How Employers Should Handle Income Tax Reporting to LHDN

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowEvery employer in Malaysia is responsible for handling income tax deductions and reporting on behalf of their staff. These duties include registering with LHDN, issuing EA forms, submitting Form E, and making monthly PCB remittances. Failure to follow the rules not only risks financial penalties but also damages trust with employees.

In this article, we outline everything you need to know about employer income tax reporting, the forms involved, and the deadlines you cannot miss.

Why Income Tax Reporting Matters for Employers

Income tax reporting in Malaysia is a legal responsibility that employers must fulfill. It covers everything from deducting monthly tax (PCB/MTD) from employees’ salaries to submitting annual forms to the Inland Revenue Board (LHDN).

If employers neglect these duties, the consequences are serious:

-

Financial penalties where LHDN can impose fines ranging from hundreds to thousands of ringgit.

-

Audits and investigations. Late or inaccurate submissions can trigger audits.

-

Reputation risks. Failing to meet tax obligations may affect employees’ trust and the company's credibility.

Below, you will find employers' core responsibilities, required forms, key deadlines, and best practices to help you stay compliant.

Employer’s Income Tax Responsibilities in Malaysia

Employers are legally required to perform the following duties under the Income Tax Act:

-

Register with LHDN and obtain an Employer Number (E Number).

-

Deduct Monthly Tax (PCB/MTD) from employee salaries.

-

Track and report taxable benefits and allowances.

-

Remit PCB/MTD payments to LHDN by the 15th of the following month.

-

Issue EA forms and submit Form E annually.

-

Collect TP3 forms from new hires with previous income in the same year.

-

Keep payroll and tax records for at least 7 years.

Mandatory Forms Employers Must Prepare & Submit

Here are the main forms that employers need to issue and submit every year:

|

Form |

Purpose |

Deadline |

|

EA Form (CP8A) |

Issued to employees summarising annual income, allowances, benefits & deductions. |

End of February |

|

Form E (Borang E) |

Employer’s annual return to LHDN, declaring total number of employees and tax deductions. |

31 March |

|

CP39 / PCB / MTD |

Monthly remittance of employees’ tax deductions to LHDN. |

By 15th of following month |

|

TP3 Form |

Collected from new hires to declare income from previous employers in the same year. |

Upon hiring |

|

TP2 Form (Optional) |

Used if employees request additional tax relief adjustments. |

Employee-initiated |

Income Tax Reporting Timeline & Deadlines

As soon as you hire employees in Malaysia, you take on legal responsibilities for income tax reporting. These responsibilities also cover registration, annual reporting, and accurate record-keeping. Here are the key duties every employer must follow:

|

Timeline |

Action Required by Employers |

|

Monthly |

Deduct and remit PCB/MTD to LHDN by the 15th of the following month. |

|

End of February |

Issue EA Forms to all employees. |

|

31 March |

Submit Form E (employer’s return) to LHDN. |

|

April (Employee Deadline) |

Employees must submit personal tax returns by 30 April (manual) or 15 May (e-Filing). Employers are not responsible for filing on behalf of employees, but timely EA forms help them meet this deadline. |

Step-by-Step Guide: How Employers Submit Income Tax

The income tax process may look complicated at first, but it becomes manageable when broken into clear steps. Employers should follow this sequence every year to stay compliant with LHDN:

-

Register for an Employer Number (E Number) with LHDN.

-

Calculate and deduct PCB/MTD from employee salaries every month.

-

Remit monthly PCB/MTD to LHDN before the 15th of the following month.

-

Track taxable benefits & allowances such as cars, housing, and bonuses.

-

Collect TP3/TP2 forms where applicable.

-

Prepare and issue EA forms to employees by the end of February.

-

Submit Form E to LHDN by 31 March.

