How to Submit Borang E & CP8D 2026

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowMany Malaysian employers think that Borang E is only for companies with employees, but that’s not true!

Even if your business has zero employees, you still need to submit it.

Every year, businesses in Malaysia must report employee income details to LHDN through Borang E and CP8D.

If you’re unsure about the process or how to submit these forms, this article will explain everything you need to know.

What is Borang E?

Borang E is a tax form that all employers in Malaysia must submit to LHDN. It is used to report employee income details for the year.

This form does not require any payment. It is simply for tax reporting.

Even if a company has no employees, the employer must submit Borang E to avoid penalties.

The form must be submitted by 31 March of the following year through e-Filing on the LHDN MyTax Portal.

What is CP8D?

CP8D is a document attached to Borang E that lists detailed employee income and tax information. It includes:

-

Employee salaries and benefits

-

Bonuses and incentives

-

Tax deductions, such as PCB (Potongan Cukai Bulanan) contributions

Employers must fill out CP8D for every employee who worked for them during the tax year. This helps LHDN track employee earnings and tax contributions accurately.

Who needs to submit Borang E / CP8D?

All companies, businesses, and organizations in Malaysia that employ workers must submit Borang E and CP8D to LHDN. This applies to:

-

Private companies (Sdn Bhd)

-

Public companies (Berhad)

-

Non-profit organizations and associations

Even if a company has no employees, it is still required to file Borang E and declare "No Employees" to avoid penalties.

Deadline for submission

The deadline for Borang E and CP8D submission depends on the filing method:

-

Manual submission (paper form): 28 February 2026

-

Online submission (e-Filing via MyTax Portal): 31 March 2026

Late submissions can result in penalties from LHDN, including fines and additional tax assessments.

How to Submit E-Data Praisi / E-CP8D

The first step in the submission process is uploading CP8D via E-Data Praisi. This method allows employers to submit employee tax data directly through the LHDN MyTax Portal.

Step 1: Log in to the LHDN MyTax Portal

-

Go to MyTax Portal.

-

Click Login via Identification Card No.

-

Enter the company director's IC number (not the company registration number).

-

Click Submit to log in.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

Step 2: Access e-Data Praisi / e-CP8D

-

From the homepage, go to ezHasil Services > e-Data Praisi / e-CP8D.

(1).png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

-

Enter the Employer Number and confirm the company details.

-

Click Confirm to proceed.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

Step 3: Upload CP8D Data

Employers have two options to submit CP8D data:

