What is e-Invoice Malaysia? (Free Download Template)

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowSince 2024, e-Invoicing has become a legal requirement for many businesses in Malaysia. The Inland Revenue Board of Malaysia (LHDN) has officially rolled out a national e-Invoice system, and the timeline to comply is tight.

In this article, you will understand what e-Invoicing is, why it matters, who is affected, and how to get your business ready to comply without unnecessary stress.

What is an e-Invoice in Malaysia?

An e-Invoice is a digital document that is submitted in real-time to LHDN through the official MyInvois system. It replaces traditional paper or PDF invoices and is part of Malaysia’s broader tax digitalisation plan.

An e-Invoice is structured using predefined data formats (like XML or JSON) and must be validated by LHDN before it becomes a legally accepted invoice. Once approved, the invoice will receive a Unique Identifier Number (UIN) and timestamp.

Key differences compared to traditional invoices:

-

Traditional invoices can be printed or emailed; e-Invoices are submitted directly through MyInvois.

-

Traditional invoices may be stored in hard copy; e-Invoices are stored in LHDN’s system.

-

e-Invoices require real-time approval from LHDN before they’re valid.

Examples of e-Invoice documents include B2B, B2C, and B2G transactions, each with slightly different formats and verification flows.

Who Must Implement e-Invoicing in Malaysia?

LHDN has laid out a tiered timeline based on annual turnover:

-

1 August 2024: Companies with over RM100 million in revenue.

-

1 January 2025: Companies with over RM25 million in revenue.

-

1 July 2025: All other businesses, regardless of size.

Every registered business will eventually need to use the e-Invoicing system.If your business falls into the early phase, preparation should already be in progress.

Why Business Needs to Do E-Invoices?

e-Invoicing will affect multiple areas of your operations. It can:

-

Improves tax transparency and reduces fraud risk.

-

Speeds up invoice validation and audit processes.

-

Required by law, and skipping it could mean penalties or compliance flags.

-

Helps simplify reimbursement claims, supplier payments, and payroll documentation, especially for HR.

When do you need to start implementing e-invoicing for your business?

Start well before your assigned implementation deadline. That includes:

-

Reviewing your current invoicing system.

-

Identifying gaps in your accounting software.

-

Training relevant staff (HR, finance, procurement).

-

Testing e-Invoice formats with LHDN sandbox.

How Does e-Invoice Work in Practice?

Here’s what the process looks like:

-

Your business issues an invoice using your accounting system or ERP.

-

The invoice is submitted to MyInvois Portal (manually or via API).

-

LHDN performs real-time verification.

-

Once approved, the invoice is stamped with a unique number and returned.

-

You send this validated e-Invoice to your customer.

-

If there’s an error, you need to cancel or amend the invoice through MyInvois.

There are two submission methods:

-

Manual submission: via the MyInvois front-end portal (for small businesses)

-

API integration: for ERP/accounting software (for automation)

Steps to Prepare for e-Invoicing

-

Check your eligibility based on your company’s annual revenue.

-

Review your invoicing process and make sure it can handle structured data formats.

-

Register on the MyInvois Portal: https://myinvois.hasil.gov.my

-

Apply for API access and Digital Certificate if using automation.

-

Choose your integration method: API, XML upload, or use a third-party vendor.

-

Train your internal team (HR, finance, admin) on the new flow.

-

Do sandbox testing and simulate invoice scenarios.

-

Go live before your deadline to reduce risk of rejection.

Tools for creating e-invoicing in Malaysia

Some tools already support e-Invoicing:

-

AutoCount

-

SQL Account

-

SAP / Oracle ERP

-

Financio

-

Cloud accounting platforms like Xero (via middleware)

