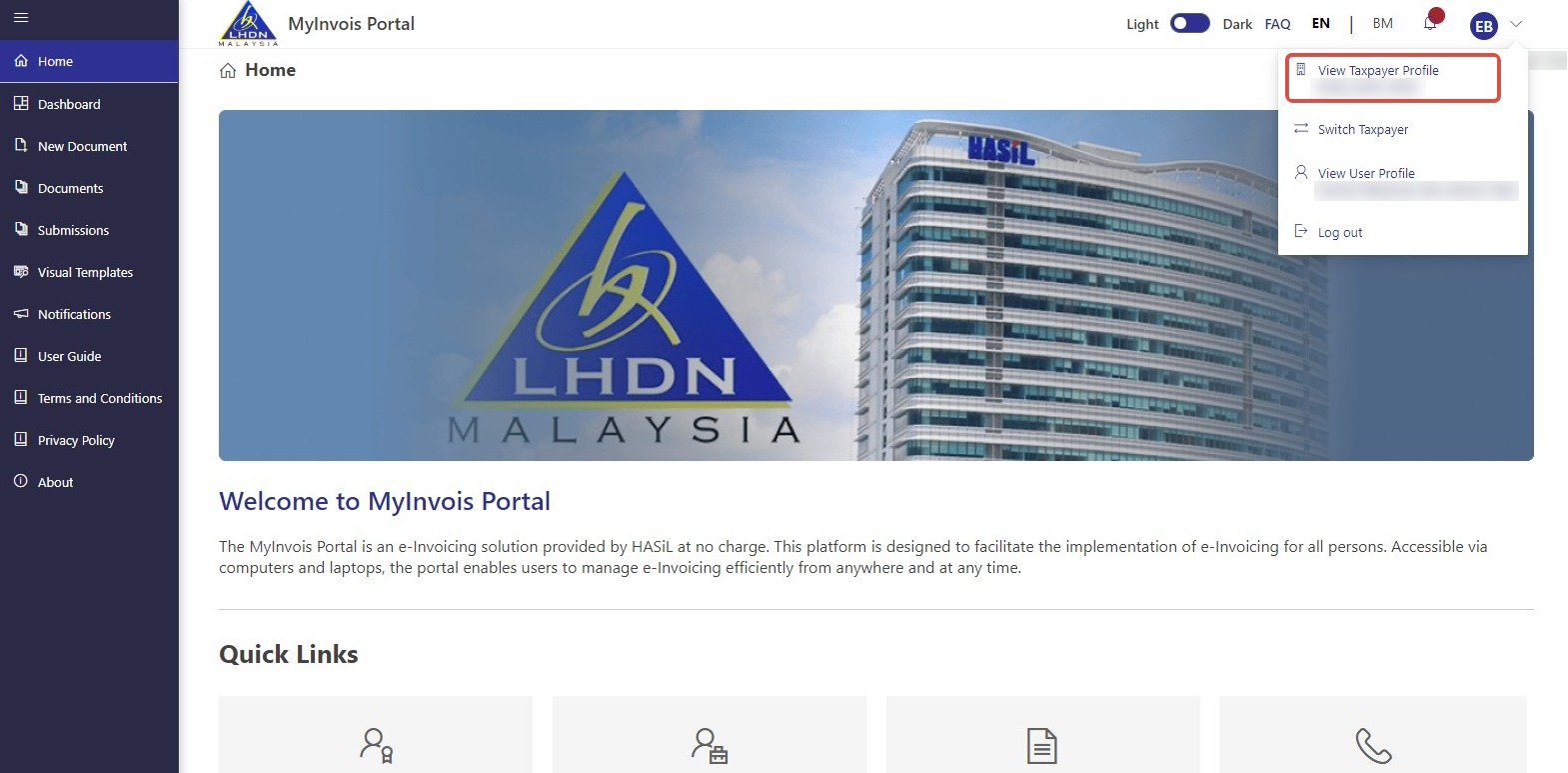

On the top-right, select the profile dropdown, then click “View Taxpayer Profile”.