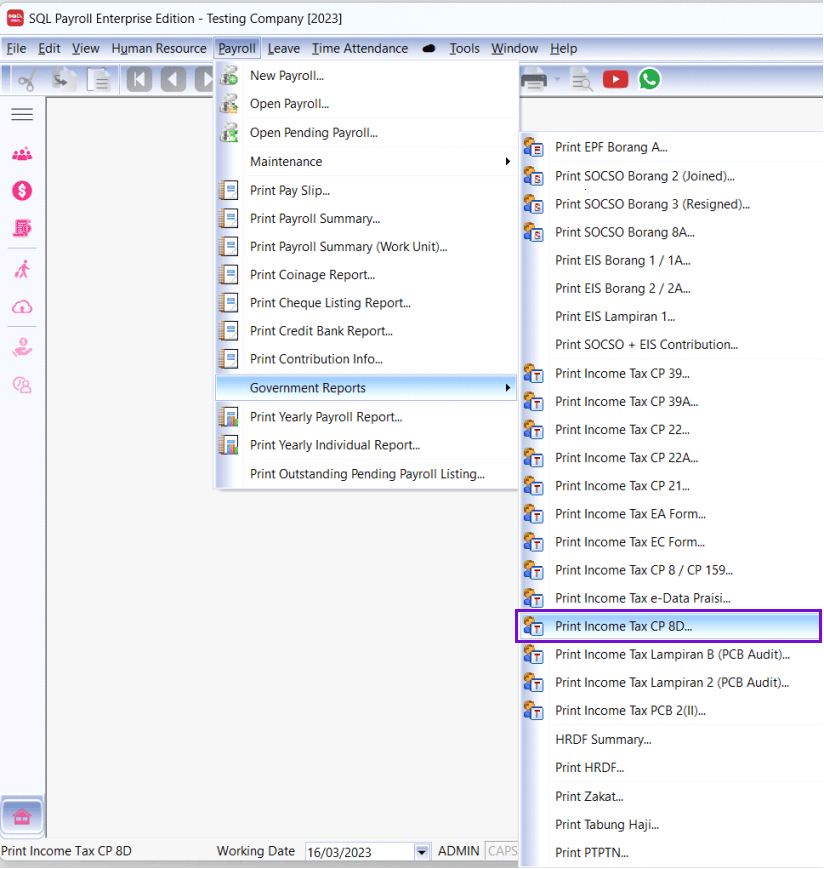

Method 1: Upload from SQL Payroll (Recommended)

-

Open SQL Payroll and go to Payroll > Government Report > Print Income Tax CP8D.

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

-

Select the year and click Apply.

-

Click Submission of LHDN’s CP8D via Magnetic Media and save the file to your desktop.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

-

Upload the file directly to LHDN CP8D on the MyTax portal.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

-

Once uploaded, all employee data will be filled in automatically.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

Method 2: Manual Entry (Without Payroll Software)

-

Manually input employee details into the online CP8D form on MyTax Portal.

-

Update Employer Declaration, then Confirm and Submit.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

Step 4: Save Submission Confirmation

-

After submission, an acknowledgment page will appear.

-

Click Print Confirmation, then save a copy for company records.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

How to Submit e-Filing

Once the CP8D submission is completed, employers must proceed with e-Filing for Borang E.

Step 1: Log in to MyTax and Access e-Filing

-

Go to the MyTax Portal and log in.

-

Click ezHasil Services > e-Filing from the homepage.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

Step 2: Fill in the e-Form

-

On the e-Filing page, click e-Form.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

-

Select the tax year under e-E.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

-

Input the company’s income tax number. After that, click Proceed.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

-

You will be directed to Profil Majikan Page. On the "Cara Pengemukaan C.P.8D" section, select "Melalui e-Data Praisi / e-CP8D," then click Seterusnya.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

Step 3: Final Submission

-

Enter the number of employees in the company, then click Next.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

-

Proceed to the designation. Then, click Sign & Send.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

-

Enter the identification number and password, then click Sign to complete the submission.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

Step 4: Save Acknowledgment Receipt

After submission, print and save the acknowledgment receipt and e-E form.

.png)

Source: https://www.sql.com.my/payroll-software/borang-e-cp8d-submission/

If you haven’t submitted Borang E and CP8D yet, now is the time. The process is simple. Log in to MyTax Portal, follow the steps, and file before the deadline to avoid penalties.

Need to hire employees in Malaysia?

Looking to hire new employees in Malaysia? Post job ads on Maukerja, Ricebowl, LinkedIn, and Google through AJobThing to find the best talent for your business!

Read More:

- Submit Your 2024 Tax Returns Online Starting March 1

- E-Invoicing Deadline Extended for SMEs Earning Below RM500K

- Jabatan Perkhidmatan Awam: No Large-Scale Contract Termination for Workers Without SPM

- EPF Contribution 2026: Rates, Eligibility, and How to Calculate

- Important Dates 2026 for Small and Medium Enterprises in Malaysia

- Tax Relief 2024 Malaysia: List, Eligibility, Calculation & How to Claim

- Steps to Submit CP22 for New Employees in Malaysia on LHDN MyTax Portal

- EA Form (C.P. 8A): Free Download Form, Deadline & How to for Employers

- Malaysia Tax Bracket 2026: Income Tax Rates for Employers

- Malaysia Form E 2026: Submission Guide, Deadline, and Penalties

- Offer Letter: Definition, How To, and Free Templates

- PCB (Potongan Cukai Bulanan) in Malaysia: A Complete Guide for Employers

- Tax Reliefs in Malaysia 2026 for Employers: Types and How to Apply

PCB (Monthly Tax Deduction) Calculator for Employers in Malaysia

Calculating employee tax manually can take a lot of time and may cause mistakes. This PCB calculator helps HR and employers calculate Monthly Tax Deduction (PCB) accurately, quickly, and without hassle.

With just a few inputs, you can get the correct PCB amount based on employee salary — no manual calculation needed.