Free KWSP/EPF Calculator Excel Template for Malaysian Employers

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowFeeling a little stressed about handling payroll and calculating KWSP/EPF?

You’re not alone. We get it—it can be confusing, especially when you're already busy running your business.

EPF is super important. It helps your employees save for their future. But doing the math? Not so fun.

Here’s the good news: we’ve got something that can really help you.

We created KWSP/EPF Calculator Excel Template, made just for Malaysian employers like you. And yes—it’s completely free.

In this blog, we’ll show you why this tool is a lifesaver—how it works, why it’s helpful, and how it can make your life a whole lot easier.

Whether you're a small business owner or leading a big team—you’re going to love this. Let’s make payroll simple (and a little less stressful) together.

How to Use a KWSP Calculator?

To start, you’ll need a few key details about each employee:

-

Their basic salary or monthly wage

-

Their employment type (e.g. full-time, contract)

-

Their age group, as different rates may apply based on age

Once you have this information, you can enter it into an EPF calculator like the one provided by KWSP on their official site. You’ll get a breakdown that shows:

-

Employee contribution (typically 11%)

-

Employer contribution (typically 13%)

-

Total contribution that goes into the employee’s EPF account each month

The calculator works instantly. Just input the salary, and it will calculate both portions for you.

This is useful when you’re reviewing payroll, onboarding new hires, or making adjustments to salaries.

Why Should I Use a KWSP/EPF Calculator?

Employer has many things to juggle: deadlines, taxes, compliance, and managing people.

When it comes to EPF, using a calculator helps you avoid manual errors and saves time.

It’s also useful for budgeting. If you plan to hire more staff or adjust salaries, a calculator shows how much extra you’ll need to contribute as a company.

It gives you a clearer picture of your monthly cash flow.

Some employees also ask questions about their EPF, like how much they’re contributing, or how much they’ll save over time.

Having a calculator ready makes it easier for you to explain the numbers clearly.

How is EPF Calculated?

EPF in Malaysia is calculated based on a percentage of the employee’s monthly wages. The standard contribution rates are:

-

11% from the employee

-

13% from the employer (for employees earning RM5,000 and below)

-

12% from the employer (for employees earning above RM5,000)

Let’s say your employee earns RM3,000 per month:

-

Employee contributes RM3,000 × 11% = RM330

-

Employer contributes RM3,000 × 13% = RM390

-

Total contribution = RM720

This total goes into the employee’s EPF account every month. The money is then invested by KWSP and earns annual dividends, helping the employee build their retirement fund.

If the employee is above 60 years old, the contribution rates are lower.

In this case, both employer and employee may contribute 4% each, though contribution is optional for employees.

KWSP Withdrawal Calculations

Many employees ask, “How much will I have when I retire?” You may not be expected to answer this in detail but understanding the basics helps in guiding your team.

A KWSP/EPF calculator can estimate total savings by projecting monthly contributions over time.

For example, if an employee contributes RM720 monthly (combined from both parties) over 30 years, they will have contributed more than RM250,000, and that’s before adding dividends.

The amount will grow further thanks to KWSP’s annual dividend. In 2024, EPF can achieve 6.30% dividend for both Simpanan Konvensional and Simpanan Shariah.

Over time, even a small change in contribution amount or dividend rate can make a big difference in retirement savings.

This is why salary changes, bonuses, and even voluntary top-ups can have a long-term impact.