-

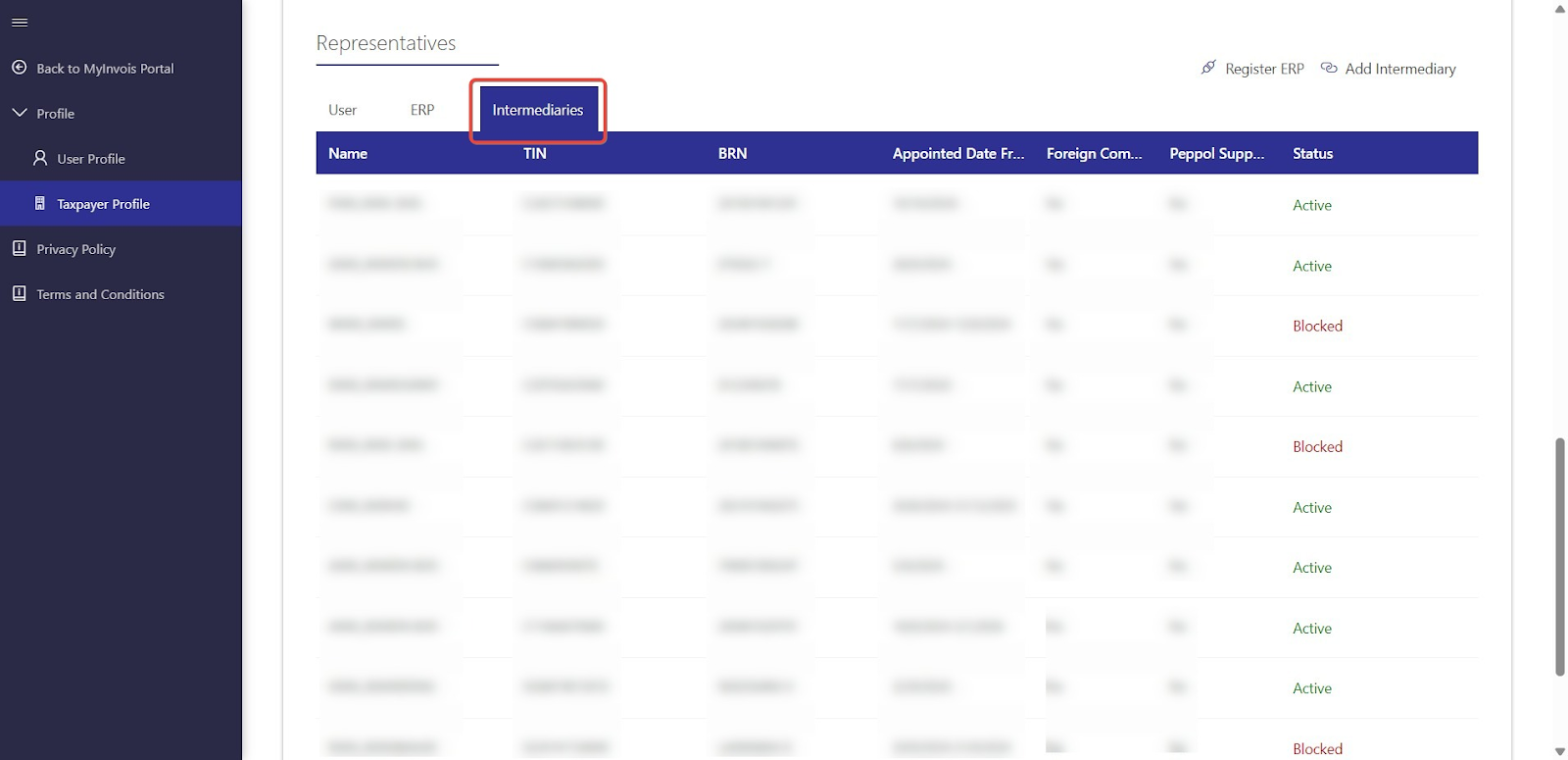

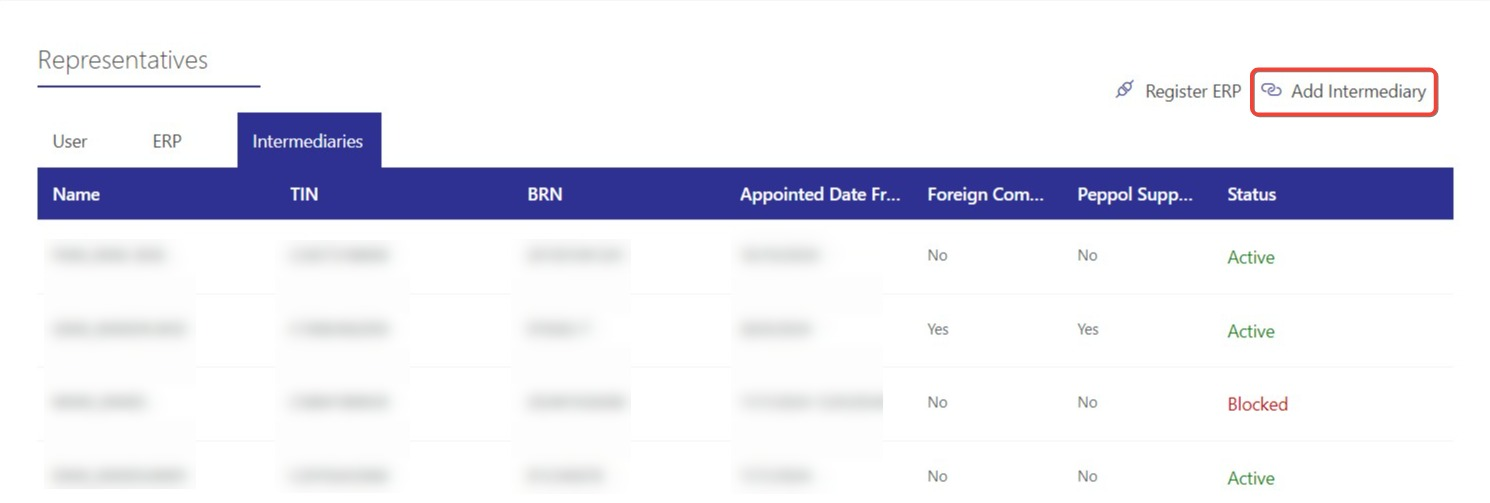

Scroll down to the “Representatives” section, click “Intermediary”.

-

Click “Add Intermediary”.

