Salary Increase Calculator: How to Calculate & Free Excel Template

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowSalary adjustments can be confusing. Too low, and your best people might leave. Too high, and it may strain your budget.

So how do you strike the right balance?

A salary increase calculator tool helps you find that sweet spot by doing the math for you, and helping you understand the bigger picture behind every raise.

What is a Salary Increase?

A salary increase is an adjustment made to an employee’s basic pay. It usually happens once a year, during a promotion, or after a performance review.

From an employer’s side, increasing someone’s salary means recognising their contribution, keeping them motivated, and staying competitive in the market.

Salary increments can vary by company and industry. Some companies give a small percentage increase every year, like 3% to 6%.

Others adjust salaries only when employees get promoted or take on more responsibilities.

Whatever the reason, having a clear method to calculate and communicate the salary increase is key to building trust and transparency.

How to Calculate Salary Increase?

Let’s say one of your employees is performing well, and you’re considering a raise. How do you know how much to give and what that means for your payroll?

Here’s the basic formula:

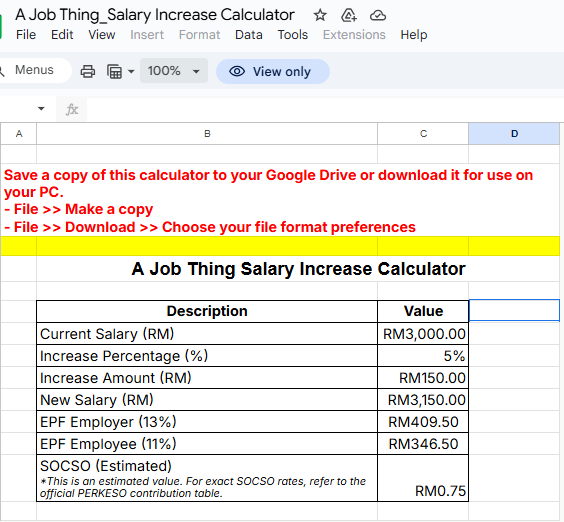

For example, if someone is earning RM3,000 per month and you decide to give a 5% raise, the calculation looks like this:

-

RM3,000 × 0.05 = RM150

-

RM3,000 + RM150 = RM3,150

So, their new salary will be RM3,150 per month.

Another way to calculate it faster is to turn the percentage into a multiplier. In this case, a 5% increase means multiplying the current salary by 1.05:

-

RM3,000 × 1.05 = RM3,150

This method works whether you’re giving a 2%, 4%, or even a 10% increase. It’s straightforward and saves time when doing bulk calculations for your team.

There are also salary changes that happen because of promotions or big changes in the role. To find the percentage increase in these cases, you can use this formula:

So if you promote someone from RM5,000 to RM6,000:

-

(RM6,000 – RM5,000) ÷ RM5,000 × 100 = 20%

That means they received a 20% salary increase.

Factors Influencing Salary Increments in Malaysia

Several things affect how employers decide on salary increases. These are the most common:

Company Budget and Financial Health

Salary increases often depend on whether the business is doing well financially. If profits are up, companies may give bigger raises.

If revenue is tight, increments may be smaller or delayed.

Employee Performance

Staff who meet targets, show good work habits, or take on extra responsibilities are more likely to receive higher increases.

Performance reviews often help decide the percentage of the raise.

Tenure and Loyalty

Employees who have been with the company for many years, for example, five or ten years, may receive a raise as a reward for their loyalty.

Cost of Living and Inflation

When prices go up across the country, many companies adjust salaries to help employees manage rising living costs.

This is especially common in urban areas where daily expenses are higher.

Qualifications and New Skills

If an employee gets a new certification, finishes a degree, or learns a skill that benefits the company, a salary adjustment might be given to reflect their added value.

Market Benchmarking

Employers often compare their pay rates with other companies in the same industry. If salaries at competitors are higher, companies may raise theirs to stay attractive to talent.

Government Policies

Changes in Malaysia’s minimum wage or labour regulations can also influence salary adjustments. Employers need to keep up with policy updates when planning pay raises.

