Form 48 & 49 Malaysia: Meaning, How to Submit, and Free Download Forms

Are You Hiring?

Find candidates in 72 Hours with 5+ million talents in Maukerja Malaysia & Ricebowl using Job Ads.

Hire NowHiring new employees in Malaysia requires employers to follow certain legal steps.

One of the important tasks is submitting the correct documents to the Companies Commission of Malaysia (SSM).

Two key documents that every employer should know about are Form 48 and Form 49.

These forms help keep your company in line with the rules and avoid any legal problems.

Whether you run a small business or a large company, it’s important to understand what these forms are and how to handle them properly.

In this simple guide, we will explain what Form 48 and Form 49 are, why they are important, and how to submit them correctly.

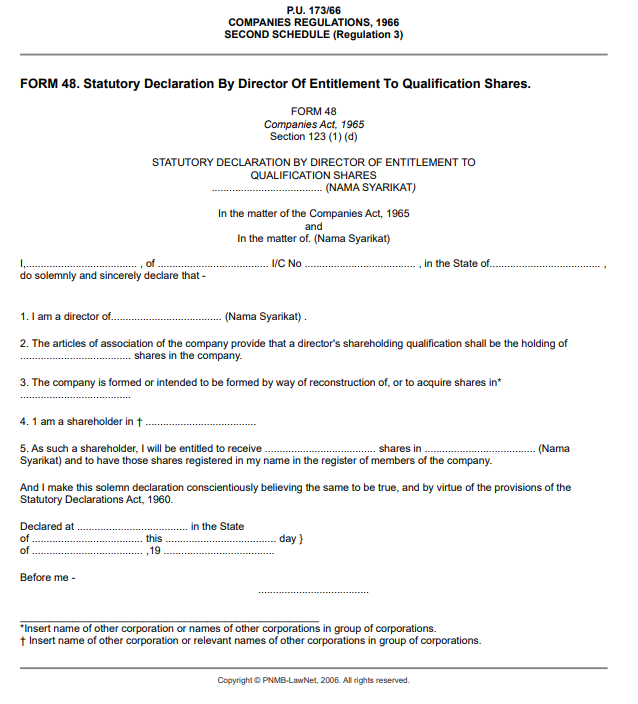

What is Form 48?

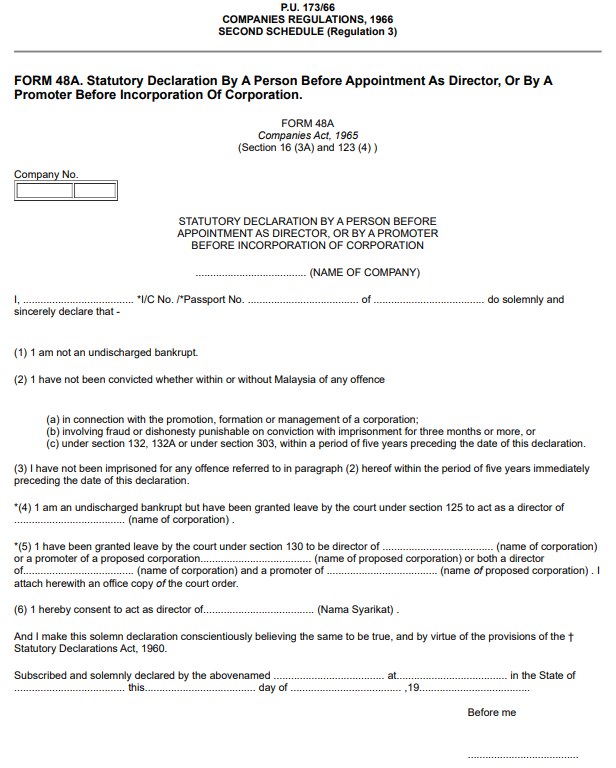

Form 48, more specifically Form 48A, is a statutory declaration made by a person who is about to become a director or promoter of a company.

The purpose is simple: it’s a signed declaration to confirm that the person is eligible to take on that role.

This includes confirming they are not bankrupt, not convicted of any offences that would disqualify them, and that they understand their legal responsibilities.

This form is submitted as part of the company incorporation process, right before someone is officially appointed as a director.

It’s also required when changes are made to the board during the life of a company.

The legal foundation for this comes from the Statutory Declarations Act 1960 and the Companies Act 2016.

Since it is a statutory declaration, it must be signed before a commissioner for oaths, a magistrate, or a notary public.

The statement must be true; making false statements in Form 48 is a criminal offence that can lead to up to seven years in jail and a fine under the Penal Code (Sections 199 and 200).

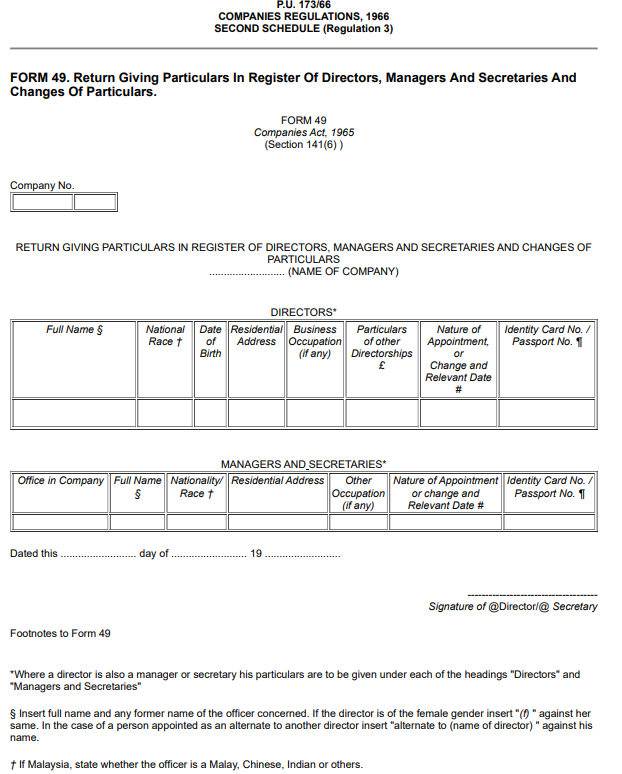

What is Form 49?

