How Businesses Register LDHN MyInvois Portal for E-Invoice

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowIf your business operates in Malaysia, you’ll soon need to submit e-Invoices through LHDN’s MyInvois portal. This article will help you to know how to get started, what you’ll need, and what happens after registration.

What is the LHDN MyInvois Portal?

The MyInvois portal is LHDN’s official online platform for e-Invoice submissions and compliance tracking. It helps businesses generate, validate, and manage electronic invoices in a secure and centralised system. The portal is part of the Malaysian government's broader e-Invoice initiative under the Tax Administration System Modernisation plan.

Using the MyInvois portal offers a few key benefits:

-

Simplifies tax reporting and invoicing

-

Reduces manual paperwork and errors

-

Creates better audit trails and faster validation

-

Keeps your business aligned with digital tax rules

Who Must Register for the MyInvois Portal?

All registered businesses that fall under the e-Invoice rollout by LHDN must register for the portal. This includes:

-

Large corporations

-

SMEs

-

Employers managing payroll and HR systems

-

Professional services providers

Registration is based on your annual turnover. The LHDN has outlined different mandatory compliance dates depending on your revenue bracket. Even if your business has not yet reached the mandatory phase, early registration is encouraged to prepare in advance.

Step-by-Step: How to Register for MyInvois Portal

-

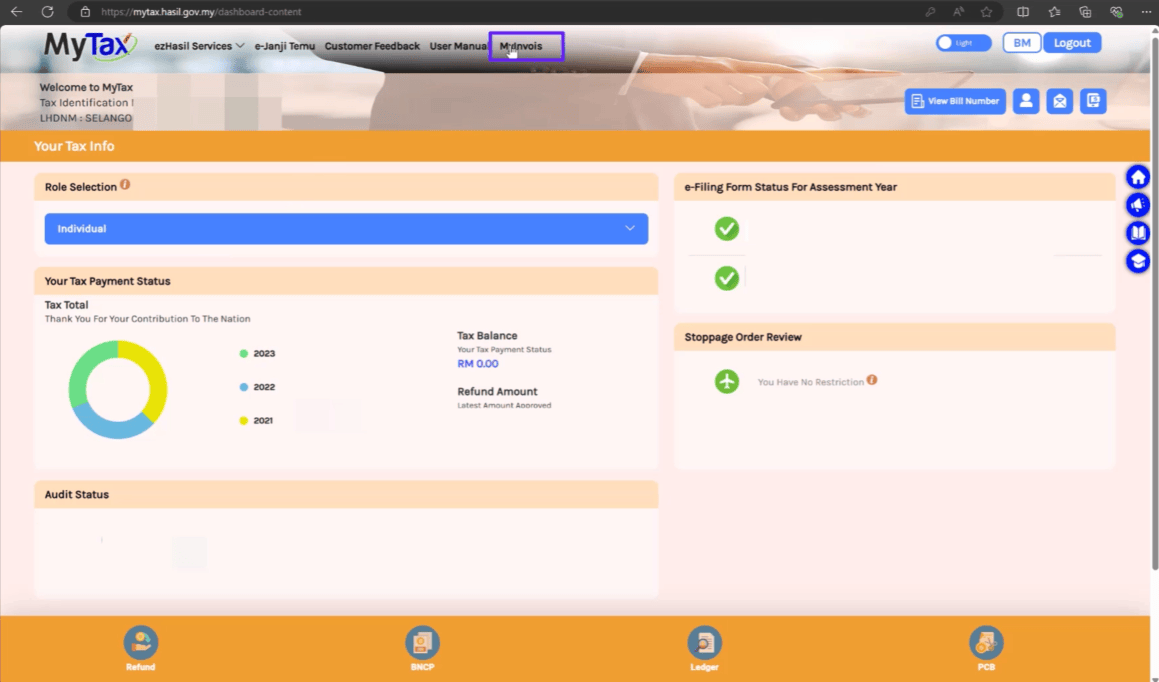

Access the official portal at https://myinvois.hasil.gov.my. Login with Identification Card Number. Enter username and password.