Salary Increase Calculator: How to Use It?

To make your life easier, you can use a calculator increase salary tool. We’ve even created a simple Google Sheet version for you.

This calculator asks for three inputs:

-

Current Salary: the employee’s existing pay.

-

Increase Percentage: how much raise you want to give (e.g. 3% or 7%).

-

New Salary Output: the final number after the raise.

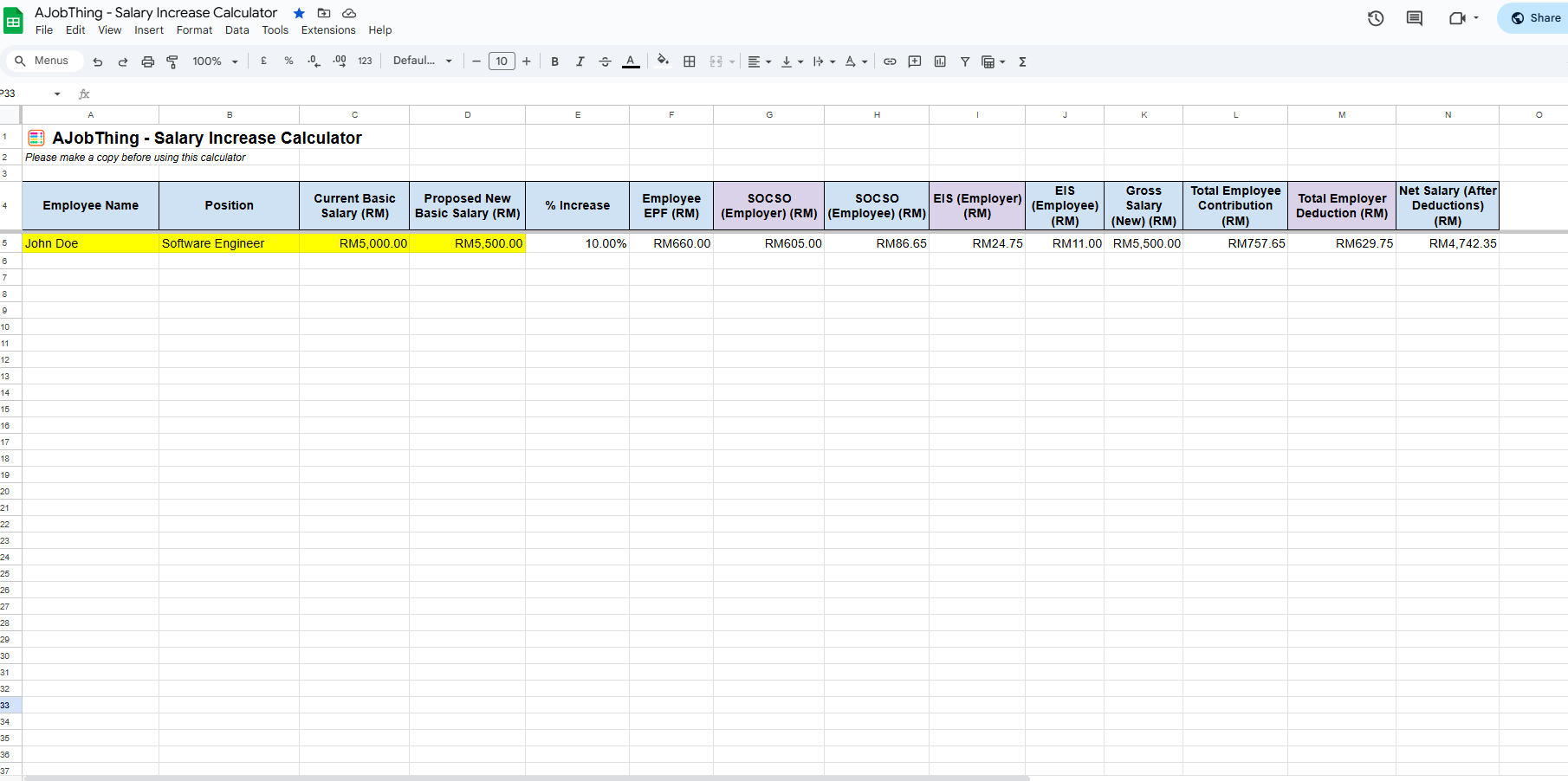

Before using it, make a copy of the calculator. After that, all you need to do is type in the numbers on the copied sheet calculator, and the calculator will do the rest.

