How to Submit Form P via MyTax in Malaysia (Step-by-Step)

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowPartnership tax can feel confusing, especially if you are used to personal returns only. For Malaysian HR teams, business owners, and partners, Form P is the main tax return for partnership income, and it must be submitted correctly through MyTax to avoid penalties.

This guide explains in simple steps what Form P is, what you need to prepare, and how to submit Form P online via MyTax, so you can stay compliant and keep your partnership records clean.

What is Form P?

Form P is the annual tax return for partnerships registered in Malaysia. It is used to report:

-

The partnership’s total income and allowable expenses

-

The resulting net profit or loss

-

How that profit or loss is shared between partners

Important points:

-

A partnership itself does not pay income tax.

-

Instead, each partner pays tax personally on their share of profit via Form B.

-

Even though the partnership does not pay tax, Form P is still compulsory so LHDN can see the full picture of the business.

If your organisation is structured as a partnership (e.g. professional firm, family partnership, small business with partners), Form P must be filed every year, even if profit is low or there is a loss.

What You Need Before Submitting Form P

Before you open MyTax, prepare all important details and documents. This saves time and reduces errors. Use this checklist:

Basic Partnership Information

Have these ready:

-

Partnership name and income tax/registration number

-

Business registration details (SSM)

-

Registered business address and contact information

-

Year of Assessment (YA) you are filing (for example YA 2024, YA 2025, etc.)

Financial Documents

You will need figures from your accounting records:

-

Profit & Loss statement for the YA

-

Balance sheet/statement of financial position

-

Partnership tax computation (how you arrive at statutory income)

-

Capital account movements for each partner (if there are new partners, withdrawals, or capital injections)

These help ensure your Form P numbers match your books.

Partner Information

Form P requires accurate partner details:

-

Full name and NRIC / passport number for each partner

-

Profit-sharing ratio or apportionment percentage

-

Updated list of partners if there were admissions, retirements, or changes during the year

Each partner’s share in Form P should match what they later report in their Form B.

MyTax Login Access

To file online, you need:

-

MyTax login for the partnership (usually under the precedent partner / main partner)

-

e-Filing PIN or digital certificate if required by LHDN for your profile

If you are filing for the first time, make sure the partnership is registered with LHDN and has e-Filing access set up before the deadline.

How to Submit Form P via MyTax (Step by Step)

Submitting Form P online is the easiest and fastest way. Follow these steps in order.