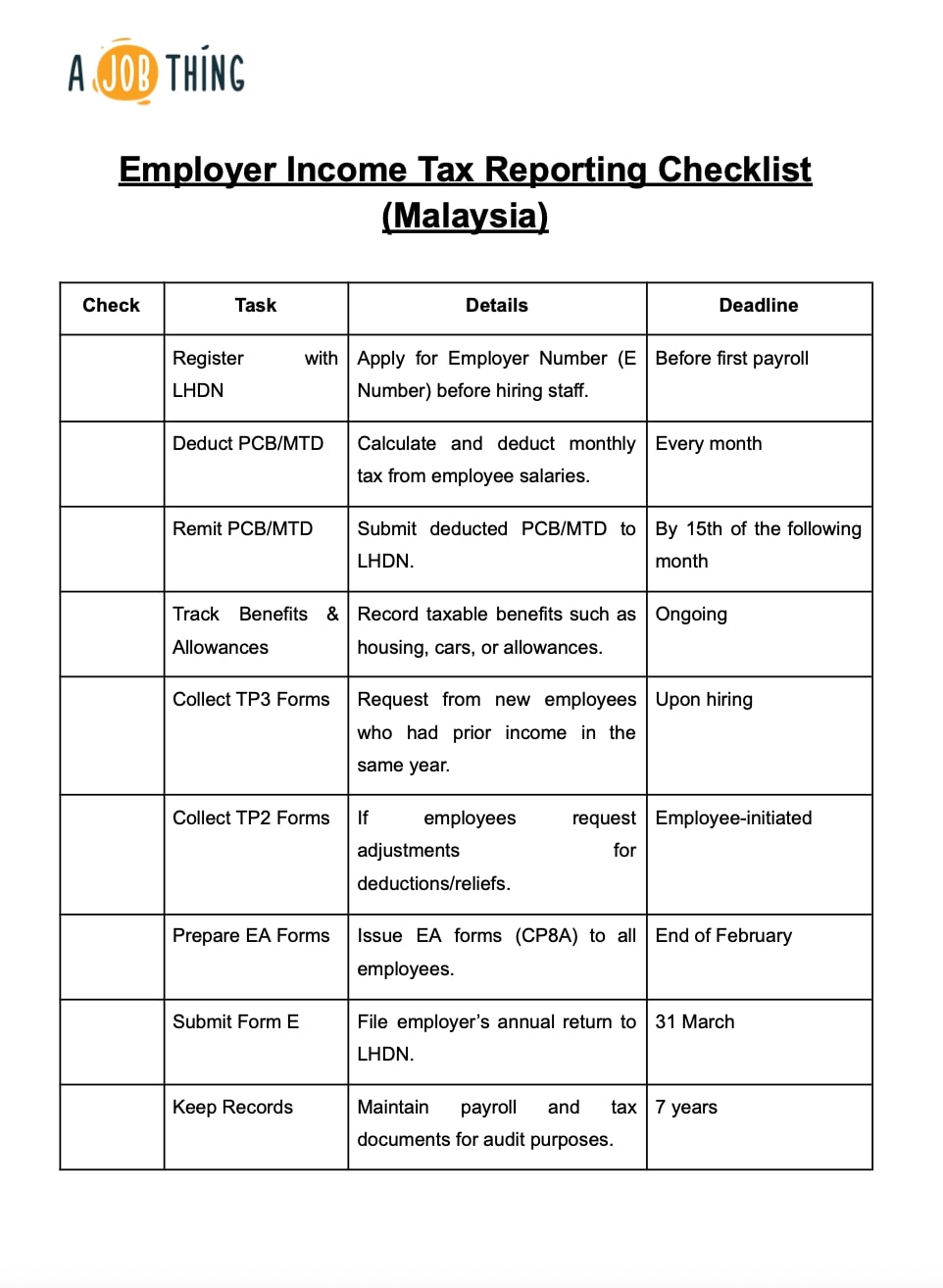

Downloadable Employer Income Tax Reporting Template

To simplify compliance, we’ve prepared a downloadable Income Tax Reporting Checklist. Use this as a reference to track forms, deadlines, and monthly deductions. Employers can adapt it to their payroll system to avoid missing key obligations.

Download Income Tax Reporting Template

Best Practices for Smooth Income Tax Reporting

To avoid errors and last-minute stress, employers should follow these practices:

Use Payroll Software with Built-in Tax Compliance

Automating PCB/MTD calculations reduces mistakes and ensures deductions match LHDN’s schedule.

Automate Reminders for Deadlines

Setting system alerts for the 15th of every month, February, and March keeps you from missing critical submission dates.

Cross-check Payroll with Finance Records

Reconciling monthly deductions with accounting entries ensures that the correct amounts are remitted to LHDN.

Run Quarterly Internal Audits

Spotting discrepancies early allows you to fix reporting issues before they become penalties.

Train HR and Payroll Staff

Regular updates on LHDN rules help staff apply the right tax rates, reliefs, and exemptions.

Communicate Clearly with Employees

Guiding staff on their EA, TP3, or TP2 forms avoids confusion and prevents errors in personal tax filings.

FAQ Section

What forms must employers submit for income tax reporting in Malaysia?

Employers must submit monthly PCB/MTD deductions, issue EA forms to employees, and file Form E with LHDN.

What is the deadline for submitting Form E?

Form E must be submitted by 31 March of the following year.

Are employers responsible for filing employees’ personal tax returns?

No. Employers only deduct and report taxes; employees must file their own returns.

How do employers calculate PCB for employees?

PCB/MTD is calculated using LHDN’s monthly tax deduction schedule, which factors in salary, benefits, and applicable reliefs. Many payroll systems automate this.

What happens if an employer fails to issue EA forms?

Employees will struggle to file their tax returns, and the employer risks fines or penalties from LHDN.

Do foreign employees also require income tax reporting in Malaysia?

Yes. If they qualify as tax residents (182 days or more in a calendar year), employers must deduct PCB/MTD and issue EA forms. Non-residents are taxed at a flat rate.

Are You Looking for New Staffs?

Start your hiring journey with AJobThing today!

Post your job ads, connect with top talents on multiple platform like Maukerja, Ricebowl, and Epicareer with our easy-to-use platform.

Read More:

- Financial Year End in Malaysia Explained: Deadlines, Forms, and Payroll Duties

- Payroll Checklist Malaysia 2025: Deadlines, Penalties, and Best Practices for Employers

- Withholding Tax in Malaysia Explained for Employers

- How to Handle Tax Residency Certificate Requests in Malaysia

- How to Check Income Tax for Employers in Malaysia

- Employee Income Tax Number in Malaysia: How to Check and Register for It

- Malaysia Tax Bracket 2025: Income Tax Rates for Employers

- Tax Reliefs in Malaysia 2025 for Employers: Types and How to Apply

- Withholding Tax in Malaysia Explained for Employers