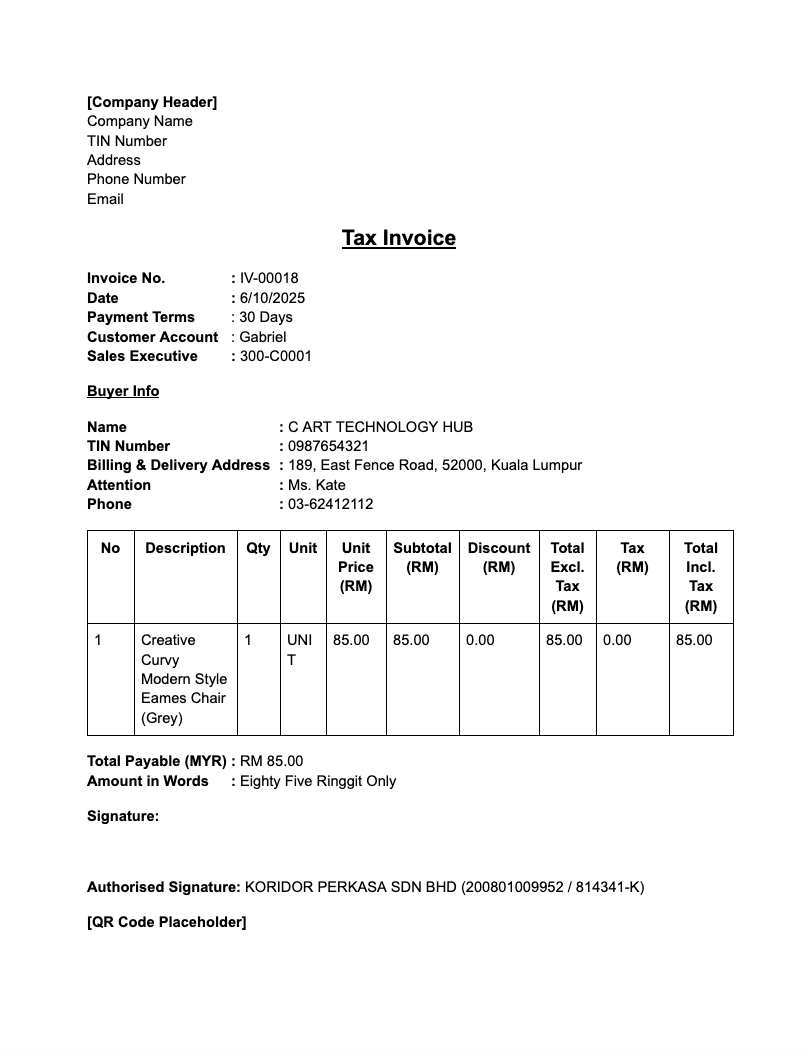

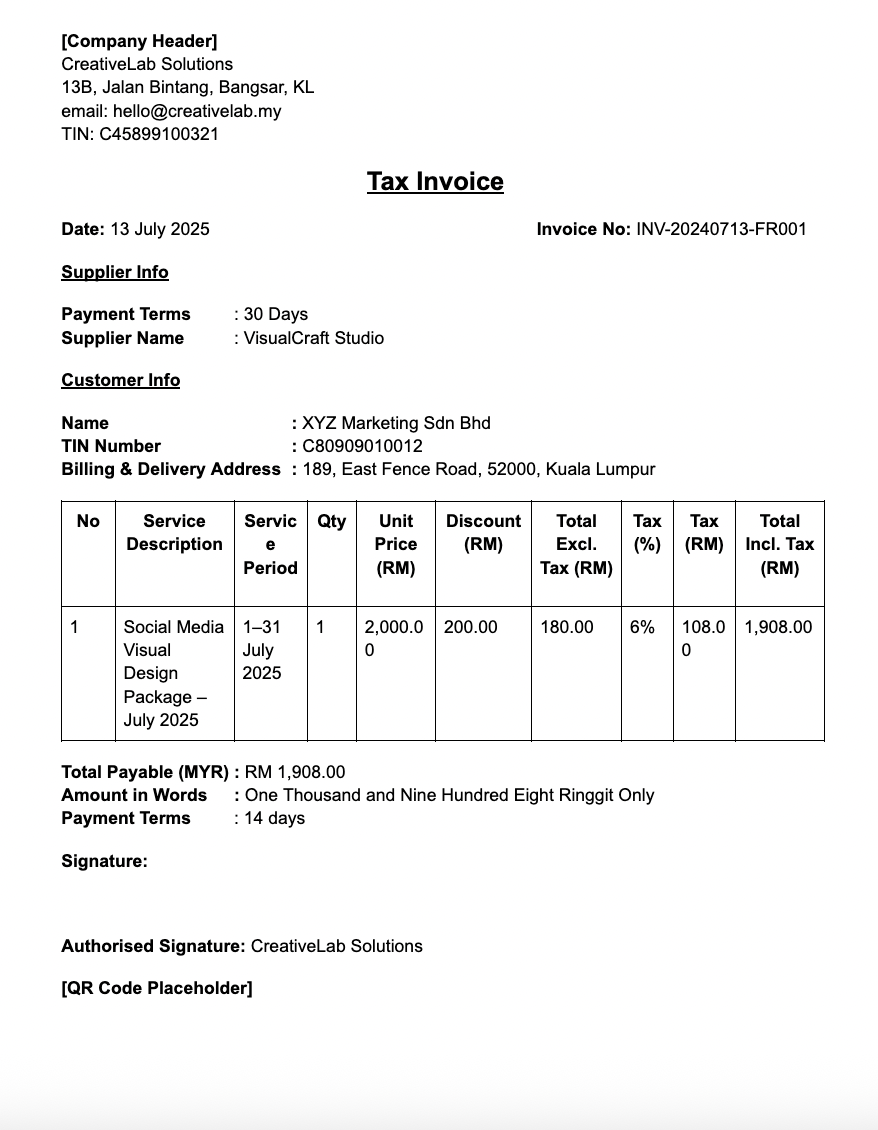

3 E-Invoice Report Template Based on Industry

-

Retail or Consumer Goods e-Invoice Template

-

Services/Freelancer e-Invoice Template

-

Construction / Contract Work (Project-based billing)

Impact of e-Invoicing on Employers, HR and Payroll

E-Invoicing doesn’t only affect finance teams. It changes how:

-

Employee expense claims are documented and reimbursed

-

Contractor or freelancer invoices are processed

-

Payment approval workflows are tracked

HR and payroll departments must work with finance to streamline claim submissions and ensure third-party payees are properly registered.

What are the Penalties for Non-Compliance?

Failure to comply with LHDN’s e-Invoice mandate can result in:

-

Fines from RM200 to RM20,000

-

Imprisonment of up to six months in serious cases

These penalties apply to missed registration deadlines, incorrect invoice data, or failure to submit e-Invoices.

FAQs

Is e-Invoicing compulsory for HR reimbursements or claims?

Yes, if they involve payments from company accounts that qualify as taxable transactions.

Can I still use Excel or PDF invoices?

No. Only invoices issued and validated through the MyInvois system will be accepted.

How do freelancers and gig workers issue e-Invoices?

They can register on MyInvois and submit invoices manually or via certified software.