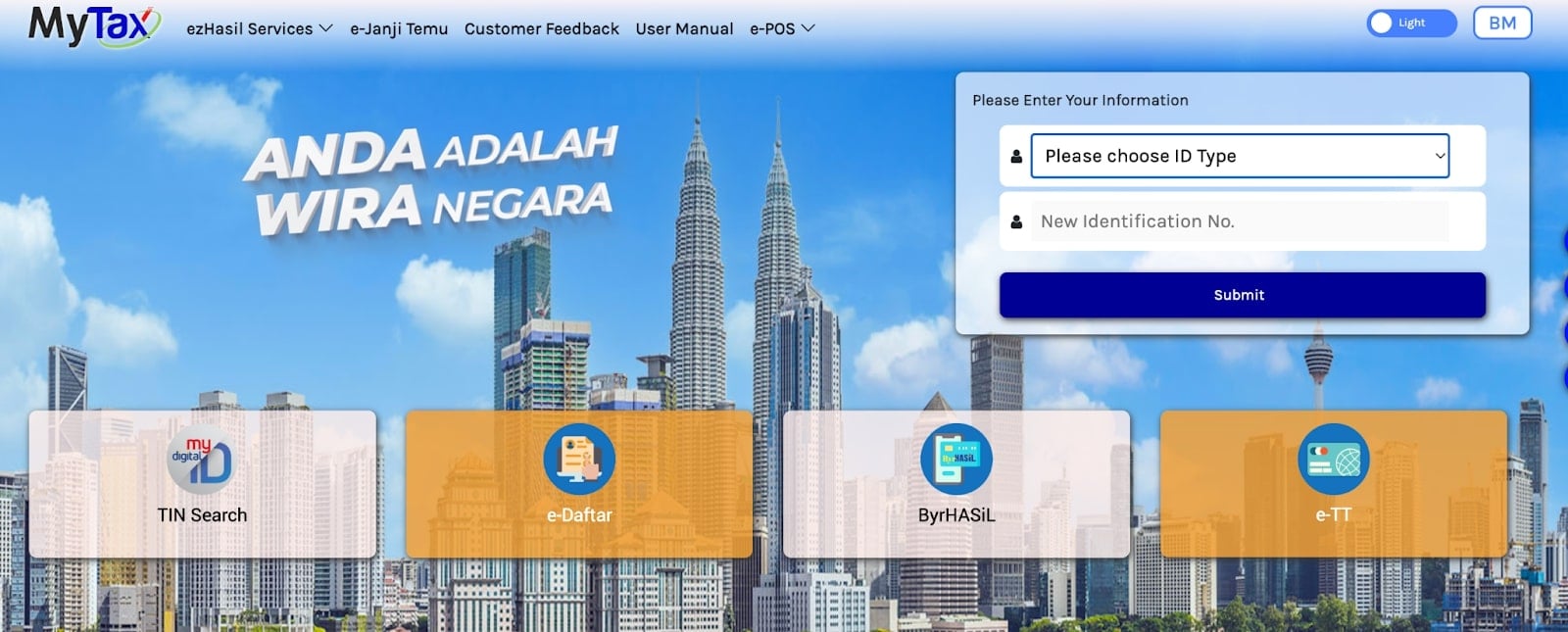

Step 1: Log In to MyTax

-

Go to the MyTax portal (mytax.hasil.gov.my).

-

Log in using the partnership’s e-Filing ID / TIN and password, or via MyKad login if linked.

-

Make sure you are using the partnership profile, not an individual partner’s personal account.

Step 2: Open e-Filing and Select Form P

-

From the dashboard, click e-Filing.

-

Choose e-Form (e-Borang).

-

In the list of forms, select “Form P – Partnership”.

-

Pick the correct Year of Assessment (YA), for example YA 2024.

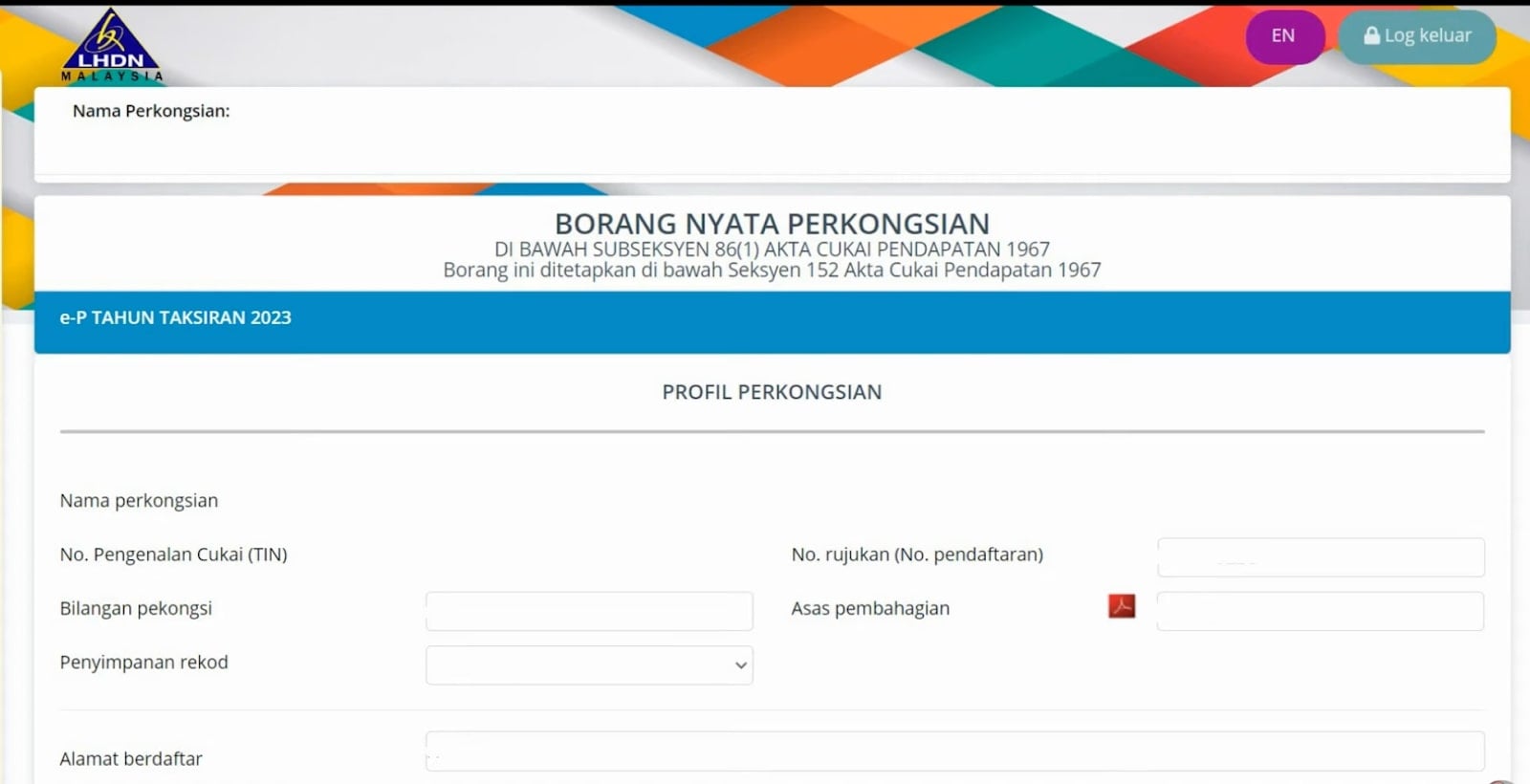

Step 3: Fill In Required Sections

Go through each section in order and use your financial statements as a reference.