-

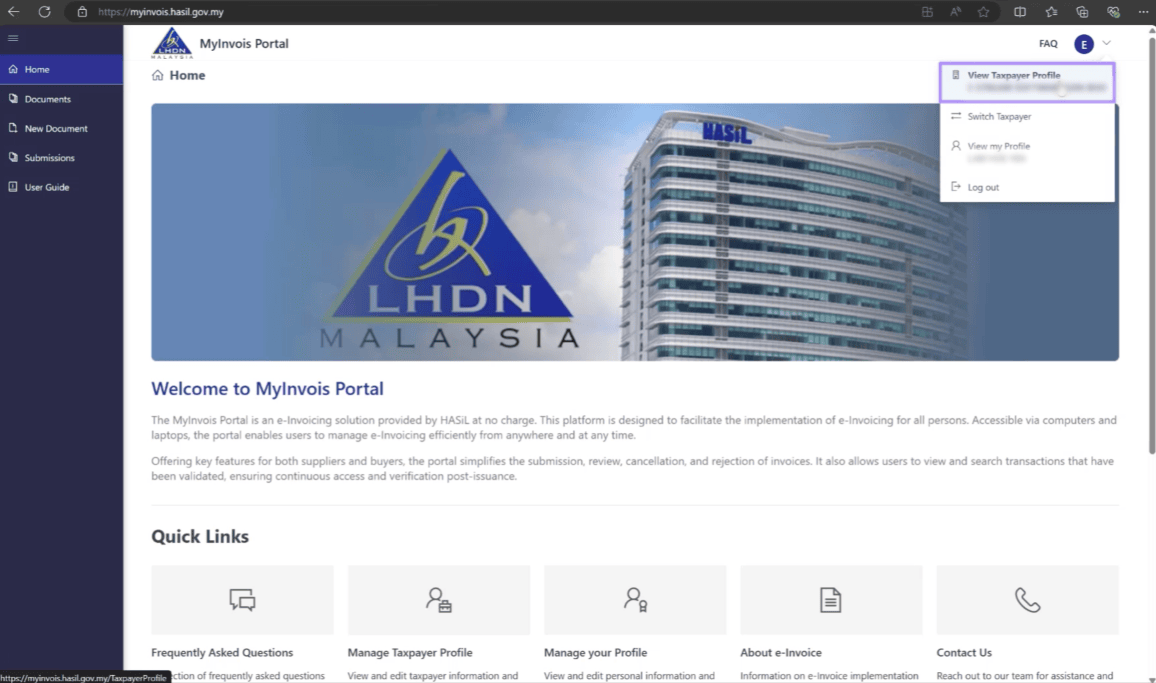

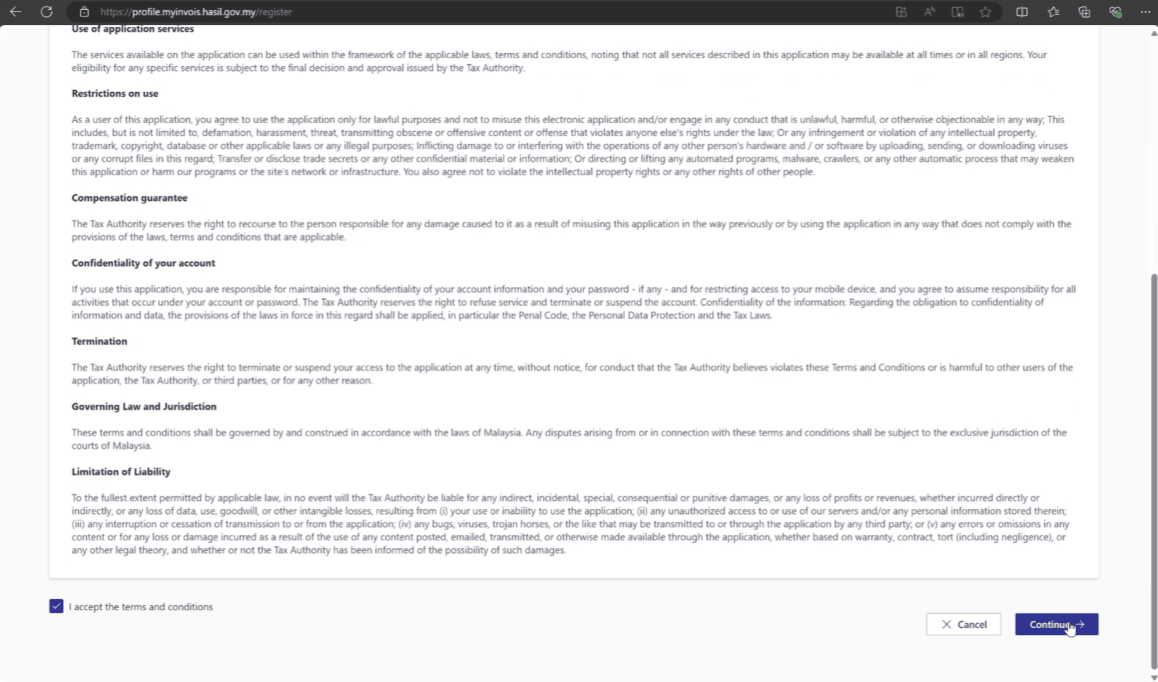

Select “MyInvois”. Read the terms and conditions, then click “Continue” to proceed.