-

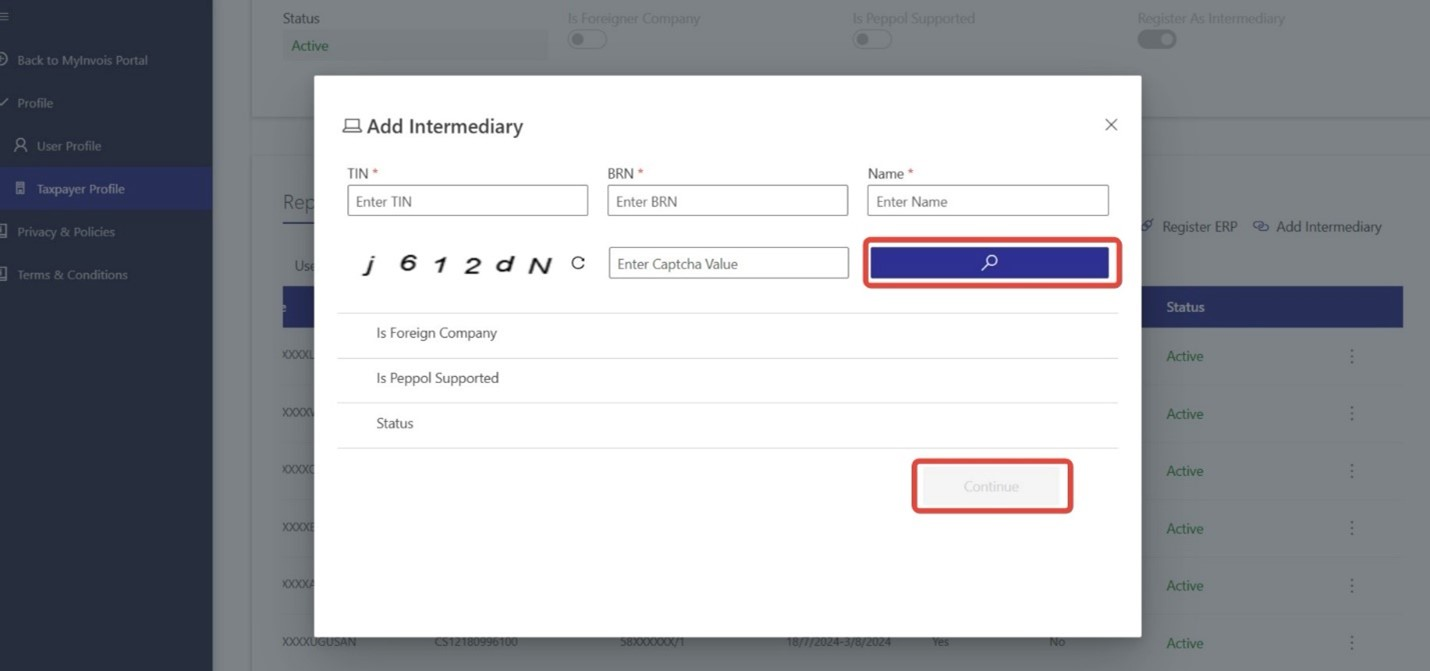

Enter TIN, BRN, Name, and captcha value. Click the search icon to validate the TIN, BRN, and Name. Then, click “Continue”.

-

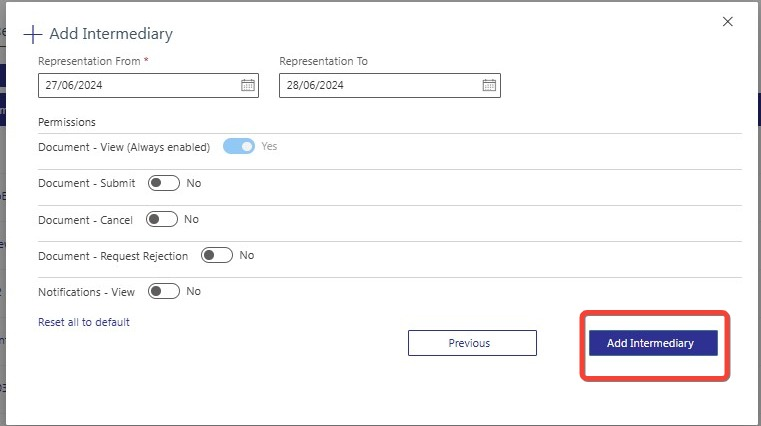

Modify the “Representation From” and “Representation To” dates and the permission toggle button. Click on “Add Intermediary” button to add an intermediary.