Form 49 used to be a standard part of corporate filings under the old Companies Act 1965.

It was used to submit the particulars of directors, managers, and company secretaries to the Companies Commission of Malaysia (SSM).

This included their names, ID numbers, addresses, and positions.

Every time a new director or secretary was appointed, or if someone resigned or changed their details, a new Form 49 had to be filed.

Today, Form 49 has been officially replaced by something called the Section 58 Notification, which is part of the updated Companies Act 2016.

However, many people in business still refer to it as “Form 49” out of habit.

If you’re dealing with banks, investors, or auditors, they might still ask for a “Form 49” to see who is legally listed as the company’s board or secretary, even though the actual name of the document has changed.

When to Submit Form 48 and Form 49?

For Form 48, it must be submitted before a person becomes a director or promoter.

That means it’s part of the incorporation process, or must be submitted immediately when someone new is being appointed to the board.

Without a completed and signed Form 48, the appointment is not legally recognised.

As for Form 49, or more accurately, the Section 58 Notification, this needs to be submitted within 14 days after any change.

This includes new appointments, resignations, or any changes in the particulars of current directors or secretaries.

If the submission is late or skipped, the company can be penalised.

Where and How to Submit These Forms?

Today, most of these submissions are done online through the MyCoID portal, introduced to make the company registration process more efficient.

Through MyCoID, you can:

-

Register a new company

-

Submit changes to the company directors or secretaries

-

Lodge statutory forms like the Super Form (which includes Form 48)

To complete the Super Form, you’ll need information such as the director’s full name, IC number, address, and a signed statutory declaration.

The declaration must be witnessed by a Commissioner of Oaths, Magistrate, or Notary Public.

As for the updated version of Form 49 (Section 58 Notification), you’ll need to fill out the changes and submit them online to SSM.

If you still use the term “Form 49” in your internal processes or HR templates, just remember it now refers to the Section 58 update.

You can get digital copies or samples of these forms via:

Why are Form 48 and Form 49 Important for Employers and HR?

At first glance, Form 48 and Form 49 may seem like something only company secretaries should handle.

But for HR and business owners, these forms serve an important purpose.

Form 48 makes sure the person you're appointing is eligible to take on a leadership role. You wouldn’t want to hire someone with a disqualified status unknowingly.

By declaring this in writing, you're also protecting the company from future legal trouble.

Form 49 (or Section 58) ensures that your company's leadership records are up to date with SSM.

If this isn't done, your company might face penalties or struggle with processes like securing loans, signing contracts, or onboarding new staff into leadership roles.

Form 49 vs Section 58 (Post-CA 2016)

One of the biggest changes in the Companies Act 2016 was the move toward digital filing.

Instead of filling out physical forms like Form 48A or Form 49, companies now use the Super Form for incorporation and the Section 58 Notification for director changes.

Things that changed are:

-

Form 49 is no longer filed manually. It’s now called a Section 58 Notification.

-

You submit these updates through the MyCoID system.

-

You no longer need to submit separate forms for each change. The system streamlines the process.

Free Link Download Form 48 & Form 49

If you need to refer to or download the forms for internal use, here’s where to find them:

FAQ

Do I still need to file Form 49 under the new Act?

Not exactly. Form 49 has been replaced by Section 58 Notification, which must be submitted through MyCoID anytime there are changes to your company’s directors or secretaries.

How do I prepare a Statutory Declaration under Form 48?

The declaration must follow the Statutory Declaration Act 1960. It needs to be written using a specific format and signed in front of a Commissioner of Oaths or a similar authority. Only factual information can be included.

Can HR submit these forms, or must it be the company secretary?

In most cases, the company secretary handles official submissions to SSM. However, HR teams often collect and prepare the necessary information. So both departments usually work together.

What happens if I fail to notify SSM of changes?

Late or missing submissions may result in penalties, including fines or even legal action. Also, outdated records can lead to problems with banks, investors, and government agencies.

Need to hire new employees in Malaysia?

Post your job ads on Maukerja, Ricebowl, LinkedIn, and Google with AJobThing to find the best talent today!

Read More:

- 75 Company Gift Ideas for Employee Resignation

- Jadual Caruman KWSP 2024/2025 (EPF Contribution Schedule)

- 10 Exit Interview Questions to Ask Employees

- Tips for Interviewer: How to Prepare and Conduct a Virtual Interview

- Key Performance Indicator (KPI): Definition, Types, Dashboard, Criteria and Examples

- How to Handle Quiet Quitting in Malaysia

- How to Check Income Tax for Employers in Malaysia

- What Are Statutory Deductions? Definition, Types, Example

- Calculate Take-Home Salary in Malaysia (With Examples)

- Tax Borne by Employers: What is it and How to Calculate

- How to Check Income Tax for Employers in Malaysia

- B40, M40, and T20 Salary Range in Malaysia (2025 Update)

- Malaysia Salary Tax Rate 2025 (YA 2024): How to Calculate, Tax Bracket

- Salary Slip Malaysia: Format, Sample, and Free Download