-

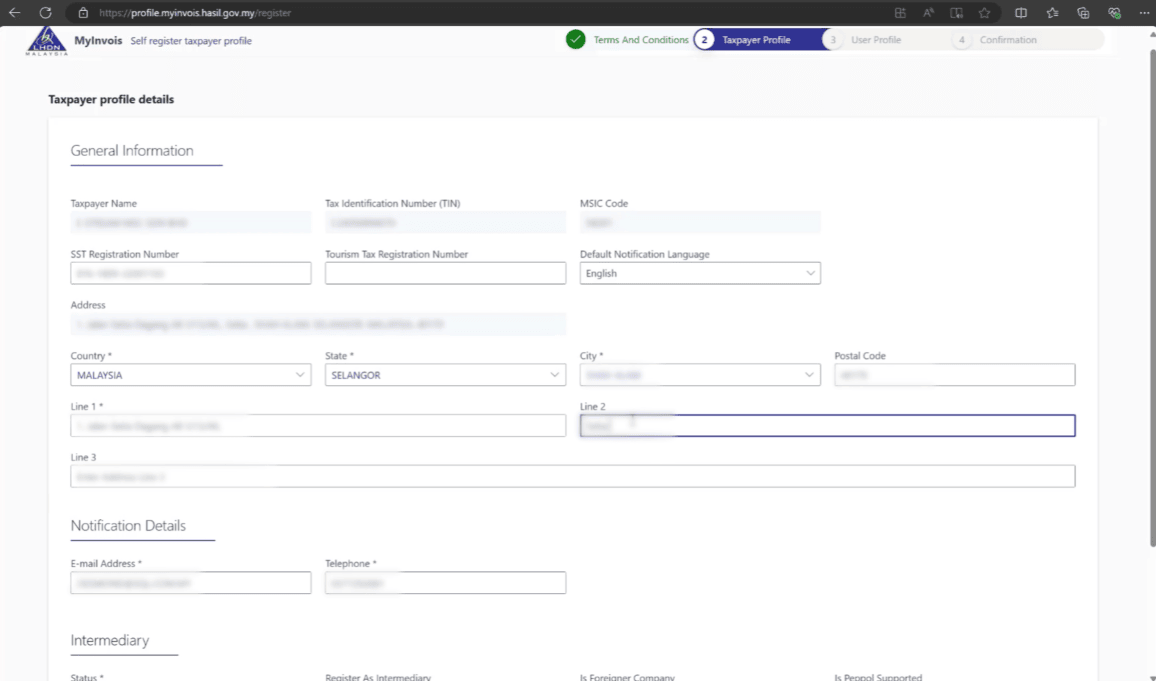

Fill in company profile and relevant business information on the taxpayer profile.

-

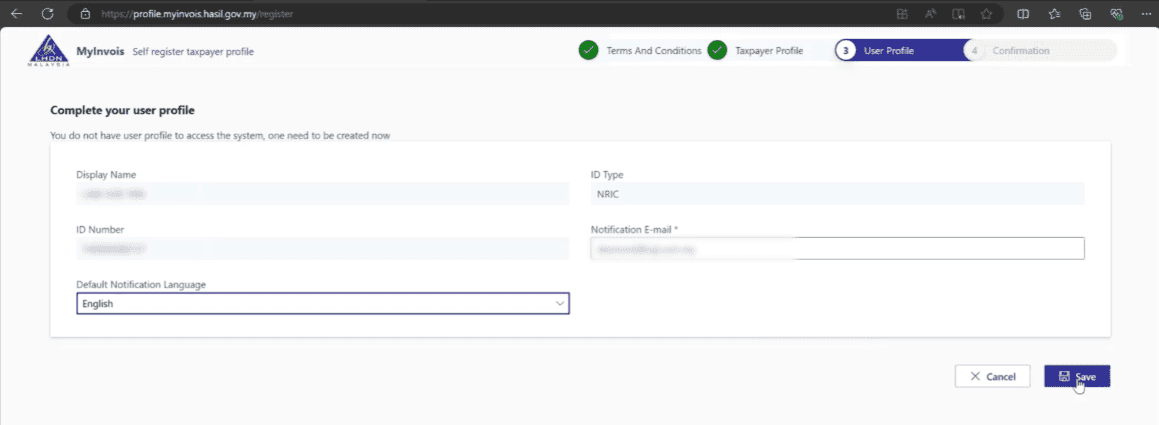

Complete the information asked in the User Profile section.