-

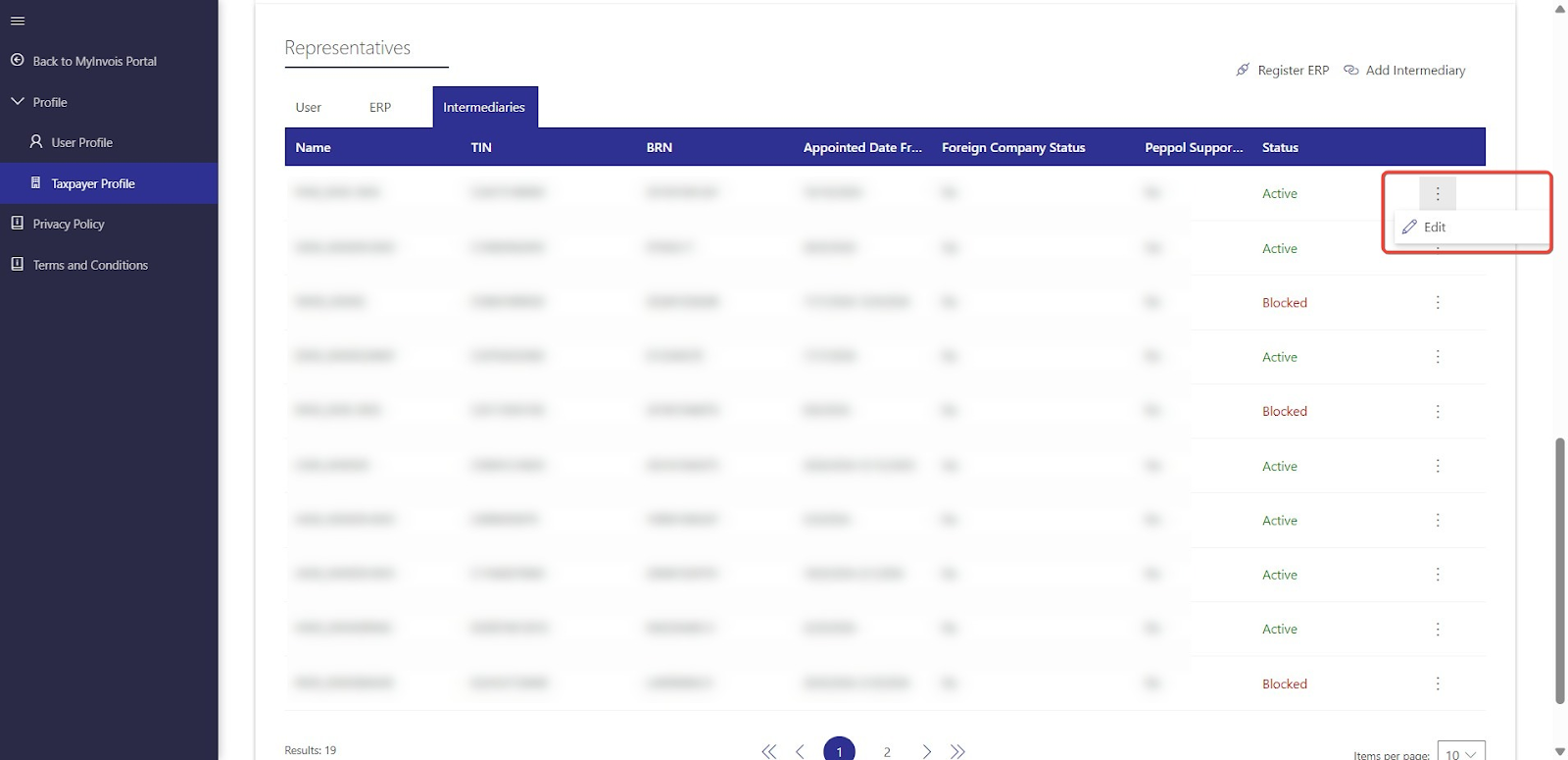

The intermediary will be saved in the “Intermediaries” tab.

Once accepted, the intermediary can begin submitting e-Invoices on your behalf.

Best Practices When Working With Intermediaries

Appointing a third party is convenient, but it also requires care. Follow these good practices:

-

Choose a credible and experienced service provider

-

Sign a written agreement outlining duties, confidentiality, and timelines

-

Make sure the intermediary keeps you informed of every submission

-

Monitor submission status regularly via your MyInvois portal

Remember, even if someone else is submitting for you, the responsibility still lies with your company.

LHDN’s Role in Monitoring Intermediaries

LHDN has the right to monitor, review, or audit any e-Invoice submissions, whether submitted directly by the business or through an intermediary. If errors are found, the business (not the intermediary) will be held accountable.

That’s why you should:

-

Keep proper records of all submissions

-

Request regular reports from your intermediary

-

Store copies of all e-Invoices, especially if requested for audit

Revoking or Changing an Intermediary

Once an intermediary is registered in MyInvois, the profile cannot be deleted. However, you can manage their access or activities by adjusting their active period.