We’ve also added a few extra fields that help with budgeting.

For example, it can estimate EPF and SOCSO contributions based on the new salary.

This helps you see the real cost to the company when giving a raise, not just the amount paid to the employee.

You can also use another version here: Make a copy and Download the calculator on our spreadsheet here.

How Much Salary Increase Should Employers Give?

There’s no fixed rule for how much of a raise to give.

But based on reports from Malaysian HR surveys, most employers give a 3% to 10% salary increase every year, depending on the company’s performance and industry standards.

Some sectors, like tech or finance, may go higher to attract talent. Others, like retail or manufacturing, might be more conservative due to tighter margins.

It’s also helpful to compare your salary adjustments with industry benchmarks.

If your company gives 3% every year but competitors are offering 6%, you might struggle to keep your best people.

At the same time, salary increases don’t always need to be across the board.

You can give higher increments to top performers and lower ones to others. This approach helps control your budget while still rewarding the right people.

Employer Strategies for Salary Adjustments

There are different ways employers can manage salary increases. Here are a few strategies:

Link Increases to Performance Reviews

Tie salary raises to yearly performance appraisals. This helps reward high-performing staff fairly and keeps the process consistent.

Use Tiered Increments

Offer different percentages based on employee performance or job grade.

For example, top performers get 6%, average performers get 3%, and new staff might receive a fixed amount.

Plan Salary Adjustments During Budgeting

Include salary increases in your yearly budget planning. It makes it easier to balance pay raises with other company expenses.

Offer Non-Monetary Benefits

If the company can’t afford big raises, offer other benefits like flexible work hours, extra paid leave, or better insurance to keep staff motivated.

Communicate Clearly with Employees

Explain the reason why employees get a salary raise and how it was calculated. So, employees can understand the decision and build trust between staff and management.

FAQ

What is a good percentage for a salary increase in Malaysia?

A good salary increase in Malaysia is usually between 3% to 10% annually, depending on performance, inflation, and industry standards.

How often should salaries be increased?

Many companies review salaries once a year, often during performance reviews. However, promotions or role changes may also lead to off-cycle salary increases.

Does a salary increase affect EPF and SOCSO contributions?

Yes, once a salary increases, the employer’s and employee’s EPF and SOCSO contributions will increase accordingly based on the new amount.

How do I negotiate a salary increase with my employer?

From an employer’s view, it’s best when employees come prepared with clear achievements, market comparisons, and a realistic figure. This makes the conversation more productive.

Can a company refuse to give a salary increase?

Yes, companies can decide not to give raises based on budget limitations, business performance, or other internal reasons. However, it’s good practice to explain the reason clearly to employees.

Need to hire the right talent?

If you’re hiring, post your jobs on Maukerja or Ricebowl—with over 6 million jobseekers in Malaysia, your next top talent is waiting!

Read More:

- How to Prepare a Monthly Salary Report in Malaysia (+ Free Templates)

- Jadual Caruman PERKESO 2025 | SOCSO Contribution Schedule & Rates

- What is Sistem Insurans Pekerjaan (SIP)? A Complete Guide

- How to Handle a Retirement Letter to Employer

- How to Handle Resignation Letter for Employers

- 10 Exit Interview Questions to Ask Employees

- Tips for Interviewer: How to Prepare and Conduct a Virtual Interview

- Key Performance Indicator (KPI): Definition, Types, Dashboard, Criteria and Examples

- How to Handle Quiet Quitting in Malaysia

- How to Check Income Tax for Employers in Malaysia

- What Are Statutory Deductions? Definition, Types, Example

- Calculate Take-Home Salary in Malaysia (With Examples)

- Tax Borne by Employers: What is it and How to Calculate

- How to Check Income Tax for Employers in Malaysia