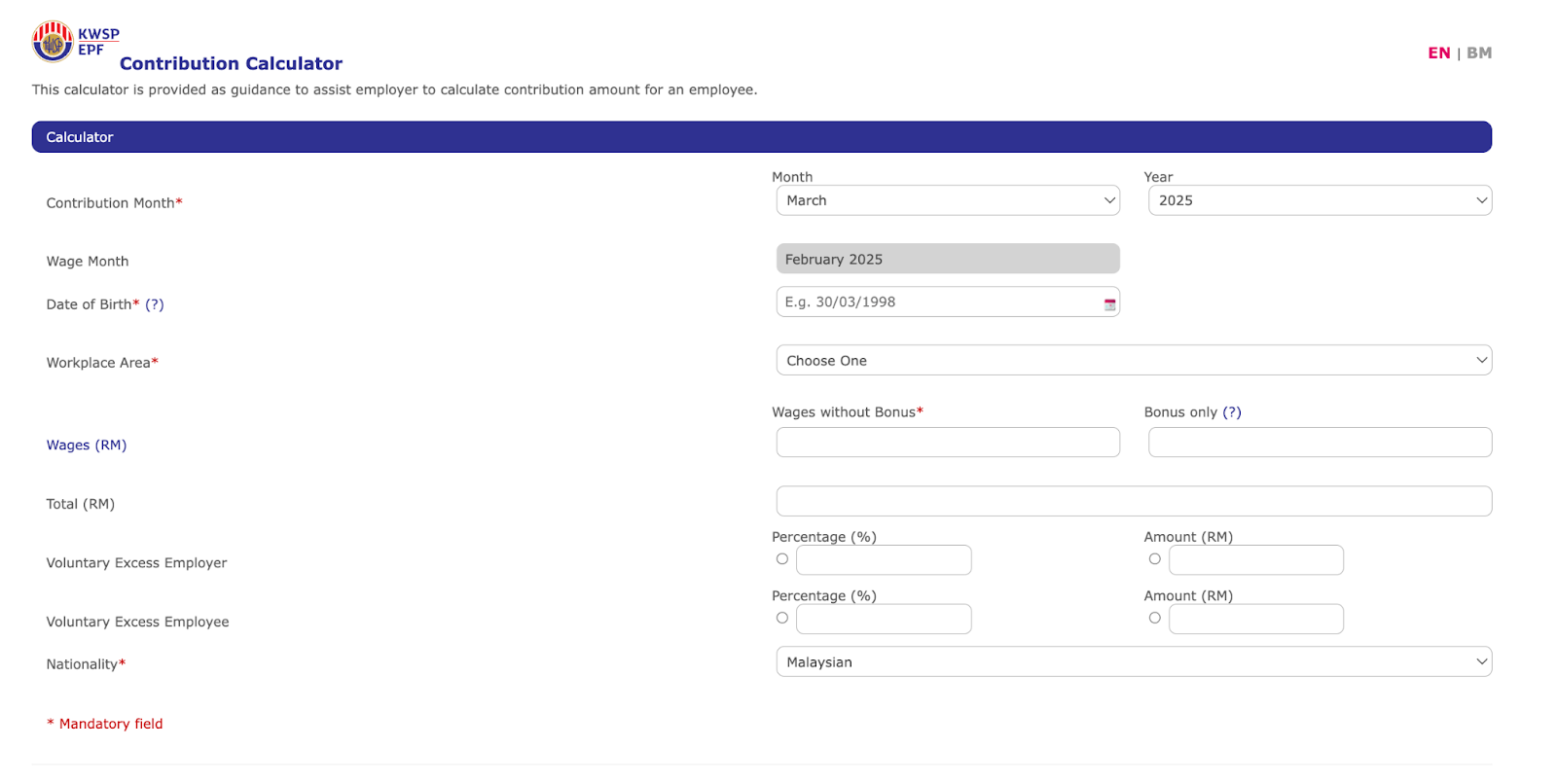

How to Access the KWSP Online Calculator?

To use the official calculator, visit the KWSP Contribution Calculator.

The page is simple and easy to use. You just enter these elements:

-

Contribution Month

-

Date of Birth

-

Workplace area

-

Wages without bonus

-

Bonus only (if applicable)

-

Voluntary Excess Employers and Employees

-

Nationaility

and it will automatically display the employer and employee contributions.

For mobile access, the i-Akaun app from KWSP also provides tools for checking balances and understanding contribution history.