-

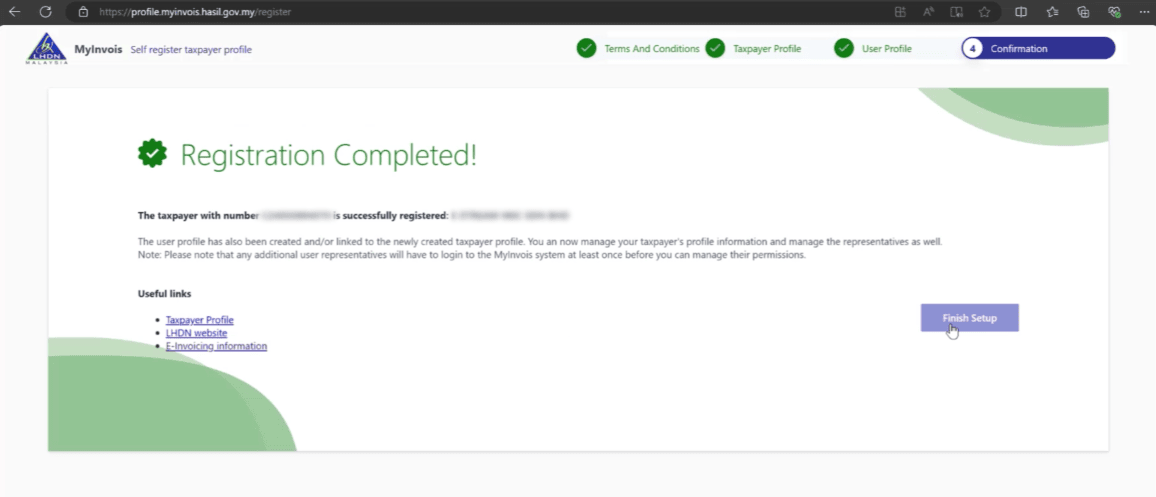

Registration completed, then click “Finish Setup”

Documents Needed for Registration

Before starting, prepare these key documents:

-

Company registration certificate (SSM)

-

Identification of the authorised person (IC or passport)

After Registration: What’s Next?

Once your registration is approved, your business can begin setting up its e-Invoice processes. This includes:

-

Connecting your ERP/accounting system (if using API)

-

Learning to categorise invoices (e.g. B2B, B2C, B2G)

-

Familiarizing with invoice validation flow on MyInvois

Don’t forget also to assign internal roles: who will handle invoice submission, validation, and daily monitoring.

Deadline and Timeline for Mandatory Compliance

LHDN has provided a phased rollout:

-

Businesses with annual turnover above RM100 million must start by 1 August 2024

-

RM25 million to RM100 million: 1 January 2025

-

RM1 million to RM25 million: 1 July 2025

-

Below RM1 million: 1 January 2026

Failure to register or comply within these dates may expose your business to tax audits or administrative penalties.

Tips for Employers & HR Teams

Before you get into the technical setup, it's worth preparing your internal teams for the change. We have some tips below to help you smoothen up the process:

-

Coordinate early with your finance and IT team for system readiness

-

Assign someone to track regulatory updates and deadlines

-

Train relevant staff on how to use the MyInvois portal

-

Consider certified e-Invoice solution providers if the internal setup is limited

Download Guide from LHDN

For official guidelines, refer to:

-

e-Invoice Guideline Version 4.5 (published on 7 July 2025)

-

e-Invoice Specific Guideline Version 4.3 (published on 7 July 2025)

FAQ

What is the difference between MyInvois and MyTax?

MyInvois is for e-Invoice management. MyTax is for overall tax filing and taxpayer services.

Can I register if I’m a sole proprietor?

Yes, as long as you are a registered taxpayer with a valid TIN.

What if I already use accounting software?

You can integrate it via API with MyInvois after registration.

Do I need to issue e-Invoices to foreign clients?

Yes, if the transaction is subject to Malaysian tax regulations.

Is registration required if I’m below the RM100 million threshold?

Yes, but according to your rollout date. Early registration is still encouraged.

How long does the registration take?

If all documents are correct, approval can be issued within a few working days.

Can I delegate the registration to my accountant or tax agent?

Yes, they can register on your behalf using your tax credentials.

What penalties apply for late registration?

Failure to register or submit e-Invoices on time may lead to penalties or scrutiny during tax audits.

Your Next Hire Could be Just a Click Away!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best while staying compliant with LHDN regulations.

Post your job ads today & simplify your hiring process!

Read More:

- KWSP Application Deadline 2025 for Employers in Malaysia

- 10 Types of SOCSO Claims in Malaysia (Jenis-jenis Tuntutan PERKESO)

- How to Get Ready for LHDN e-Invoicing in Your Company

- GST vs SST in Malaysia: Key Differences Every Employer Should Know

- Extended SST Rates (6%–8%) Effective 1 July: Why and What to Prepare

- Kenapa SOCSO Ditolak dalam Gaji? | Why is SOCSO Deducted from Salary?

- Full LHDN Stamp Duty Guide on Malaysia Employment Contract [2025]: Penalties, Exemptions, & More

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- What is SST 8%? Types, How to Charge, and SST Filling

- Pelepasan Cukai 2024/2025: Tax Reliefs Guide for Employers

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- How to Submit CP22 for New Employees in Malaysia in LHDN MyTax Portal