You will normally see sections similar to:

Partnership Details

Name, tax reference number, business registration, address, and contact details.

Business Particulars

Main business code, nature of business, accounting period (e.g. 1 Jan – 31 Dec).

Income and Statutory Income

-

Total business income (sales, fees, services).

-

Allowable expenses (rent, salaries, utilities, etc.).

-

Capital allowances and other adjustments based on your tax computation.

-

The system will calculate statutory income / adjusted income.

Apportionment of Income to Partners

For each partner, enter:

-

Name and NRIC / TIN

-

Share of profit or loss (percentage or amount)

Make sure the total equals 100% and matches your partnership agreement and CP30 (if prepared).

Source: https://www.youtube.com/watch?v=oEPFF5vjNPc

Attach or keep supporting schedules (like detailed computations, P&L, and capital accounts). MyTax usually does not require uploading all documents, but you must keep them in case of an audit.

Step 4: Review All Information

Before you press submit, check everything one more time.

Confirm that:

-

Total income and expenses match your financial statements.

-

Statutory income or loss is correct.

-

Partner names, NRIC/passport numbers, and profit-sharing ratios are accurate.

-

The apportionment across partners adds up correctly with no missing partner.

Use the “semak/validate” function if available to catch missing fields.

Step 5: Submit Form P Online

-

Once everything is correct, click “Submit / Hantar”.

-

Confirm the declaration as the precedent partner / authorised person.

-

After successful submission, download or print the acknowledgement receipt (slip pengakuan penerimaan).

Keep this slip together with your partnership’s tax file and financial statements. It is your proof that Form P has been filed.

Form P Submission Deadline

Deadlines are strict, so mark them clearly in your calendar. For recent years (YA 2024 example):

-

Paper/manual submission: 30 June of the following year

-

e-Filing (MyTax): usually extended to 15 July

LHDN may announce slightly different dates each year, so always check the latest Form P e-Filing programme on the MyTax or LHDN website. Late submission can attract penalties of up to 35% of the tax amount at partner level.

FAQs

Who needs to submit Form P?

Form P must be submitted by all registered partnerships in Malaysia, including professional firms, trading partnerships, and small businesses with two or more partners. Even if the partnership makes a loss, Form P is still required.

Do partners still submit personal tax after Form P is submitted?

Yes. Each partner must still file their individual income tax return (Form B) and report their share of partnership profit or loss as stated in Form P and CP30.

Can I amend Form P after submission?

In many cases, you can amend limited items through e-Amendment within a certain window or by contacting LHDN directly. If you discover a big error (for example, wrong income or wrong profit share), contact LHDN as soon as possible for guidance.

How can I check if my Form P submission is successful?

After you submit via MyTax, you will see an on-screen confirmation. An acknowledgement slip will be available to download/print. You can log back into MyTax and check the e-Filing history to confirm that Form P for the relevant YA is marked as “submitted”.

Is manual (paper) submission still allowed?

Yes, but e-Filing is strongly encouraged. Manual submission through LHDN branches or by post is slower, more prone to error, and may delay confirmation. MyTax e-Filing gives faster processing and immediate acknowledgment.

Your Next Hire Could be Just a Click Away!

At AJobThing, we connect you with 5+ million jobseekers in Malaysia, ensuring you hire the best.

Post your job ads today & simplify your hiring process!

Read More:

-

Cara Claim SOCSO Kemalangan: A Complete HR Guide for Work Accident Claims

-

i-Sayang KWSP Guide: Requirements, Benefits & How to Register

-

EPF, SOCSO, EIS, and LHDN Employer Registration Guide for Malaysian Companies

- Cara Kira Potongan KWSP dan SOCSO | How to Calculate EPF and SOCSO Deductions in Malaysia

-

Statutory Contributions in Malaysia Explained for Employers and HR

-

Deadlines & Penalties for SOCSO, EPF, PCB/Form E, and HRD Levy in Malaysia

-

PCB for Foreign Workers in Malaysia: Employer’s Complete Guide

-

EPF Withdrawal for Education: Employer’s Guide to Supporting Staff

-

Akaun Fleksibel (EPF’s New Account Structure): Key Info for Employers

-

KWSP Call Centre for Employers: Contact Numbers, Services, and Support Channels

-

How to Check KWSP/EPF Balance: Online, SMS, Call Center, and More (2025)