-

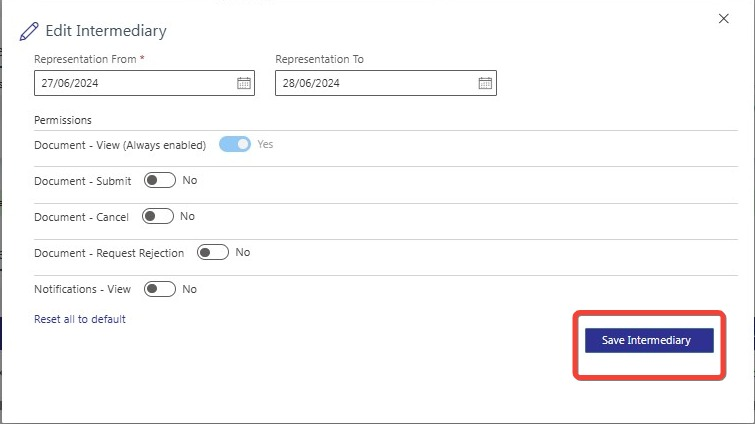

On the “Intermediaries” tab, click on the three dots on the right side of your desired intermediary, then click “Edit”.

-

Adjust the “Representation To” date to your desired expiration date and the permissions with the intermediary. Click “Save Intermediary”

Download Guide from LHDN

For more technical details, please find LHDN’s official documents here:

-

e-Invoice Guideline Version 4.5 (published on 7 July 2025)

-

e-Invoice Specific Guideline Version 4.3 (published on 7 July 2025)

-

User Guide Video for MyInvois Portal Intermediary Management

FAQs

What is the difference between an intermediary and an e-Invoice provider?

An intermediary submits e-Invoices on your behalf. An e-Invoice provider may be a software company offering tools or platforms to help generate or send invoices.

Is it mandatory to appoint an intermediary?

No. You can submit e-Invoices yourself. Appointing an intermediary is optional but helpful if you lack internal capacity.

Can I appoint more than one intermediary?

Yes, depending on your operational needs. However, each must be added and managed separately in the MyInvois system.

What happens if an intermediary submits incorrect data?

Your company is still responsible. You must coordinate with the intermediary to correct errors and maintain accurate records.

Can an HR outsourcing company act as my intermediary?

Yes, if they are registered with a valid TIN and capable of submitting e-Invoices under your company profile.

How to know if my intermediary is approved by LHDN?

You can confirm their TIN and status during the appointment process in MyInvois. They must also accept your appointment.

Can I switch back to self-submission later?

Yes. Revoke the current intermediary and manage submissions directly through your own MyInvois login.

Is there a penalty if I don’t declare my intermediary?

Yes. If someone submits on your behalf without being appointed, it may be considered non-compliant under LHDN rules.

What documents are needed to appoint an intermediary?

You’ll need the intermediary’s TIN. It’s recommended to also prepare a written service agreement for recordkeeping.

Your Next Hire Could be Just a Click Away!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best while staying compliant with LHDN regulations.

Post your job ads today & simplify your hiring process!

Read More:

- How Businesses Register LDHN MyInvois Portal for E-Invoice

- KWSP Application Deadline 2025 for Employers in Malaysia

- 10 Types of SOCSO Claims in Malaysia (Jenis-jenis Tuntutan PERKESO)

- How to Get Ready for LHDN e-Invoicing in Your Company

- GST vs SST in Malaysia: Key Differences Every Employer Should Know

- Extended SST Rates (6%–8%) Effective 1 July: Why and What to Prepare

- Kenapa SOCSO Ditolak dalam Gaji? | Why is SOCSO Deducted from Salary?

- Full LHDN Stamp Duty Guide on Malaysia Employment Contract [2025]: Penalties, Exemptions, & More

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- What is SST 8%? Types, How to Charge, and SST Filling

- Pelepasan Cukai 2024/2025: Tax Reliefs Guide for Employers

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- How to Submit CP22 for New Employees in Malaysia in LHDN MyTax Portal

- ePASS Malaysia: Benefits, Processing Time, and Common Employer FAQs