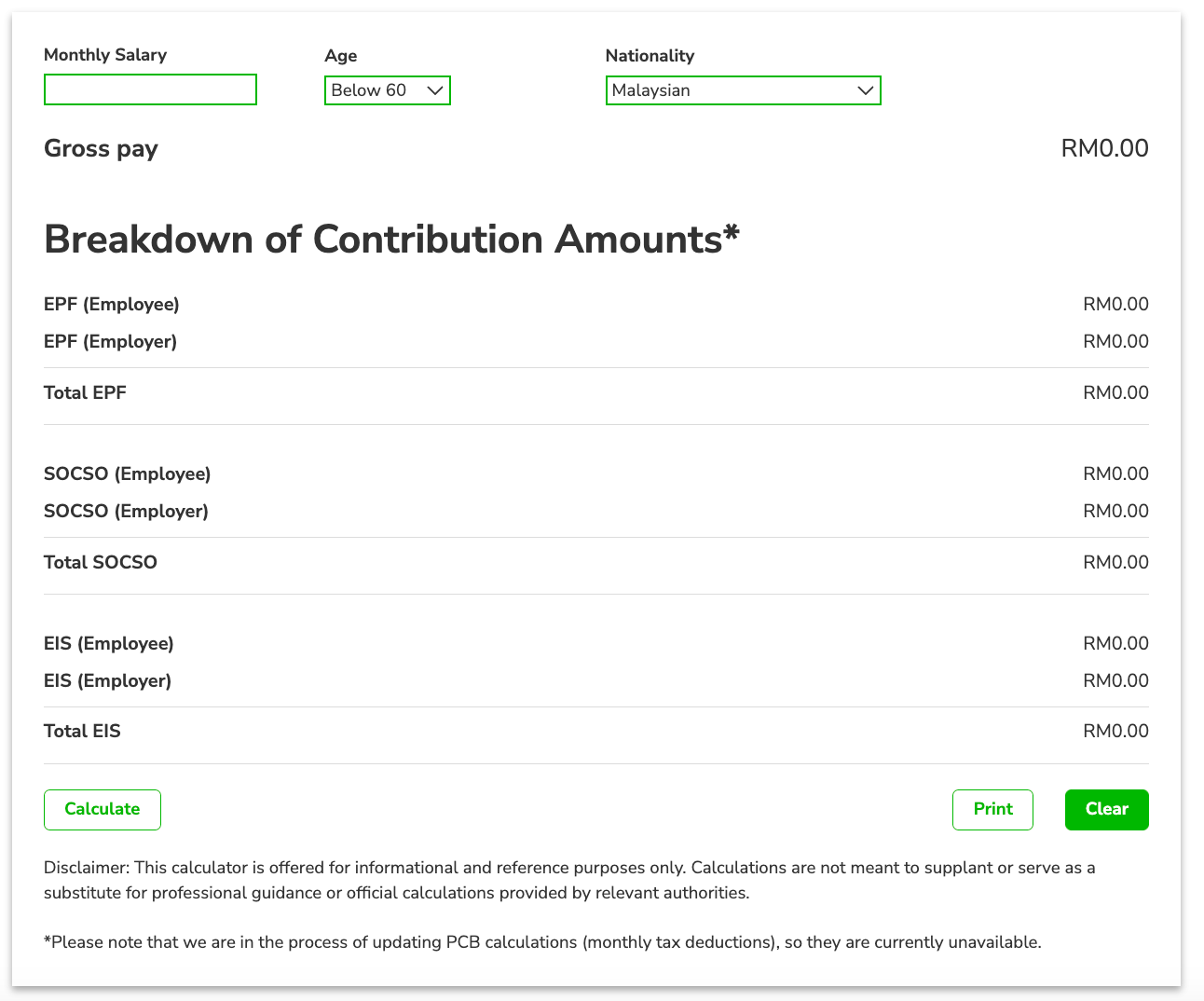

Some employers also use third-party tools like PayrollPanda’s EPF Calculator, which offer additional features like SOCSO and EIS calculations.

Free Download: KWSP Calculator using Excel

If you prefer to customise your own calculator, you can build one in Excel or Google Sheets. Here’s a simple version we've prepared:

Download or Copy: EPF Calculator (Google Sheets)

This sheet includes:

-

Input fields for salary

-

Automatic calculation of employer and employee contributions

-

Editable percentages if you want to run different scenarios

It’s especially useful for HR or payroll teams handling many employees at once.

Can I withdraw my EPF savings before retirement?

Generally, EPF savings are meant for retirement.

However, there are special conditions where partial withdrawals are allowed, such as for buying a house, paying for education, or medical emergencies.

Employees need to apply through KWSP and meet the conditions for each withdrawal category.

What happens if EPF contributions are not paid on time?

Late or missing contributions can lead to penalties. Under Malaysian law, employers are required to submit EPF contributions by the 15th of every month.

If payment is delayed:

-

A dividend is still credited to the employee

-

The employer may face late payment charges

-

KWSP may take legal action if non-payment continues

How can I check my EPF balance?

Only employees can check their individual EPF balance through:

-

The i-Akaun online portal

-

The KWSP mobile app

-

Or visiting a KWSP branch

Who is eligible to contribute to the EPF?

All Malaysian employees who are working in the private sector or under formal employment are required to contribute to EPF.

This includes full-time, part-time, and contract workers.

Employers are responsible for making contributions for each eligible staff member. Even foreign workers can contribute voluntarily, though it’s not compulsory.

FAQ

How much should I contribute to KWSP?

Employers typically contribute 13% for staff earning RM5,000 and below, and 12% for those earning above RM5,000. Employees usually contribute 11%.

Can I change my KWSP contribution percentage?

Employers must follow the standard rate. Employees, however, may apply to increase their contribution voluntarily.

How do I check my KWSP balance?

Employees can log in to their i-Akaun via KWSP's website or mobile app to view their balance and statements.

What happens if my employer doesn’t contribute to KWSP?

Failure to contribute is a violation of the law. Employees can report this to KWSP for investigation.

How do KWSP dividends affect my retirement savings?

KWSP pays annual dividends on total savings. This helps grow retirement funds over time even small increases can lead to big savings in the long run.

Need to hire the right talent?

If you’re hiring, post your jobs on Maukerja or Ricebowl—with over 6 million jobseekers in Malaysia, your next top talent is waiting!

Read More:

- How to Prepare a Monthly Salary Report in Malaysia (+ Free Templates)

- Salary Schedule (Jadual Gaji) in Malaysia: When to Pay & Pay Dates

- Salary Increase Calculator: How to Calculate & Free Excel Template

- Jadual Caruman PERKESO 2025 | SOCSO Contribution Schedule & Rates

- What is Sistem Insurans Pekerjaan (SIP)? A Complete Guide

- How to Handle a Retirement Letter to Employer

- How to Handle Resignation Letter for Employers

- 10 Exit Interview Questions to Ask Employees

- Tips for Interviewer: How to Prepare and Conduct a Virtual Interview

- Key Performance Indicator (KPI): Definition, Types, Dashboard, Criteria and Examples

- How to Handle Quiet Quitting in Malaysia

- How to Check Income Tax for Employers in Malaysia

- What Are Statutory Deductions? Definition, Types, Example

- Calculate Take-Home Salary in Malaysia (With Examples)

- Tax Borne by Employers: What is it and How to Calculate

- How to Check Income Tax for Employers in Malaysia