Does this apply to foreign vendors or remote teams?

Yes, if the supplier is subject to Malaysian tax laws.

Can I issue e-Invoice using my POS system?

Yes, but only if the POS system is integrated with MyInvois via API.

How do I correct errors after issuing an e-Invoice?

You must cancel the invoice in the system and reissue it with the correct details.

Looking to Build a Stronger Team?

Let AJobThing help you find the right people who will grow with your company.

Post your job ads and connect with top talent across platforms like Maukerja, Ricebowl, and Epicareer today.

Read More:

- KWSP Application Deadline 2025 for Employers in Malaysia

- Employee Income Tax Number in Malaysia: How to Check and Register for It

- GST vs SST in Malaysia: Key Differences Every Employer Should Know

- Employment Pass (EP) Malaysia: Application, Renewal, and Employer Duties

- Professional Visit Pass (PVP) Malaysia: Process, Rules, and Tips for Hiring Short-Term Foreign Workers

- What is Visit Pass Temporary Employment (Temporary Employment Pass)?

- How to Register a Business in Malaysia: Step-by-Step Guide (2025)

- What is SST 8%? Types, How to Charge, and SST Filling

- Pelepasan Cukai 2024/2025: Tax Reliefs Guide for Employers

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- How to Submit CP22 for New Employees in Malaysia in LHDN MyTax Portal

.png)