![Salary Calculator for Employers in Malaysia [+FREE Template]](/resources/blog/data/blog/images/2025/04/20250408032656-big.jpg)

Salary Calculator for Employers in Malaysia [+FREE Template]

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowFinding the right person for the job in Malaysia is already hard. You want someone with the right skills, good attitude, and fits into your team.

But once you’ve found them, there’s another big question: How much should you pay them?

As an employer, you’ve probably been stuck here before. Pay too little, and good candidates walk away. Pay too much, and your budget cries. It’s not easy to get it just right, kan?

That’s why we created something to help you—a Salary Calculator for Employers in Malaysia.

Think of it like your personal assistant, helping you figure out the right pay, fast. No more wild guesses or jumping from one website to another.

And the best part? It’s FREE. Yup, we’ve prepared a simple excel template to make your life easier.

In this article, we’ll show you:

-

Why this salary tool can really help you

-

How to use it in just a few steps

-

And how it can save your time, money, and all that hiring headache

Sound good? Let’s get started, together.

How to Calculate Net Salary in Malaysia?

To find out how much your employee takes home each month, here’s how you can calculate their net salary step by step:

Step 1: Identify the gross salary

Start with the employee’s gross salary. This is the total monthly pay before any deductions. It includes basic salary, fixed allowances, and any regular bonuses.

Step 2: Deduct EPF

The employee’s share of EPF is usually 11% of their gross salary. This amount is deducted directly from their pay and contributed to their KWSP account.

Step 3: Deduct SOCSO and EIS

Based on the salary, SOCSO and EIS contributions are calculated using official contribution tables. For a salary around RM5,000, the total deduction is often about RM35.

Step 4: Calculate PCB (Potongan Cukai Bulanan)

This is the monthly tax deduction based on the employee’s income level and personal tax reliefs. You can use the LHDN PCB calculator to find this amount.

Step 5: Subtract any other contributions or deductions

If there are union fees, HRDF levies, loan repayments, or other deductions, include them in this step.

Step 6: Arrive at the net salary

Subtract all the above deductions from the gross salary. The result is the net salary the actual amount that will be credited to the employee’s bank account.

10 Salary Calculator Tools: Where to Calculate Salary Online?

If doing all these calculations manually sounds like a lot of work, you’re not wrong. Thankfully, there are many free salary calculator tools online that can help.

Some are simple. You just enter the monthly salary, and they’ll show the deductions.

Others are more advanced, letting you include bonuses, allowances, and tax reliefs. Here are some popular options used in Malaysia:

- AJobThing Salary Comparison

- PayrollPanda Salary Calculator

- Salarycal App

- Payroll.my

- Talenox

- Simple PCB Calculator (iOS)

- iMoney Tax Calculator

- SaverAsia

- LHDN PCB Calculator

- KWSP EPF Calculator

These tools are especially helpful when preparing offer letters or when employees ask for a breakdown of their payslip.

Free Download: Salary Calculator in Excel for Employers

Some employers prefer using spreadsheets, especially for small businesses or customised reporting.

For this reason, we’ve created a manual salary calculator in Excel format that mirrors how payroll is calculated in Malaysia.

This version lets you input:

-

Gross salary

-

Contribution rates (EPF, SOCSO, EIS)

-

Bonuses, allowances, and other pay items

-

Output: total deductions and net salary

Download Salary Calculator (Excel format)

You can modify this to match your company’s structure and use it as part of your HR or payroll system.

How to Use a Malaysian Salary Calculator

Using a salary calculator is very straightforward. Here’s a simple example of how it works from the employer’s point of view:

Let’s say you want to check how much your new hire will take home each month.

-

First, enter the gross salary (e.g., RM4,800).

-

Then, the calculator will automatically apply EPF, SOCSO, EIS, and PCB deductions.

-

If there are bonuses or fixed allowances, add them before the deduction step.

-

The tool then calculates the net salary, which is the amount to pay the employee.

-

Some calculators will also show the employer's portion, so you know your full payroll cost.

Most of these tools are updated with the latest contribution rates, but it’s always a good idea to cross-check with official sources like LHDN or KWSP.

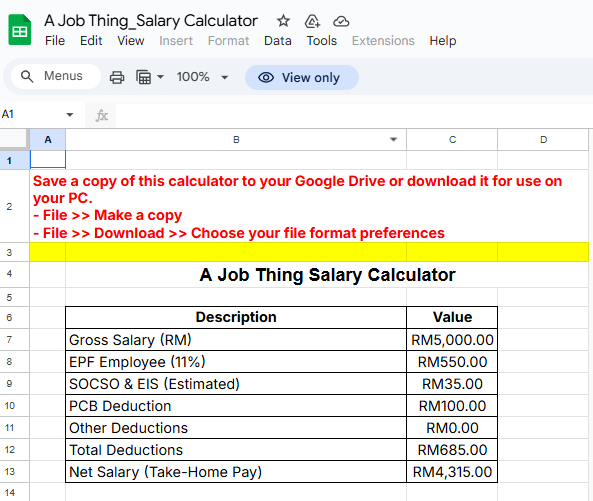

Example of Salary Calculation in Malaysia (2025)

Let’s walk through a full breakdown for a clearer picture.

-

Gross Salary: RM5,000

-

EPF Deduction (Employee): RM5,000 × 11% = RM550

-

SOCSO & EIS Deduction: RM35 (estimated)

-

PCB Deduction: RM100

-

Net Salary: RM5,000 – RM550 – RM35 – RM100 = RM4,315

This is the amount that should appear in the employee’s bank account each month.

If bonuses or allowances are added, they may be partially taxable or subject to deductions, depending on company policy and tax laws.

FAQ

How do I calculate my monthly salary in Malaysia?

Start with the gross salary. Then subtract EPF (11%), SOCSO, EIS, and PCB. The remaining amount is your net salary.

What is the PCB tax deduction, and how is it calculated?

PCB stands for Potongan Cukai Bulanan, a monthly tax deduction based on your income level and personal reliefs. You can use the LHDN PCB calculator for an estimate.

How much is the EPF deduction for employees and employers?

Employees typically contribute 11%, while employers contribute 12% or 13%, depending on salary level. Contributions are based on the monthly wage.

How do I check my salary contributions online?

Employees can check EPF through the i-Akaun system, and tax records through the LHDN MyTax portal. Employers can view company payment history through their respective employer dashboards.

Can an employer deduct more than the required amount for EPF/SOCSO?

Employers can’t deduct more than the required amount unless the employee agrees to voluntary contributions. Any extra deduction must be clearly documented and explained.

Need to hire the right talent?

If you’re hiring, post your jobs on Maukerja or Ricebowl—with over 6 million jobseekers in Malaysia, your next top talent is waiting!

Read More:

- Free KWSP/EPF Calculator Excel Template for Malaysian Employers

- How to Prepare a Monthly Salary Report in Malaysia (+ Free Templates)

- Salary Schedule (Jadual Gaji) in Malaysia: When to Pay & Pay Dates

- Salary Increase Calculator: How to Calculate & Free Excel Template

- Jadual Caruman PERKESO 2025 | SOCSO Contribution Schedule & Rates

- What is Sistem Insurans Pekerjaan (SIP)? A Complete Guide

- How to Handle a Retirement Letter to Employer

- How to Handle Resignation Letter for Employers

- 10 Exit Interview Questions to Ask Employees